Get instant access to this case solution for only $19

Westwood Plastics Inc Case Solution

Westwood Plastic Inc. is a manufacturing company that has been engaged in the manufacturing and sale of a wide range of plastic products since 2004. In March 2006, the company entered into an agreement with Schalke Industrie AG – a plastic-resin manufacturing company based in Germany – that granted Westwood access to exclusive rights to manufacture and distribute a new plastic called Crayola. In order to purchase the raw materials for Cryolac, Westwood entered into a loan agreement with Canadian Bank and Schaller to finance this arrangement. The loans required Westwood to maintain minimum before-tax profitability of Cdn$9 Million.

The issue at hand is that Westwood faces foreign exchange currency risk because of the Schaller agreement since a lot of expenses are required to be made in euro. The revenues of the company are in Canadian dollars while most of the expenses are incurred in Euros. Whereas the currency market has been very volatile, and the Canadian dollar is expected to fall in value over the course of next year, the company is likely to face a high risk of falling below the profitability threshold for Canadian bank’s covenants. Hence, under these circumstances, the main risk faced by Westwood is that if the Canadian dollar falls in value against the euro, the profitability target will not be met, and the company would violate the bank loan’s covenant.

Following questions are answered in this case study solution

-

Introduction and Problem Statement

-

Profit before Tax at Five Different Exchange Rates

-

Forward Contracts

-

Call Option

-

Put Option

-

Results

Case Analysis for Westwood Plastics Inc

Westwood has a number of options available to hedge the currency risk faced. Firstly, it can purchase 12 monthly call options, option to buy Euros at a fixed exchange rate, to hedge itself against foreign exchange risk. Secondly, Westwood can purchase 12 monthly forward contracts to fix the exchange rate at the current level. Finally, Westwood can purchase a put option, the option to sell Canadian dollars, based on the speculation of the rise in the value of the dollar. A careful analysis of all of the three options available to Westwood is presented below:

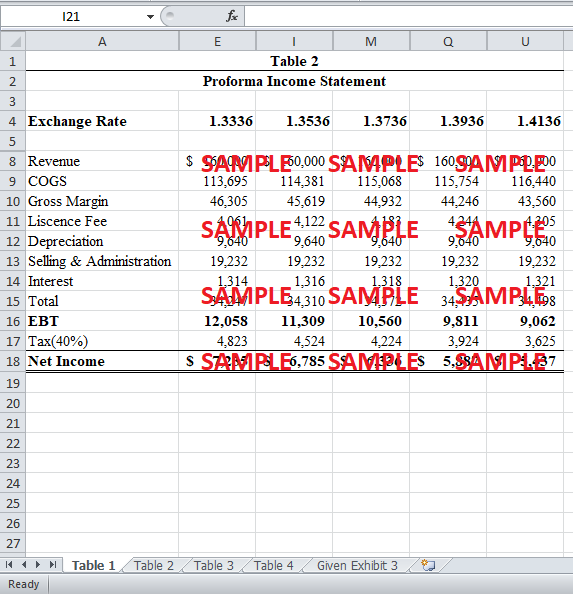

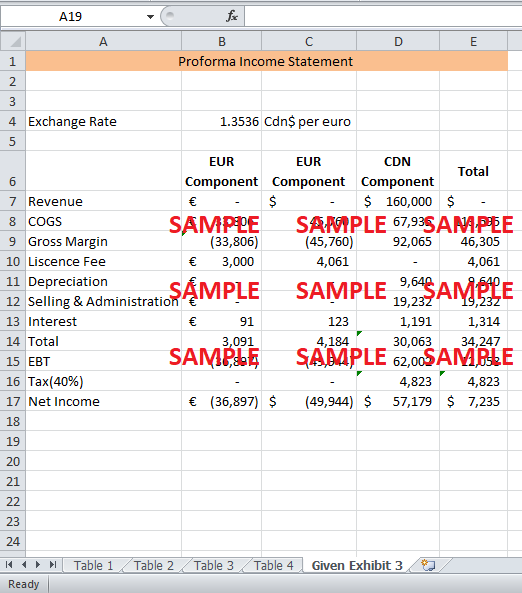

2. Profit before Tax at Five Different Exchange Rates

Before analyzing the three hedging options available to Westwood, a report summarizing the impact of change in the exchange rate is presented below:

