Get instant access to this case solution for only $19

Aurora Textile Company Case Solution

The Aurora Textile Company has been facing financial difficulties as it operates in a challenging business environment with significant competition from the import markets, which benefit from lower costs of production and free trade agreements. Due to this competition, local manufacturers have to make efforts to operate more efficiently and reduce costs. Aurora Textile has suffered from net losses in the last four years, and in 2020, it closed down four manufacturing facilities. Since then, there has been some improvement in the profitability margins. The management of Aurora Textile is considering whether to invest in a new machine called the Zinser 351. The new machine would be able to produce a finer quality yarn that would be used to produce higher-margin products. It would be sold at a 10% higher price as compared to the yarn currently being produced. In addition, the Zinser is a more reliable and efficient machine and would result in cost savings with respect to power and maintenance. On the other hand, sales volumes would be 5% lower, and the cost of customer returns would be higher.

Following questions are answered in this case study solution:

-

How has Aurora Textile performed over the past four years? Be prepared to provide financial ratios that present a clear picture of Aurora's financial condition.

-

What are the limitations to ratio analysis? Are there any ratios that are particularly important or revealing? Ratios are often grouped into liquidity, solvency, profitability and activity ratios. Which is (are) the most important for Aurora?

-

List the factors affecting the textile industry. What do you think is the state of the industry in the United States? How should you incorporate the state of the textile industry into your analysis? Why should anyone invest money in the industry? What is the current and expected impact of trade agreements and foreign competition?

-

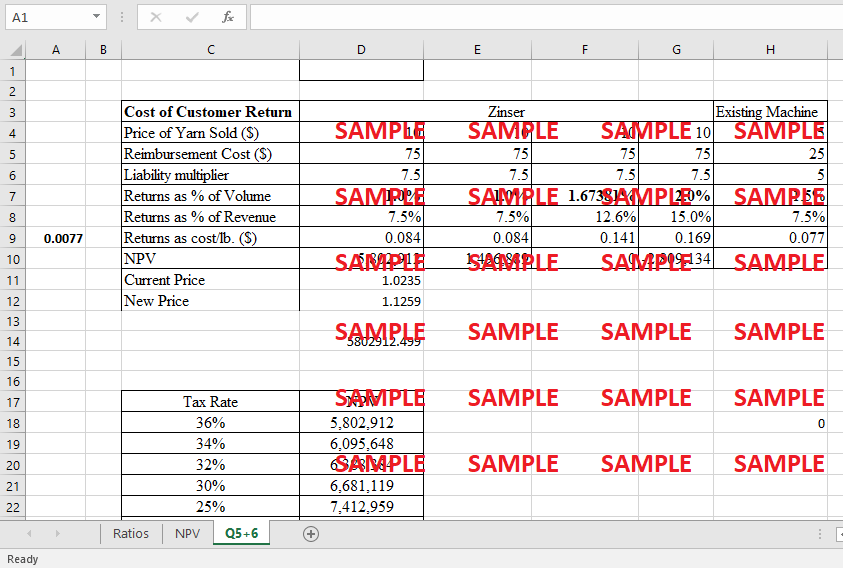

What are the relevant cash flows for the Zinsser investment? Using a 10% WACC and assuming a 36% tax rate, what do you calculate as the NPV for the project? What are the value drivers in your analysis? What do you estimate as the cost per pound for customer returns under the Zinsser alternative? Should you use expansion analysis or replacement analysis for the proposed Zinsser investment?

-

One of managements' primary concerns is the return rate (as percentage of volume) associated with the Zinsser machine. What would be the NPV if the return rate remained at 1.5% instead of dropping to 1%? As part of the risk management process, management is concerned with realistic "worst-case" scenarios. In particular, at what return rate would the project break even?

-

The 36% tax rate assumed in the case is the marginal tax rate for Aurora based on Exhibit 1. Given that the firm has previous losses and potential carry forwards, the effective tax rate in the near future is likely to be lower. Assess the impact of a lower tax rate on the decision to purchase the Zinsser.

Case Study Questions Answers

1. How has Aurora Textile performed over the past four years? Be prepared to provide financial ratios that present a clear picture of Aurora's financial condition.

