Get instant access to this case solution for only $19

Accounting For Frequent Fliers Case Solution

The frequent flier program initiated by ‘United’ should be valued and reported on the financial statements. Currently, united has the discretion of choosing any appropriate accounting technique. There are two methods available for united. The incremental cost method will value the additional costs of passengers while the deferred revenue method will assume a fair value of liability and will report it in the balance sheet. The analysis shows that the incremental cost will result in low liability value in comparison with the value that is obtained using deferred revenue technique. Additionally, it is recommended that united should report the liability by employing the incremental cost method. Furthermore, the analysis also showed that the frequent flier program should be discontinued as the lost revenue is less than the cost saved. Ideally, United should report the liability figure in the balance sheet with a detailed description of the calculations. The deferred revenue disclosure requirements also show that the disclosure should be reported exclusively, and the assumptions behind the calculations should be justified to be ‘pertinent’ by the management.

Following questions are answered in this case study solution:

Part 1

-

What are the various methods United might use to measure the costs of its frequent flier program? What are the potential differences in dollars of the cost measured by each method?

-

What method should united use to measure the cost of its frequent flier program? Estimate the cost of the program using this method. Show all calculations and indicate the assumptions you make.

-

If you were the chief financial officer (CFO) of United, how would you determine if continuing the frequent flier program would be beneficial to United?

Part 2

-

Do you believe that United should account in its published financial statements for the frequent flier program or is "disclosure" in public filings with the SEC sufficient? Why?

-

In either case, what is it that should be accounted for or disclosed? Why?

-

What possible ways might United choose to account for the program in its published financial statements if it chooses to do so?