In order to calculate the euro component in Euros, the amounts given in Canadian dollars were divided by 1.3536 since the Euro component in Exhibit 3 was calculated at this exchange rate. Furthermore, for each of the five exchange rates that Chang chose to analyze (i.e. 1.3336,1.3536,1.3736,1.3936 and 1.4136), table 1 presents the results of the change. After calculating the euro component in Euros, all of the values for the euro component were multiplied with respective exchange rates for each scenario. This gave us the figures for a profit before tax for each scenario. Clearly, the profit before tax decreases as the exchange rate rises. In other words, the profitability of Westwood falls much closer to the threshold for the bank’s covenant.

However, by using one of the hedging techniques, Westwood can protect itself against the currency risk and save itself from the worse consequences.

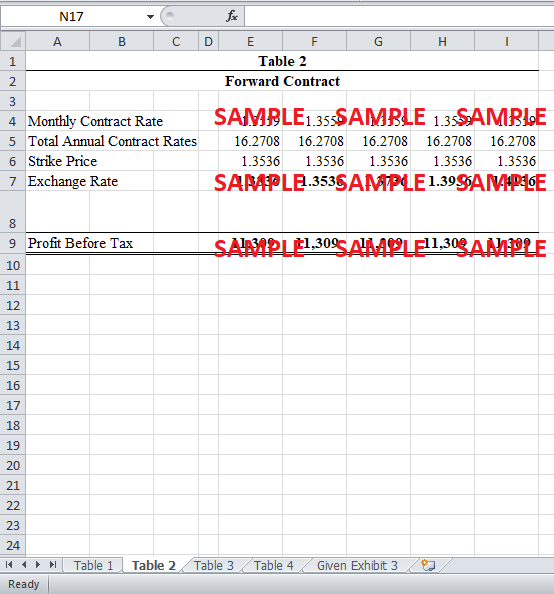

3. Forward Contracts

A forward contract is a contract that obligates the party to buy or sell a certain asset at a certain price and at a certain date. The two positions of a forward contract are long and short. Long position signifies the obligation to buy while a short position creates an obligation to sell the asset. Westwood can purchase 12 monthly forward contracts; one contract to exercise each month, to make the payments for expenses in Euros at the current exchange rate of 1.3536. Essentially, such contracts would obligate the company to purchase Euros at the rate of 1.3536 regardless of whether the actual exchange rate falls or rises.

Table 2 presents the profit before tax for each of the five interest rates if the company purchases the monthly forward contracts. The offered rate of a one-month forward contract is Cdn$1.3559 which will amount to Cdn$16.27 which will be a sunk cost and hence will be subtracted from the company’s profits. Hence, as already stated, since the company is now obligated to buy Euros at a rate of 1.3536 regardless of the actual exchange rate, the profit before tax in each scenario would equal to Cdn$11.309 Million (Cdn$11.309 Million – Cdn$17.27). Although the forward contracts hedge the downside of the profits, one disadvantage of forwarding contracts is that it is an obligation exercise as opposed to the right.

4. Call Option

A call option is a right to buy the underlying asset at a certain price at a certain date. Since call option gives rise to a right rather than an obligation, it increases the upside potential while hedging the downside. Westwood can purchase 12 monthly call options; option to buy Euros. Hence, if the exchange rate rises above the strike price i.e. 1.3536, the company can exercise its right and buy the Euros at Cdn$1.3536. However, if the exchange rate falls below Cdn$1.3536 per Euro, the company can choose not to exercise the right and purchase the Euros at the lower market price.

Table 3 presents the profit before tax for each of the five scenarios or exchange rates. The average call premium for the year is 1.91. In other words, the company can purchase 12 monthly call options at Cdn$22.92 which will be a sunk cost in the arrangement. In the scenario when the exchange rate is equal to 1.3536, the company will be indifferent about exercising the right as the cost is the same. When the exchange rate falls below 1.3536, say 1.3336, the company will not exercise the right. As the market price is lesser than the strike price, the company will lose if it exercises its right since it will purchase the Euros more expensive than the market rate. In this case, the profit before taxes for the company will be Cdn$12.035 Million after subtracting the call premium. However, if the market price of Euro rises above Cdn$1.3536, the buyer of a call option will benefit since he can purchase the Euros as a price that is lesser than the market.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.