Get instant access to this case solution for only $19

Canadian Pacifics Bid For Norfolk Southern Case Solution

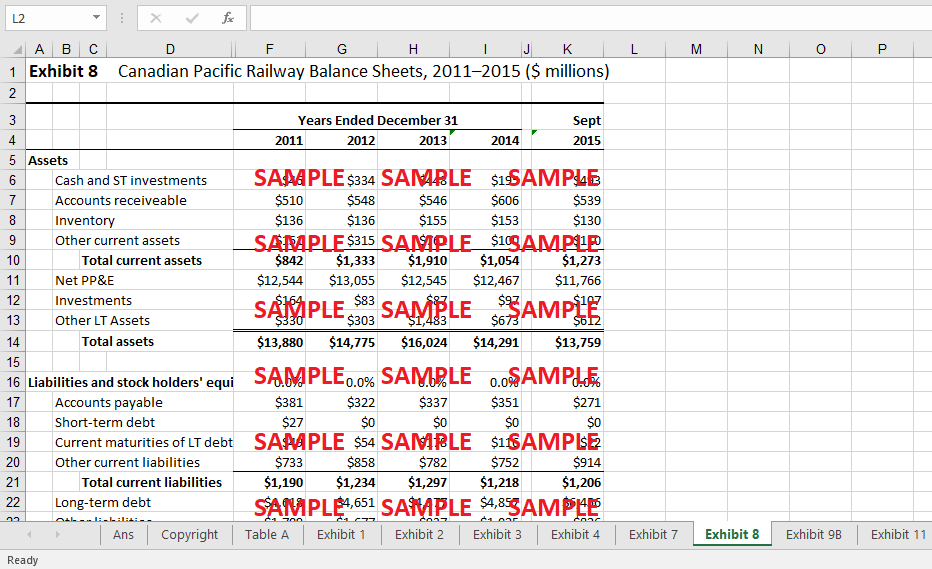

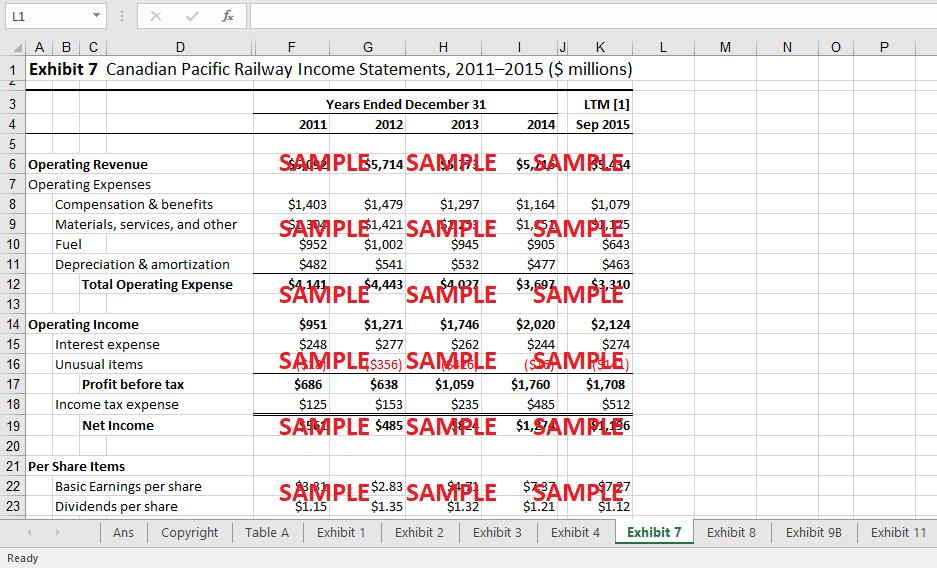

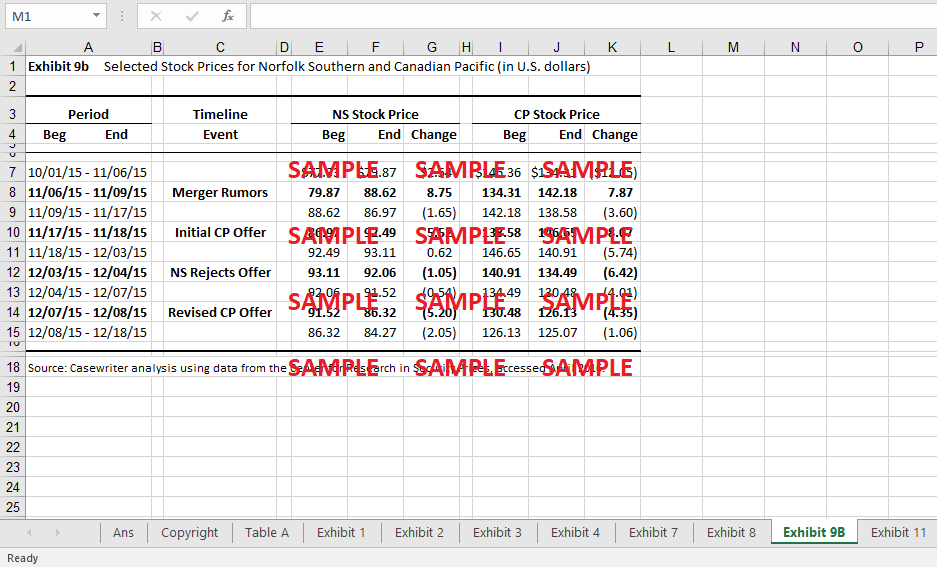

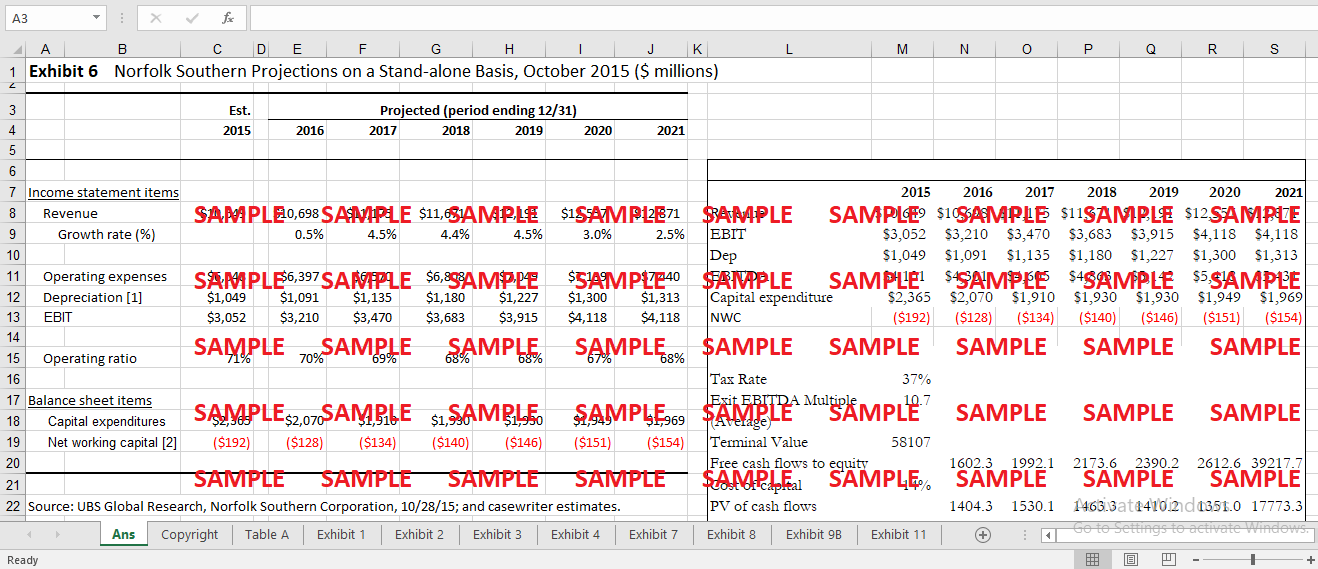

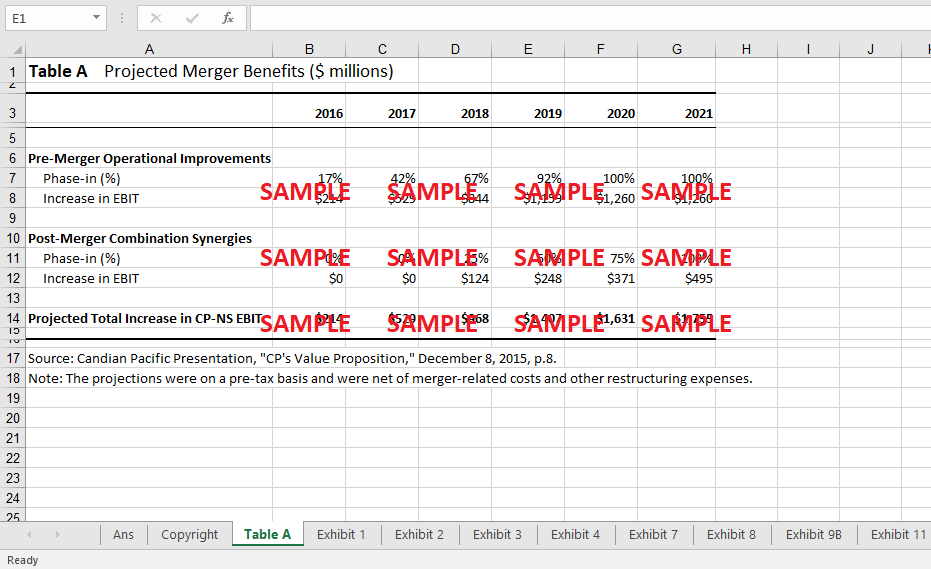

