Get instant access to this case solution for only $19

Wilson Family Foundation Case Solution

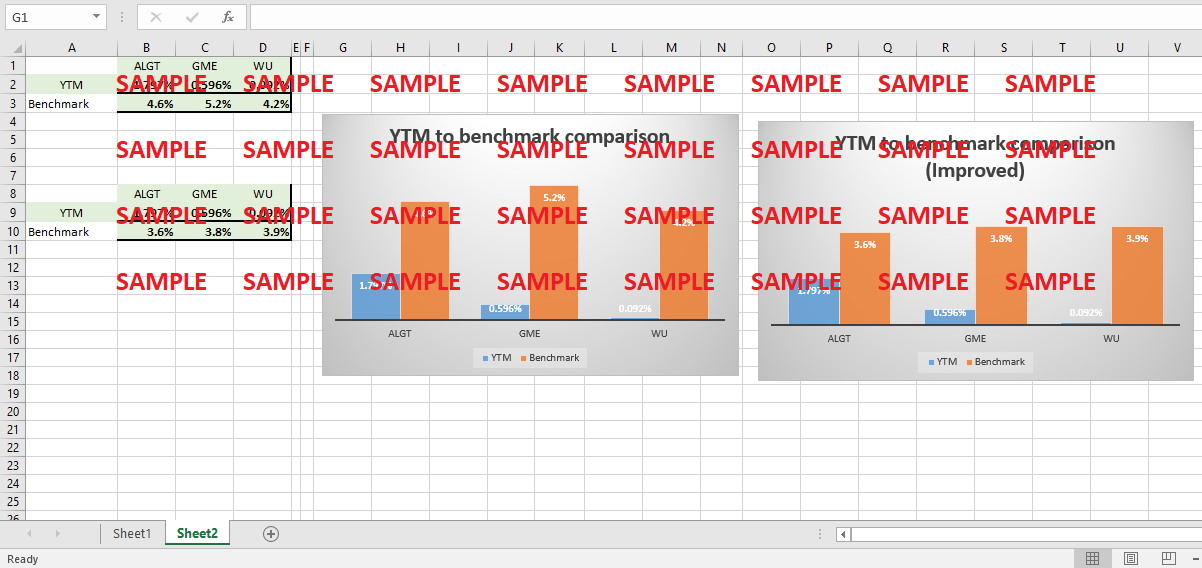

This report is an analysis of the three corporate bonds that is done using the parameters of YTM. The Wilson Foundation needs to make an investment that offers higher returns. Janet O Brian would be pitching these bonds in front of the investing committee and ALGT, GME and WU seems like the best options. However after analysis it has been found that all three bonds are performing lower than benchmarks and seem to be overvalue by the market. If the company decide to invest in one of three ALGT is the better candidate among all three.

Following questions are answered in this case study solution

-

Introduction

-

Questions:

i. Yield to Maturity Calculations

ii. Comparison with benchmark

iii. Improvised Yield

-

Recommendation

-

Conclusion

Case Analysis for Wilson Family Foundation

1. Introduction

This report is analysis of an investment that has to be made by Wilson family foundation and include an analysis of three corporate bonds for the sake of comparison. This report will help in comparing all three bonds with each other and also with their respective benchmarks as all of these bonds have different maturities and ratings. Janet O Brian needs to convince the investing committee with her analysis that these bonds are the best candidates for investment in the market. She also believes that they are rated poorly and their actual ratings should have been improvised.

Definitions

-

YTM: It is the total rate of return on any investment if it is held till maturity. It considers the coupon payments as well as principal return.

-

Benchmark: Benchmark indices are set as standard or parameter to review the value of security against a set standard.

-

Fed Rate: Federal rate is set by the government as act as the benchmark rate for all other securities including bonds. This rate is used for comparisons against different types of investments.

-

Credit ratings: Credit ratings are given by certain authorized firms to companies after a thorough analysis of their long term business perspective. These ratings help the investors to gauge the outlook of the company and compare in case of different investments.

