Get instant access to this case solution for only $19

The Cooperative Bank Case Solution

Co-operative Bank, established in 1971 as a separate legal entity, emerged as one of the most successful banks. It had broadened its customer base and introduced a wide range of products and services by the 1990s. Although the bank had made accelerated growth, it faced stringent challenges such as competition and changing customer needs. In order to combat the issues and increase the cost-income ratio, the bank considered re-engineering of loss-making processes. The Co-operative Bank implemented an ABC system for better allocation of costs to various products and customers. Through ABC implementation, the management was able to identify profitable and unprofitable products and customers. Using the information derived using the ABC system; the management redirected marketing efforts to focus more on profitable customers and cross-sell other products. ABC system enabled managers to agree on the profitability of products and services and make well-informed decisions.

Following questions are answered in this case study solution

-

What were the main characteristics of the costing system used by the Co-Operative Bank before the Project Sabre study was launched? What were the system’s strengths and weaknesses?

-

Evaluate the Co-Operative Bank’s ABC system and its implementation.

-

Should the Co-Operative Bank phase-out Independent Financial Advice / Insurance and Pathfinder products?

-

What does customer profitability add to the product profitability analysis? How can the information on customer profitability be used to improve the bank’s financial condition?

-

What should be done with customers identified as unprofitable?

-

Should the Marketing Manager concentrate on Visa customers?

-

What differences do you see between applying ABC in a service company setting and in a manufacturing company?

Case Analysis for The Cooperative Bank

1. What were the main characteristics of the costing system used by the Co-Operative Bank before the Project Sabre study was launched? What were the system’s strengths and weaknesses?

Before the project SABRE Study was launched, the Co-operative Bank was using a traditional responsibility accounting system. Under the traditional responsibility accounting system, product revenues of the bank were being measured using fee income and net interest which was equal to gross interest net of funding costs. Furthermore, the cost system estimated expenses for geographic and departmental cost centers. Under this system, the costs incurred at central headquarters, such as information systems and document transmission, were allocated to the operating segments using high-level cost drivers related to the volume and size of the business. Although it measured the revenue brought by different products, the intense weakness of the existing cost system at the Co-operative Bank was that it did not estimate the cost of production attributable to each product or service. Due to this, the bank could not measure the profitability of each product and service accurately.

2. Evaluate the Co-operative Bank’s ABC system and its implementation.

The Co-Operative Bank decided to implement Activity Based Costing (ABC) system in order to have a standard for cost allocation to be able to make well-informed decisions. For the purpose of ABC implementation, a cross-sectional team was formed which consisted of managers from different areas of the bank. In addition to this, an external consulting company was hired to assist the team in the implementation of the ABC system. Before ABC implementation, the management could not consent to which products and customers were profitable and which were unprofitable. The main objective of ABC implementation was to establish a base method for the allocation of costs to bank products so that the management could identify the strength and weaknesses of individual products. These would enable them to identify those business processes that did not add value to customers. ABC system at the co-operative bank enabled the bank management to better allocate the costs to its diverse products and customers and provided better measures of product and customer profitability than the previously existing costing system. Consequently, the management was able to make well-informed decisions. Furthermore, the process of implementation itself was well organized and comprehensive. The ABC team identified the activities, resource pools, and products with much attention to accuracy and detail. However, since the team used past data for the estimation, the costs will not remain accurate for future periods.

3. Should the Co-operative Bank phase-out Independent Financial Advice / Insurance and Pathfinder products?

The product profitability analysis reveals the Independent Financial Advice/Insurance and Pathfinder products to be unprofitable. According to exhibit 8, both the products exhibit direct loss, the directly attributable cost of the products is greater than the revenue. Generally, it is extremely difficult to alter the profit margin in case of services. Adding or removing components produce little improvement in profitability but can adversely impact the overall experience of the customer sometimes. For Co-operative Bank, these unprofitable products have substantial costs relative to the revenue they bring. Under these circumstances, it is advisable for the bank to phase out these products. Nevertheless, customer analysis can provide further insight that will enable the management to identify the reasons for high costs. It might be the case that the cost for certain customers is higher than the rest. In that case, it will be more prudent to divest unprofitable customers and encourage profitable ones rather than eliminating the product overall.

