Get instant access to this case solution for only $19

Blackheath Manufacturing Company Case Solution

The Production schedule is shown in Exhibit 1. It shows that number of units produced depends on the expected sales and demand for the product. The company has a policy of keeping a closing inventory of 50% of the next month sales. This means that the production for January would be the difference in the current month expected sales and the closing inventory from December. Additionally, in January, the units will be produced for February to maintain the “50% of next month expected sales” inventory level.

The schedule for raw material use is derived from the production schedule. Blackheath has a policy of keeping at least enough raw material for 700 units in the closing inventory. It is assumed that in order to keep the storage and maintenance cost at the minimum, a minimum inventory for 700 units is maintained. Exhibit 1 shows a schedule of raw material purchase where the material for units produced in January is the difference in January’s production units and the closing inventory from December. Also, in January, the raw material would be required for units produced for February. Hence, additional raw material will be kept in closing stock for 700 units in January.

The Schedule of raw material purchase is, then derived from the schedule of raw material use. In order to get the amount of raw material ordered each month, the total required raw material per unit each month is multiplied with the variable raw material cost of $0.75 per unit.

Following questions are answered in this case study solution:

-

Prepare a production schedule, schedule of raw material use, and a schedule of raw materials purchases for January, February and March.

-

Prepare a flexible expense budget using the format shown in the variable budget table in the case

-

Prepare a projected income statement for January, February, and March.

-

Prepare a cash budget for the quarter

-

Prepare a projected balance sheet as of April 1st

-

Adeliade Ladywell, Crofton Brockley and Trafalgar Blackheath will be meeting to discuss the material developed in questions 1 through 5. What points would be likely to dominate such a meeting Why?

-

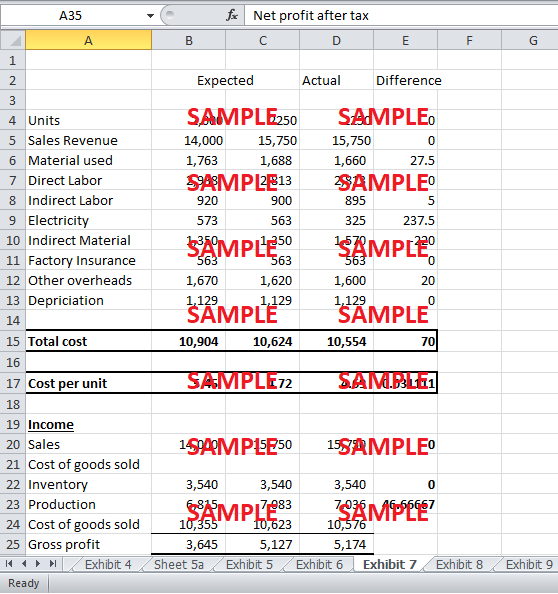

Using the information presented in the case of regarding actual activity in January, prepare an analysis of the results.

-

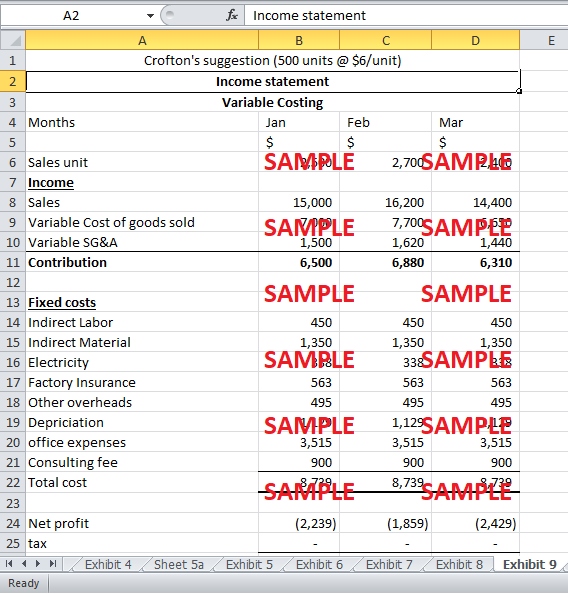

How would net profit on the income statement change if Adelaide were to prepare the income statement under an assumption of variable costing?

