Get instant access to this case solution for only $19

Butler Lumber Company Case Solution

Mr. Butler is considering the offer that Northrop Bank has extended to him for the credit line of $465k. Currently Butler Lumber Company has credit agreements with Sub Urban National Bank with a cap of $250k. While Butler has managed to keep his funds requirement below $250k, the recent growth in sales has led to an increased requirement of funds. Although the business is running profitably, the management of cash is posing problems for the business. Butler utilizes the trade discounts which come with purchasing larger quantities. It is advised that Butler reforms his financial strategy, make his treasury management efficient and reconsider his expansion plans.

Following questions are answered in this case study solution:

-

How well is Butler Lumber doing? Why?

-

What has been the company’s financial strategy? Why does Mr. Butler have to borrow so much money to support this profitable business? Has he been managing his company’s cash flow wisely?

-

Do you agree with his estimate of the company’s loan requirements? How much will he need to borrow to finance his expected expansion in sales in 1991 (assume sales volume of $3.6 million)? How much will he need over the next several years?

-

Would you urge Mr. Butler to proceed with, or to reconsider, his anticipated expansion plans?

Butler Lumber Company Case Analysis

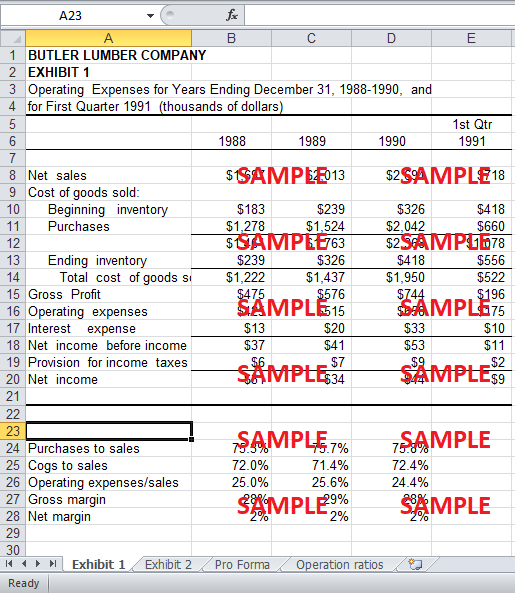

1. How well is Butler Lumber doing? Why?

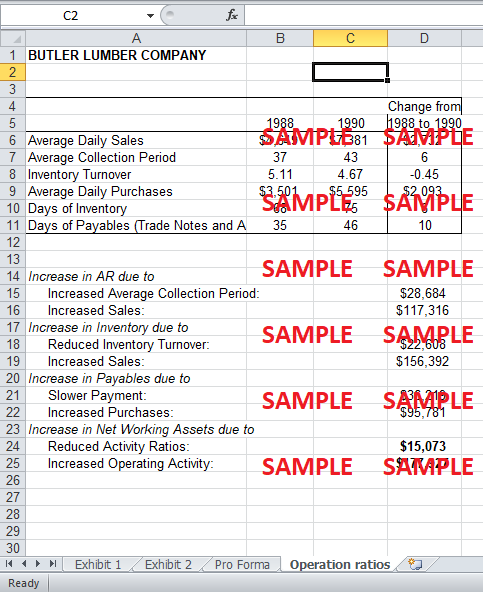

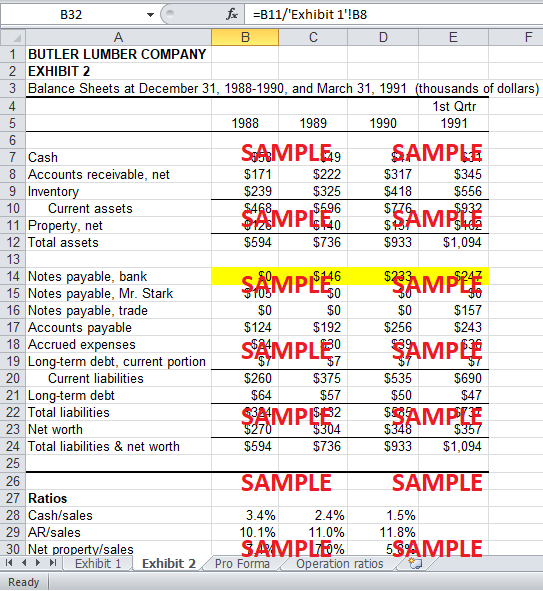

As, seen from the exhibits given in the case, Butler Lumber’s performance has been performing consistently in the last few years. Its gross margin ratio is slightly below 30%, and its operating costs are maintained well at 25%. Considering that there is fierce price competition, the ability of a new venture to make profits since its very inception is an indicator of well managed business. However, after examining the ratios deduced from the exhibits, there appears to be some problem. The cash to sales ratio is decreasing with the increase in sales, and only 1.5% of sales are maintained on the balance sheet, as cash. The account receivable to sales ratio is increasing year by year which can be explained either by increasing sales or by inefficient management of cash flow. The accounts payable to sales ratio has also increased. It can also be explained by either of the two situations. Either Butler has very good ties with its suppliers or he does not have the cash to pay back to the suppliers. From the case,it is known that Butler is relying heavily on the trade credits to keep his bank borrowing under the ceiling of $250k. Further analysis would tell by how much the two situations have impacted on the accounts payable to sales ratio. The days of inventory ratio have also increased because Butler needs to buy in bulk to avail the quantity discounts.