-

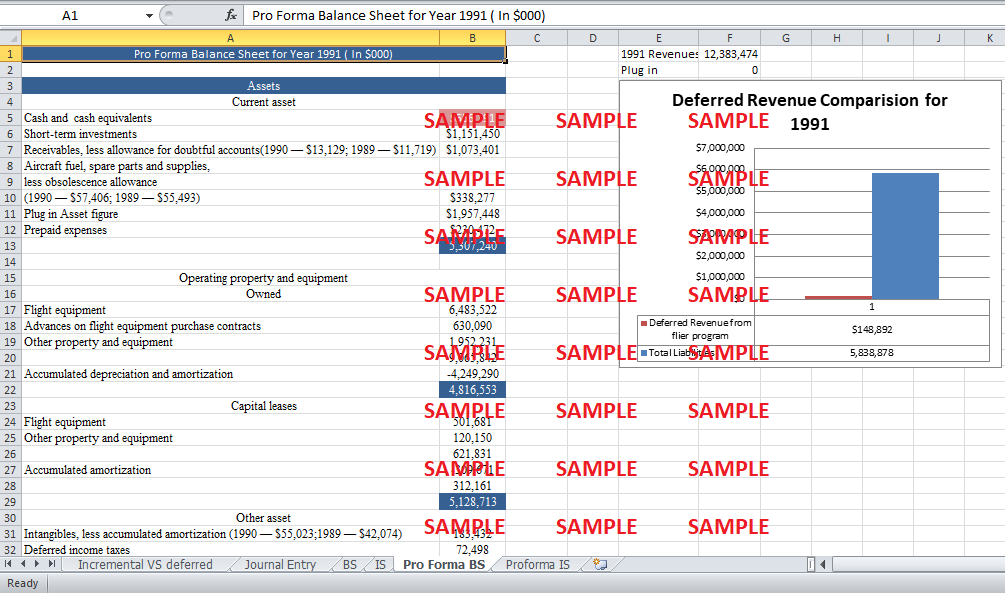

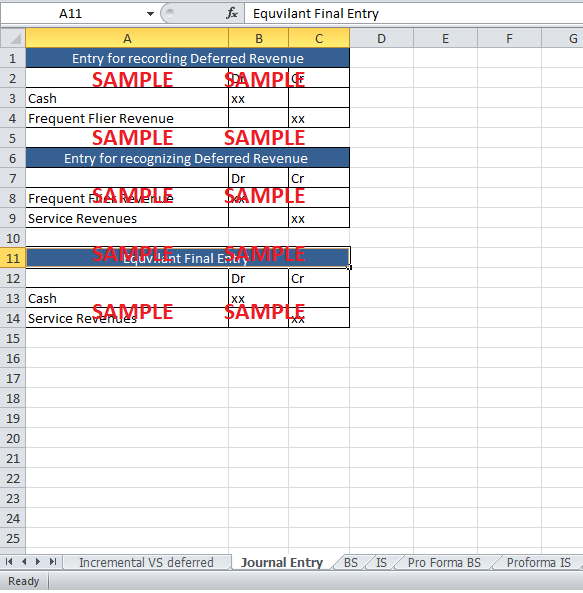

How do you believe United should account for the program in its published financial statements? Explain and support your chosen method and why you rejected other approaches. Show by some means (such as journal entries, T accounts, or pro forma statements) how your chosen method would be applied and all of the accounts that would be affected by the accounting you believe to be best.

-

If you were CFO of United, what would you do?

Case Study Questions Answers

Part 1

1. What are the various methods United might use to measure the costs of its frequent flier program? What are the potential differences in dollars of the cost measured by each method?

