Get instant access to this case solution for only $19

CyberLab A New Business Opportunity For PRICO A Case Solution

CyberLab has developed a machine that has the capability of revolutionizing the lab robotics industry. The market for the product, however, is very tight with some stiff competition. In order to expand, the company has offered 30% of its equity stakes, along with marketing rights of the product, for a total of $1 million. The three elements of the deal (the equity stake, the marketing agreement, and the technology patent) need to be individually valued before PRICO can accept the deal. The decision will be based on whether or not the total of the values assigned to each element is greater than the investment, or not.

Following questions are answered in this case study solution

-

Abstract

-

Introduction

-

CyberLab Stake

-

Marketing Rights

-

The Patent

-

Conclusion

Case Analysis for CyberLab A New Business Opportunity For PRICO A

2. Introduction

As PRICO examines the offer put on the table by CyberLab for an equity investment, the company’s management has to determine whether or not the offer is worth investing in. CyberLab has offered a 30% stake in its company, along with marketing rights to its sole product, the CyberLab 800, for a sum of $1 million. From an evaluation standpoint, this deal consists of three different elements packaged into one. First is the 30% stake in CyberLab; second is the ability to buy CyberLab’s product at cost and sell it on premium through PRICO’s own, well established, promotion, sales and distribution network; third is the patent on the technology that CyberLab 800 comprises of.

For the offer to be profitable for PRICO, the sum of the valuation of the company (PRICO’s share i.e. 30%), the value of the marketing proposal, and the value of the patent for PRICO has to be more than $1 million.

3. CyberLab Stake

The value of CyberLab to PRICO will be the future expected net cash flows of CyberLab discounted at the cost of capital for the firm. These cash flows will have to be projected assuming that the deal, currently on the table, is executed, and CyberLab has received $1 million to fund its expansion, and not the current expectations. This is because PRICO will be concerned with the post-acquisition value, or CyberLab’s potential rather than the current value.

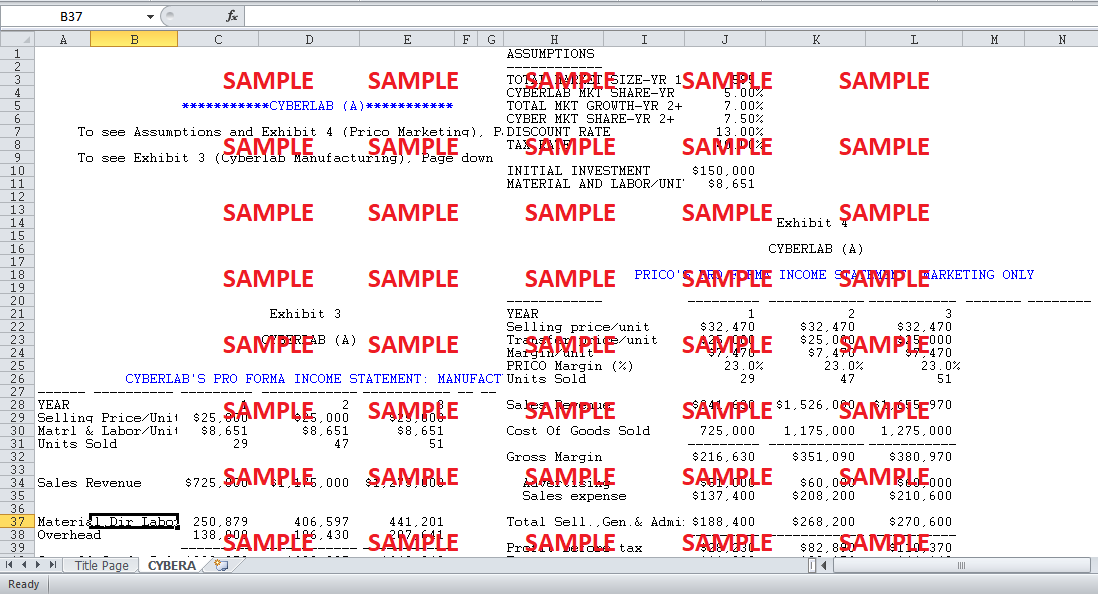

Now based on the facts of the case the market for a sample preparation machine was significant, with over 18,000 sites requiring the device presently. However, penetrating the market was not going to be easy considering the big names (such as Zymark, which held 42% of the market share, and Micromedic, which held 17% of the market share) that represented the competition. Furthermore, the lucrativeness of the market was also attracting many, huge, new entrants like Hewlett Packard. Therefore, even though CyberLab 800 was more efficient and less costly, CyberLab (being a small and relatively new company) was only expected to capture 5% of the market share initially. The growth in the overall market and the competition, also means that CyberLab’s share in the market would be growing to 7.5% only, by year three.

Each unit was to be transferred by CyberLab to PRICO at a pre agreed rate of $25,000. Based on the small scale production made earlier by CyberLab, the direct materials and labor cost to manufacture each unit would be $8,651. The overhead expenses are expected to be $138,000 in the first year, and then steadily increase (due to inflation and rising utility costs) to $196,430 in year two and $207,641 in year three. Similarly, general administration expenses are expected to be $258,044 in year one, and then rise (due to inflation and rising utility costs) to $343,047 in year two and $344,908 in year three. Depreciation of fixed assets will be deducted on a reducing balance basis with $16,000, $9,600, and $5,760 deducted in years one, two, and three respectively. Using the applicable tax rate of 40%, these figures result in a net profit after tax of $37,246 in the first year, $131,596 in year two, and $165,294 in year three.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.