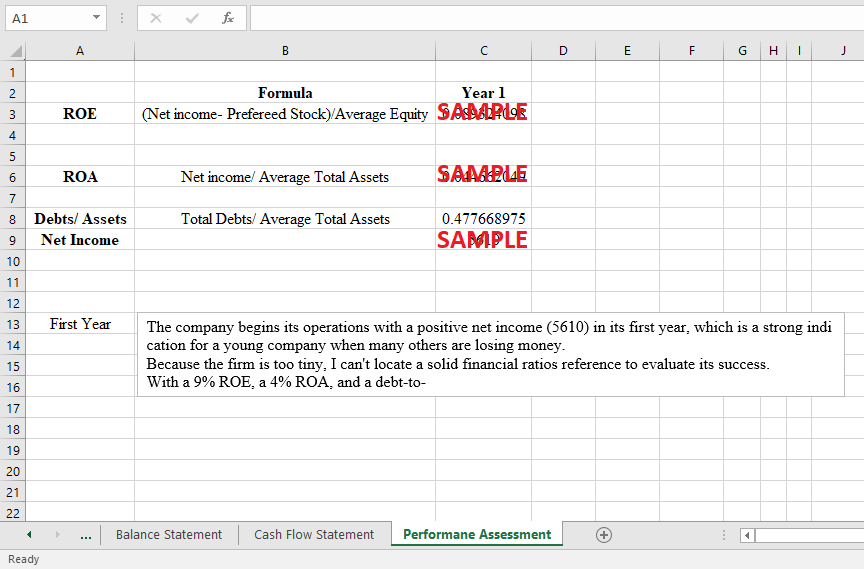

Get instant access to this case solution for only $19

The Garden Place Case Solution

This particular case study was carried out at Darden University, which is located in the United States. This case study might be used in the very first lecture of a course on financial accounting to expose students to the process of analyzing financial accounts and producing reports based on their findings. Newly settled in Lynchburg, Virginia, and Mary Jane Bowers plans to open a garden center for commercial sales. It is a description of her attempts to build a budget for the start-up period of her firm as well as the first full year that it would be in operation. This case study stands on its own, but it may also serve as the context for another paper, "The Garden Place-One Year Later," which delves into the financial effects of the events of the business's debut and first year of operation.

Following questions are answered in this case study solution

-

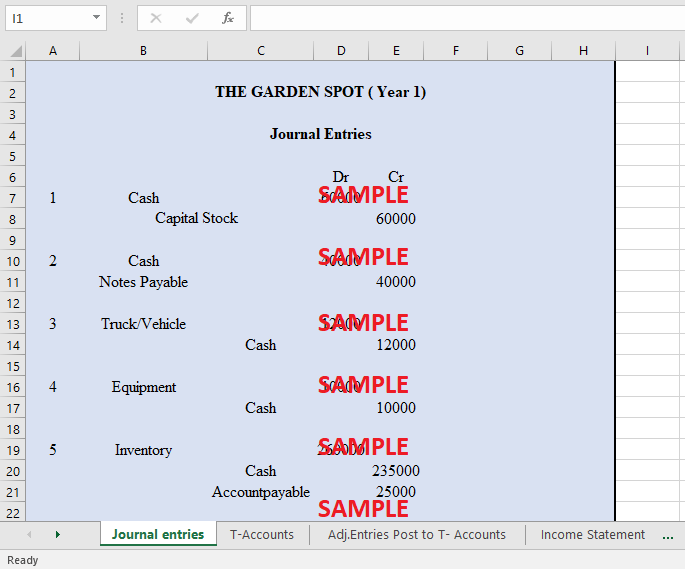

Prepare journal entries for items 1 through 13.