4. What does customer profitability add to the product profitability analysis? How can the information on customer profitability be used to improve the bank’s financial condition?

Customer profitability provides a further breakdown for the product profitability analysis which can form the basis for better managerial decision making. It helps classify customers by importance and identify the loss-making ones. Since each person uses bank services differently, customer analysis can provide valuable insight. The management, using the additional information, can easily identify which customers it should focus on. In the case of the Co-operative Bank, the customer profitability analysis provides information that can help in the restructuring of bank products and redirecting its marketing efforts.

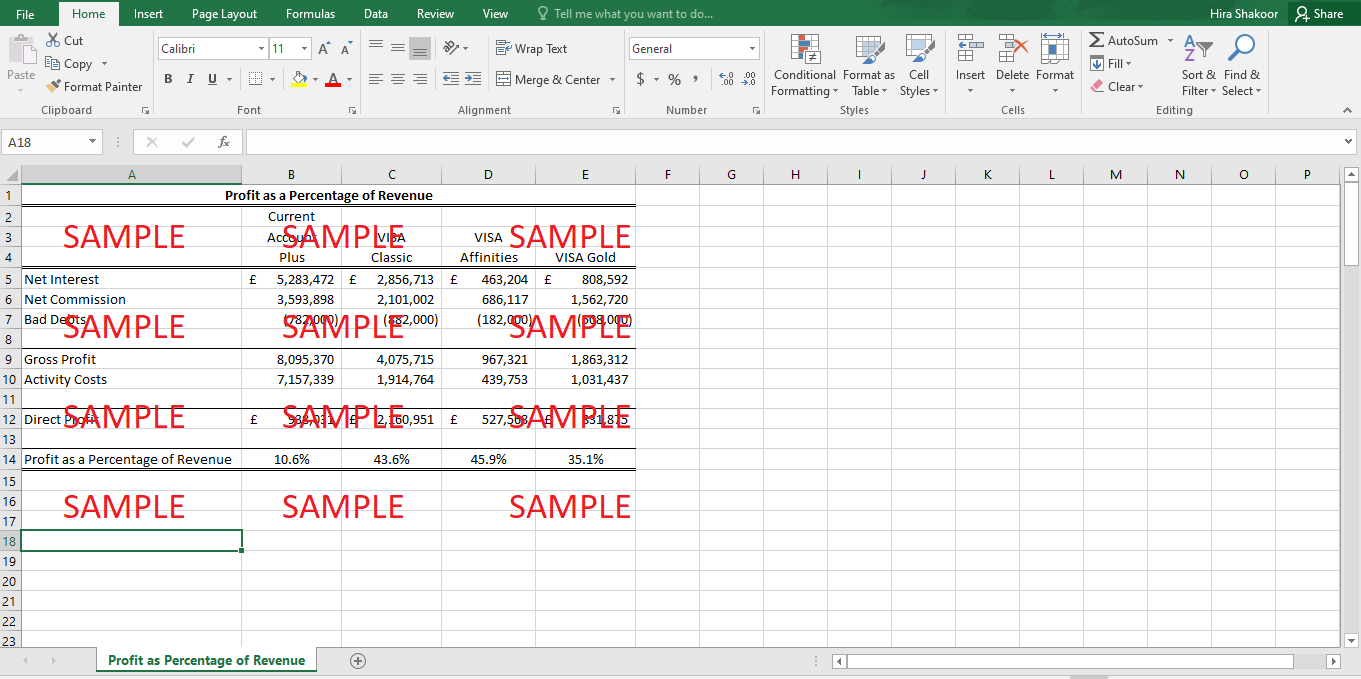

Using the information from customer profitability analysis, the Visa customers were classified into profitable and unprofitable ones.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- The Deepwater Horizon Oil Spill The Politics of Crisis Response A Case Solution

- The Eleganzia Group Case Solution

- The Eli Lilly MDR TB Partnership Creating Private and Public Value Case Solution

- The Espresso Lane to Global Markets Case Solution

- The Euro in Crisis Decision Time at the European Central Bank Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.