Get instant access to this case solution for only $19

The Super Project Case Solution

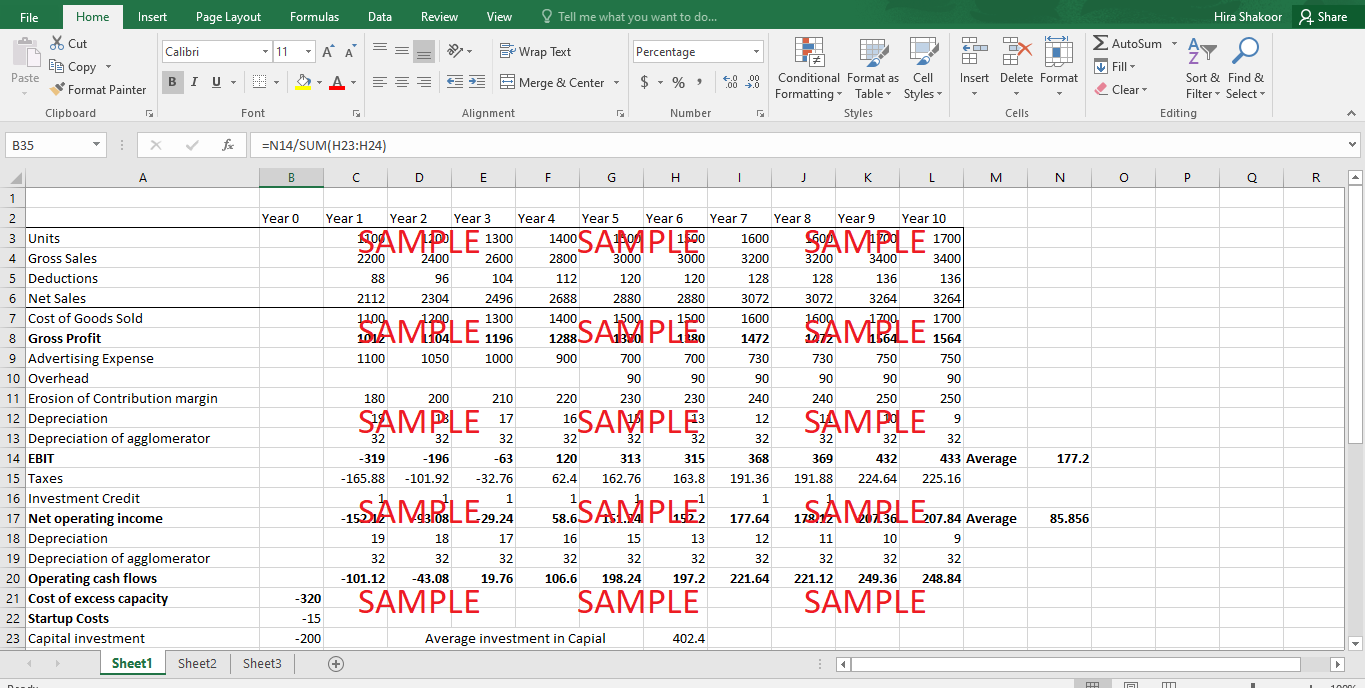

The relevant cash flows for the Super project are detailed in the excel model. The main heads of relevant cash flows are sales, cost of goods sold, advertising expense, taxes and investment credits. The investment in net working capital has to be taken care of in every year because it has an effect on the net operating cash flows generated from the project.

Following questions are answered in this case study solution

-

Relevant Cash flows

-

Test marketing expenses

-

Overhead expenses

-

Erosion of Jell-O contribution margin

-

Allocation of charges for the use of excess agglomerator capacity

-

Attractiveness of the project

-

Net Present Value

-

Payback period

-

Internal Rate of Return

-

Accounting Rate of Return

-

ROFE

-

C.Sanberg suggestions

-

Incremental basis

-

Facilities-Used basis

-

Fully Allocated Basis

-

The strategic importance of Super Project

-

Benefits

-

Risks

-

Conclusion

Case Analysis for The Super Project

The specific treatments of the main heads are given below:

2. Test marketing expenses

Test marketing expenses were incurred while the product was not ready for launch and its feasibility was being tested. For the purposes of evaluating the super project now, these cash flows are not relevant and thus would be treated as a sunk cost, having no impact on the evaluation of the project. These cash flows were important when the decision to whether test market the product or not was under consideration. This cost cannot be saved if the project is rejected which shows that this cost should not have an impact on the evaluation process.

