Get instant access to this case solution for only $19

SZLN Acquiring Pem Case Solution

Founded in 1992, SZLN is a company dealing in lead zinc products, construction materials and decorations. Though in the year 2001, there was a 75% decline in the company’s net income, but the company undertook the passage of restructuring of the firm and soon it made 30% greater profits as opposed to the previous year. However, due to the continuously growing zinc demands and upturn in the lead consuming industry the company anticipated the increased amounts of zinc required; hence, leading to the procurement of zinc locally, as well as, internationally. Therefore based on the key trends in the lead zinc industry, SZLN decided to pursue a new strategy of either to acquire another firm or to be acquired.

Following questions are answered in this case study solution

-

Assume you are a current shareholder in PEM and you are trying to value it. The 10 year Australian Treasury bond rate is 4.58%, the 5 year Australian rate is 3.97%, the 10 year US Treasury rate is 3.53%, and the 5 year US Treasury rate is 2.29% in November 2008. The equity beta is in footnote 4 of Exhibit 14. What rate would you use to discount US dollar cash flows to equity if leverage remains unchanged at its current value over the life of the project?

-

Assume that the entire ore reserve in Broken Hill is fully depleted at the end of 8 years and some assumptions. What are the cash flows to equity?

-

What is the present value of the equity of PEM per share in Australian dollars? Note that PEM’s leverage changes over time. Assume that you are finding the value from the perspective of a current holder of PEM shares, and not from the perspective of a partially state owned corporation like SZLN. State any other assumptions you make while doing the calculations.

-

Using the price paid for Herald, what would be the comparable price you would pay for PEM? State any assumptions you make. What might cause you to doubt the valuation you get from such an analysis?

-

Suppose SZLN decides to proceed with the purchase. Would you advocate that it buys PEM shares in the market, buys newly-issued PEM Treasury shares, or buys convertible debt issued by PEM? What are the advantages and disadvantages of each approach?

-

What might SZLN do to convince the Australian government not to block the transaction?

Case Analysis for SZLN Acquiring Pem

1. Assume you are a current shareholder in PEM and you are trying to value it. The 10 year Australian Treasury bond rate is 4.58%, the 5 year Australian rate is 3.97%, the 10 year US Treasury rate is 3.53%, and the 5 year US Treasury rate is 2.29% in November 2008. The equity beta is in footnote 4 of Exhibit 14. What rate would you use to discount US dollar cash flows to equity if leverage remains unchanged at its current value over the life of the project?