Blackheath Manufacturing Company Case Analysis

2. Prepare a flexible expense budget using the format shown in the variable budget table in the case

Exhibit 2 shows the flexible expense budget. Exhibit 2a shows a separation of the variable cost from the fixed cost. The direct cost of production is the direct material cost and direct labor. To make the flexible budget, we calculate the variable cost by multiplying variable cost per unit with the number of units expected to be sold in each month. The fixed cost is calculated by multiplying the fixed cost per week with 4.5 weeks to get fixed cost per month. The total cost for an expense is the sum of both variable and fixed cost. The budgeted cost of production will be $9,924, $10,484 and $9644 in January, February and March, respectively.

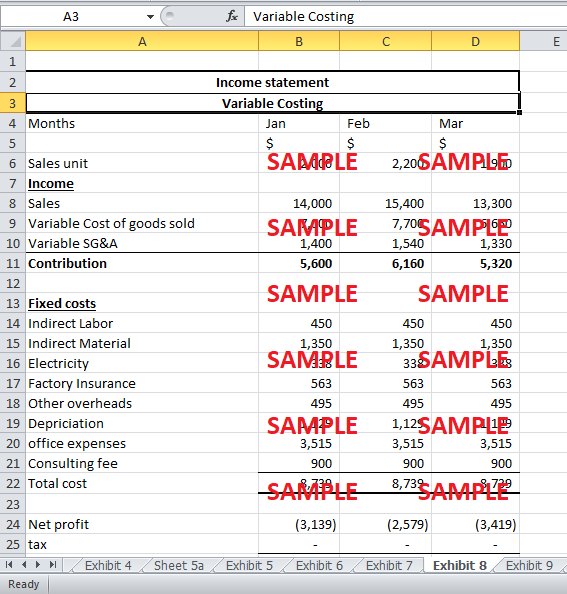

3. Prepare a projected income statement for January, February, and March.

Exhibit 3a shows the calculation of cost of goods sold. The cost of inventory sold in the current month is based on previous months cost per unit but the cost per unit of the current month is used to find the cost of goods sold and produced in the current month. Exhibit 3 shows the projected income statement. The company is forecasted to earn losses of $1,155 in January, $1,059 in February and $1822 in March. Unlike flexible budget, sales and selling general and administrative are included in the income statement.

