Get instant access to this case solution for only $19

Chemalite Inc Case Solution

Bennett Alexander, a consultant chemical engineer, has launched a new company called Chemalite, Inc. Founded with an initial investment of about $1 per share, Chemalite, Inc. is privately held by Alexander and other stockholders. Alexander created and patented the glow-in-the-dark sticks, which are Chemalite, Inc.'s only offering. Despite the lack of market research to back up his claims, he was certain that the device would be commercially successful due to the wide variety of situations in which it might be used. This was the first issue for Chemalite, Inc. and the company's formation. Since no one involved in the founding of this firm have prior experience in business management or accounting, the company has been plagued with incompetence since its inception. Not only that but Chemalite, Inc. was launched without a comprehensive business plan outlining the company's future operations or assigning specific duties to each founding member.

Following questions are answered in this case study solution

-

Record the effects of Chemalite’s 1991 events on a Balance Sheet Equation (BSE) worksheet, filling in appropriate account headings at the top. When you have completed the event analysis, compute the ending balances for each account.

-

Several of the events you recorded in Question 1 required you to make one or more assumptions. Pick two such events and briefly (25 words or less for each) explain your rationale for the assumption(s) you made.

-

Prepare year-end financial statements for Chemalite, Inc. - Balance Sheet, Income Statement, and Statement of Retained Earnings.

-

Refer to the Cash account in column 1. Classify whether the transaction that affects cash is related to the firm’s operations, investments, or financing activities. Prepare a report that lists transactions in these three categories and the corresponding amount of cash inflow or outflow (this report is called the direct statement of cash flows). How much of the total cash change is related to operations? How much is related to financing? How much is related to investments?

-

Based on the information in 3) and 4), explain the apparent contradiction in Alexander’s mind on why Chemalite’s bank account fails to reflect his sense that the firm is “doing quite well”.

Case Analysis for Chemalite Inc

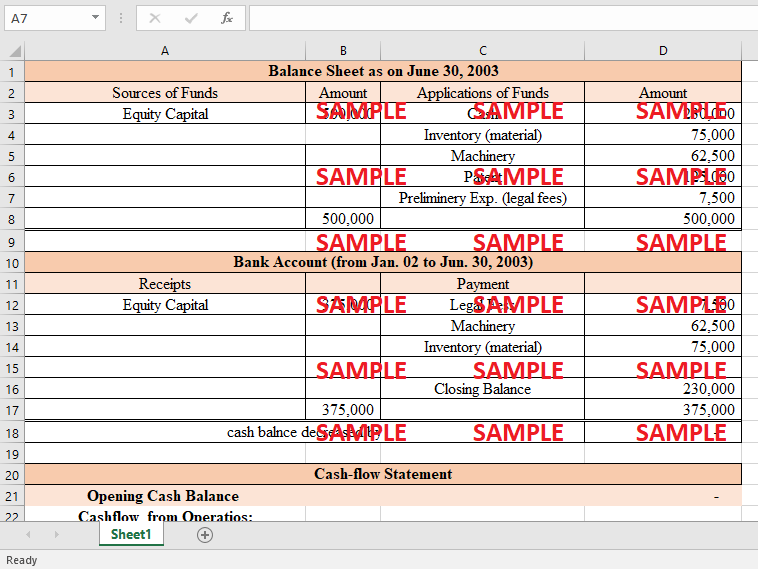

1. Record the effects of Chemalite's 1991 events on a Balance Sheet Equation (BSE) worksheet, filling in appropriate account headings at the top. After completing the event analysis, compute the ending balances for each account.

Cash Flow type (O, I, F)

|

Event |

Cash |

A/R |

Inventory |

Patent |

Cap. Exp. |

PPE |

|

Notes Pay |

Paid in Capital |

RE |

RE Explanation |

|

P1 |

375,000 |

|

|

125,000 |

|

|

|

|

500,000 |

|

|

|

P2 |

(7,500) |

|

|

|

7,500 |

|

|

|

|

|

|

|

P3 |

(62,500) |

|

|

|

|

62,500 |

|

|

|

|

|

|

P4 |

(75,000) |

|

75,000 |

|

|

|

|

|

|

|

|

|

|

230,000 |

- |

75,000 |

125,000 |

7,500 |

62,500 |

|

- |

500,000 |

- |

Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T1 |

(23,750) |

|

|

|

|

|

|

|

|

(23,750) |

R&D Expense |

|

T2 |

685,000 |

69,500 |

|

|

|

|

|

|

|

754,500 |

Revenue |

|

T3 |

(175,000) |

|

175,000 |

|

|

|

|

|

|

|

|

|

T4 |

(22,500) |

|

|

|

|

|

|

|

|

(22,500) |

Adv. Expense |

|

T5.1 |

(350,000) |

|

350,000 |

|

|

|

|

|

|

|

|

|

T5.2 |

(80,000) |

|

|

|

|

|

|

|

|

(80,000) |

Admin Expenses |

|

T6 |

(150,000) |

|

|

|

|

150,000 |

|

|

|

|

|

|

T7.1 |

50,000 |

|

|

|

|

|

|

50,000 |

|

|

|

|

T7.2 |

(50,750) |

|

|

|

|

|

|

(50,000) |

|

(750) |

Interest Expense |

|

O1 |

|

|

(545,000) |

|

|

|

|

|

|

(545,000) |

Inv. Adjustment |

|

O2 |

|

|

|

(25,000) |

|

|

|

|

|

(25,000) |

Amort. Expense |

|

O3 |

|

|

|

|

|

(10,625) |

|

|

|

(10,625) |

Depr. Expense |

|

O4 |

|

|

|

|

|

|

|

|

|

|

|

|

O5 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

113,000 |

69,500 |

55,000 |

100,000 |

7,500 |

201,875 |

|

- |

500,000 |

46,875 |

Balance Sheet |

2. Several events you recorded in Question 1 required you to make one or more assumptions. Pick two such events and briefly (25 words or less for each) explain your rationale for the assumption(s) you made.

Operating cash flow, which measures the amount of money made by a firm through its regular business activities, is a crucial indicator of the success of such activities. A company's ability to produce positive operating cash flow reveals whether it can sustain and develop its operations without seeking additional finance for capital growth. The criteria of operational cash flow justify treating the limited cash flows as operating cash flows. The term "operating cash flow" describes the monetary effect of an organization's core business operations' net income (NI). The cash flow statement begins with a presentation of operational cash flow, also known as cash flow from operating operations. Operating cash flows examine a company's cash inflows and expenditures because of its primary operations, such as selling and buying products, providing services, and paying personnel.

Free cash flow should reflect that cash flow is a measure of current expenditure rather than past transactions, which is why the metric was adjusted. As a result, free cash flow (FCF) is an effective method for identifying rapidly growing companies that must make costly initial expenditures that may cut earnings in the near term but pay off in the long run. After a company deducts operating expenses and capital expenditure maintenance charges, the remaining cash is known as free cash flow (FCF). Free cash flow is the remaining cash inflow after subtracting a company's operational expenses (OpEx) and capital expenditures (CapEx). If you take off all of your organization's operational expenditures (OPEX), what's left over is your free cash flow (FCF). Calculating and assessing free cash flow is crucial for a company's successful cash management. Investors who learn about a company's financial health via the FCF calculation may make better investment decisions based on that information.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.