On a more rigorous analysis of the numbers, it was found that although the increase in account receivables was due to the increased sales yet the credit management of the Butler Lumber has led to the increase in the account receivable ratio as can be seen in the accompanying spreadsheet. The deeper look into the account payable turnover also shows that inability of the company to manage cash properly has led to the increased ratio. The increase in this ratio may not be a good sign for Butler, because he is relying heavily on the trade credits to make his business run. Any loss in the creditworthiness of Butler can cause a great harm to the business.

2. What has been the company’s financial strategy? Why does Mr. Butler have to borrow so much money to support this profitable business? Has he been managing his company’s cash flow wisely?

The company’s financial strategy is based on getting trade discounts. As, it has been mentioned in the case, Butler has not availed any considerable cash discounts on his purchases. This strategy can be the cause of the cash problems that Butler is facing right now. The companies, which are in their start-up phase usually face difficulties in meeting their cash requirements, but for a profitable business like this one, keeping the enterprise liquid is what matters. Butler purchases in large quantities, which warrant a relatively large discount but this keeps the cash balance to the minimum.

Butler needs external finance because his business is undergoing significant growth, but the business is not capable of generating enough working capital. If, Butler had managed the account receivables and inventory more efficiently, there would have a much better financial position of the business. If, the purchased were not made in large quantities, the ending inventory would not have piled up, and the funds blocked in the inventory could have been utilized somewhere else where they would generate income. This argument is further solidified with the decrease in the inventory turnover ratio. The inventory is not being converted into sales. Butler is losing a considerable amount of money because of inefficient management of cash.

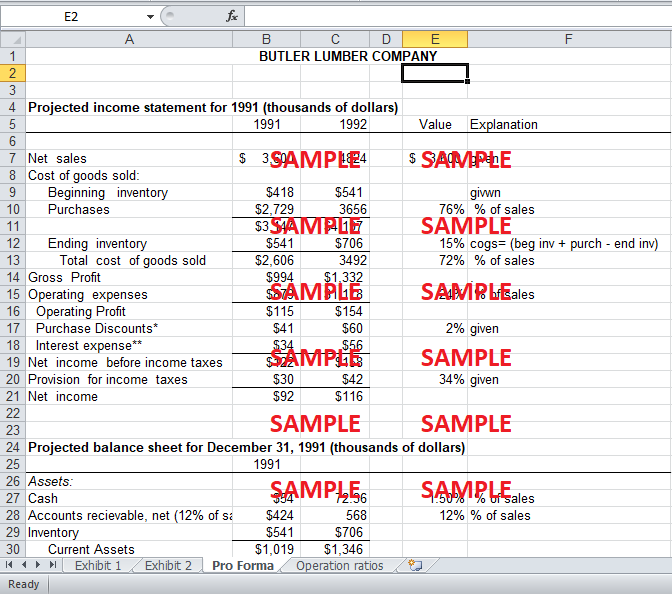

3. Do you agree with his estimate of the company’s loan requirements? How much will he need to borrow to finance his expected expansion in sales in 1991 (assume sales volume of $3.6 million)? How much will he need over the next several years?

No, Butler has over-estimated the funds required for the year 1991. From the pro forma balance sheet in the accompanying spreadsheet, it can be seen that the funds required for 1991 are $324k. As, already mentioned in the case, the projection of financial position for years ahead will not yield any reliable results; the analysis is done for the one year ahead. All the variables have been calculated using the instructions given for the year 1991. From the calculations, it is found that the line of credit that Northrop Bank is extending towards Butler will run out in a year and the requirement in 1992 will exceed the credit ceiling of $465k provider by the bank. The funds needed in the year 1992 are $473k, slightly above the bank ceiling only after one year, and these are expected to increase given the current cash management of the company. If, the accounts receivables are not decreased, inventory is not efficiently managed, or the account payables are carefully dealt with, then the need for external finance is not going to go away.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.