2. Questions:

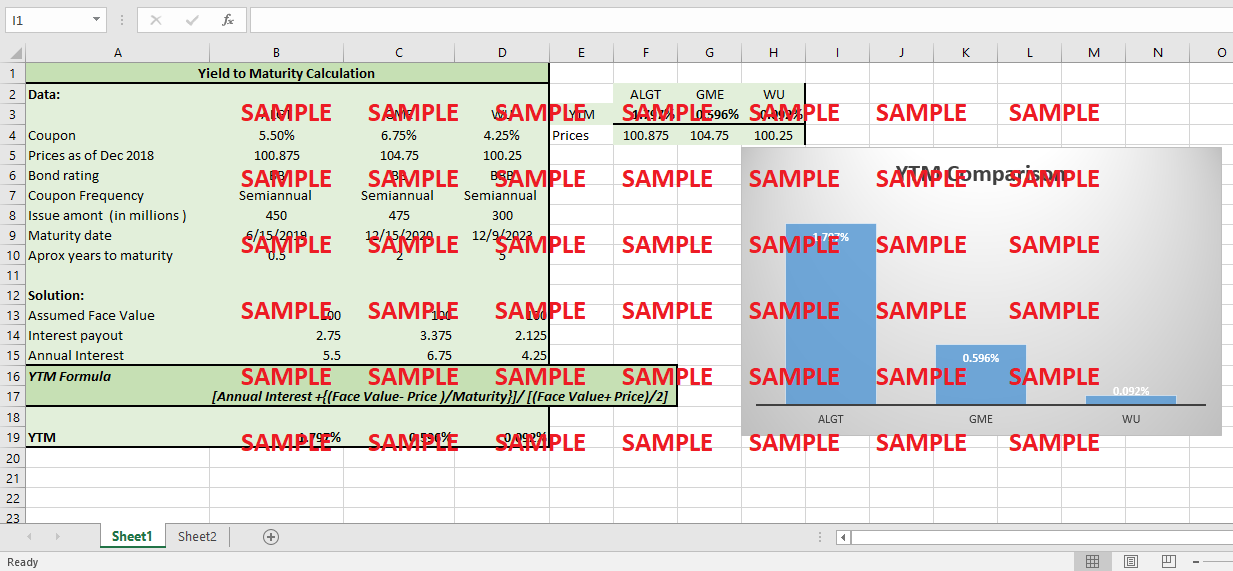

i. Yield to Maturity Calculations

Below are the YTM Calculations base ion the given data and taking assumptions of 100 USD each for bonds.

|

Yield to Maturity Calculation |

|

|

|||

|

Data: |

|

|

|

|

|

|

|

ALGT |

GME |

WU |

|

|

|

Coupon |

5.50% |

6.75% |

4.25% |

|

|

|

Prices as of Dec 2018 |

100.875 |

104.75 |

100.25 |

|

|

|

Bond rating |

BB |

BB |

BBB |

|

|

|

Coupon Frequency |

Semiannual |

Semiannual |

Semiannual |

|

|

|

Issue amount (in millions ) |

450 |

475 |

300 |

|

|

|

Maturity date |

6/15/2019 |

12/15/2020 |

12/9/2023 |

|

|

|

Approx. years to maturity |

0.5 |

2 |

5 |

|

|

|

|

|

|

|

|

|

|

Solution: |

|

|

|

|

|

|

Assumed Face Value |

100 |

100 |

100 |

|

|

|

Interest payout |

2.75 |

3.375 |

2.125 |

|

|

|

Annual Interest |

5.5 |

6.75 |

4.25 |

|

|

|

YTM Formula |

|

|

|

|

|

|

|

[Annual Interest +{(Face Value- Price )/Maturity}]/ [(Face Value+ Price)/2] |

||||

|

|

|

|

|

|

|

|

YTM |

1.797% |

0.596% |

0.092% |

||

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.