Get instant access to this case solution for only $19

Airbus A3XX Developing The Worlds Largest Commercial Jet A Case Solution

For past many years, Boeing remained a monopoly for many years until Airbus entered the same market. Although Boeing faced competition in small and medium sized aircrafts, Boeing still had a monopoly in VLA market with 747 on its disposal. Airbus was expecting a sudden increase in demand of large aircrafts in future. So, after spending millions of dollars, Airbus planned to launch A3XX, the largest commercial aircraft in the world. The success of this plan depended on the accuracy of the estimates on the part of Airbus regarding demand of VLA’s in the future. The response of Boeing to the introduction of A3XX was also of great concern for airbus because Boeing was capable of introducing a new variant of 747 that could compete with A3XX.

Following questions are answered in this case study solution:

-

Should Airbus enter the jumbo jet segment? If so, then how? And, what should Boeing do about it?

-

Why is Boeing’s demand estimate for very large aircraft so different from Airbus’s estimate?

-

What is your estimate of the demand for the A3XX? Please explain your methodology, and the reason you obtain different estimates from those reported by Boeing and Airbus.

-

What is the cost of capital for Airbus?

-

What is the breakeven volume for Airbus? Assume that the revenue stream for Airbus can be treated as perpetuity and that the various costs are to be discounted at the appropriate cost of capital for Airbus.

-

What are the financial and non-financial risks for Airbus? How has Airbus attempted to control the downside impact of these risks?

-

As Airbus senior management, are you going to develop the A-3XX? As Boeing senior management, how will you respond to (a) the threat and (b) the actual development of the A3-XX?

Airbus A3XX Developing the Worlds Largest Commercial Jet A Case Analysis

1. Should Airbus enter the jumbo jet segment? If so, then how? And, what should Boeing do about it?

Airbus Company is much smaller than the being company. In addition to being a monopoly in the jumbo jet market, Boeing is a key supplier of aircrafts manufactured for defense purposes. So, the demand of Boeing products is very stable due to which the company is in a much better position to cater to the growing market of Airplanes. Airbus can only compete with Boeing and emerge as a biggest player in VLA, if it can compete with Boeing’s 747 in the jumbo jet market.

Airbus has to enter the market for VLA because in the upcoming years, demand for large jets was expected to increase, particularly in Asia. Such unprecedented increase in passenger and cargo traffic can only be catered by launching large jets with a capacity greater than 400 seats. This is a high time for Airbus to move one step ahead of Boeing by launching the world’s largest commercial jet. Management of Airbus is of the view that large aircrafts used for long distance flights are more cost effective and consume resources efficiently. After spending millions of dollars, Airbus was finally able to launch a product that could compete directly with 747. Although, the operating costs of A3XX were 12% more than those of 747, capacity of A3XX was 35% greater than 747. This enhanced capacity of the airplane was enough to compensate for an increase in operating costs and increase net operating margins. In terms of quality, A3XX was supposed to be far superior than 747 due to better safety and comfort arrangements as it used four engines instead of two. Aisle spaces were better to enable the passenger to escape in case of an emergency. So, if everything goes according to the plan, Airbus can effectively dominate the VLA market if Boeing does not respond quickly.

The response of Boeing should depend entirely on the extent to which they think the plans and estimate of Airbus are realistic. A common belief among the experts is Airbus will not be able to practically pursue A3XX project because the risks are too high and this project will practically put the survival of the company at stake. If, the management of Boeing, on the other hand, feels that threat of this new entrant is credible, then they should be proactive rather reactive. Owing to unprecedented growth in demand expected in future, Boeing has to respond quickly before Airbus could quickly drive Boeing 747 out of VLA market. Boeing Company should introduce new variants of 747 that can compete with A3XX in terms of price and quality. Being a large and capital intensive organization, the company should invest heavily in R&D to strengthen its competency.

2. Why is Boeing’s demand estimate for very large aircraft so different from Airbus’s estimate?

The estimates of the two companies were quite similar for all categories except for demand in VLA market. VLA demand estimates of the two companies were quite different due to conflicts assumptions underlying the methodologies used to forecast the estimates. The differences in the extent of importance for flight frequency, routes development and the capacity of aircraft in the methodologies of the two companies were the reasons why their estimates were conflicting. Boeing was quite pessimistic in forecasting the demand of large aircrafts of capacity greater than 500 passengers. The management of the company believed that a large chunk of the growth rate in passenger and cargo traffic will be catered by small and medium aircrafts. The demand for VLA will remain low as new route developments, and flight frequencies will be able to cater to the increase in demand. On the other side, Airbus held a very optimistic and aggressive view regarding demand of VLA in future. Their management was of the view that flight frequencies and route developments were only short term solutions, and in the long run, demand for VLA’s is bound to increase. They believed that large Aircrafts like A3XX with greater capacity will be more cost efficient for airlines. Therefore, a significant portion of the market will switch from medium size to large size aircrafts.

