Get instant access to this case solution for only $19

Wildcat Capital Investors Real Estate Private Equity Case Solution

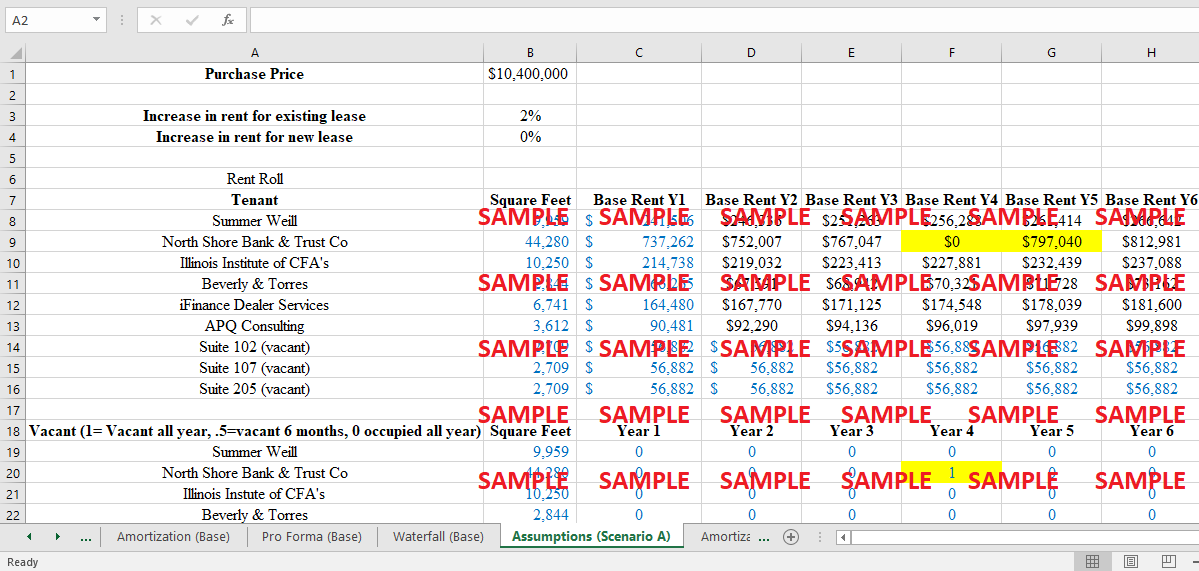

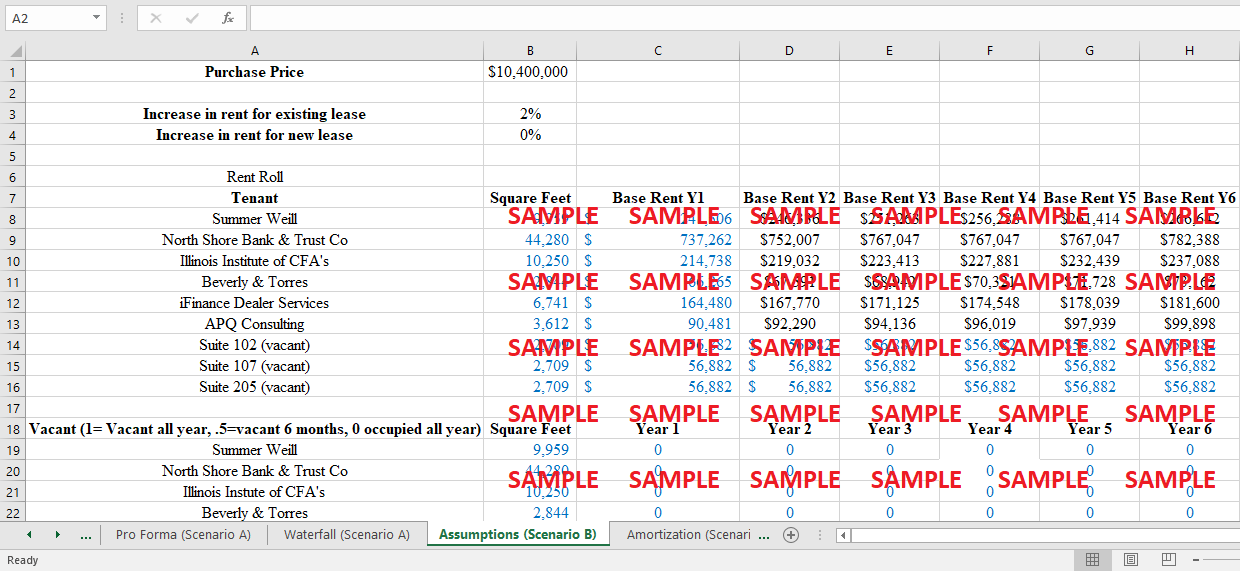

Wildcat Capital Investors, LLC is a real estate investment company with its headquarters in Evanston that is privately owned. Deal after deal, the corporation makes investments in a wide variety of real estate assets. After doing some research, Zaski discovered that the Chicago suburb of Skokie, Illinois, had seen a significant change in the year 2007. On a total of 6.5 acres of land, the property that is part of the mezzanine transaction offers 85,812 square feet of rentable space in addition to a bigger parking lot. According to the most recent figures that are currently accessible, there were just six tenants that used 90.5% of the available leased space in the year 2009. According to the market research conducted by Zaski, the neighbourhood of Skokie, which is located on the Near Northsides of Chicago, has around 14 million square feet of corporate office space that is controlled by significant companies.

