Get instant access to this case solution for only $19

Teletech Corporation 1996 Case Solution

In January 1996, a raider suggested selling a significant part of the company's operation since it is not generating enough profit, prompting the CFO to formulate a response (ROR). The case describes the internal discussion on whether or not the firm should utilize a single hurdle rate to assess all business units, or if a risk-adjusted hurdle rate system should be used instead. The students' objectives are to reach a consensus on the contentious issue, calculate the WACC for the two business divisions, and provide a suitable response to the raider. The case study was written as a supplement to a unit on the weighted average cost of capital (WACC), therefore, it makes the most sense to read it after students had learned about WACC calculation. Numerical computations are very simple, but understanding the nuances of how to apply risk-adjusted hurdle rates will take some effort for a newcomer.

Following questions are answered in this case study solution

-

How does Teletech currently use the hurdle rate?

-

Estimate divisional or segmented WACC for Teletech.

-

Interpret Rick Phillip’s graph (Figure 2 in the case).) How does the choice of constant versus risk-adjusted hurdle rates affect the evaluation of Teletech’s two segments? What are the implications for Teletech’s resource allocation strategy?

-

Do you agree that “all money is green”? What is the implication of this view? What are the arguments in favor? What are the arguments opposed to it?

-

Has Product and Systems destroyed value? What evidence or illustration can you give to support your opinion?

-

What should Teletech say in response to Victor Yossarian?

