Get instant access to this case solution for only $19

Breeden Security, Inc. (A) Case Solution

The company Breeden Security Inc (A) case study analysis deals with the manufacturer of radio equipment RC1 and RC2. Breeden Security Inc GMBH (BS), a Germany-based company, was a large-scale manufacturer of radio equipment. In 2007, the company set up a subsidiary in the United States to manufacture two products; RC1 and RC2. Both the products were miniature signaling devices. While RC1 was mainly used for operating the garage door using a remote, RC2 was used to turn on the house lights when the householders arrived in the dark.

In October 2007, the parent company set a target profit for BS USA of $210,000 for 2008. Therefore, Herman Klein, the president of BS USA, and Marlene Baer, the controller of the same company, reviewed the monthly budgeted figures in order to plan to meet the target.

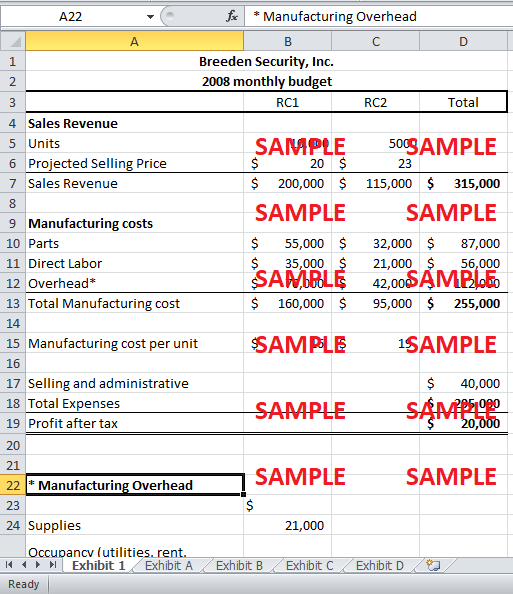

The current monthly budgeted data shows a forecasted sales volume of 10,000 units of RC1 and 5000 units of RC2. This volume of sales and production resulted in a profit (after tax) of $20,000. This means that the Breeden Security Inc company earns a profit of around $240,000 in 2008. This is well above the target profit. However, Klein and Baer both need to analyze the costs and volumes in order to plan more effectively.

Following questions are answered in this case study solution:

-

What would the Break-even sales volume be, assuming ratio of two RC1s sold for each RC2 sold?

-

What level of sales would provide the profit target specified by the parent company of $210,000 for the year? (Assuming that they sell all that they produce)

-

What would be the manufacturing cost per unit if they made and sold only 8000 RC1 units and 4000 RC2 units per month? In this case, what is the profit?

-

What would profit be if they sold 8,000 RC1 units and 4,000 RC2 units (as in the previous Question) but produce 10,000 RC1 units and 5,000 RC2 units, putting the unsold units in the finished goods inventory?