3. Overhead expenses

Only the incremental overhead charges should be included in the evaluation of the project since all other overheads will be incurred with or without this project. Overheads are the costs that relate to the company as a whole and should be treated as sunk costs for the evaluation of projects. However, if the projects call for additional overhead charges which can be avoided if the project is rejected, then these overheads have to be taken into account (as has been done for Year 5 and onwards).

4. Erosion of Jell-O contribution margin

The erosion of the Jell-O contribution margin has to be taken into account while evaluation of the decision to invest in Super Project. This is, in fact, the most crucial element to be taken care of. By the launch of Super Project, the sales of the company as a whole will be cannibalized and the contribution margin lost for the lost sales of Jell-O is a relevant cost for this project. The super project should create more value for the firm as a whole. If this cost is not accounted for then there is a possibility of choosing an alternative which in effect reduces the value of the overall firm as it were before the project. By introducing this cost in the evaluation process, the feasible option would be the one with the contribution margin more than that of the lost sales and the firm as a whole will benefit from the move.

5. Allocation of charges for the use of excess agglomerator capacity

The charges for the use of excess agglomerator capacity are indeed a relevant cost for the project. If the agglomerator were not used in the project, it could have been used in some other project, adding value to the firm. Thus, the excess capacity usage constitutes a cost for the project. For the correct calculation of the cost of the project, it is necessary to take into account this cost. Also, the cost of using the agglomerator can be avoided if the project is not taken up, which justifies its inclusion in the relevant cash flows. However, the building cost is irrelevant on the same grounds and thus will be excluded.

6. The attractiveness of the project

Capital Budgeting techniques

For the calculation of NPV, the free cash flows of the project were calculated as follows

|

Item |

Comment |

|

Net Sales |

An estimate of the sales (from the case) |

|

Cost of Goods Sold |

Deduced from sales |

|

Gross Profit |

|

|

Advertising Expense |

Deducted from Gross profit |

|

Overhead |

Only incremental overheads are deducted (Year 5 through 10) |

|

Erosion of Contribution margin |

Treated as a cost |

|

Depreciation |

Deducted |

|

Depreciation of agglomerator |

Deducted |

|

EBIT |

|

|

Taxes |

|

|

Investment Credit |

|

|

Net operating income |

|

|

Depreciation |

The depreciation is added back because it is not a cash expense and thus it should not affect the free cash flow calculation |

|

Depreciation of agglomerator |

|

|

Operating cash flows |

|

|

Change in Net Working Capital |

Investment in net working capital affects the cash flow. Can be positive or negative |

|

Free Cash Flow |

7. Net Present Value

The net present value measures the direct value that the project adds to the firm. However, it ignores the more tangible outcome like goodwill which could be potentially generated. The net present value of the project as calculating at 10% WACC (assumed) comes out to be negative by a huge amount of ($166.9). Thus this project will be rejected in terms of NPV. The NPV method is the most efficient way of evaluating capital investment projects because it incorporates all the crucial elements that should be taken into account. This figure is based on the estimated sales price, which can be increased in the future which will have a positive impact on the NPV.

8. Payback period

The payback period method evaluates a project on the time that it takes to return its initial investment. The Payback period of this project comes out to be 7.859 years. Although this might be an attractive figure for General Foods this method of evaluating capital investments has many drawbacks. This does not take into account the time value of money nor does it consider any cash flows after the project pays back the entire investment. Thus basing a decision on this method of calculation will not lead to a rational decision.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- The Tip of the Iceberg JP Morgan and Bear Stearns (A) Case Solution

- Threadless The Business of Community Case Solution

- Toyota Motor Corporation Launching Prius Case Solution

- TruEarth Healthy Foods Market Research for a New Product Introduction Case Solution

- Uber Pricing Strategies and Marketing Communications Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.