Get instant access to this case solution for only $19

Bill French, Accountant Case Solution

Bill French, a Staff Accountant, has determined Break Even point for the company for evaluation and planning purposes. The basic purpose is to summarize the costs and profits regarding different products. Furthermore, the Break even analysis is designed to account for all the changes in the costs and profits. However, this designed model is based on certain assumptions to simplify the whole process; for example, averaging the breakeven point for three different products, excluding some variable costs and considering constant sales mix. In the meanwhile, this analysis is flexible enough to allow for the changes such as an increase or decrease in the total fixed or variable costs due to various factors. Break Even analysis helps to a great extent in planning and organizing the company’s resources to achieve a certain target profit. It helps in allocating proper resources for different operations to reach an efficient outcome. In this case, Bill French is challenged by major discrepancies that exist between his model and the reality at hand. However, all these problems are efficiently solved through proper calculations to achieve the target profit. Hence, Break Even proves to be a major helping tool in analyzing the business activities and organizing the costs in order to maximize profits.

Following questions are answered in this case study solution:

-

What are the assumptions implicit in Bill French’s determination of the company’s break-even point?

-

On the basis of French’s revised information, what does next year look like:

-

What is the break-even point?

-

What level of operations must be achieved to pay the extra dividend, ignoring union demands?

-

What level of operations must be achieved to meet the union demands, ignoring bonus-dividends?

-

What level of operations must be achieved to meet both dividend and expected union requirements?

-

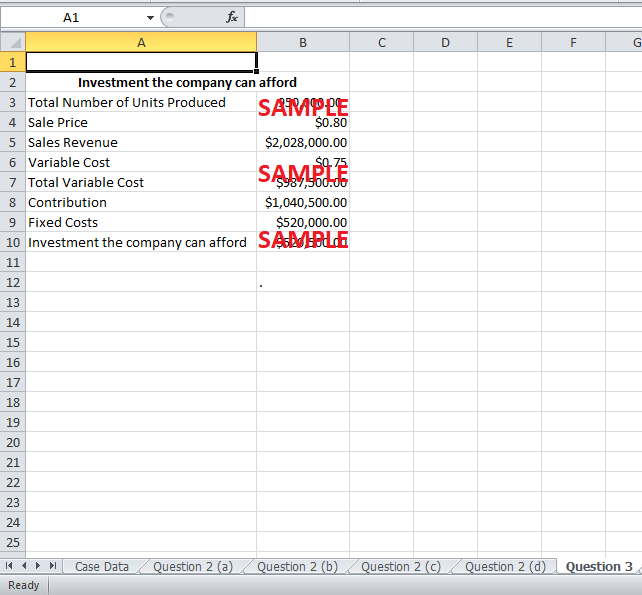

Can the break-even analysis help the company decide whether to alter the existing product emphasis? What can the company afford to invest for additional C capacity?

-

Is this type of analysis of any value? How can it be used?

Bill French Accountant Case Analysis

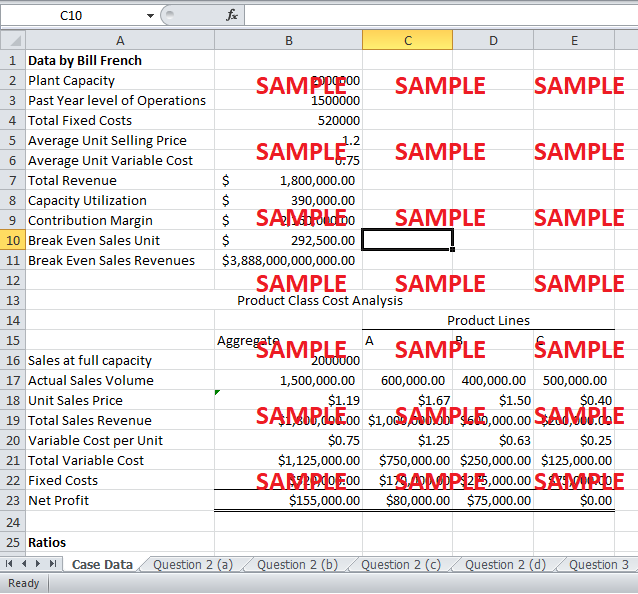

1. What are the assumptions implicit in Bill French’s determination of the company’s break-even point?

There are following assumptions that Bill French has made in determining the company’s break-even point;

He has considered the same break-even point for three different product lines by taking the average. The company deals with three different product lines namely: Product A, Product B and Product C line. These different product lines significantly differ in their overall orientation regarding their sales, pricing and costs; for example, the profitability of different products is different with Product A having the least number of sales. Hence, there is a certain need for different break-even points based on sophisticated methods and calculations.