-

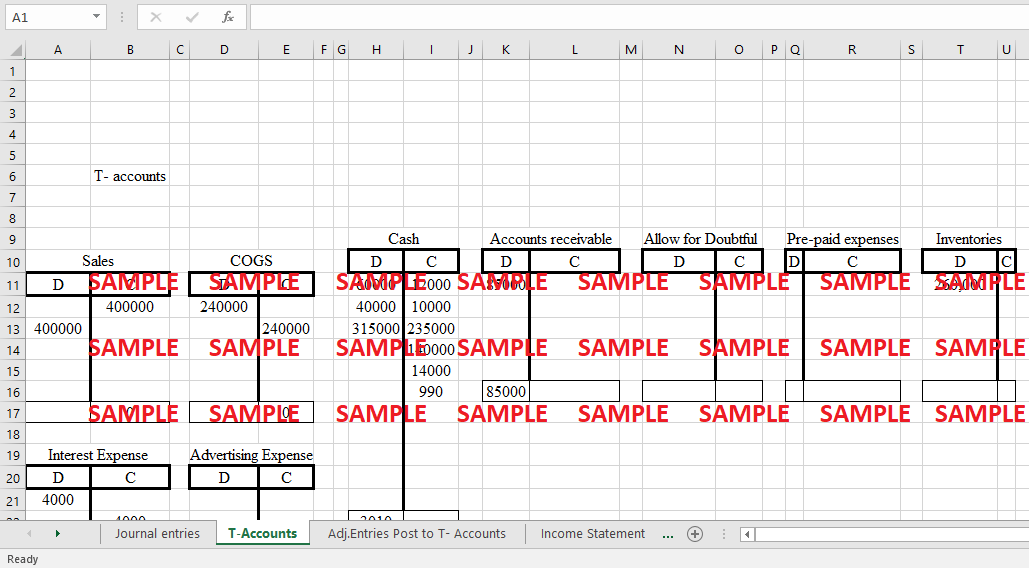

Post this information to T-accounts.

-

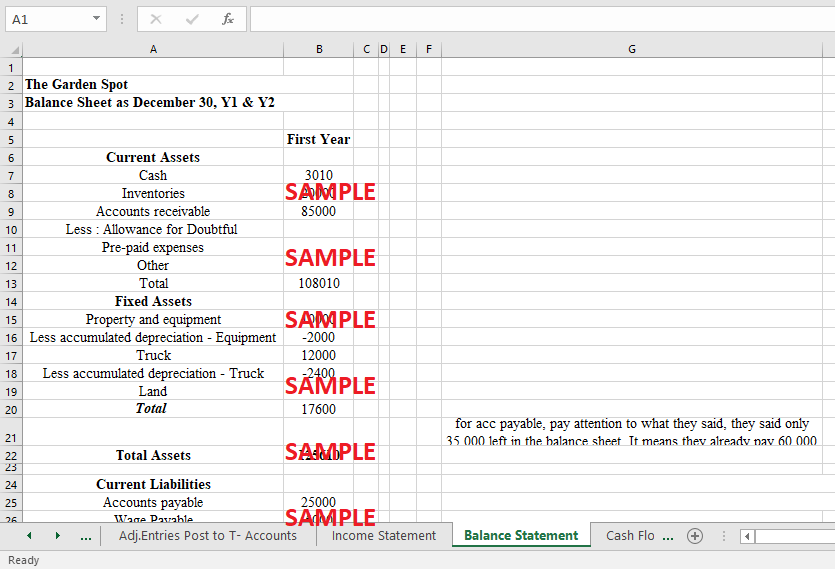

Prepare a projected balance sheet as of the end of the day on April 1, 2006.

-

Prepare a statement of projected cash receipts and disbursements for the year ending March 31, 2007.

-

Prepare a projected income statement for the year ending March 31, 2007, and a projected balance sheet as of March 31, 2007.

-

What additional information do you think you need to prepare this projected income statement and projected balance? Why do you need that information?

-

What will the annual breakeven point in sales dollars for the Garden Place be?

