Get instant access to this case solution for only $19

Anandam Manufacturing Company Analysis of Financial Statements Case Solution

The Anandam manufacturing company is one of India's largest textile manufacturing firms offering its expertise in the production of garments. In 2015, the company approached a bank for its expansion plans and strategic goals to be reviewed and set on track to be executed. The company has achieved growth in double figures in recent years, and the owners and management are positive about the lucrative and profit-making ability of the Anandam manufacturing facility. He spoke at length with the bank manager about his firm's long history of success and the prospects for future growth in India's textile and apparel sectors. To check the feasibility, profitability, and reasonableness of the growth objectives and strategies, this case presents various analyses to evaluate the decisions. The tools involve analysing the cash position, the common-sized statements, recent internal and external trends, and comparative ratio analysis to evaluate the decision for the Anandam manufacturing facility.

Following questions are answered in this case study solution:

-

Prepare and analyze the cash flow statement of the company.

-

Prepare and analyze the common size statement of the company.

-

Compute and analyze the trend analysis of the company.

-

What are the various ratios computed to analyze financial statements?

-

Compute the above ratios based on case Exhibit 3.

-

Based on these ratios and their comparison with industry ratios, would you, as the loan officer grant the loan request?

-

What areas of improvement can you suggest for the future?

Case Study Questions Answers

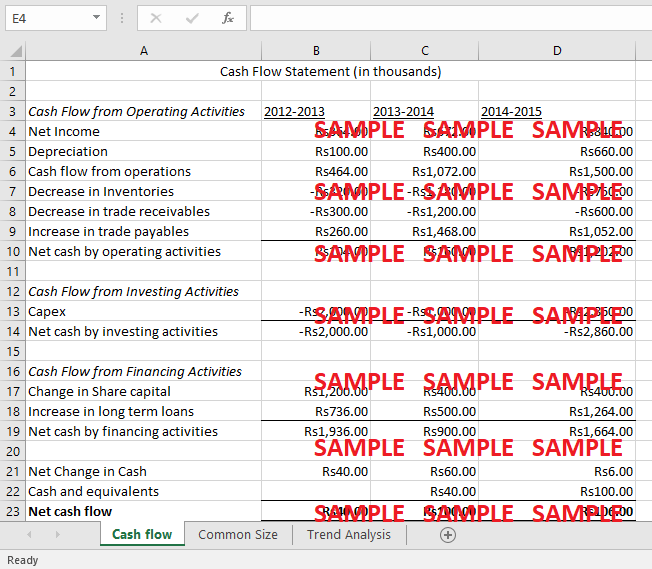

1. Prepare and analyse the cash flow statement of the company.

This report on operational activities' cash flow component concentrates on the company's main business: the amount of cash generated by those operations. The main source of revenue should come from this segment. The net cash supplied by operational operations is fairly low in the first two years, but this is also rather understandable, given that the firm is only getting started. The net cash supplied by operational operations is fairly low in the first two years, but this is also rather understandable, given that the firm is only getting started. Some businesses may even have a negative cash flow from operations at the beginning of their operations. Additionally, Anandam's cash flow from operations has skyrocketed, reaching 1202 in 2014–2015. This shows that the business is currently profitable.

Listing the cash inflow/outflow utilized for investments like the acquisition of equipment essential for the company's activity is what is meant by the phrase "cash flow produced by investing activities." Anandam invests, which makes sense at the beginning of the activity, and the outcome is negative. The largest investment has occurred in the most recent year; it can be seen (2860). Anandam wishes to grow, which calls for investments. Anandam is unafraid to reinvest.

All the actions the business takes to fund itself are included in the cash flow from financing. This might involve financial inflows, such as issuing debt or a boost in capital, or cash outflows, such as the payment of dividends or a debt's interest rate. In this case, Anandam chose to grow share capital and extra paid-in capital, particularly at the start of the activity in 2012–2013, to 1200, before stabilising at 400 in 2013–2014 and then at the end of the activity in 2014–2015. In 2014-2015, Anandam decided to boost the number of long-term loans even further to 1264. Overall, the cash balance in 2013–2014 and 2014–2015 is positive and constant at approximately 100. The balance sheet is favourable since Anandam is profitable and can independently fund its operations.

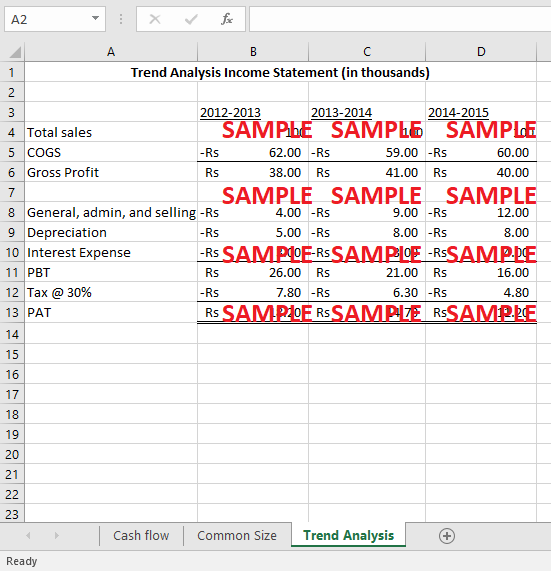

2. Prepare and analyse the common size statement of the company.

PL

The firm reported a profit of 364 000 rupees with a gross profit of 760 000R in its first year of operation. The profit after taxes virtually increased by two the next year. And because there was a 25% rise from the previous year, we saw growth slow in 2014–15. However, it is still much more than the sector's growth during the previous three years, which averaged about a 14% increase annually. Consequently, Anandam's profit is increasing faster than the market.

Furthermore, while the profit after sales only had a 20% gain in 2014–15, the gross profit climbed from 38,5%. Therefore, we must exercise caution as fixed expenses rise. This discrepancy demonstrates that fixed costs are increasing more quickly than sales.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.