Bill French has assumed that the sales mix will remain constant. Over the relevant range, total revenues and expenses behave linearly. However, the facts prove otherwise. According to the company’s Assistant sales manager, they are expecting a shift in their product mix next year owing to different profitability and cost structure of various products; For example, Product A line is expected to decline in its sales volume next season while the company has to focus more on the product C line’s sales. On the other hand, Product B line is expected to show no change in its sales volume. Besides, the demand and supply schedule does not corroborate with Bill French’s analysis since there is not a simple linear relationship between revenues and expenses. The pricing structure is very sensitive especially for Product C line and the expenses do not exactly match linearly with the revenues generated by different products.

Bill French has considered reducing the production of Product A line. However, the total fixed costs regarding A line have been unchanged. This leaves space for further adjustments as is elaborated by the Administrative Assistant that they can capitalize on the proposed scaling down of the production of Product A line by investing in some other activities. Likewise, Product C production is intended to increase by increasing the capacity; however, there are serious reservations against this proposal since there would be certain ten thousand dollars increase in the total fixed costs by increasing investment. Additionally, given the increased price for Product C line, it renders the whole proposal ineffective and infeasible.

2. On the basis of French’s revised information, what does next year look like:

a. What is the break-even point?

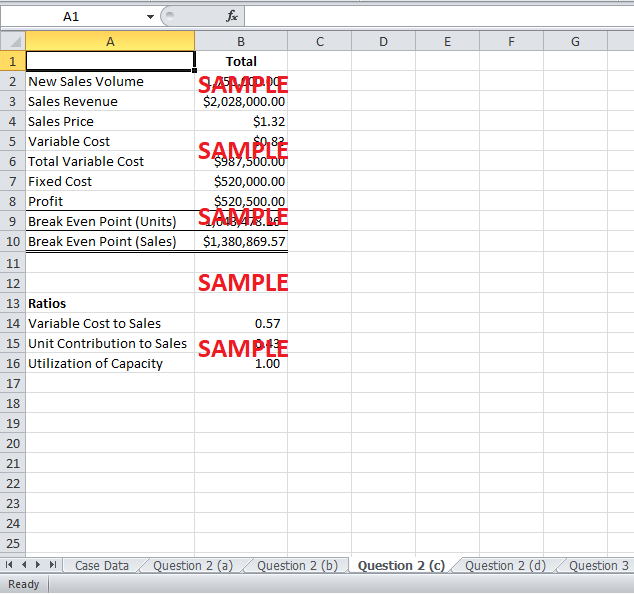

Break-even point using the new estimates has been calculated as follows:

Break-even point = Fixed Costs/Contribution Margin per Unit

Where;