Case Analysis for Teletech Corporation 1996

1. How does Teletech currently use the hurdle rate?

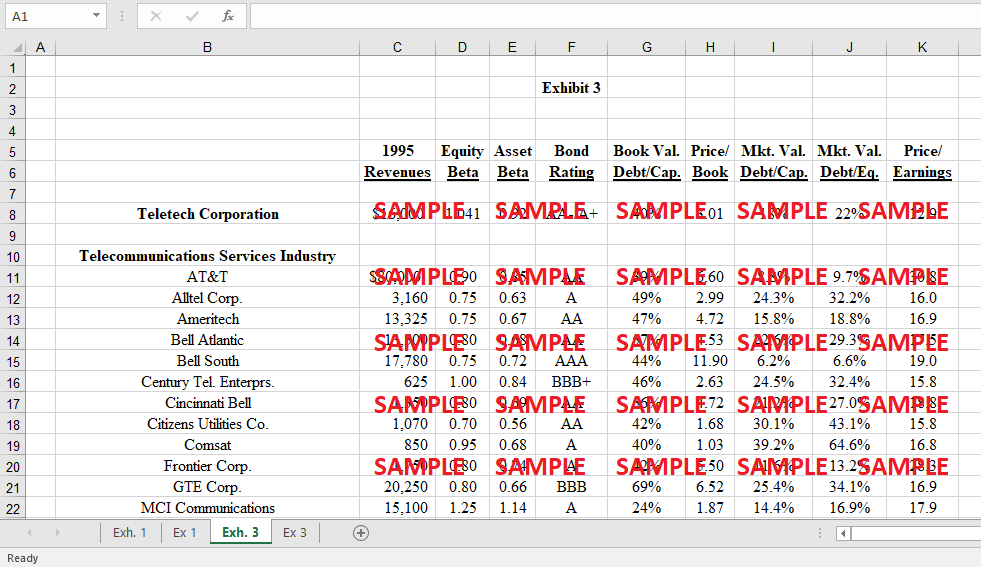

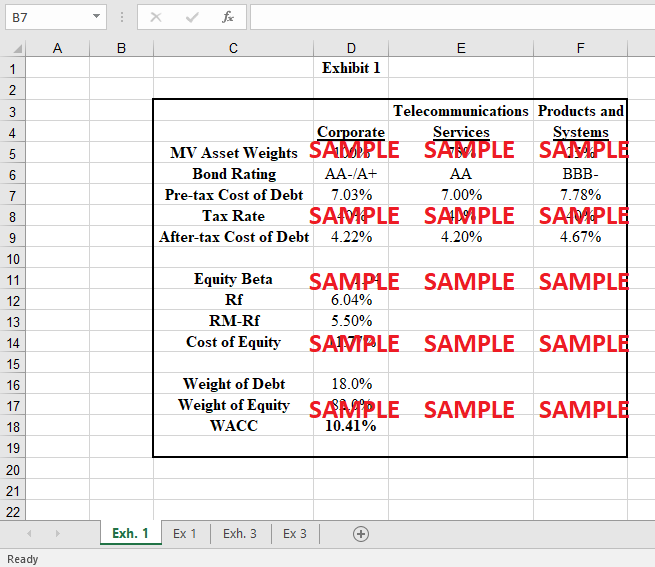

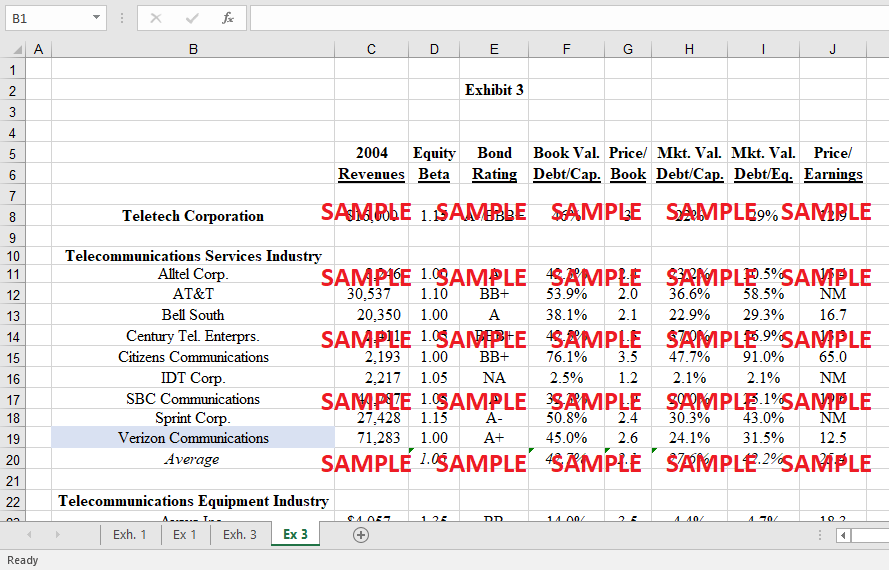

Teletech Corporation's Products and Systems Division and Telecommunications Services Division are both being evaluated against a single hurdle rate at now. The corporate rate, also known as the hurdle rate, has been determined by determining Teletech's total weighted average cost of capital. The estimated value is 9.3 percent. The spreadsheet reveals the figures for the company's weighted average cost of capital. Analysis of current performance reveals that the telecoms sector is underperforming, with a return on capital of 9.1 percent, while the goods and systems division looks promising, with a return on capital of 11 percent. This causes the stock price to be artificially inflated relative to the company's actual value. The company's price to earnings ratio is also far lower than the expectations of investors in light of the uncertainties in the business. When a corporation adopts a single rate of resistance, it creates uncorrelation. For the first time, the company's risk and return have become uncorrelated. The complaint also claims the company's leadership annually invests roughly $2 billion. As a result, it is crucial to estimate a reasonable discount rate in order to determine which initiatives would provide the greatest returns and to invest in those projects in order to boost the value of the company's shares. Due to the fragmented nature of the company's operations, the use of a corporate obstacle would be unsuitable. The equity betas for the two sectors illustrate that they involve varying degrees of risk. The beta for the telecommunications industry is around 1.04, whereas the beta for all other goods and systems is 1.36. Therefore, the second sectors provide a substantially bigger investment risk than the telecommunications sector. As a result, the rate of return on investment for each market sector varies, as do the risks associated with those investments. As a result, the company's two lines of operation need distinct break-even points.

2. Estimate divisional or segmented WACC for Teletech.

Spreadsheet displaying WACC calculations for both business units. Separate procedures have been run to determine the after-tax cost of debt and cost of equity for each division. Due to differences in bond ratings, the after-tax cost of debt for each sector is also distinct. The telecom segment has an A bond rating and a cost of debt of 5.74 percent. However, the goods and systems business unit, with its bond grade of BB, has a cost of debt of 7.47%. We have also estimated the cost of equity for both segments using the distinct beta values for each company subsegment. Debt and equity both make up the equal proportion of each section. The weighted average cost of capital for the two divisions of the company has been determined using the data provided. The telecommunications industry has a weighted average cost of capital of around 8.81%, while the goods and systems industry has a cost of capital of about 10.41%. We have computed economic profits for each parts under two different scenarios, after first calculating their respective weighted average cost of capital. In the first case, a divisional hurdle rate is utilized, whereas, in the second, a corporate rate is used. The variations were studied in terms of the differences in economic profits. Economic profit calculations reveal that using the same hurdle rate for both segments would mislead investors, with the telecoms sector showing a loss and the goods and systems section showing a gain. When the divisional rates are applied, however, the telecoms division sees significant financial gains. Although the goods and systems division shows economic profit beneath the corporate hurdle rate, this profit has dramatically shrunk in recent years. Below are the formulas for determining economic profits and the weighted average cost of capital:

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- The Chicago Blackhawks Greatest Sports Business Turnaround Ever Case Solution

- AmazonFresh Rekindling the Online Grocery Market Case Solution

- Asante Teaching Hospital Activity Based Costing Case Solution

- Nissan Motor Company Ltd Building Operational Resiliency Case Solution

- The Rise and Fall of Iridium Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.