Get instant access to this case solution for only $19

Blackheath Manufacturing Company Case Solution

Blackheath Manufacturing Company produced only one product called Great Heath. Lee High was a new accountant hired by the company. He used flawed cost accounting to make the decision rules for selling which did not make intuitive sense and led to unprofitable decision making. Mr. Charlton Blackheath, the owner, CEO and President of the company trusted High’s judgments and made a few unreasonable decisions regarding the selling prices. This not only confused the employees working for the firm but also directed towards foregoing profitable orders.

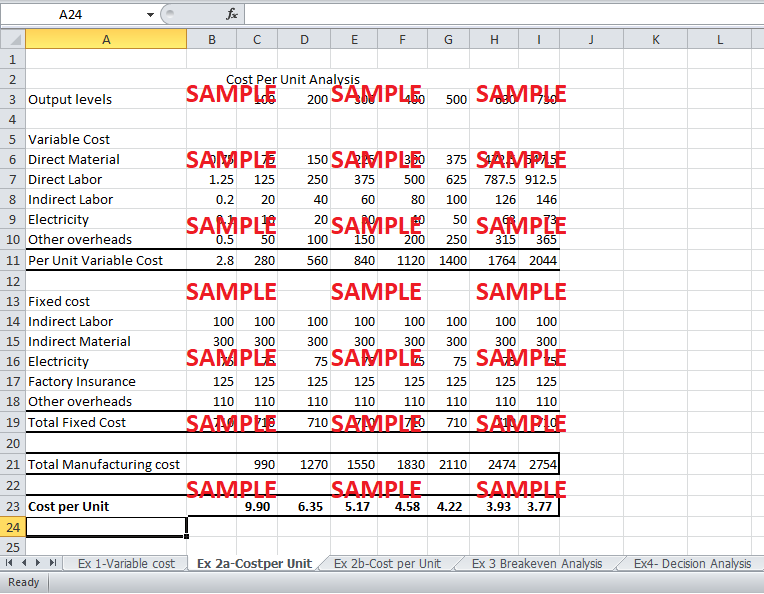

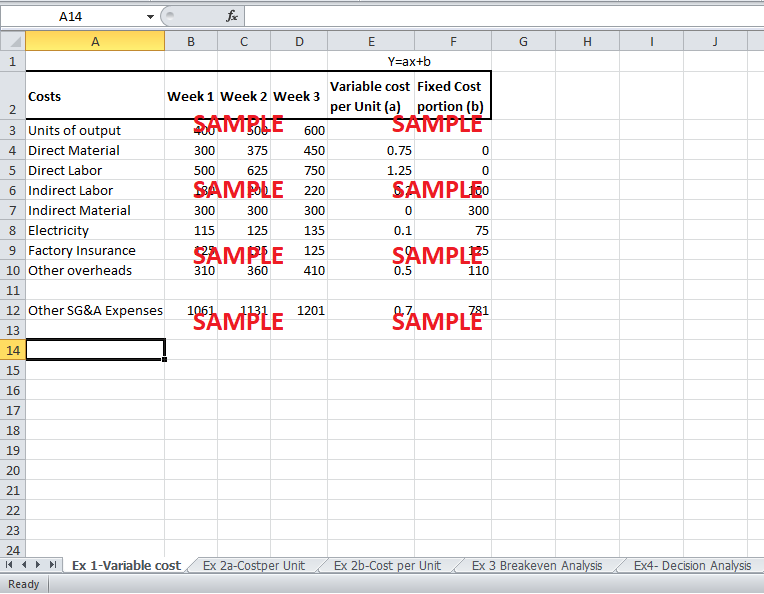

The first and the most critical mistake made by High were not separating the fixed and variable costs in the costs available to him. The significance of this move is that the division of variable and fixed costs helps determine the breakeven volume of sales and to make a decision rule. Exhibit 1 shows the division of all the costs available to High in the three weeks into the Fixed and variable portion. In order to determine the variable cost per unit change in cost per unit change in output is calculated. This gives the per unit variable portion of the cost. This per unit variable cost is important because it remains constant as the output rises. When this per unit variable cost is multiplied by the output the total variable portion of the cost can be calculated. This variable portion is subtracted from the total cost to determine the fixed cost. The fixed cost remains constant at all output levels. For Instance, if we take the example of Indirect Labor, it can be seen that the variable cost per unit is $0.2. It is calculated by subtracting the total indirect labor cost at output level of 400 units from total indirect labor cost at output level of 500 units and dividing it by the difference in output level i.e. 100 units. When the variable indirect labor cost per unit is multiplied with the output level, they give the total variable indirect cost at each output level. The fixed cost is calculated by subtracting this total variable indirect labor cost from the total indirect labor cost.