-

Conclusion

Breeden Security Inc A Case Analysis

1. What would the Break-even sales volume be, assuming ratio of two RC1s sold for each RC2 sold?

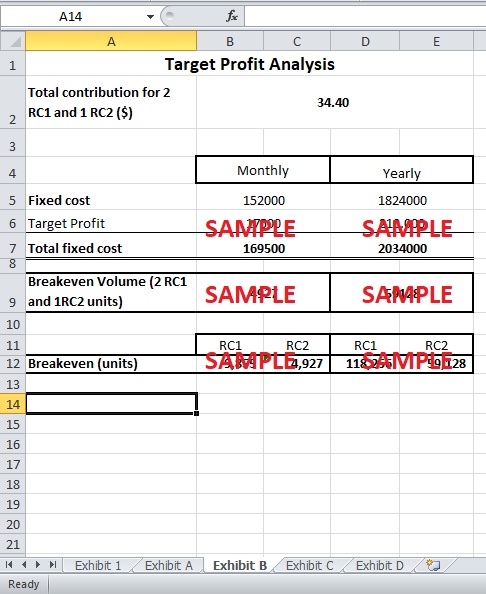

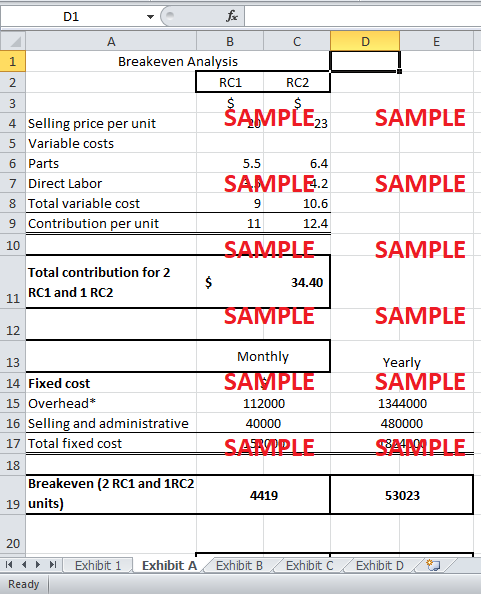

The Breakeven analysis for BS is shown in Exhibit A. To calculate the breakeven volume; it is assumed that 2 units of RC1 are produced for every unit of RC2. This is assumed because RC2 is more expensive then RC1. Moreover, the demand for RC 2 is higher than the demand for RC1. For the calculation of breakeven volume, the costs are first divided into variable and fixed costs. The material (parts) and direct labor cost are both variable costs. The values for these costs available in month budget are divided by the unit volume and added together in order to get per unit variable cost. This variable cost is subtracted from the selling price per unit to calculate the contribution per unit. The contribution per unit is $11 for RC1 and $12.4 for RC2. A combined contribution is calculated treating two RC1 and one RC2 as one unit and adding the contribution per unit of each unit. This combined contribution is $34.4.

The remaining costs like manufacturing overheads and selling and administrative expenses are fixed costs. The total monthly fixed cost is $152,000. This monthly cost is multiplied by twelve to get the total fixed cost of 2008. The fixed cost is divided by the combined contribution to get the breakeven volume of two RC1 and one RC2.

The Exhibit shows that in order to breakeven, the company needs to produce and sell 8,837 units and 4,419 units of RC1 and RC2, respectively. The margin of safety is 1,163 units of RC1 and 581 units of RC2. This means that the company would need to produce and sell around 106,047 units of RC1 and 53,023 units of RC2 in the entire year of 2008 in order to cover all its manufacturing, selling and administrative costs.

BS has a contract with a large producer of motorized garage door. This contract ensures a minimum of 100,000 RC1 control units being ordered and supplied each. The minimum amount is a little less than the breakeven volume, but it can be assumed that the producer of these garage doors would order more than 100,000 units of RC1. Thus, the expected sale of 120,000 units of RC1 seems reasonable. Similarly, RC2 is often sold through the mail-order catalogue. For RC2, a sale of 60,000 is expected which is half the estimated sale of RC2 because RC2 is more expensive and is not sold through contract with a company.

2. What level of sales would provide the profit target specified by the parent company of $210,000 for the year? (Assuming that they sell all that they produce)

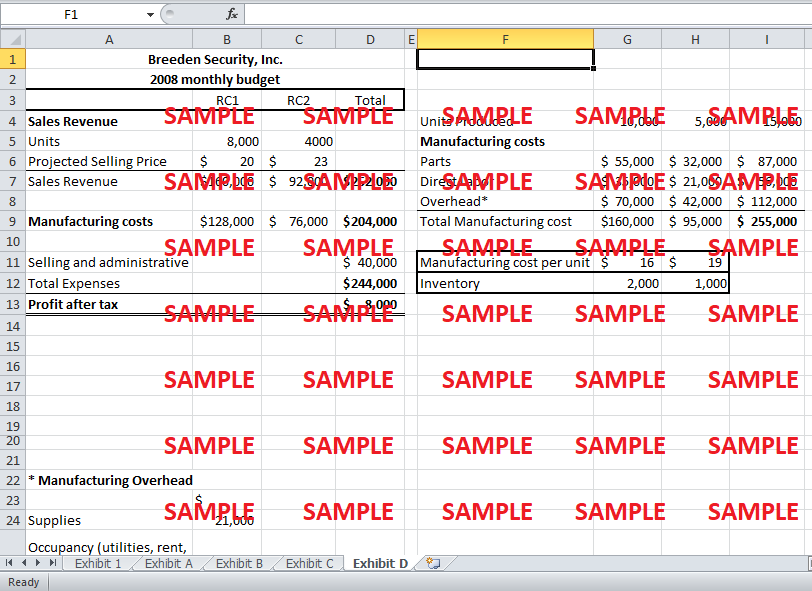

It became important for Klein and Baer to calculate the volume to produce in order to meet the target profit of $210,000. This is done by incorporating the target profit in the breakeven analysis. After adding the total yearly fixed cost and target profit, we get the total contribution required to meet the target. This total contribution is divided by the contribution per block to get the required volume of the block. Exhibit B shows that 118,256 units of RC1 and 59,128 units of RC2 are required to be produced and sold in 2008 to meet the target.