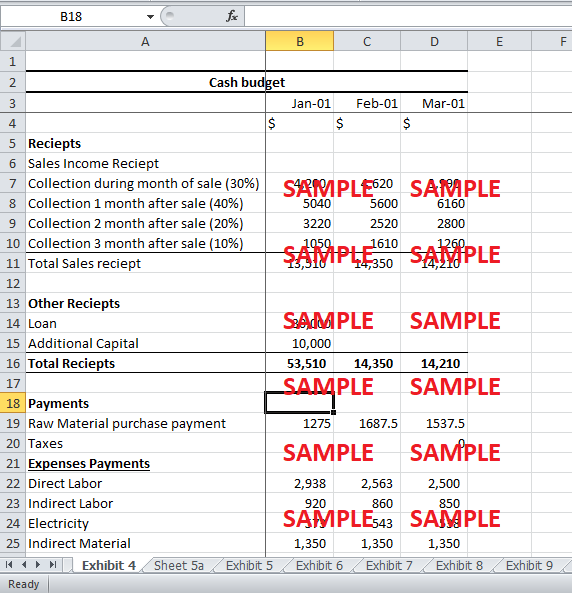

4. Prepare a cash budget for the quarter

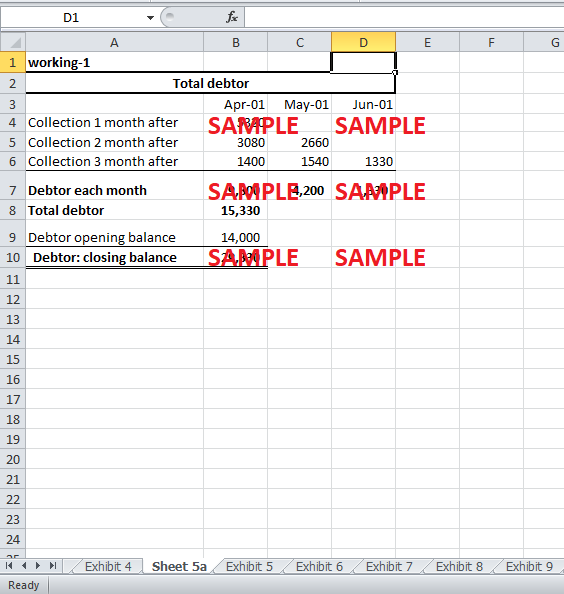

Exhibit 4 shows the cash budget for Blackheath Company for the first quarter. The main payment inflow for the company is through the payment of customers for the products. We assume that all the expenses are paid in the month they are incurred. Additional loan and capital totaling 40,000 is invested in the business. For forecasting the payments received from customers, it is assumed that 30% of the customers pay in the month after, 40% of them pay one month after, 20% pay 2 months after, and 10% is paid three months after the product is sold. The payment made to suppliers is done one month after the purchase. The cash budget shows that, February and March, there is a cash outflow for the firm. However, for January, there is a large cash inflow in the firm. The reason for this is the additional capital invested in the business and the loan taken by the company.

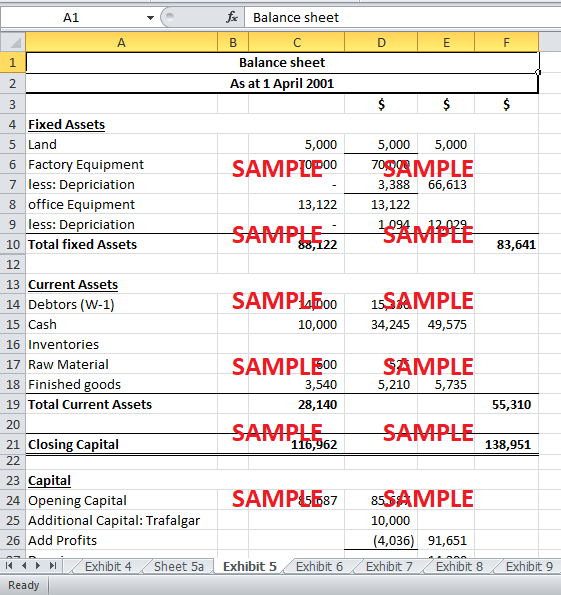

5. Prepare a projected balance sheet as of April 1st

Exhibit 5 shows the Projected Balance sheet for April. The balance sheet is mostly the same as that of December. There has been an increase in investment during this quarter. The business is earning losses but, due to high cash inflow in January the cash, the cash balance has increased. Moreover, the loan increased the long term liability of the firm and the additional capital increased the equity of the firm.

6. Adeliade Ladywell, Crofton Brockley and Trafalgar Blackheath will be meeting to discuss the material developed in questions 1 through 5. What points would be likely to dominate such a meeting Why?

Due to lack of proper cost accounting system of the firm for more than three years, there are several points that Ladywell, Brockley and Bleckheath can discuss during the meeting. Lee High had little knowledge about the budgeting and cost accounting. He was the cause of a lot of flawed decision making done by the firm employees over the years. After the analysis shown in Exhibits 1 to 5, it is obvious that the company is not in a healthy financial condition. Ladywell, Brokley and Blackheath will have to change the costing and decision making of the firm drastically in order to make the firm profitable again otherwise the firm will end up bankrupt.

