Get instant access to this case solution for only $14

Vestige Capital Case Solution

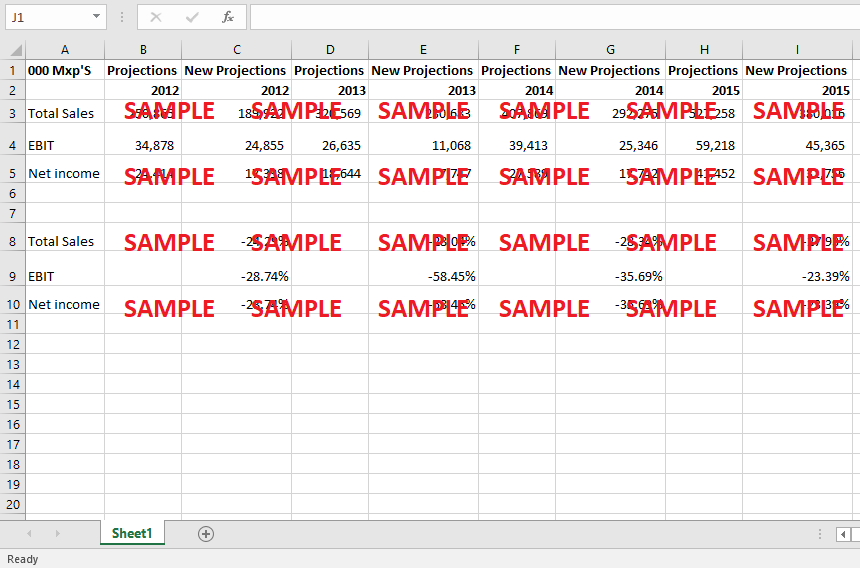

As a result of the customer concentration which caused 26% of the total sales of Bomi Mexico to J&J allowed Sicilia and Fernandez to adjust the projections of revenues and EBITDA. As of FY12, the new projections have been revised as per table 1 whereby the sales have been reduced by 24.29% followed by 28.04% in FY13.

Case Analysis for Vestige Capital

The net income has been reduced by 28.74% in FY12 and is expected to decrease by 58.45% from the previous projections in FY13.

As per the new partnership relationship, Fernandez remained supportive and engaged in the business meetings with the target investors however it was difficult for Sicilia to trust a partner with uncertain availability. Since the new projections for Bomi Mexico still seem to have growth potential even after the revenue and margin adjustment. In this regard, Fernandez may stick with the company for a longer period with full engagement and propose an offer price that may be acceptable to Bomi Mexico for acquiring the business and close the deal.

Get instant access to this case solution for only $14

Get Instant Access to This Case Solution for Only $14

Standard Price

$25

Save $11 on your purchase

-$11

Amount to Pay

$14

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- TokenFunder Democratizing Funding And Investing With Blockchain Case Solution

- SuDa Electric Vehicle Company Private Equity Investment In China Case Solution

- The Chain Saw Industry In 1978 Case Solution

- Dollar Shave Club Disrupting The Shaving Industry Case Solution

- Baidus Business Model And Its Evolution Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.