In order to consider the bid of the Canadian Pacific for the acquisition of Norfolk Southern, it is important to understand the stand-alone value of Norfolk Southern. For this purpose, discounted cash flow model has been used to estimate the free cash flows to equity holders of Norfolk Southern. Firstly, revenue projections and EBIT margins were provided in the case which was utilized to determine free cash flows.

Following questions are answered in this case study solution:

-

Norfolk Southern Valuation

Case Study Questions Answers

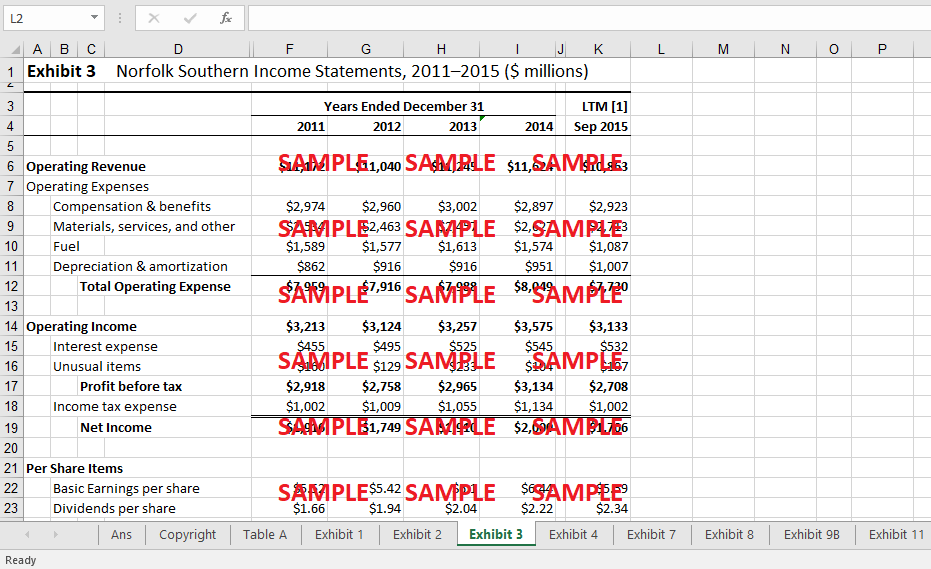

The EBITDA was calculated by adding back the depreciation expense subsequently after-tax EBITDA was determined. The tax rate of 37% was used since it is the effective tax rate on the income statement of the company.

