Get instant access to this case solution for only $19

Saito Solar Discounted Cash Flow Valuation Case Solution

The case makes a note of Saito Solar, a homegrown Japanese solar Photovoltaic Cell manufacturing company that is run by Mr. Saito and his two sleeping partners – Mr. Yoshida and Mr. Suzuki. The company was founded with the mission to introduce a cost-effective alternative energy solution for the commercial and residential market in Japan. They had been successful in introducing and marketing their products to a niche, small market and had successfully navigated the financial crisis to be presented with future growth opportunities on the back of rising fossil fuel costs and better solar tariffs. The company has now been approached by a boutique investment firm that is looking to acquire Saito Solar, for which they have opened up the conversation for the potential valuation of the company. For this, the partners were forced to band together and come up with a logical figure for the valuation of Saito Solar in view of its growth potential and future market prospects.

Following questions are answered in this case study solution

-

Using the discounted cash flow approach, why are projected free cash flows, rather than profits, used in estimating the value of the firm?

-

What is the role of WACC in valuation?

-

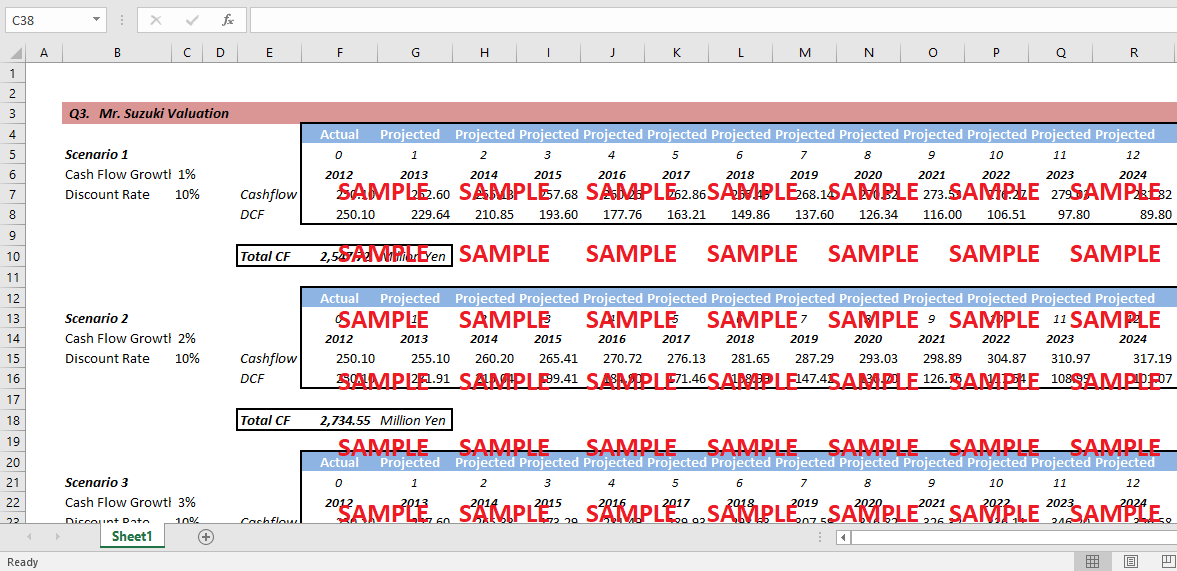

Based on Mr. Suzuki’s estimate of 1-3% growth rate of Saito Solar’s free cash flows over the next 20 years, how much would Saito Solar be valued at? The owners’ required rate of return was 10%.

-

How do you estimate firm value when free cash flows of the firm are uneven for the first few years but stay constant after?

-

Based on the free cash flow forecast provided in Appendix 3 of the case, and assume a range of 9-11% WACC and 1-3% terminal value growth rate, what is the range of values for Saito Solar?

-

Strategically, do you think Mr. Saito and his partners should sell the firm at this time? Why? Conclude.

Case Analysis for Saito Solar Discounted Cash Flow Valuation

1. Using the discounted cash flow approach, why are projected free cash flows, rather than profits, used in estimating the value of the firm?

On a holistic level, some might believe that free cash flows can be used interchangeably with accounting profits and hence be utilized to value a firm; however, that is not the case. Profits refer to accounting profits that are shaped by practices of following internationally approved standards of financial reporting. Profits are, therefore, a function of the accounting rules applied by a firm to ascertain and quantify its operational matters in financial terms. They are derived from subtracting the Cost of Goods Sold, expenses including overheads such as labor and variance in materials, and other items such as non-cash charges (depreciation/amortization), interest and taxes. Cash flows, on the other hand, are a direct subset of the actual cash-generating ability of the business. This implies that though a firm might adjust its profits in any way to showcase a profit of its choice (recognize revenues differently, change practice for adjusting depreciation etc.), there is truly only one way for it to calculate the cash flows that it generates for a particular year. This involves concepts of matching costs and revenues, causing a smoothening of profits over the years. Moreover, earnings also include non-cash transactions such as depreciation. Therefore, cash flows are a more reliable way to ascertain the financial prowess and potential of a firm and this is realized by the fact that cash flows allow for the concept of the time value of money to be applied much more coherently. Since cash flows are not liable to be changed by calculations, they can be projected much more easily – that is, they are not subject to changes in accounting practices and can be discounted more readily at known rates, allowing companies to arrive at quantifiable answers for the value of a firm by focusing on incremental cashflows for subsequent years.

2. What is the role of WACC in valuation?

WACC refers to the Weighted Average Cost of Capital for the firm, which is essentially the cost incurred at raising the firm's capital. The need for a weighted average arises as a firm's capital is composed of two segments, which include debt and equity. Both creditors and equity investors ask for a return on their investment, which is basically the cost for the firm at which it has obtained this financial capital, which it must repay to capital providers. The cost of equity is associated with the required rate of return associated with equity holders, whilst the cost of debt is associated with the interest rates liable to be paid to the creditors of the firm. In that sense, WACC serves multiple purposes when used in investment analysis, mainly as the discount rate at which future cash flows are discounted to ascertain the possible undertaking of financial investment. In order to satisfy the requirements of the stakeholders in terms of financial capital providers, all proceeding cash flows must be discounted at the WACC as it is the true opportunity cost that the firm would incur and hence, is the basis of DCF valuation. As WACC is the minimum return that must be derived to satisfy investors, any rate achieved WACC is thought to be a sufficient enough rate as it meets the minimum required rate of return. Therefore, WACC serves as the opportunity cost against which a possible new investment is judged, particularly in terms of discounting as well as in capital budgeting decisions that look at Internal Rates of Return, which are gauged against hurdle rates which are essentially WACC. WACC is the underlying return expected by all shareholders of the firm and is, therefore, the adequate measure for the opportunity cost against which any other project or its valuation is measured.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.