Get instant access to this case solution for only $19

Tire City Inc Case Solution

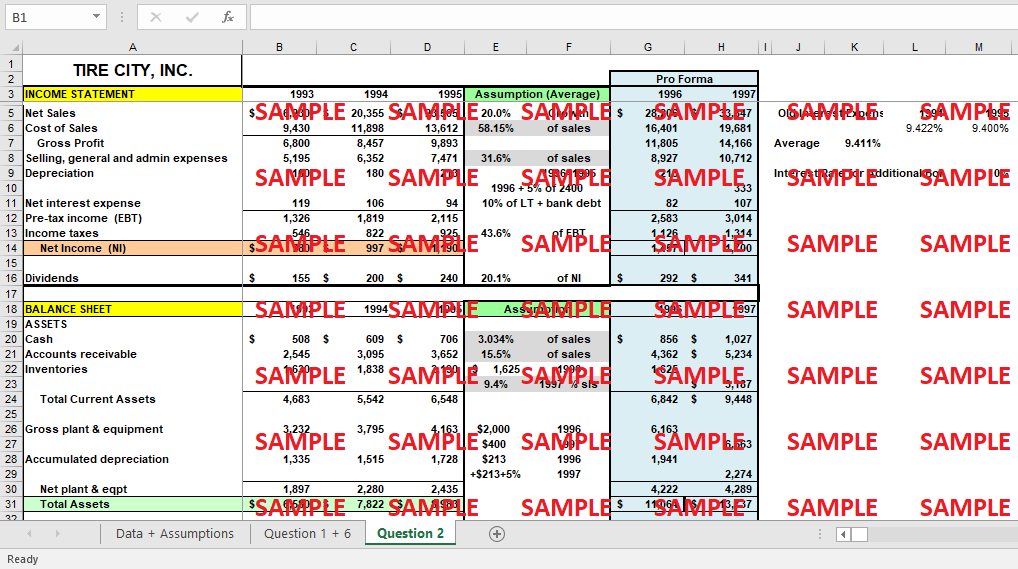

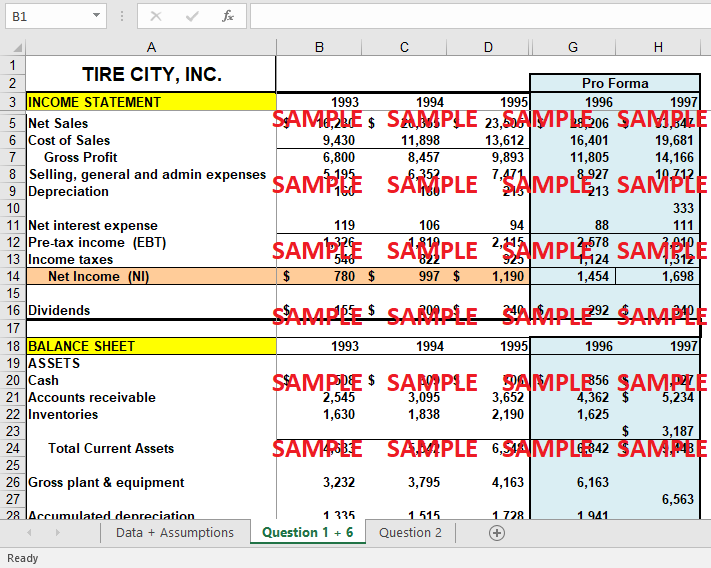

When it came to retail tyre distribution in the north-eastern United States, Tire City, Inc. (TCI) was a fast-rising player. When Jack Martin, Tire City's CFO, was getting ready for a bank meeting to ask for a five-year loan to fund the company's planned development and expansion of its storage facilities, he ran into a problem. The addition would cost TCI $2,400,000. The planned financing conditions called for the loan to be taken out in two equal payments, if required, in 1996 and 1997, and returned in four equal yearly instalments of $600,000 one year after the warehouse's construction was finished. Mr. Martin planned to prepare a set of pro forma financial statements for the firm in advance of his meeting. With an eye on Tire City's financial future, Mr. Martin sought to forecast what the remainder of the income statement and balance sheet will look like in 1996 and 1997.

Following questions are answered in this case study solution

-

Evaluate Tire City’s past performance and current financial health. Do a quantitative analysis of the company’s past financial performance.

