Get instant access to this case solution for only $19

Bake Me A Cake Case Solution

Bourgon is faced with a dilemma to either grow the business via in-house expansion or by leasing a property. Bourgon has enough capital to invest in the business but still she needs assistance from the bank for the renovation and expansion option. Both options yield a different form of additional expenses. Additionally, with the option of renovation, the assets of bake a cake will also increase significantly. At this point, the income, cash flow and asset differential for the two options (renovation or leasing) should be considered. Moreover, there are some structural issues as well. For example, what will happen to the accounting ratios if one of the options is selected? For this reason, it is crucial to prepare the projected or forecasted financial statements for both scenarios and compare the limitations of each one of them.

Following questions are answered in this case study solution

-

Introduction

-

Renovation

-

Leasing

-

Profitability Analysis

-

Conclusion

Case Analysis for Bake Me A Cake

2. Renovation

In the case of renovation, the existing property of Bourgon will be used to carve out a space for the business growth. However, for this to happen, huge construction costs must be incurred. These construction costs cannot simply be expenses as they result in the formation of a property. Hence, these costs should be capitalized.

i. Forecasted Income Statement

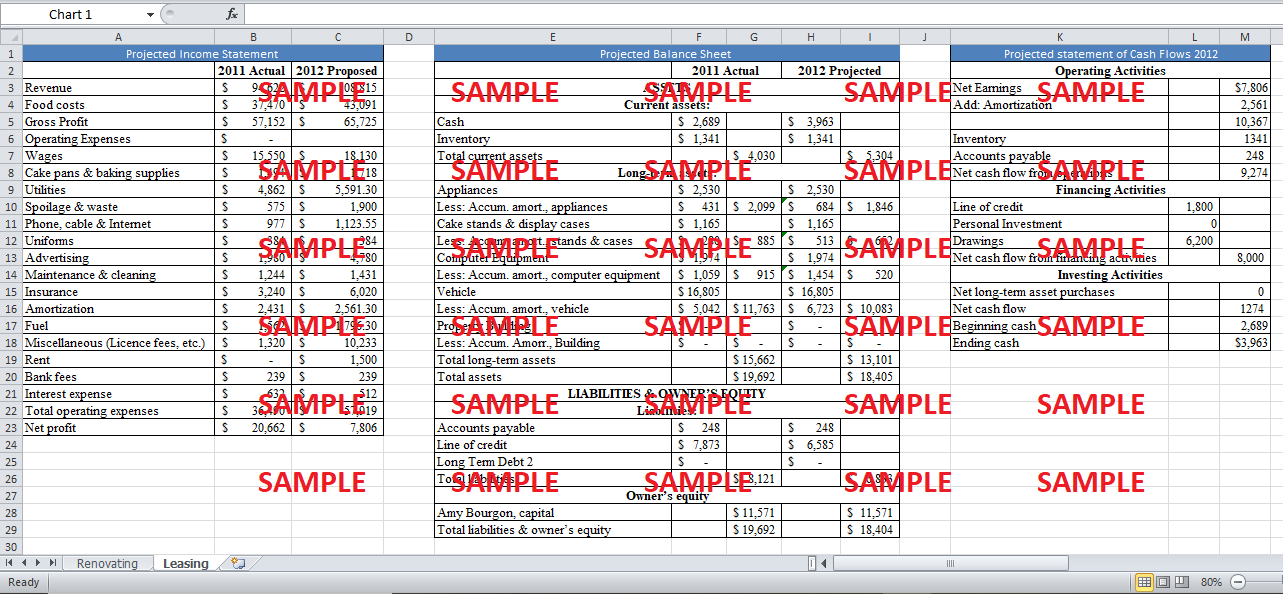

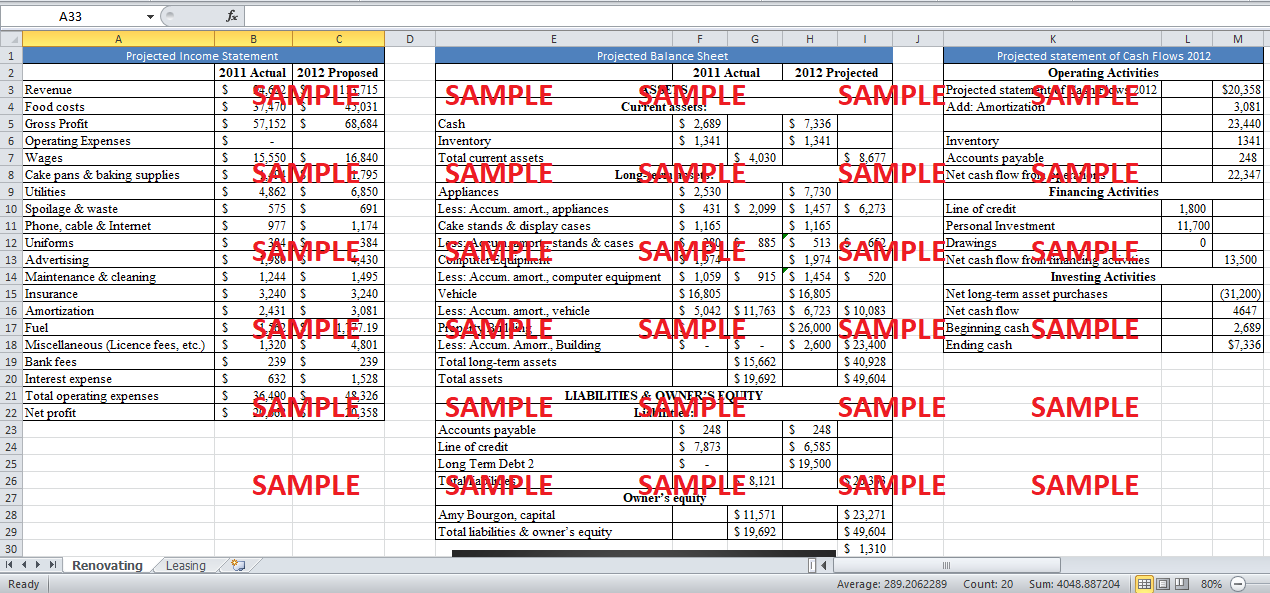

The forecasted income statement for the renovation option is shown below:

As mentioned in the case, the next year’s revenue will increase by 15%. Moreover, in the case of renovation, the enhanced and professional outlook of the business will also result in a $750 monthly increase in revenues. Therefore, renovation option will increase the revenue by $9000. Apart from that, the 15% growth rate still applies to 2011 revenue amount. The cost of goods sold/revenue ratio is assumed to be constant at the 2011 level. Renovation option will cost a monthly increase in wages amounting to $107.5. Hence, annual additional wages amount to $752.5 as only seven months are left after the renovation ends. Supplies are also assumed to be constant in relation to Supplies/revenue ratio of 2011. The utilities for renovation option will amount to $6850. Costs of uniform, insurance, and bank fees are assumed to be constant at 2011 level as no additional employee is hired. Moreover, the renovation option does not require additional insurance premium as the building on which the renovation is carried out is already insured. Even though Bourgon will have to borrow