Get instant access to this case solution for only $19

Valuing Wal Mart Stock Case Solution

Wal-mart is the considered to be the largest retailer in the world. It was founded in 1970. Wal-mart is operating in 8400 stores worldwide. There are Wal-mart stores in all 50 states of United States. Wal-mart is running its business operations in Argentina, Brazil, Canada, Germany, Mexico and many other countries around the globe. 2.1 million employees are directly or indirectly associated with Wal-mart. The client base of Wal-mart is approximately 200 million customers per week. Only during the fiscal year 2010 which ended on 31 January, Wal-mart reported net sales revenue of worth more than $405 billion. During the same year, the dividend payout of Wal-mart was $1.090 per share. Currently Wal-mart has approximately 3.36 billion outstanding shares in the market.

Following questions are answered in this case study solution

-

Valuing Wal-Mart Analysis

-

Dividend Perpetuity Model

-

Three Stage Approach to Stock Pricing

-

P / E Multiple Valuation Model

-

Conclusion

Case Analysis for Valuing Wal Mart Stock

The closing market value of a Wal-Mart stock is $53.48, which is the current market price, as well. A consensus by analysts has anticipated that the market value of Wal-Mart will be $60.50 per share as on February 2010. The estimated price by analysts has been reviewed under various Dividend Discount Models such as; Dividend Perpetuity Model, Three Stage Model and P/E Multiple Model.

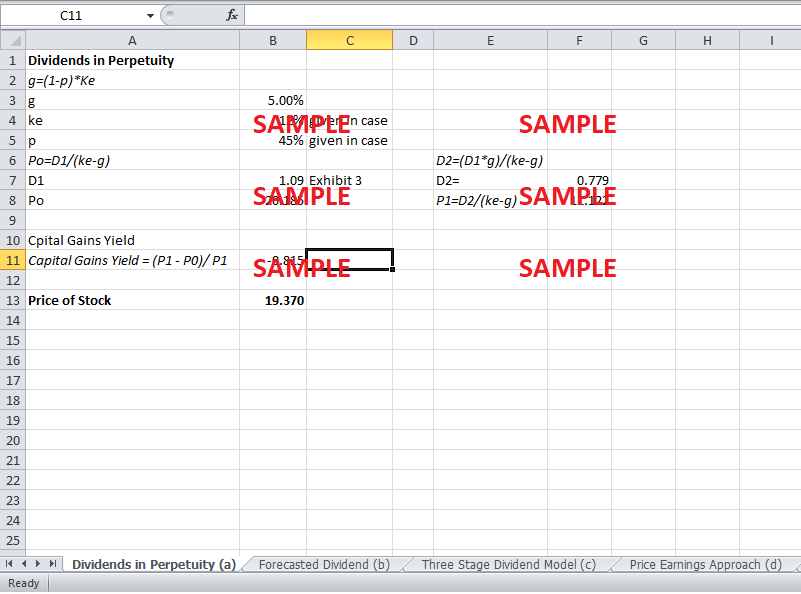

2. Dividend Perpetuity Model

According to Dividend Perpetuity Model, the price of stock is calculated by discounting all expected future cash flows to the present value. The discounted rate is applied by obtaining the cost of capital of the firm or an investor’s required rate of return. Under this model, the share price is valued by estimating dividends in perpetuity. To calculate all the future dividends, a growth rate is used. In the most basic form of this model, a constant growth rate is applied. Also the price of stock is considered to be P0. Using this model, the price of Wal-Mart’s share is calculated at $19.37 with a growth rate of 5% and discount rate of 12%. The value given by Dividend Perpetuity Model is highly unrealistic. This model assumes certain implications, which are not applicable in real market. The assumptions are:

-

Dividend growth rate will be constant forever which is not possible

-

This model is not applicable to companies which do not pay any dividend at all

-

Dividend per share cannot grow at a higher rate than Ke

-

This model completely fails to take into account the risk factor

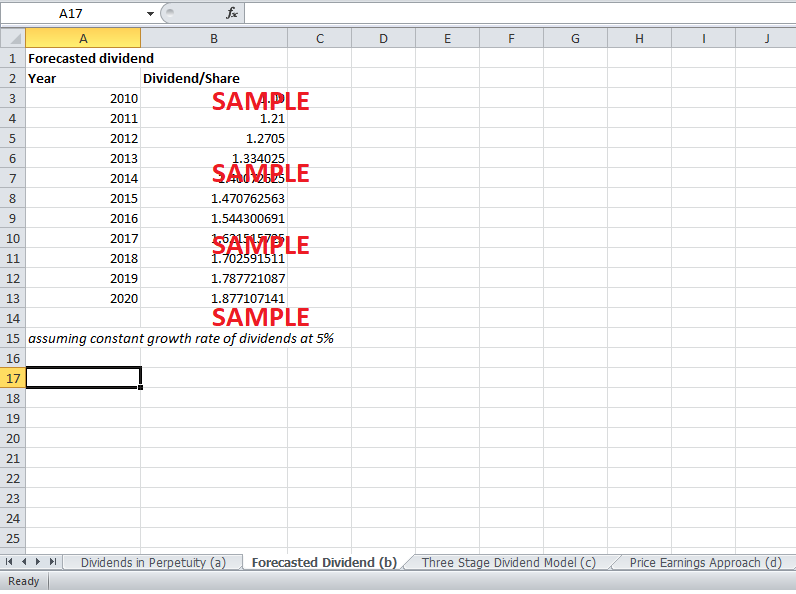

Moreover, the future dividend per share for next ten years was calculated assuming a constant growth rate of 5%. Forecasted dividend per share at constant growth remotely showed the dividend growth rate of past years.

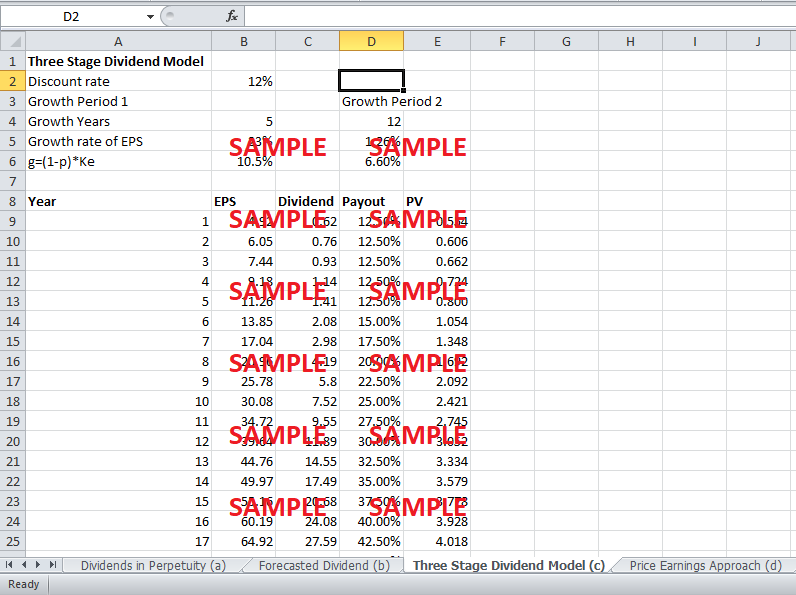

3. Three Stage Approach to Stock Pricing

While using three stages approach of dividend discount model, the future growth in further divided into three different time horizons. These time horizons are:

-

Growth years, during which the company earns abnormal levels of profitability

-

Transition years, during this time period the profitability percentage of the company is slowly decreasing toward the average profitability percentage of the industry

-

Maturity years, during this time period, the profitability percentage of the company is considered to be equal to the profitability percentage of the industry. The company is earning normal levels of earnings.

The three stage approaches to dividend model has showed realistic price valuation of the Wal-Mart stock. It is given in exhibit 4 that, under this model, the theoretical value of Wal-Mart stock is $120.37. This theoretical valuation of future Wal-Mart stock was confirmed under certain assumptions incorporated. The assumptions taken were as following:

-

There will be a constant payout of 45%

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Foreign Direct Investment And Irelands Tiger Economy A & B Case Solution

- Costco Wholesale In 2008 Mission Business Model And Strategy Case Solution

- SAS Institute A Different Approach To Incentives And People Management Practices In The Software Industry Case Solution

- Nokias Supply Chain Management Case Solution

- MoGen Inc Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.