Following questions are answered in this case study solution:

-

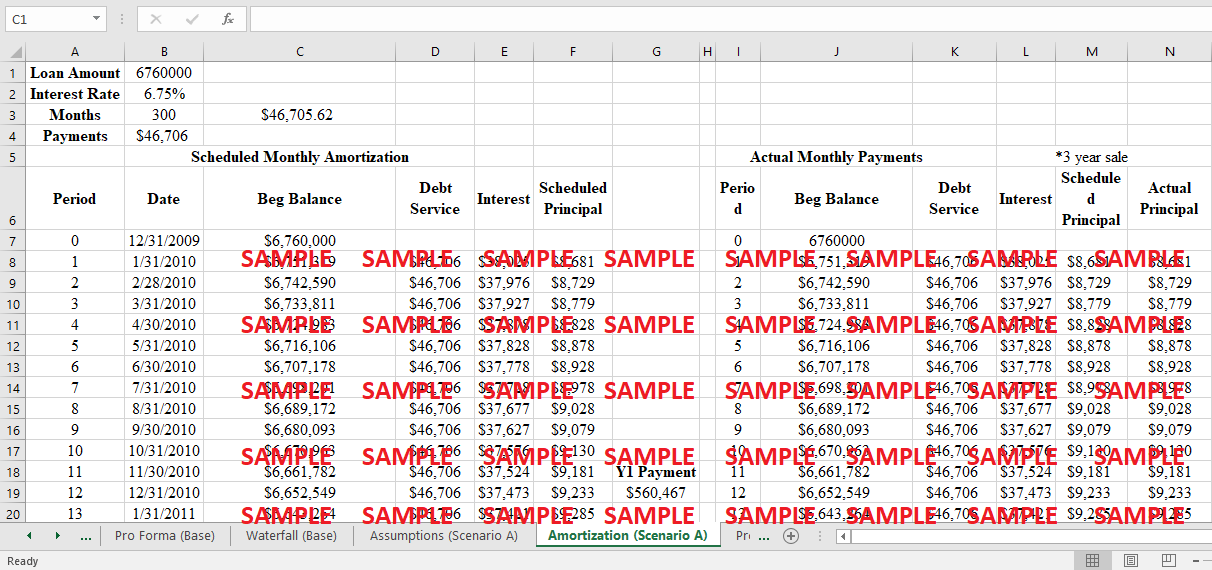

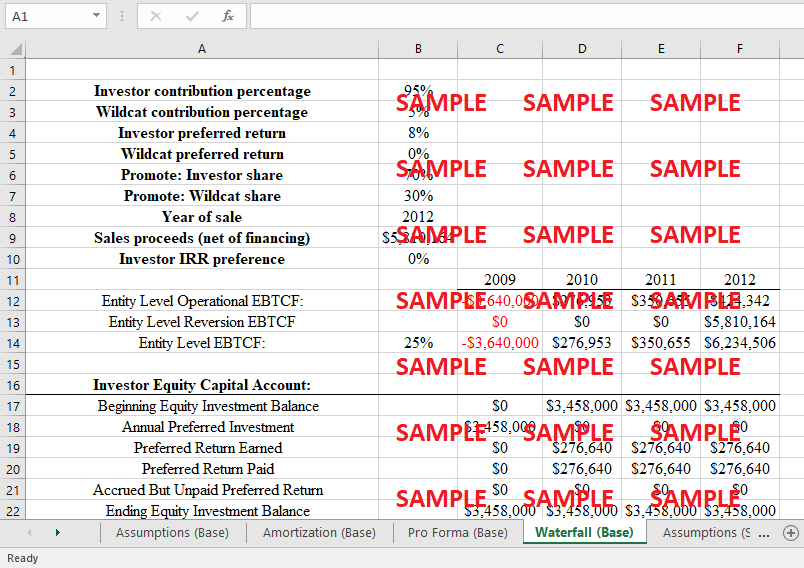

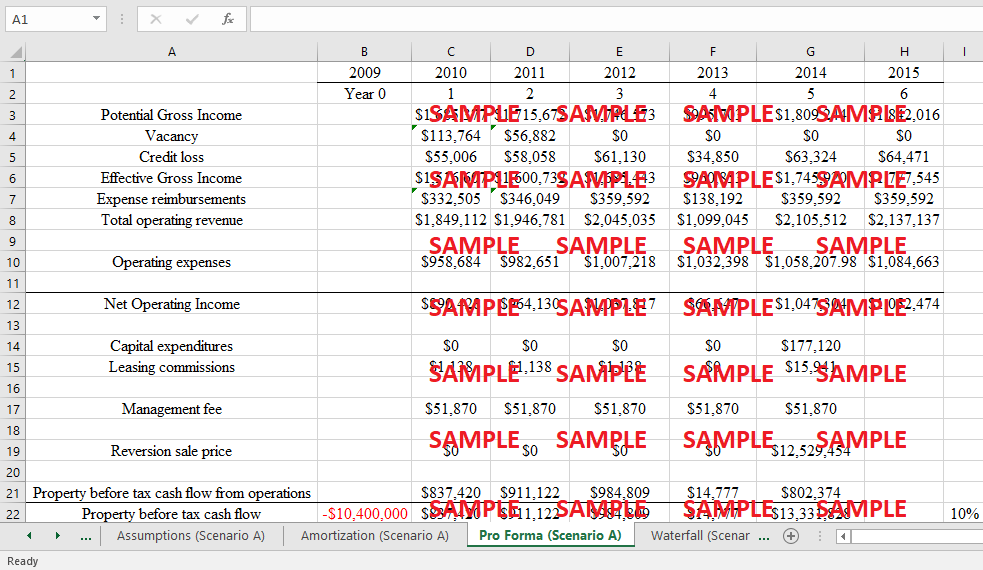

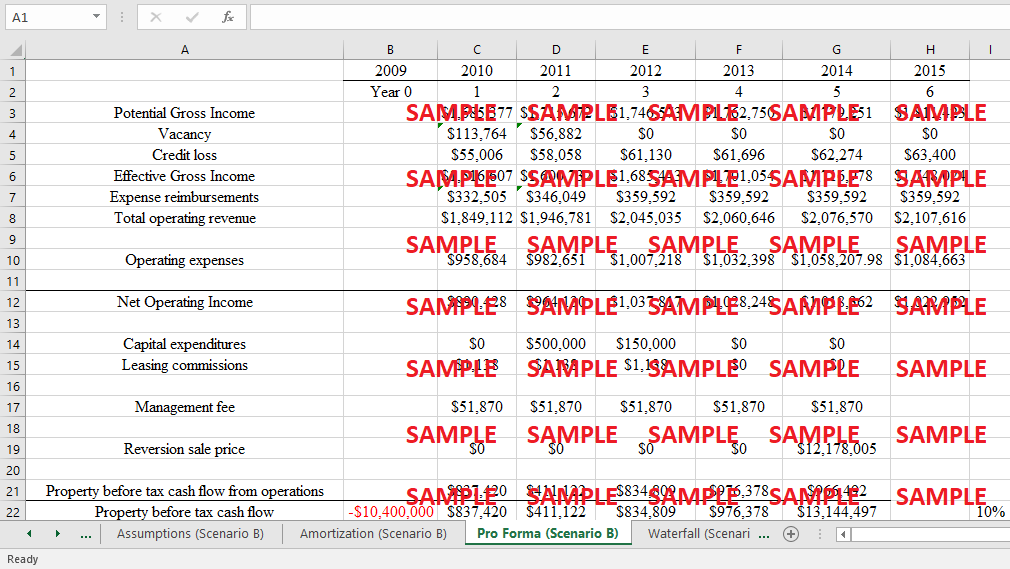

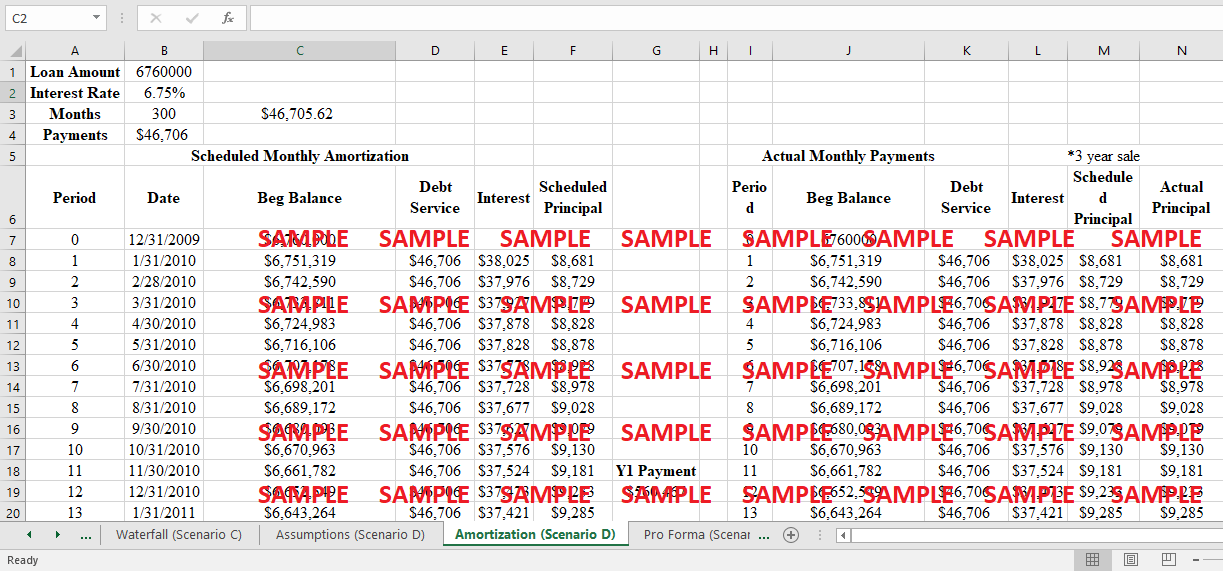

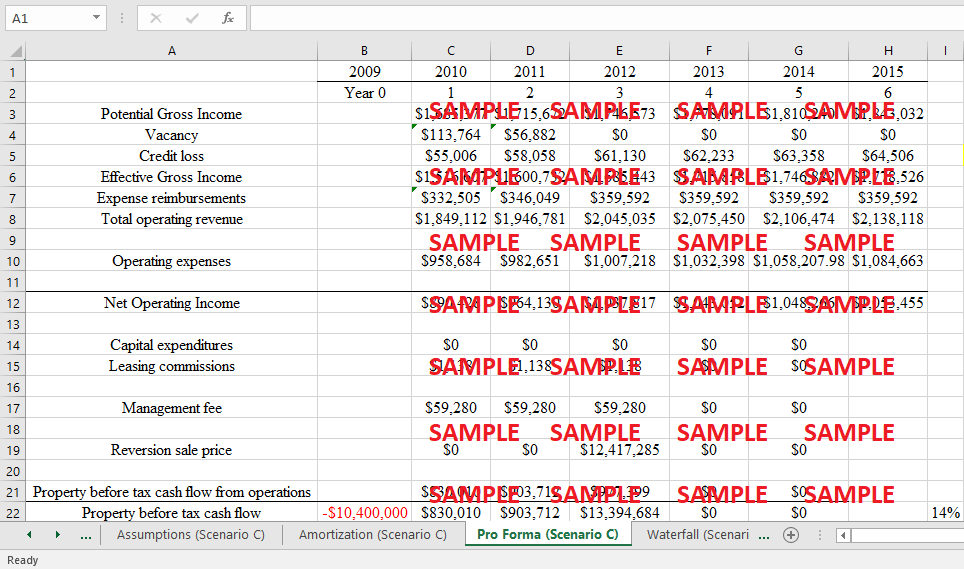

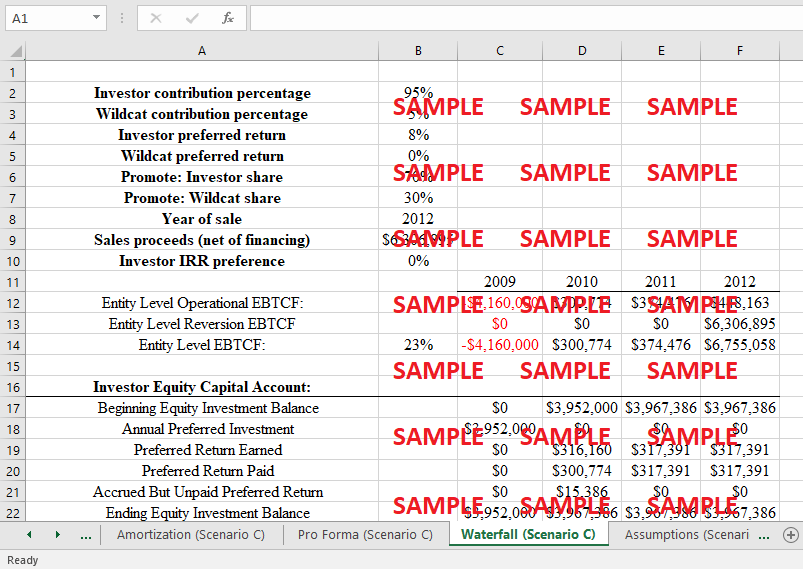

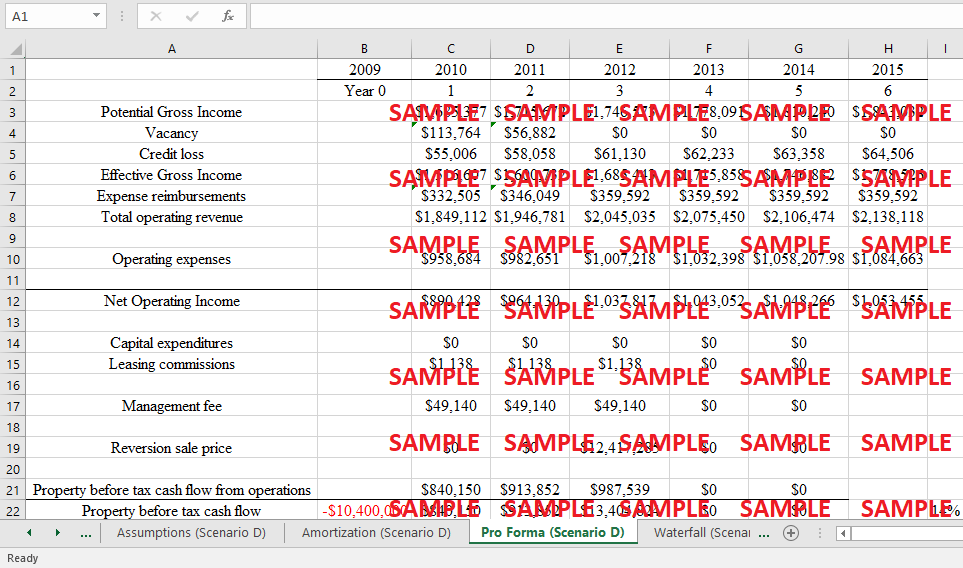

Re-create the base-case property proforma with debt. Using the rent roll numbers in the Excel template, the operating cash flows will differ from the case exhibits by $2-$6 (The reversion cash flow will differ by about $60 due to multiplier effects). Then complete the waterfall shown in exhibit 10 using the benchmark assumptions outlined in the case. (Skip to the last page of this document for instructions on filling out the waterfall) Under these assumptions, calculate the expected return to Wildcat Capital Investors and its limited partners and compare those returns to the property-level return on Financial Commons if it is sold after three years. Returns to Wildcat should be calculated without including its management fee. Note that the waterfall to the equity partners doesn’t get paid until after the loan payments have been made/OLB paid back to the bank.