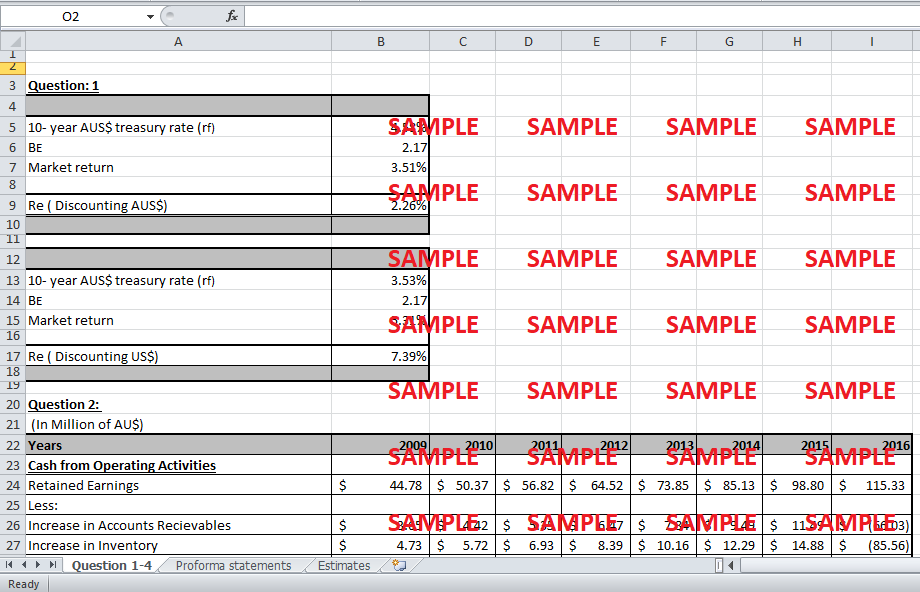

The computations for the discount rate used for US dollar are presented in the exhibits. The cost of equity is calculated by using the Capital Asset Pricing Model (CAPM). The risk free rate of return is considered to be the longest US Treasury bond rate given i.e. 3.53%. Equity beta is 2.17 as mentioned in the exhibit 14 of the case while the market return is the geometric average of the returns of ten year government bonds. Therefore, the cost of equity used for discounting the cash flows in US dollars is calculated as 7.39%.

2. Assume that the entire ore reserve in Broken Hill is fully depleted at the end of 8 years and some assumptions. What are the cash flows to equity?

It was November 2008 when the news spread about the stock crash of PEM, an Australian mining company. Knowing that PEM is looking for a strategic buyer, SZLN approached them.