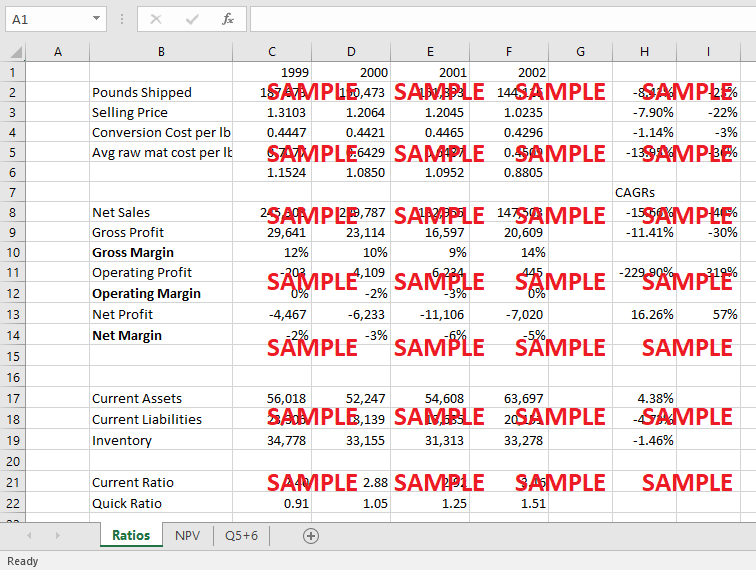

Aurora Textile’s performance in the last four years has been poor as demonstrated by the net losses it has suffered in each of the last four years. The company has suffered due to the high level of competition it has faced from the import market. Due to this, Aurora Textile has had to improve its efficiency and reduce costs to try and improve its financial performance. During 2020, Aurora Textile closed down four plants that were not operating optimally, in order to improve overall efficiency. Moreover, net sales have declined significantly due to a decrease in both sales volume and sales price, which have been impacted by the competitive market environment. As a result, overall profits exhibited a declining trend from 1999 to 2001, while there was a slight recovery in profitability during 2002. This recovery may be attributable to the closure of inefficient plants which has improved margins. Aurora Textile’s profitability margins are shown below.

|

Profitability Ratios |

1999 |

2000 |

2001 |

2002 |

|

Gross Margin |

12% |

10% |

9% |

14% |

|

Operating Margin |

0% |

-2% |

-3% |

0% |

|

Net Margin |

-2% |

-3% |

-6% |

-5% |

In terms of liquidity, Aurora Textile’s position has improved steadily in the past four years with both the current ratio and quick ratio increasing during the period. The company does not have any liquidity problems and has sufficient current assets to fulfill its current liabilities.

|

Liquidity Ratios |

1999 |

2000 |

2001 |

2002 |

|

Current Ratio |

2.40 |

2.88 |

2.92 |

3.16 |

|

Quick Ratio |

0.91 |

1.05 |

1.25 |

1.51 |

In terms of solvency, the interest coverage ratio indicates that while Aurora Textile had sufficient earnings or EBITDA to meet its financial liabilities during 1999 and 2000, however, the interest coverage ratio decreased significantly during 2001 and 2002. This is due to the asset impairments incurred due to the shutdown of inefficient plants, which have significantly decreased the company's EBITDA. Meanwhile, the debt-to-asset ratio has increased slightly during the four years but remains well within a reasonable range, indicating that the company does not have excessive debt and that its debt can easily be covered by the company’s assets.

|

Solvency Ratios |

1999 |

2000 |

2001 |

2002 |

|

Interest Coverage Ratio |

2.22 |

2.52 |

-0.20 |

0.68 |

|

Debt to Assets Ratio |

0.38 |

0.42 |

0.41 |

0.43 |

Examining the activity ratios of accounts receivable turnover and asset turnover indicates that the company’s activity levels have decreased during the last two years, 2001 and 2002. A major factor in this is the decline in sales that has occurred during the last two years as well as the closure of the four plants.

|

Activity Ratios |

1999 |

2000 |

2001 |

2002 |

|

Accounts Receivable Turnover |

14.20 |

15.86 |

11.42 |

6.35 |

|

Asset Turnover |

1.38 |

1.34 |

1.19 |

1.06 |

2. What are the limitations of ratio analysis? Are there any ratios that are particularly important or revealing? Ratios are often grouped into liquidity, solvency, profitability, and activity ratios. Which is (are) the most important for Aurora?

While ratio analysis is a helpful technique or tool to understand the financial performance of a company, it also has some limitations. Ratio analysis is based on past performance and cannot provide an accurate or reliable estimate of future or current performance. It is also not suitable to use past ratios to determine or estimate future trends since various factors can cause the ratios to change. If there are changes to certain drivers, for example, the installation of new machinery, a number of ratios would deviate from their past trends. Moreover, there are dozens of ratios that could be calculated or presented, and often it is difficult to determine which ratios provide the most accurate and useful picture and analysis of a company's financial position. Moreover, ratio analysis does not account for external factors faced by a company, such as worldwide recessions, trade deals, and competition. Ratio analysis can be useful for comparison with other firms; however, this is limited to firms of equivalent size and type. It would not be useful to compare firms that vary significantly in size and operate in different industries.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- ASICS Chasing a 2020 Vision Case Solution

- Aravind Eye Cares Vision Centers Reaching Out to the Rural Poor Case Solution

- Anandam Manufacturing Company Analysis of Financial Statements Case Solution

- American Apparel Drowning in Debt Case Solution

- Alibabas IPO Dilemma Hong Kong or New York Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.