Case Analysis for The Garden Place

1. Prepare journal entries for items 1 through 13.

The journal entries are able to provide a record of not just monetary transactions but also of everything else that takes place over the course of a day. A company's debit and credit balances, along with the documentation of any other financial activity, should be recorded in an accounting journal that was developed specifically for the purpose of containing such information. This type of journal was developed in addition to the documentation of any other financial activity. The entry that is made in the journal could be comprised of more than one entry, and depending on the specifics of the situation, each of those entries might be either a credit or a debit. We argue that a journal entry is imbalanced when the total number of debits in that record is either more than or equal to the total number of credits in that record. Either of these two scenarios meets our definition of an unbalanced entry. Journal entries are one approach that may be used to keep track of recurring expenses like depreciation and bond amortization, for example. Another option is to use a spreadsheet to record the information.

|

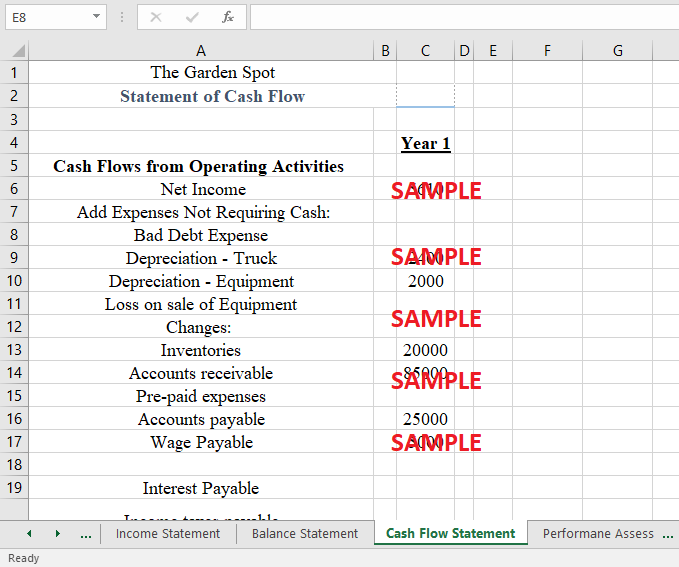

THE GARDEN SPOT ( Year 1) |

|

|

||||||

|

|

|

|||||||

|

|

|

|||||||

|

Journal Entries |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dr |

Cr |

|

|

|

|

|

1 |

Cash |

|

60000 |

|

|

|

|

|

|

|

Capital Stock |

|

60000 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

2 |

Cash |

|

40000 |

|

|

|

|

|

|

|

Notes Payable |

|

|

40000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Truck/Vehicle |

|

12000 |

|

|

|

|

|

|

|

|

Cash |

|

12000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Equipment |

|

10000 |

|

|

|

|

|

|

|

|

Cash |

|

10000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Inventory |

|

260000 |

|

|

|

|

|

|

|

|

Cash |

|

235000 |

|

|

|

|

|

|

|

Accounts payable |

|

25000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Cash |

|

315000 |

|

|

|

|

|

|

|

A/R |

|

85000 |

|

|

|

|

|

|

|

Sales Revenue |

|

|

400000 |

|

|

|

|

|

|

COGS |

|

240000 |

|

|

|

|

|

|

|

|

Inventory |

|

240000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Operating expenses |

|

140000 |

|

|

|

|

|

|

|

|

Cash |

|

140000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Interest expense |

|

4000 |

|

|

|

|

|

|

|

Notes Payable |

|

10000 |

|

|

|

|

|

|

|

|

Cash |

|

14000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31-Dec |

Tax Expense |

|

990 |

|

|

|

|

|

|

|

|

Cash |

|

990 |

|

|

|

|

|

31-Dec |

Wages Exp |

|

5000 |

|

|

|

|

|

|

|

|

Wages Payable |

|

5000 |

|

|

||

2. Post this information to T-accounts.

Informally, the process of keeping an accurate record of monetary transactions is referred to as "T-accounts," which is shorthand for the double-entry accounting system. T-accounts are maintained using the double-entry accounting system. This remark refers to the standard for the way in which the books are physically bound together as well as the way in which they are kept together in a collection. The first letter of the word is a "t" with the lowercase "t," and it is a capital letter. The account numbers should always be placed in the top left corner, the account names should be placed in the top right corner, and the debits and credits should be written in the bottom left and right corners, respectively, with a vertical line that forms the letter T separating them from one another. Every monetary transaction, in accordance with the concept of double-entry accounting, has an impact not only on one account but on two accounts. When a transaction is finished, money will be moved from one account to another.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.