3. What is your estimate of the demand for the A3XX? Please explain your methodology, and the reason you obtain different estimates from those reported by Boeing and Airbus.

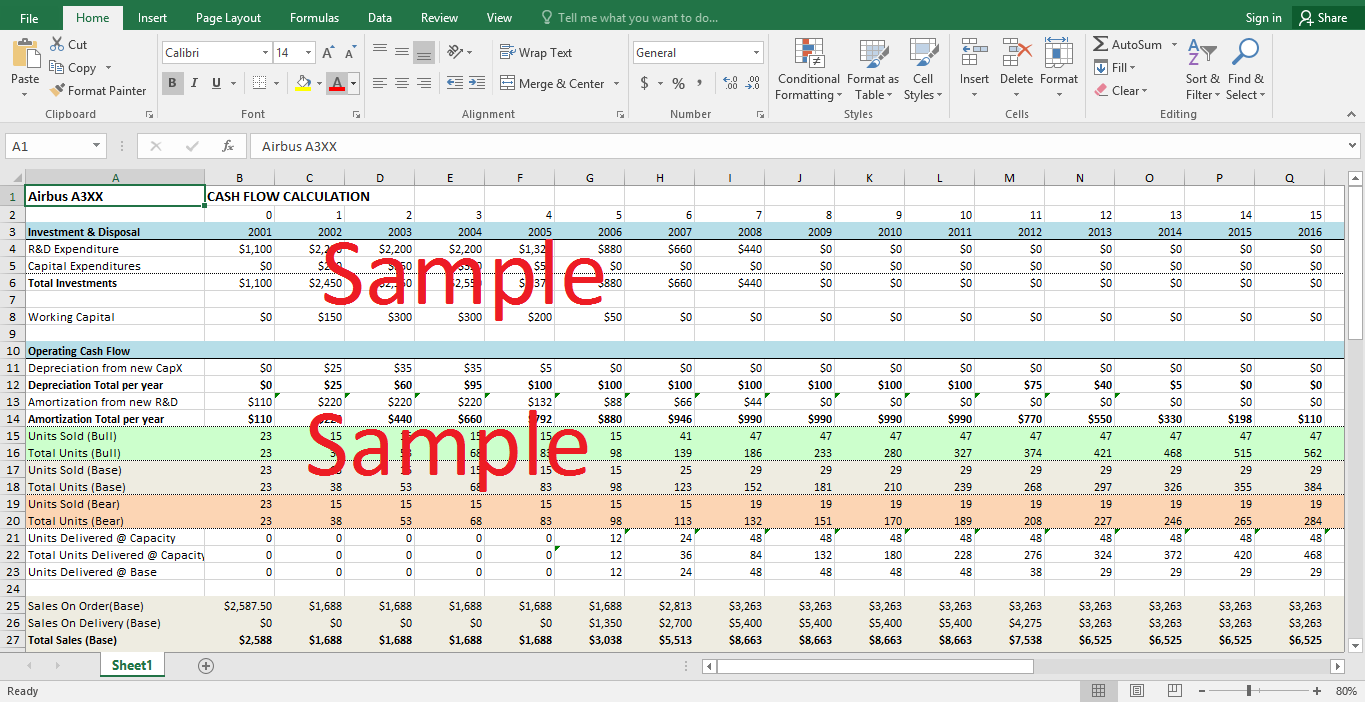

Estimates for the demands of A3XX can be calculated using information given in exhibit 11 of the case. The case provides sales order data for 2000 by including actual and expected pool of demand. Number of orders can be estimated by assigning probabilities to the total demand of the market based on the chances of Airbus getting those orders. For the purpose of this analysis, it can be assumed that there is 75% chance that the orders in “probable” category will be materialized, whereas Airbus will be able to get 50% orders in “potential orders” category. For example, there are 34 orders and 21 estimates in “probable” category. Estimated number of orders can be calculated by adding the two numbers and multiplying by 0.75 ((34 + 21As) * 0.75 = 41). The same goes for orders in potential category except that the probability for this category is 50%. As, for the actual orders, 100% probability should be assigned to that number.

4. What is the cost of capital for Airbus?

The target pretax IRR of Airbus was 15%, whereas yield on long term government bonds was 6%. Based on this information, a reasonable estimate of discount rate that should be used is 10%. The calculation of discount rate can be found in the spreadsheet.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.