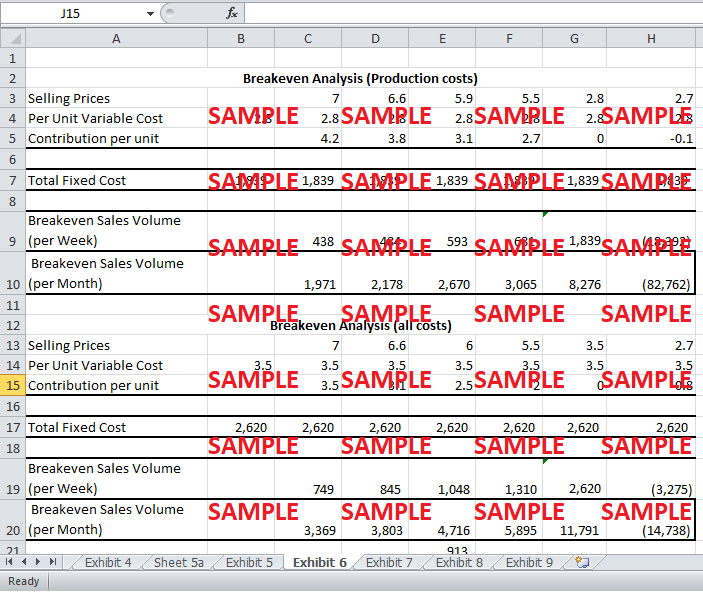

Exhibit 6 shows the breakeven analysis done for the firm at different selling prices. The lower the selling price, the more the units required to breakeven. The unit sold in January, February and March are 2000, 2,200 and 1,900 units. The number of units for breakeven point in the manufacturing unit at $7 selling price is 1971 units per months. Thus, the contribution from the sale of a unit is $4.2. Hence, this contribution from over 1971 units can cover all the fixed manufacturing cost. As the expected sales in January and February are greater than this breakeven volume, the revenue from the sales is covering all the manufacturing costs. However, expected sales in March are less than the breakeven point. This means that in March the total contribution will not be able to cover all the manufacturing costs.

Exhibit 6 also shows another table of the overall breakeven analysis. The overall breakeven number of units is 3369 units. Hence, as the expected sales in the three months are lower than the overall breakeven number of units. Blackheath manufacturing company will not be able to cover its total fixed cost from the contributions received in these months. In the meeting, new ways could be discussed of increasing the sales in order to breakeven.

Secondly, they should decide on new decision rules based on the breakeven analysis in Exhibit 6. Given the analysis from the preceding questions, the following decision rules can be established.

-

Orders which offer a price less than $3.5 per unit should be rejected.

-

When negotiating an order, the selling price could be lowered only when number of units ordered increase.

$3.5 is the contribution per unit and, if the selling price is less than this amount, the firm will not even be able to cover its variable costs. A selling price less than $3.5 would suggest that any additional unit sold would neither contribute anything towards the fixed cost nor be able to cover the variable cost. Regardless of the volume of production, the cost per unit will always stay above the variable cost per unit i.e. $3.5. Cost per unit is calculated by adding the variable cost per unit and the fixed cost per unit. Fixed cost remains constant within a range of activity. As the volume of production rises with in this range the fixed cost is divided among more and more units. Therefore, when the output level is very large, the fixed cost per unit will fall to zero but the variable cost per unit will remain constant at $3.5. This shows that, for a larger quantity of the order, a lower selling price could be negotiated.

Other important things can also be discussed. For instance, in order to be profitable the company needs to reduce their fixed costs. This can be done by improving efficiency of operations and negotiating a lower fixed cost of electricity or other expenses with the suppliers. Also, the strategies of increasing sales volumes can also be discussed. These strategies could be advertising the product. The firm could also think of a profitability of reducing the price to attract customers. They can also improve their customer service and quality of product to improve sales. Lastly, they need to discuss improvement in the cost accounting system. The budgeting, performance evaluations, variances, feedback and other analyses should be made common practice in the firm.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.