-

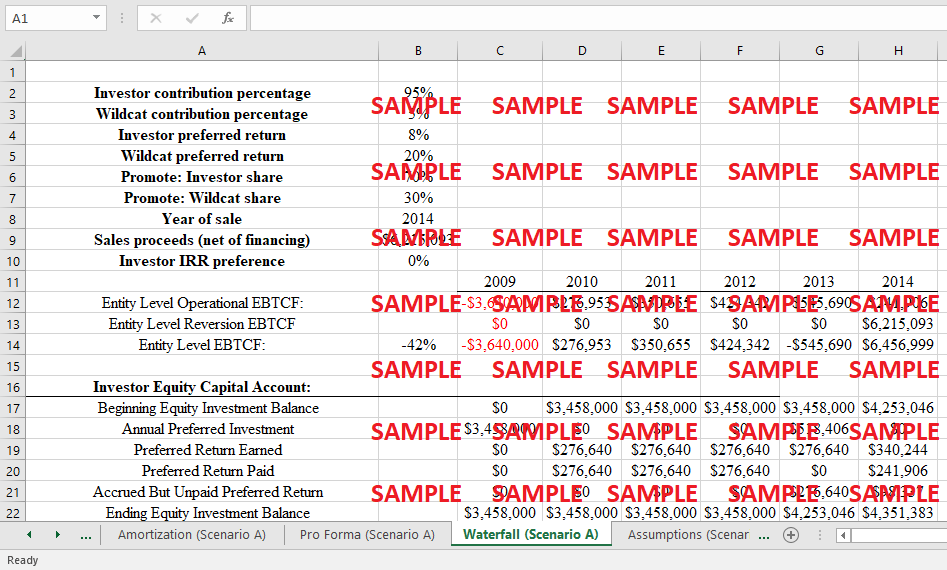

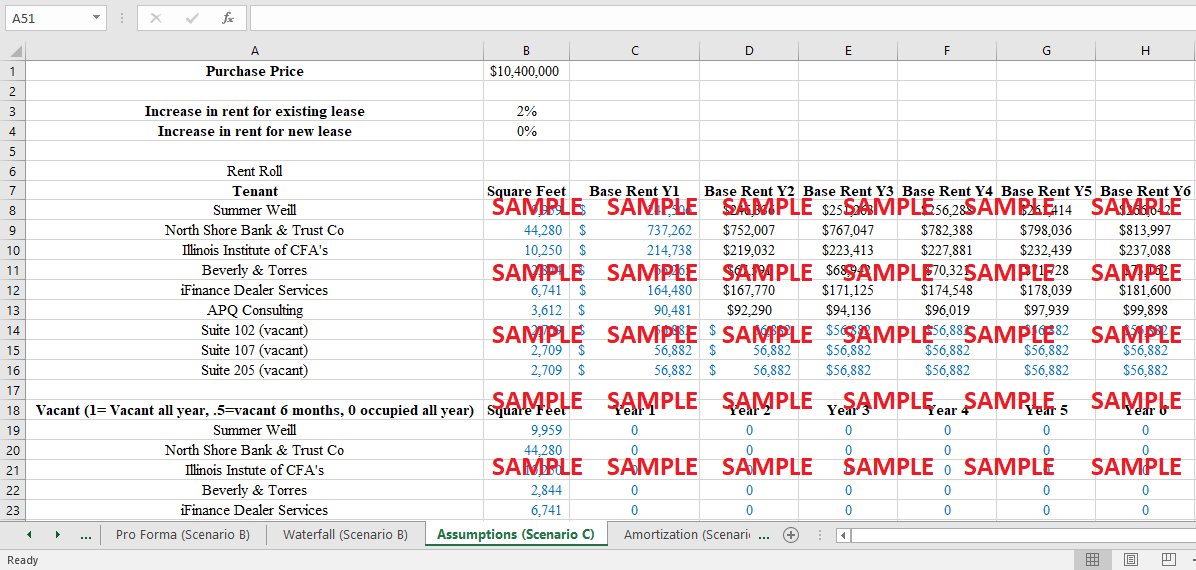

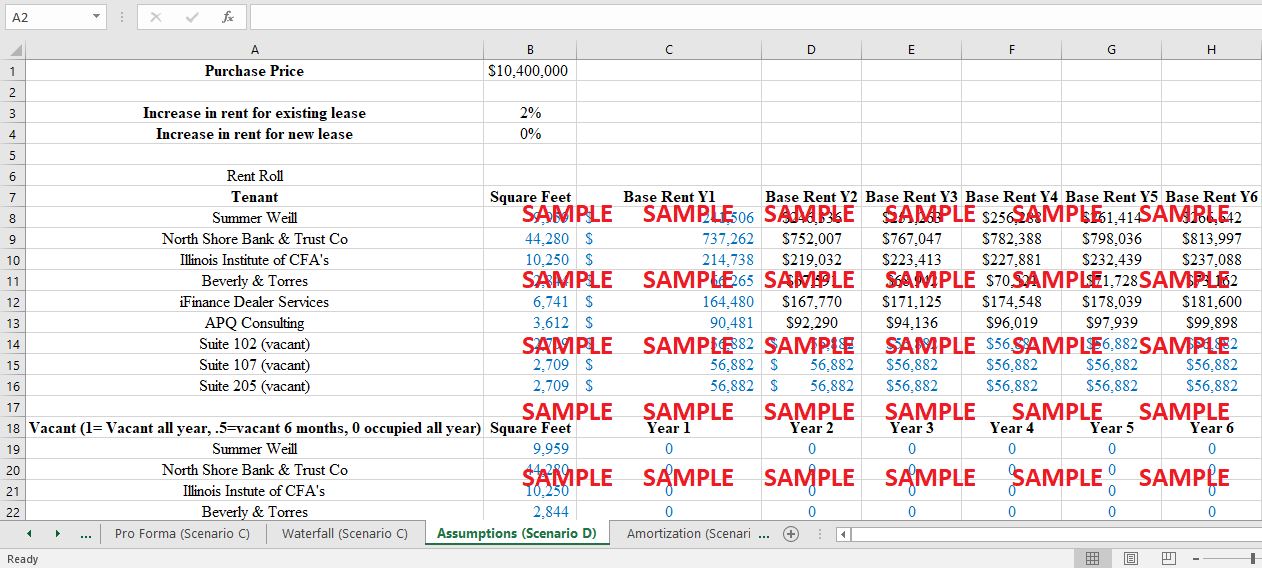

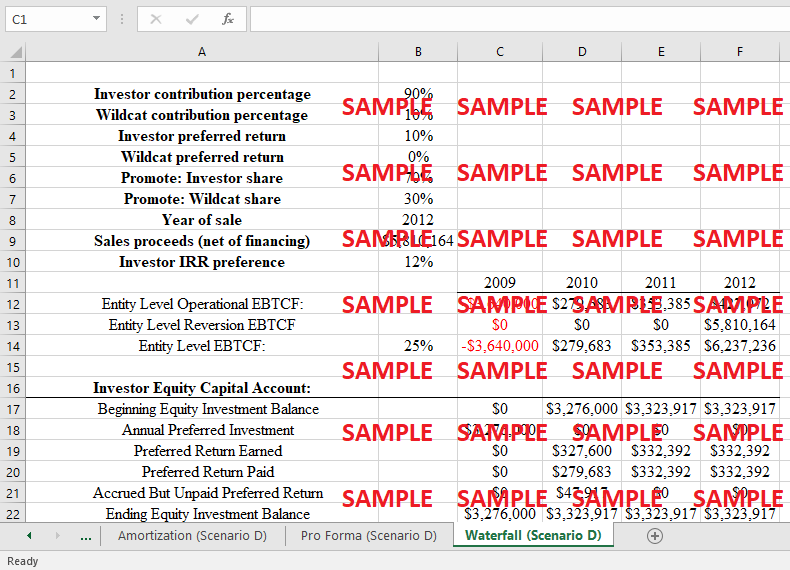

For each of the following scenarios, recalculate spreadsheets for exhibits 9 and 10. With the exception of the changes noted below, keep the benchmark assumptions constant. Each scenario will be recalculated independently; that is, each scenario is to be treated as a distinct variation from the benchmark. Assume that outside investors will become partners with Wildcat only if they believe they will receive an IRR of at least 20 percent, and Wildcat will only close on the property if it believes it can earn a 50 percent IRR. Discuss whether or not the deal will proceed. Assume that any unpaid preferred return gets added to the equity contribution and the following year’s preferred return gets calculated off of that larger balance. Finally, assume that if expenses exceed property income, both partners will make additional equity contributions in the same shares that they made their initial equity contributions to cover the shortfall. a. North Shore Bank does not renew its lease at the end of year 3 and its space remains vacant in Year 4. A new tenant begins leasing the space in Year 5 at $18/sf on a net lease requiring $5/sf of expense reimbursement. The new lease does not contain any rent escalation clause. To make the space suitable, capital expenditures of $4/sf are required in Year 5 for tenant improvements. A leasing broker charges Wildcat 2 percent of the first year's rent as a commission. As a result of this turnover, Wildcat holds the property for 5 years. [Accuracy check: reimbursements in year 4 are $138,197 and PGI in year 5 is $1,809,245] b. All tenants renew according to the benchmark assumptions. However, due to continued weakness in commercial property demand, Wildcat holds the property for 5 years. During its hold period, Wildcat makes capital expenditures of $500,000 in Year 2 for a new roof and $150,000 in Year 3 for a new parking lot. c. After more careful underwriting, the life insurance company offers a reduced loan-to-value of 60 percent and an interest rate of 7 percent. Assume