Even though the estimated sales for 2008 are greater than that required to meet the target, the difference is very less. The monthly sales should be 9,855 units for RC1 and 4,927 units for RC2. These figures are fairly close to the monthly 10,000 RC1 and 5,000 RC2. Therefore, Klein should think of trying to boost demand for the product through advertising to avoid the possibility of failing to meet the target.

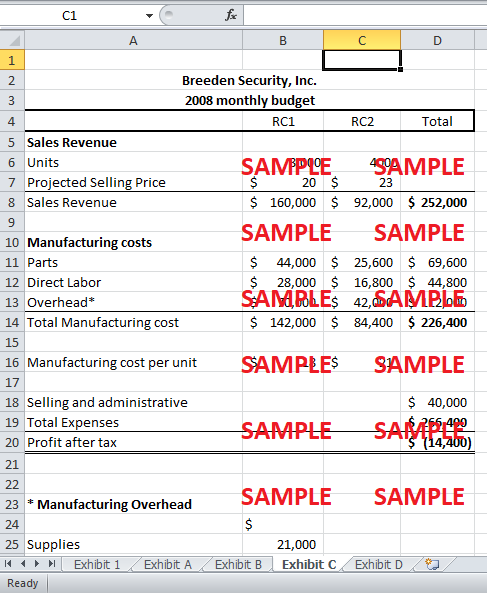

3. What would be the manufacturing cost per unit if they made and sold only 8000 RC1 units and 4000 RC2 units per month? In this case, what is the profit?

The company also would need to know the profitability at a different level of production. This is necessary to see how the level of production affected the profitability of the firm. Hence, the manufacturing cost and profits are calculated if the production and sales fall to 8000 RC1 and 4,000 RC2. Exhibit C shows the calculation for the new level of activity. Due to the change in the production level, only the variable costs of manufacturing will change, but the fixed cost will remain unchanged. For Instance, for RC1, the material cost per unit is $5.5 and the direct labor cost per unit is $3.5 (Exhibit A). These per unit costs are multiplied by the production units of 8,000 to get the material and direct labor cost for this production level. The fixed cost remains the same. Using these values the new manufacturing cost per unit for RC1 is $18 and for RC2 is $21. However, at this activity level, BS will fail to make a profit. The calculated loss is $14,400.

4. What would profit be if they sold 8,000 RC1 units and 4,000 RC2 units (as in the previous Question) but produce 10,000 RC1 units and 5,000 RC2 units, putting the unsold units in the finished goods inventory?

This scenario is important to analyze because, if more units are produced then required, per unit manufacturing cost will fall as the same fixed cost is spread over more units. Hence, we assume that while the firm produces 10,000 RC1 and 5,000 RC2 are produced only 8,000 RC1 and 4000 RC2 are sold monthly. Exhibit D shows the result for this budgeted sale and production. The calculations show that using this scenario the manufacturing cost remains the same as the original budget at $16 for RC1 and $19 for RC2. However, the firm is able to earn a profit of $8000. It is important to note that despite this profit, there will be a rise in inventory of 2000 RC1 and 1000 RC2. This would increase the inventory maintenance and storage cost for the firm which have not been included in the cost.

5. Conclusion

From the calculation and analysis discussed so far, there are two important points that can be deduced. Firstly, if BS is able to meet the budgeted production and sales of 10,000 RC1 and 5,000 RC2, they will be able to bypass the breakeven point and the target profit volume. Secondly, the larger the production level the lesser would be the unit manufacturing cost within a range of activity. If 10,000 RC1 and 5,000 RC2 are produced at full capacity, BS should produce at this capacity even if the demand falls in the future. However, if this level is not utilizing the full capacity, BS should produce as many units as demanded so as to spread the fixed cost over the maximum number of units. In which case, the firm should try boosting its demand so that its demand is enough to produce at full capacity.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Bridgeton Industries: Automotive Component & Fabrication Plant Case Solution

- BRL Hardy Globalizing an Australian Wine Company Case Solution

- Buffalo Wild Wings, Inc. Strategic Plan Case Solution

- Building the Culture at Agilent Technologies Back to the Future Case Solution

- Bunge Poised for Growth Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.