Contribution Margin per unit = Selling Price - Variable Cost per Unit

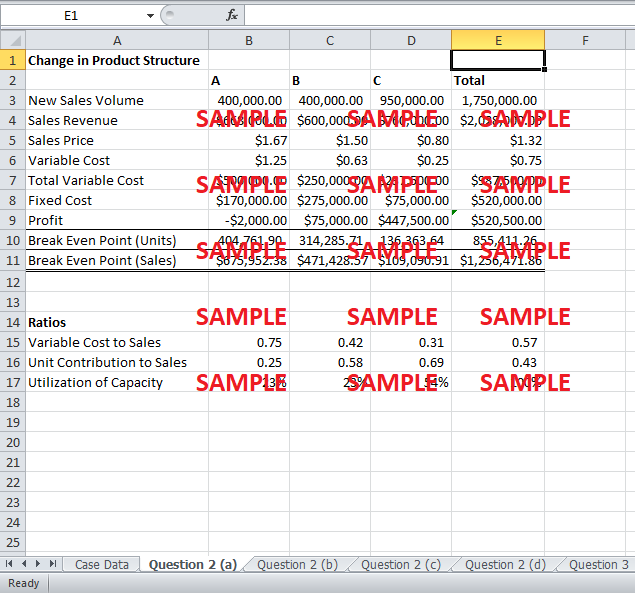

|

|

A |

B |

C |

Total |

|

New Sales Volume |

$400,000.00 |

$400,000.00 |

$950,000.00 |

$1,750,000.00 |

|

Sales Revenue |

$668,000.00 |

$600,000.00 |

$760,000.00 |

$2,028,000.00 |

|

Sales Price |

$1.67 |

$1.50 |

$0.80 |

$1.32 |

|

Variable Cost |

$1.25 |

$0.63 |

$0.25 |

$0.75 |

|

Total Variable Cost |

$500,000.00 |

$250,000.00 |

$237,500.00 |

$987,500.00 |

|

Fixed Cost |

$170,000.00 |

$275,000.00 |

$75,000.00 |

$520,000.00 |

|

Profit |

-$2,000.00 |

$75,000.00 |

$447,500.00 |

$520,500.00 |

|

Break Even Point (Units) |

$404,761.90 |

$314,285.71 |

$136,363.64 |

$855,411.26 |

|

Break Even Point (Sales) |

$675,952.38 |

$471,428.57 |

$109,090.91 |

$1,256,471.86 |

This is clear from the above table that the total Break Even Units are 855,411.26 while the total Break Even sales are $1,256,471.86.

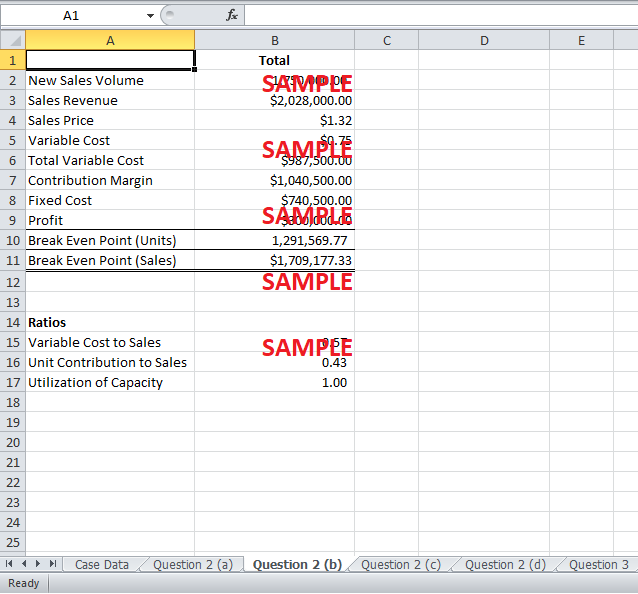

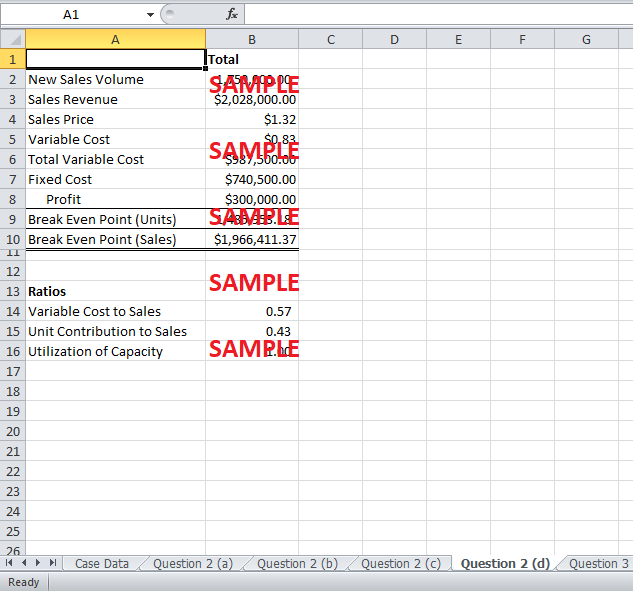

b. What level of operations must be achieved to pay the extra dividend, ignoring union demands?

To pay the extra dividend of 50% and to retain the given level of profits, the total sales revenue should be $2,028,000. The break even units at this point are 1,291,567.77. This is clear in the following table.

|

New Sales Volume |

1,750,000.00 |

|

Sales Revenue |

$2,028,000.00 |

|

Sales Price |

$1.32 |

|

Variable Cost |

$0.75 |

|

Total Variable Cost |

$987,500.00 |

|

Contribution Margin |

$1,040,500.00 |

|

Fixed Cost |

$740,500.00 |

|

Profit |

$300,000.00 |

|

Break Even Point (Units) |

1,291,569.77 |

|

Break Even Point (Sales) |

$1,709,177.33 |

c. What level of operations must be achieved to meet the union demands, ignoring bonus-dividends?

In order to meet the union demands, the total profit should be $520,500 and break even units should be 1,043,478.26.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.