a 3 year holding period. d. The outside investors are nervous about the economic climate. As a result, they demand the following investor-friendly changes to the waterfall structure. Assume a 3-year holding period and that all of the changes below are incorporated simultaneously. i. Outside investors will provide only 90 percent of the required equity ii. Outside investors will receive a 10 percent preferred return iii. Outside investors will receive a 12 percent IRR preference. (This means that at reversion after the invested capital has been returned to the outside investors and to Wildcat, the outside investors will receive additional cash until they achieve a 12 percent IRR over the lifetime of the investment. Remaining cash flow will then go through the promotion.) iv. Cash flows in the promote structure will be split 80/20 rather than 70/30

-

Evaluate the benchmark assumptions Zaski made for reasonableness. Would you have made different assumptions? What do you think is the fair market price for Financial Commons? Explain why your answer does or does not differ from $10,400,000.

-

If you were an outside investor being approached by Wildcat and were shown the financial projections outlined above, what additional information would you seek before investing?

Case Study Questions Answers

1. Re-create the base-case property proforma with debt. Using the rent roll numbers in the Excel template, the operating cash flows will differ from the case exhibits by $2-$6 (The reversion cash flow will differ by about $60 due to multiplier effects). Then complete the waterfall shown in exhibit 10 using the benchmark assumptions outlined in the case. (Skip to the last page of this document for instructions on filling out the waterfall) Under these assumptions, calculate the expected return to Wildcat Capital Investors and its limited partners and compare those returns to the property-level return on Financial Commons if it is sold after three years. Returns to Wildcat should be calculated without including its management fee. Note that the waterfall to the equity partners doesn’t get paid until after the loan payments have been made/OLB paid back to the bank.

