Get instant access to this case solution for only $19

Caterpillar Inc B Case Solution

Financial market fluctuations directly impact pension assets because pension assets are recorded at the fair value at the end of the year. Among many factors that affect the fair value of plan assets, return earned on the plan assets and the exchange rate profits/losses earned on the non U.S pension benefits have the most notable impact. Most of the plan assets are invested in the equity market by the company, and hence, as the market performs better, the fair value of plan assets increases correspondingly.

Following questions are answered in this case study solution

-

Calculate the D/E ratio (Exhibit 1) for 2007-2009.

-

What amount is reported on the balance sheet relating to the Caterpillar post-retirement benefit for 2007-2009? (Exhibit 1)

-

Assess Caterpillar’s pension asset allocation.

-

Calculate Caterpillar’s actual return rate on asset for U.S. pension benefits during 2007-2009 (Table on p. 6).

-

Comment on the impact of financial market fluctuation on pension assets.

-

If Caterpillar uses its actual return rate to calculate its net pension expense, what would happen?

-

If Caterpillar uses its actual return rate to calculate its PBO, what would happen?

Case Analysis for Caterpillar Inc B

1. Calculate the D/E ratio (Exhibit 1) for 2007-2009.

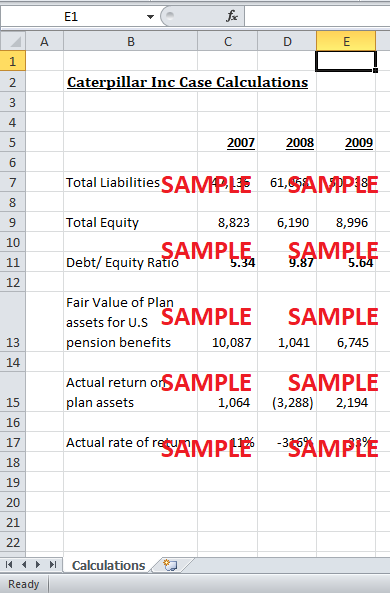

The Debt to Equity ratio can be calculated for years 2007-2009 by dividing the total liabilities with the total shareholders’ equity. The liabilities of the company for years 2007, 2008, and 2009 are given as $47,136 million, $61,068 million and $50,738 million respectively. The corresponding equity values for the company are given in the balance sheet as $8,823 million, $6,190 million and $8,996 million respectively. Thus, by dividing the debt by equity, D/E ratio for the three years comes out to be 5.34, 9.87 and 5.64 respectively.

2. What amount is reported on the balance sheet relating to the Caterpillar post-retirement benefit for 2007-2009? (Exhibit 1)

For years 2007 till 2009, liabilities related to post retirement benefits reported on the balance sheet are $5,059 million, $9,975 million and $7,420 million respectively.

3. Assess Caterpillar’s pension asset allocation.

The allocations of the pension assets of U.S, non U.S and other post-retirement benefits in equity are 70%, 55% and 80% respectively. On the other hand, the debt allocations of the pension assets are 25%, 35% and 20% respectively. Therefore, most of the assets are invested in the equity assets, which are risky compared to debt instruments and hence, high upside and downside potential. Therefore, with these asset allocations, the fair value of the assets is expected to show great fluctuations.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.