Following questions are answered in this case study solution:

-

What is an appropriate set of decision rules for pricing the great Heath?

-

Do you agree or disagree with LadyWell's decision? Why, explain in detail.

Blackheath Manufacturing Company Case Analysis

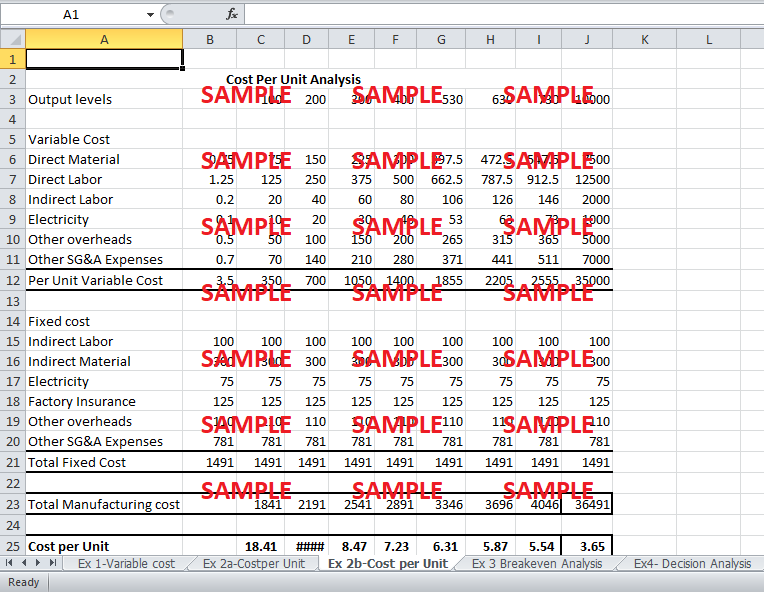

It is impossible to have one cost per unit. As the output increases, the cost per unit tends to fall. The reason for this is that the fixed cost remains same at all levels of output. Hence, when output increases, the fixed cost per unit falls. However, the total variable cost per unit of the cost per unit remains constant for all output levels. This is because the variable cost changes consistently with the increase in volume. Hence, when sales general and administrative (SG&A) expenses are not included in cost, at an output of 100 units the Cost per unit is as high as $9.90 per unit, and at an output of 500 units the cost per unit falls to $4.22 per unit. Exhibit 2a shows the cost per unit of Great Heath, excluding the SG&A expenses, at different output levels. Exhibit 2b shows the entire cost per unit, including the SG&A expenses, at different output level.

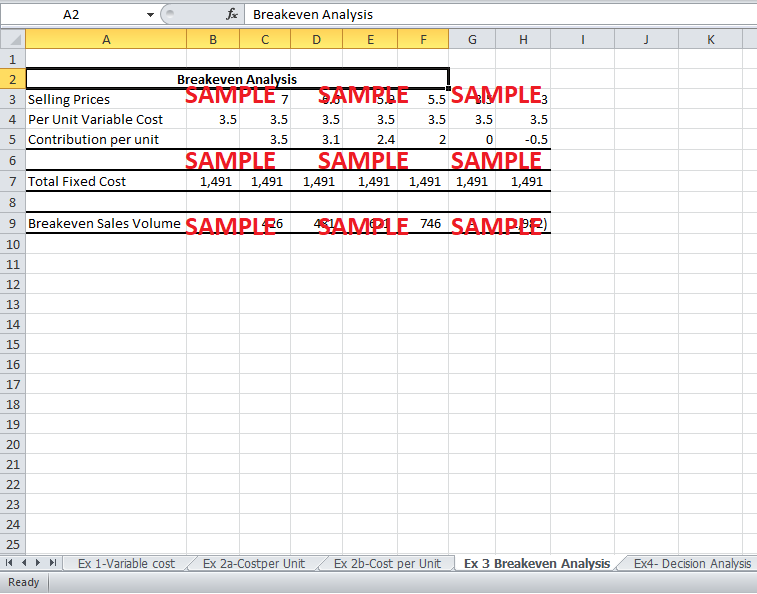

Once we have divided the cost into fixed and variable costs, the breakeven analysis can be done to determine to correct volume of output and the appropriate selling price. The total variable cost per unit turns out to be $3.5 per unit. If the firm sets the selling price of $7 per unit, the firm earns a contribution of $3.5 per unit. Contribution is the difference between the selling price and the total variable cost per unit. Total fixed cost at all level of activities is $1491 per week. When we divide this fixed cost by the contribution per unit to determine the breakeven sales volume. At this level of sales, the firm is able to earn enough contribution to pay off its fixed cost and breaking even. Exhibit 3 shows the breakeven analysis for the firm at different selling prices. It clearly shows that, as the selling price falls, the breakeven sales volume increases as more total contribution is required to cover the same fixed cost. The breakeven sales volume for the selling price of $7 per unit is 426 units.