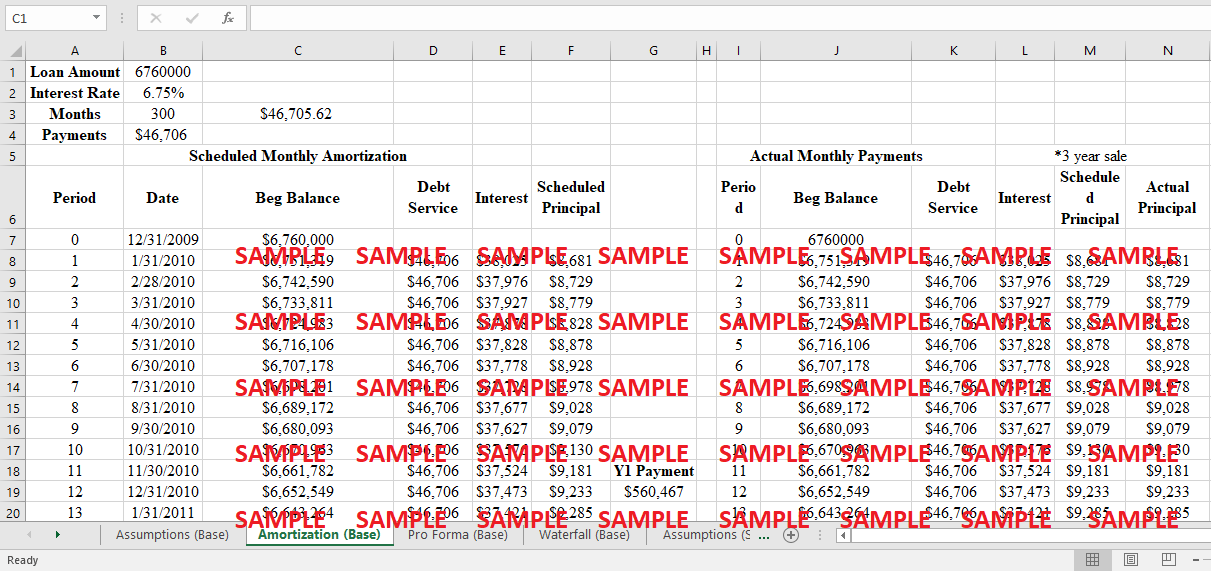

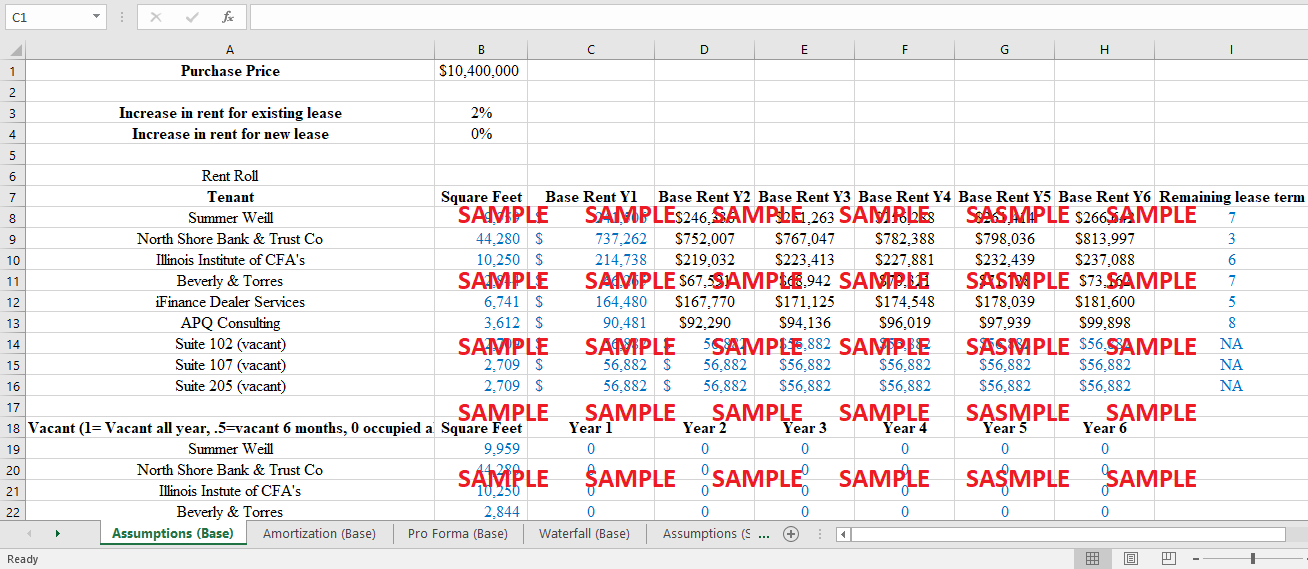

Excel was used to produce a spreadsheet that was then utilised to create a modelling Pro-forma that was based on the case study's assumptions. According to the calculations, the expected returns for Wildcat and its limited partners are, respectively, 71% and 21%. The return on investment that is anticipated is twenty-five percent, provided that the property in question is held onto until it is sold after three years. The assumptions, computations for amortisation, pro forma, and waterfall calculations are all included in the Excel file.