an additional amount from the bank, it is assumed that this debt issuance will not cost her. Spoilage, fuel, cable and maintenance expenses are also assumed to depict a constant ratio with revenue. The amortization expense for the year 2013 is taken directly from the balance sheet. The interest expense comprises of two portions, the interest on old LOC and the interest on the new debt. The old LOC interest amounts to $512 while the new debt will require interest payments of $1016. The miscellaneous expense includes the previous year’s expense plus furnishing, signing and permitting costs. The forecasted income statement shows a net profit of $20358.

ii. Forecasted Balance Sheet

The forecasted balance sheet for the renovation option is sketched as follows:

It is assumed that the owner will not draw out any cash from the business. Moreover, the level of inventory and accounts payable will remain at 2011 level. The cash amount is taken from the cash flow statement. The annual depreciation of vehicle, appliances and property is calculated on a straight line basis using ten years of useful life with zero salvage value. The depreciation expense of stands, cases, and computer equipment is calculated on a straight line basis over five year’s useful life and with zero salvage value. The accumulate depreciation for 2012 for Vehicle, appliances and property is calculated as:

Accumulated Depreciation = Last year^' s Accumulated Depreciation + (Book value of asset) / 10

In the case of appliances, the additional $520 of depreciation is added due to the induction of $5200 of appliances in the asset base.

The accumulated depreciation on Stands, cases, and computer equipment is calculated as:

Accumulated Depreciation = Last year^' s Accumulated Depreciation + (Book value of the asset) / 5

The property is valued at the construction costs estimates of $26000. Out of this amount, the 75% of estimated to be financed with debt. Hence, the long-term debt amounts to $19500. Total investment in the business amounts to $31000 as it also includes the cost of appliances, etc. in addition to the construction costs. The differential of the costs (31200-19500) is assumed to be provided by the owner herself. The old line of credit has decreased by $1360 as $512 out of the $1800 LOC payment constitutes interest amount.

iii. Forecasted Cash flow statements

Based on the inputs of the income statement and the balance sheets, the statement of cash flows is formulated as follows:

The ending cash amount is $7336 which depicts an increase of 172%. Amortization of property, vehicle, computer, cases, and appliances are all included in the amortization costs.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.