-

Prepare pro forma income statement, balance sheet and cash flow statement for the company for 1996 and 1997.

a. Based on Mr. Martin’s sales predictions

b. Keep the same percentages as 1995.

c. Assume the company will borrow enough each year to have the desired ending cash balance of 3% of each year’s sale.

d. Interest expense on the new borrowings is at 10%. Interest expense on the old loan continues to decline at the same rate as 1993-1995.

-

Using your set of pro forma financial statements, assess the future financial health of Tire City as of the end of 1997. Will Tire City be in a stronger or weaker financial condition two years from now?

-

What factors might influence the projects and the company’s performance and, therefore, repayment of the loan?

-

Evaluate Tire City’s financial health. What key items stand out to you?

-

Develop pro forma forecasts for Tire City’s income statements and balance sheets for 1996 and 1997 assuming sales reach the levels of $28,206,000 and $33,847,000 for 1996 and 1997, respectively, as predicted by management. Take into account the other assumptions provided in the case. Assume that any new financing that would be required will be in the form of bank debt at a cost of 10%.

Case Analysis for Tire City Inc

1. Evaluate Tire City’s past performance and current financial health. Do a quantitative analysis of the company’s past financial performance.

Profitability

During the years 1993-1995, sales at Tire City increased significantly. Sales rose by 25.42 percent in 1994 and by 15.48 percent the following year (in comparison to the year before). Every year, they've seen an increase in their profit margin. As of this year, their profit margin is 5.06 percent compared to 4.81 percent in 1993, and 4.90 percent in 1994. Cost of goods sold and interest expenditure both fell as a percentage of sales, both of which helped boost the company's profit margins. The tyre retailer's gross profit margin was 41.55 percent in 1994, but it increased to 42.05 percent in 1995, suggesting that it is either charging higher prices or finding lower-cost tyre suppliers. In 1994, the tyre retailer's gross profit margin was 41.55 percent. Since the firm has begun making payments on its initial warehouse loan for $125,000, its interest expenditure as a percentage of sales has fallen. This is because the company is paying off the debt.

Asset Turnover

The ratio has risen to 2.47x, 2.60x, and 2.62x in the year 1993, 1994, and 1995 respectively. In 1995, the fixed asset turnover grew from 8.93x to 9.65x. To put it another way, plant and equipment as a proportion of sales has fallen. A few extra expenditures in plant and equipment may have been made, but the company's overall fixed asset turnover was boosted by the increase in income. The accounts receivable turnover witnessed a decrease from 6.58x to 6.44x from the year 1994 to the year 1995. Consequently, the collection time was extended from 55.5 days in 1994 to 56.7 days in 1995 as a consequence of this increase.

Financial Leverage

Tire City's assets-to-equity ratio has been continuously decreasing since it reached its all-time high in 1993, going from 2.01 to 1.92 to 1.79 in 1995. As a direct consequence of this, they are lowering the amount of danger they face and enhancing the security of their finances. Tire City has sufficient financial resources to effectively manage its day-to-day operations and make progress in reducing the outstanding debt on the loan for the warehouse. Its compound annual interest rate has been climbing steadily since 1994 when it was at 18.16 percent and reached an all-time high of 23.50 percent in 1995. This has been made possible in part by improvements in both net income and interest expenditures. In 1994, the cash conversion cycle at Tire City lasted for 71.2 days. In 1995, however, it lasted for 76.8 days. When compared to 1994, this is the result of a larger amount of time spent collecting payments and a shorter period spent making payments.

Liquidity

The current ratio of the company was 2.03 whereas the quick ratio, which shows the liquidity of the company after subtracting the inventory, was 1.35 which can be considered as good. Their operational cash flows in 1994 and 1995 were $989,00, which means they have no problem paying their operating costs. The drop in cash flow was caused by an increase in inventory expenditures to keep up with the company's sales growth.

Financial Statements

In 1994, Tire City required $1,302,000 in additional assets, which was reduced to $1,101,000 in 1995, based on its financial statements from 1993 to 1995. Accounts receivable rose by $283,000 in 1994 and by $115,000 in 1995 as a consequence of unanticipated occurrences, whereas retained earnings rose by $797,000 in 1994 and $950,00 in 1995. In 1994, they had a $222,000 EFN, and in 1995, they had a $36,000 EFN. Finally, between 1994 and 1995, the long-term debt of the corporation was decreased by $125,000.

Tire City's financial status has improved since 1993 as a result of its success, as can be seen in the chart below. By keeping its expenditures as low as possible, the firm was able to increase sales and net income, as can be seen by the shift in ratios.

2. Prepare a pro forma income statement, balance sheet, and cash flow statement for the company for 1996 and 1997.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.