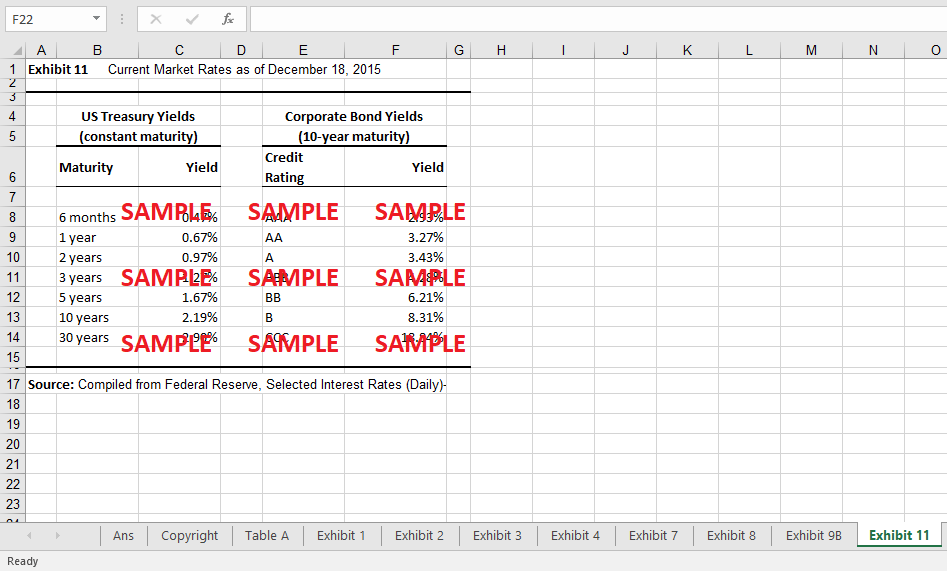

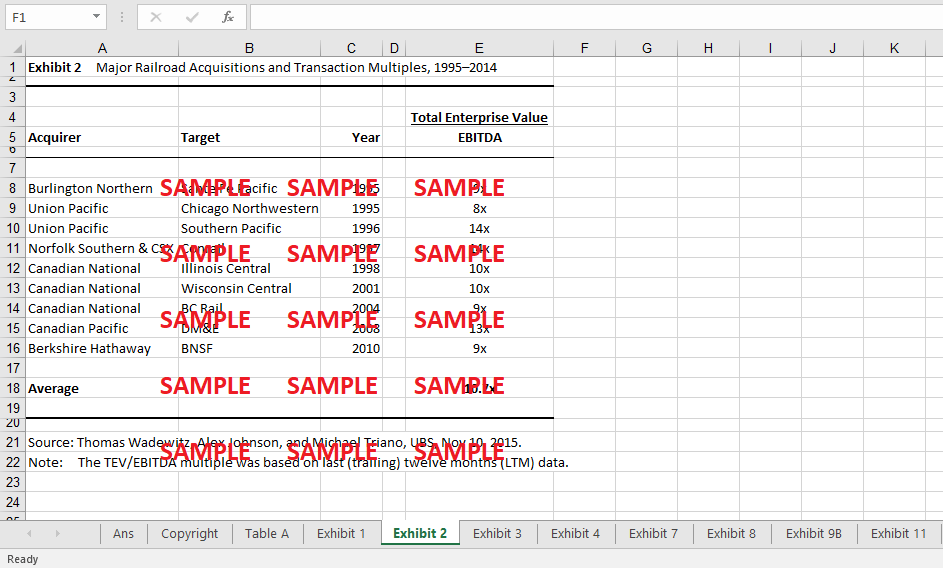

The capital expenditure and net working capital were deducted from after-tax EBITDA thereby calculating the cash flows to equity. Return on equity of 107% was used as the discount rate since it is a close proximation to the cost of equity of Norfolk Southern. The terminal value was determined using the exit EBITDA multiple f 107x which is the average of multiples of major railroad acquisitions and transaction multiples.

Discounting the cash flows, the total value of equity came out to be USD 24,943 Million. The total outstanding shares were determined by dividing the total net income for 2014 with the earnings per share in the same period. Per-share value comes out to be USD 81.7. The comparable approach was also used to determine the valuation of Norfolk Southern. The EBITDA multiple of 10.7 was multiplied by the EBITDA in 2014 which gave the enterprise value of USD 48 Million. The value of debt was deducted and cash was added to determine the value of equity.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Royal DSM From Continuous Transformation To Organic Growth Case Solution

- Arconic Inc Versus Elliott Management Corp A Battle For Control Case Solution

- Corkd Building A Social Network For Wine Lovers Case Solution

- Boulevard Sandwiches Inc B Case Solution

- Growing The Mamas And Papas Brand Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.