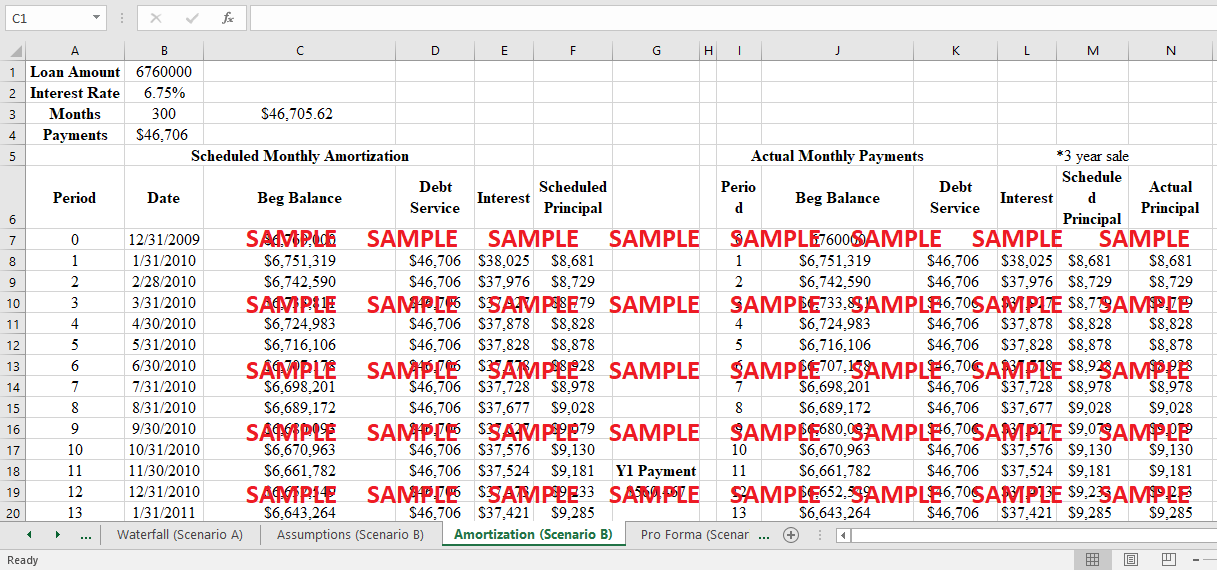

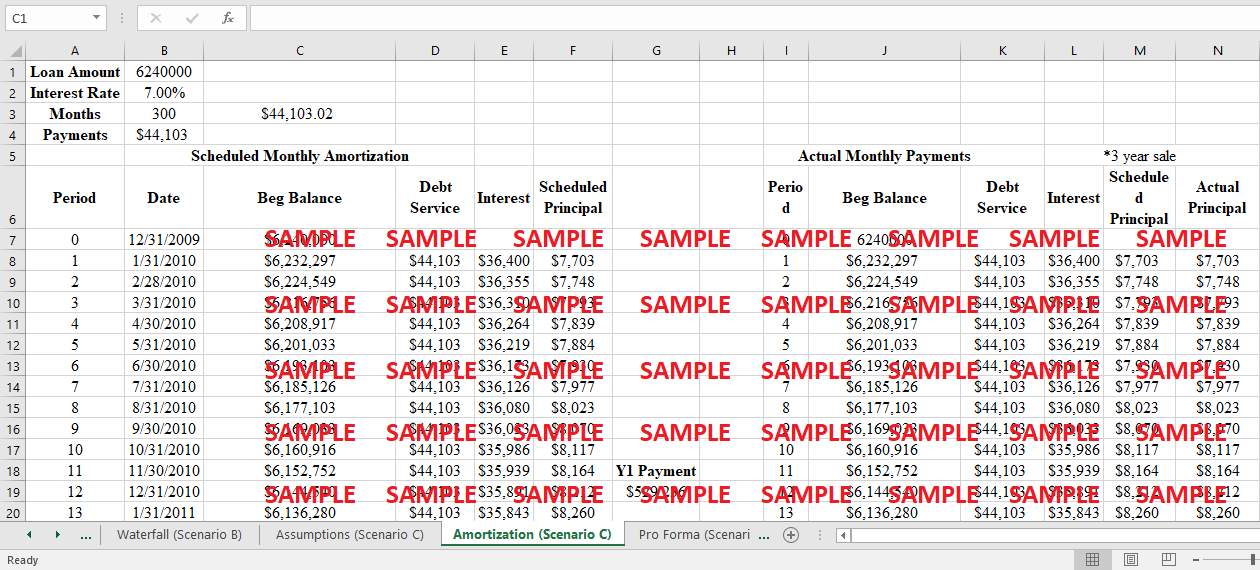

2. For each of the following scenarios, recalculate spreadsheets for exhibits 9 and 10. Except for the changes noted below, keep the benchmark assumptions constant. Each scenario will be recalculated independently; that is, each scenario is to be treated as a distinct variation from the benchmark. Assume that outside investors will become partners with Wildcat only if they believe they will receive an IRR of at least 20 percent, and Wildcat will only close on the property if it believes it can earn a 50 percent IRR. Discuss whether or not the deal will proceed. Assume that any unpaid preferred return gets added to the equity contribution and the following year’s preferred return gets calculated off of that larger balance. Finally, assume that if expenses exceed property income, both partners will make additional equity contributions in the same shares that they made their initial equity contributions to cover the shortfall. a. North Shore Bank does not renew its lease at the end of year 3 and its space remains vacant in Year 4. A new tenant begins leasing the space in Year 5 at $18/SF on a net lease requiring $5/sf of expense reimbursement. The new lease does not contain any rent escalation clause. To make the space suitable, capital expenditures of $4/sf are required in Year 5 for tenant improvements. A leasing broker charges Wildcat 2 percent of the first year's rent as a commission. As a result of this turnover, Wildcat holds the property for 5 years. [Accuracy check: reimbursements in year 4 are $138,197 and PGI in year 5 is $1,809,245] b. All tenants renew according to the benchmark assumptions. However, due to continued weakness in commercial property demand, Wildcat holds the property for 5 years. During its hold period, Wildcat makes capital expenditures of $500,000 in Year 2 for a new roof and $150,000 in Year 3 for a new parking lot. c. After more careful underwriting, the life insurance company offers a reduced loan-to-value of 60 percent and an interest rate of 7 percent. Assume a 3-year holding period. d. The outside investors are nervous about the economic climate. As a result, they demand the following investor-friendly changes to the waterfall structure. Assume a 3-year holding period and that all of the changes below are incorporated simultaneously. i. Outside investors will provide only 90 percent of the required equity ii. Outside investors will receive a 10 percent preferred return iii. Outside investors will receive a 12 percent IRR preference. (This means that at reversion after the invested capital has been returned to the outside investors and Wildcat, the outside investors will receive additional cash until they achieve a 12 percent IRR over the lifetime of the investment. Remaining cash flow will then go through the promotion.) iv. Cash flows in the promote structure will be split 80/20 rather than 70/30

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.