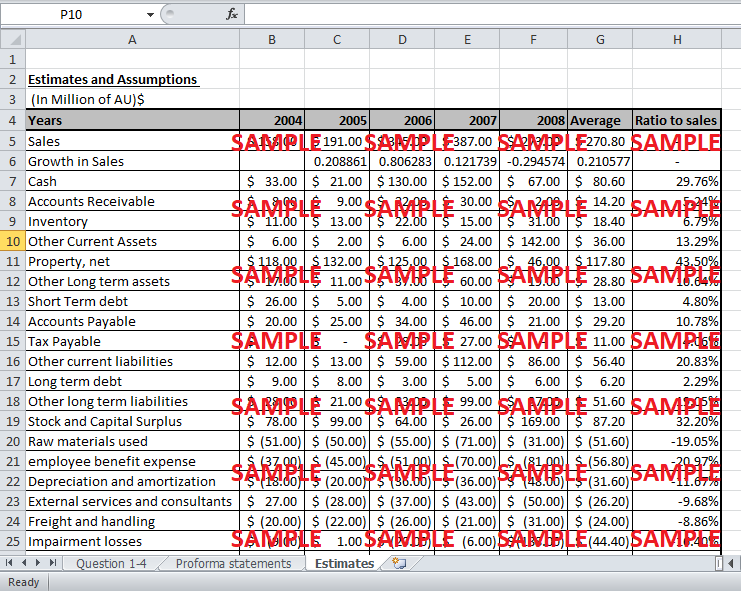

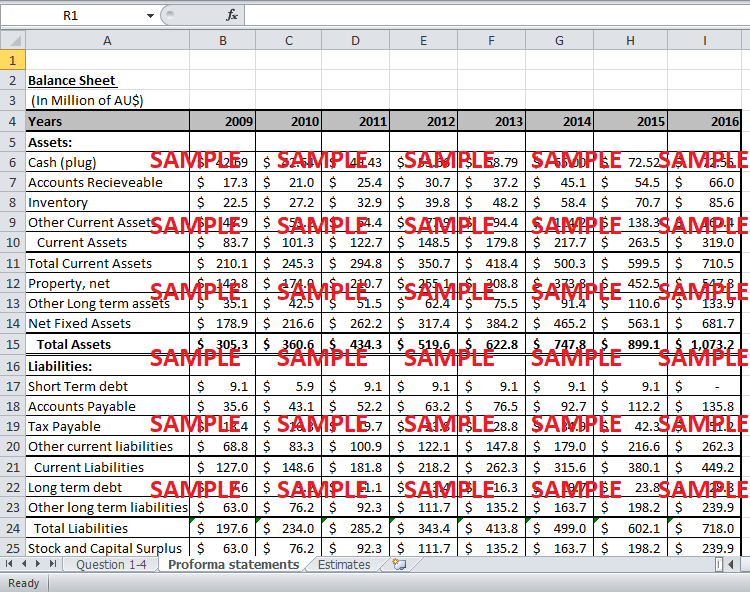

In order to value PEM cash flows to equity is calculated by setting up the financial model and projecting the financial statements over the life of the entire ore reserve i.e. eight years. Pro forma statements are formed by making estimates of the financial statements to the sales ratio from the year 2009 till 2016. Assumptions of the model are stated in the exhibits. From the Income statement after tax profit is calculated to which depreciation added back as it is a non-cash expense is followed by the subtraction of increase in assets as it represents the cash outflow of the firm while the increase in liabilities is added back as the amount not paid yet; hence, available as free cash flow. Moreover, after tax interest on debt is added back because interest is tax deductible. Therefore, the free cash flows are calculated from which taxes and debt repayments are subtracted while net borrowings are added to calculate (Free Cash Flow to Equity) FCFE.

3. What is the present value of the equity of PEM per share in Australian dollars? Note that PEM’s leverage changes over time. Assume that you are finding the value from the perspective of a current holder of PEM shares, and not from the perspective of a partially state owned corporation like SZLN. State any other assumptions you make while doing the calculations.

In order to compute the present value of the equity of PEM per share in Australian Dollars, the FCFE is discounted using the cost of equity as the discount rate. Before that, it is required to calculate the cost of equity for the discounting of the Australian dollars. Hence, 10 year Australian Treasury bonds rate of 4.58% is considered as the risk free rate of return and market rate of return of the current market is measured from the Bloomberg to be 3.51% whereas equity beta is 2.17. With all the available measures, cost of equity is calculated through CAPM.

Moreover, terminal value has to be calculated before discounting the FCFE to find an estimate of the cash flows after 2016. It is because the valuation through DCF requires an infinite number of free cash flows. Gordon growth model assisted in the calculation of terminal value for which growth is assumed to be 1.9%. Much conservative estimate is considered for the growth because of the economic downturns and huge PEM stock crash. Equity value is computed by using the NPV formula in excel where cost of equity is taken as the discount rate. The total value of the equity is divided by the total number of outstanding shares, which gives the per share value as an output. The equity value appeared to be 0.09$ which is lower than the market value of 0.14$. However, the DCF value is based on the assumptions which are subjective in nature. Hence, as the assumptions such as growth rate are changed the intrinsic value of the firm varies.

4. Using the price paid for Herald, what would be the comparable price you would pay for PEM? State any assumptions you make. What might cause you to doubt the valuation you get from such an analysis?

SZLN was willing to pay $ 2.5 per share for Herald. The fact that while paying directly the control premium is also charged to the acquirer leads to the higher price per share than the actual value of the equity per share. Therefore, using the price of $ 2.5, it is assumed that the control premium is 35%. It is the average of the minimum amount of 20% and maximum percentage of 50% of control premium. Hence, the actual price per share of Herald is $ 1.75 for which the company is willing to pay $ 2.5.

Similarly, as the value per share of the PEM calculated through the DCF model is $ 0.09. Therefore, by adding the 35% control premium the comparable value that can be paid is $ 0.12. The calculations are displayed in the exhibits.

Based on the above analysis of price comparison following are the reasons, which exhibits that the price comparison measure is not effective:

-

SZLN will have to pay an additional amount than the actual valuation of the company.

-

Control premium is a subjective measure and can vary from 20% to 50%, which changes the value per share.

-

Moreover, valuation of the firm based on the price comparison is not a good measure as there might be other risks associated with it such as debt servicing costs or firm may constitute high cash cost assets as in the case of CBH.

-

Besides, the DCF model for valuation considers the growth and cost cutting strategies which are not encountered in the case of valuing the firm through price comparisons.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.