Based on our analysis and the calculations shown in the first three Exhibits, the following decision rules can be derived.

-

Order should be rejected if the offered Price is less than $3.5 per unit.

-

The higher the units ordered the lower the selling price could be offered.

The Order should be rejected for a selling price below $3.5 per unit because $3.5 is the contribution per unit. A selling price below this value would mean that an additional value sold will neither contribute anything towards the fixed cost nor be able to cover the variable cost. In Exhibit 2b, an extreme output value is shown of 10,000 units. The value shows that even at this high a value the cost per unit stays above the variable cost per unit. Cost per unit is the sum of variable cost per unit and fixed cost per unit. Hence, even if the output level is so large that fixed cost per unit becomes zero the variable cost per unit will still exist.

Exhibit 2b also shows that the larger the output the lesser the cost per unit. As the output increases, the fixed cost is spread over more and more units, and fixed cost per unit falls. This fall causes the fall in cost per unit. Hence, a lower selling price could be negotiated for a larger quantity of the order.

2. Do you agree or disagree with LadyWell's decision? Why, explain in detail.

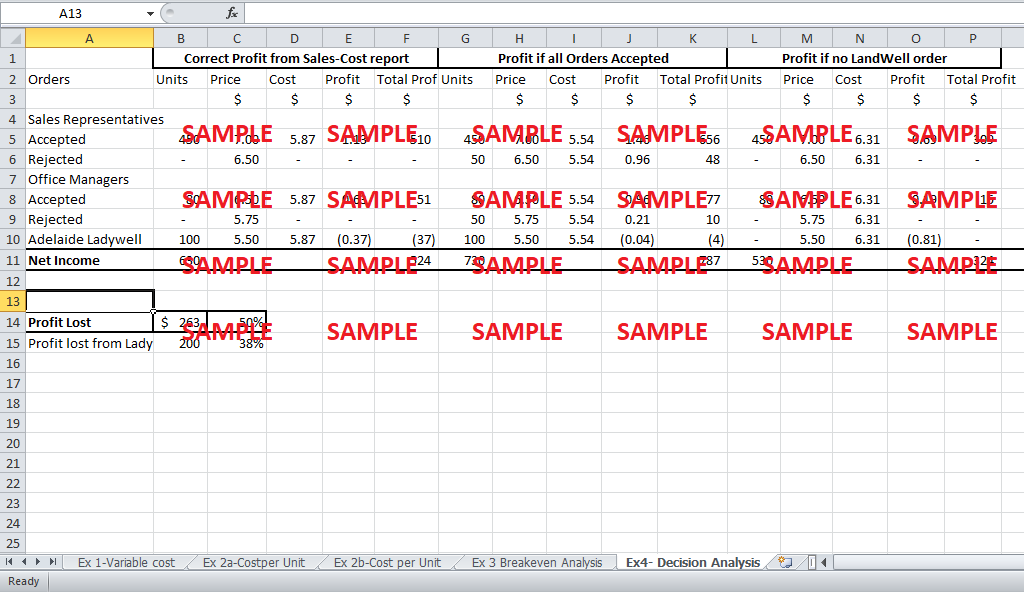

It is obvious from the discussion above that High’s calculation and decision rules were clearly flawed. The incorrect decision rules not only lead to uncertainty but also inappropriate decision making. Exhibit 4 shows the profit earned on the decisions based on the incorrect decision rules. This profit is $524.

Exhibit 4 also shows that, based on the new decision rule, all orders should have been accepted because they all have a selling price of above $3.5 per unit and they all contribute in increasing the output level. If all orders are accepted, the profit earned would be $787.

Lee High’s incorrect calculations led to a lot of unwise decision making. High was inaccurate in his analysis because he failed to separate the variable and fixed cost. Due to his faulty decision rules, Blackheath lost Profits of about $263 i.e. 50% of the Profit earned.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.