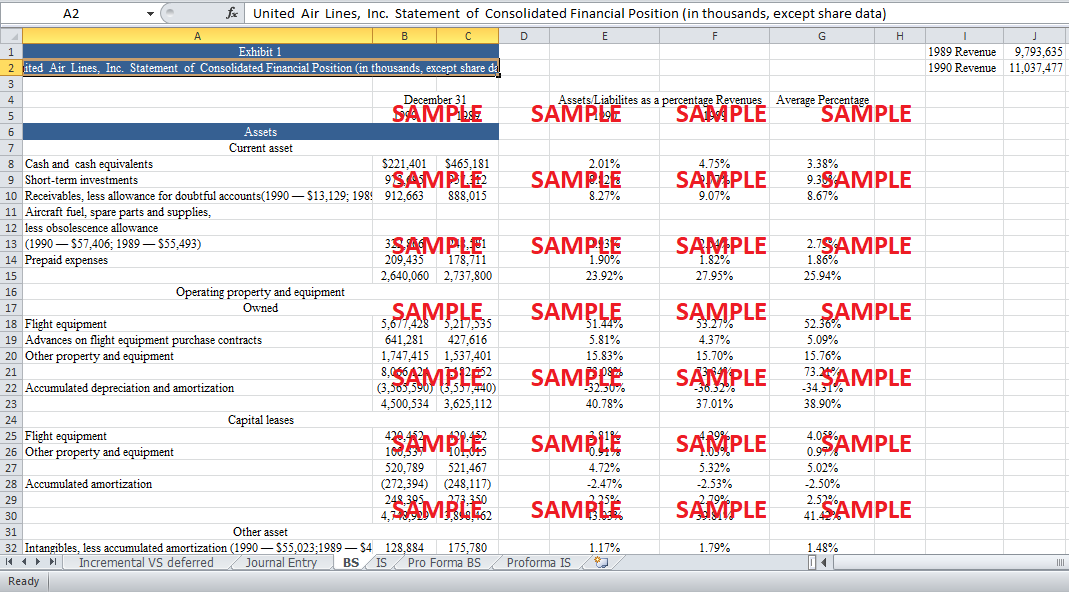

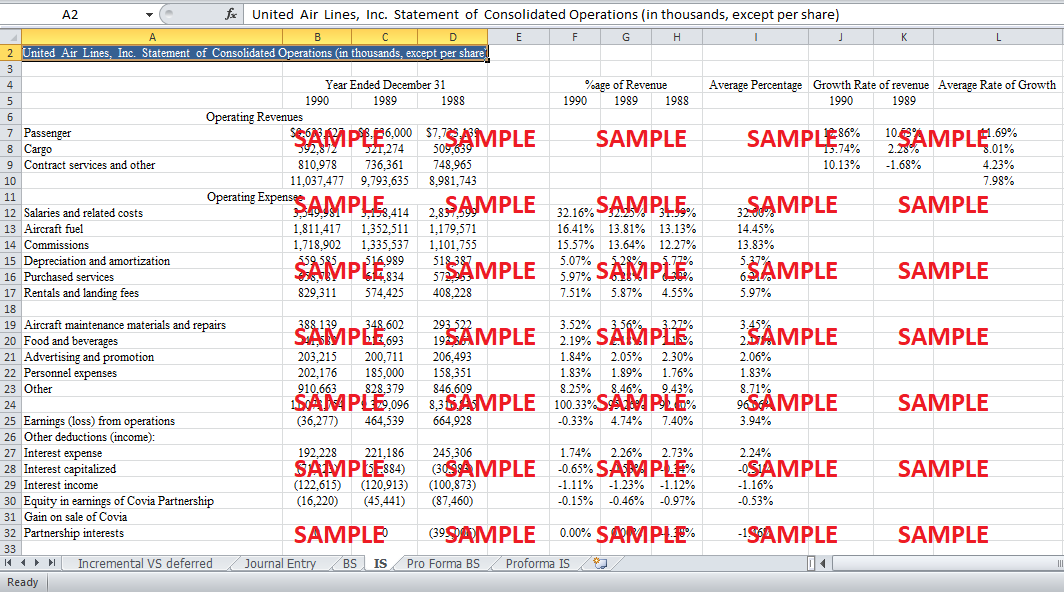

The promise or the obligation that is deemed upon united by virtue of its ‘frequent fliers program’ should be a major concern for a company. This concern is rooted in the fact that all the accrued costs are reported as a liability on the company’s balance sheet. Accounting for these deferred liability amount has been a controversial subject since 1980s. Therefore, with time passage of time, the international financial reporting standards have tried to offer updated, comprehensive and applicable methods for valuing frequent fliers program. There are two main methods for reporting the liability amount and most of the companies also use the same two methods. The first method is termed as ‘incremental cost method’. The logic behind the use of this method is that any ‘free’ passenger will require some ‘marginal costs’ like the cost of ticket, fuel, luggage transportation, meals and taxes etc. The concerned value of a liability is reported by adding up the incremental costs of all the passengers. On the other hand, the second method resorts its calculations on an entire different principle. The technique of ‘deferred revenue’ constitutes the fact that the fair value of any future liability should be reported on the balance sheet. However, as there has always been a dispute on the definition of fair value; therefore, the IFRS has also specified the definition of fair value in the case of frequent fliers accounting as:

“The amount for which the award credits could be sold separately.”

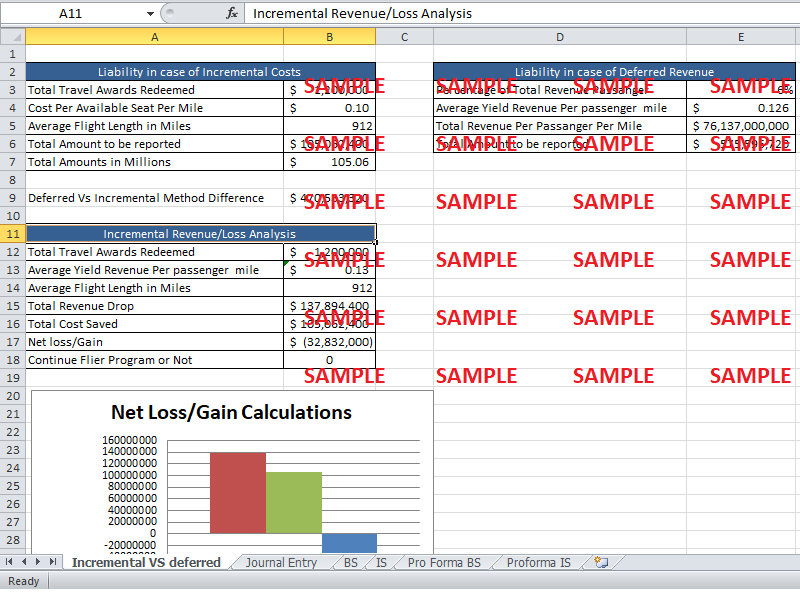

This fair value is reported as a future or deferred liability, and upon redemption time, the recognized liability is accepted as revenue. If you measure the amount of liability from the incremental cost approach, the final figure for the liability comes out to be $105.06 million. The formula for the calculation of liability amount is as follows:

Total Liability = Total Travel Awards Redeemed * Cost Per Available seat per mile * Average flight length in miles

On the other hand, the deferred revenue practice dictates the following formula:

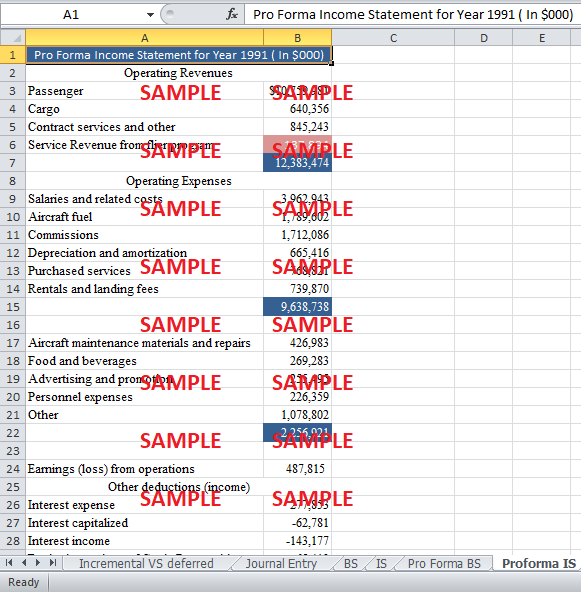

Total Deferred Revenue = %age of total Revenue passenger * Average Yield Revenue per passenger mile * Total Per passenger mile revenue

By employing the above formula, the 'deferred revenue' comes out to be approximately $575.6 million. There is a substantial difference in the calculated amounts of the two methods. If deferred revenue method is utilized, an additional $470.5 million of liability has to be reported on the balance sheet.

2. What method should united use to measure the cost of its frequent flier program? Estimate the cost of the program using this method. Show all calculations and indicate the assumptions you make.

United has the discretion of using any method until and unless it can prove that the assumptions and calculations are realistic. Before moving forward to the decision of choosing an appropriate method, one key and crucial disadvantage of deferred revenue technique should be discussed. Deferred revenue treats the potential passenger equal to a normal and average passenger. However, this passenger should be treated exclusively as the costs associated with it may vary from the costs of a passenger that flies in normal flights. The Incremental cost method solves this disparity and associates only those costs to the passenger that are applicable to him/her.

Relying on the earlier fact and analysis of numbers, this is recommended that United should use ‘incremental cost’ method to value the liability. There are two primary reasons behind it.

-

The load factor in USA for the year of 1990 is 66.2%. This value of the load factor is below than the ‘break even’ load factor value of 66.5. If the company uses deferred revenue accounting technique, it will be at a net loss.

-

As the analysis of the costs show that by applying deferred revenue technique; therefore, the company will be reporting an additional $470.5 million in the liability side. The value of the difference is equal to 4.5 times the amount of ‘incremental liability’. This increase in the value of the total liability can alter the financial ratios by a deciding factor.

3. If you were the chief financial officer (CFO) of United, how would you determine if continuing the frequent flier program would be beneficial to United?

In order to find out the amount of benefit offered, we should carry out an incremental profit/loss analysis. As per the decision in the previous question, the incremental cost accounting method should be used. This method would cost united a total of $105.06 million. If united discontinues this program, how much incremental revenue will it loose? Let’s take a conservative assumption about the number of total travel awards that are given ($1.2 million). Total revenue drop can be calculated by the following formula:

The calculations show that revenue drops by $137.8 million. Therefore, the company is in a net loss of approximately $32.8 million. The following graph offers a snapshot of the fliers program’s feasibility:

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.