Get instant access to this case solution for only $19

Chemalite, Inc. (B) Cash Flow Analysis Case Solution

Chemalite, Inc. was founded by Mr. Bennett Alexander in 1990. The company produced and sold Alexander’s invention, the Chemalite. After the first year of successful operations, the company shareholders supported the expansion of the production facility. Hence, the shareholders decided to meet in March 1992 to review the company’s performance and analyze the projected financial statements for the year. In order to prepare for the meeting, Alexander required the proforma cash flow statements to determine the cash flow over the year. The forecasted financial statements for 1992 revealed that despite the 400% increase in net profit, there is a significant cash outflow. This outflow could be attributed to high capital investment.

Following questions are answered in this case study solution:

-

Prepare a proforma statement of cash flows for 1992 using the indirect method.

-

Prepare a proforma statement of cash flows for 1992 using the direct method.

-

What are the main sources and uses of cash revealed by your analysis?

-

What would you recommend to Bennett Alexander?

Chemalite Inc B Cash Flow Analysis Case Analysis

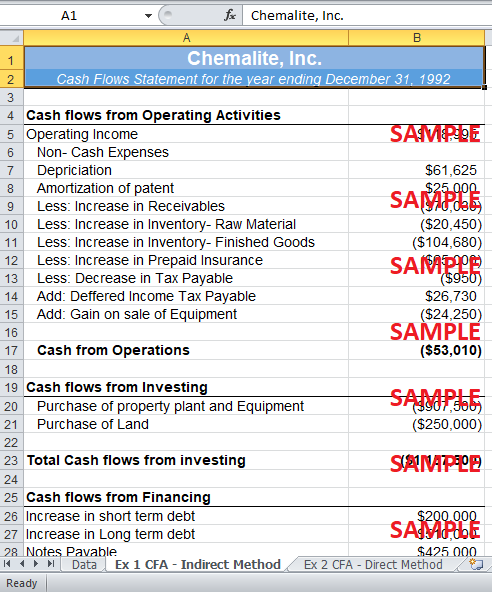

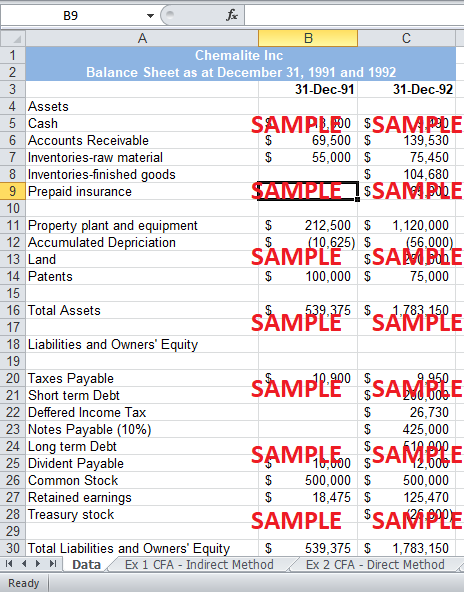

1. Prepare a proforma statement of cash flows for 1992 using the indirect method.

Exhibit 1 shows the proforma cash flow statement for 1992 using the indirect method. In this statement, the operating income from the income is used to deduce the cash from operations. The non-cash income like gains on disposal was subtracted from the operating income while the non-cash expenses like depreciation expense were added to it. Similarly, the increase or decrease in accounts receivable, inventory, taxes payable and prepaid insurance were adjusted to derive the actual cash from operations. The cash outflow from operations is $53,010.

The cash flow from investing activities was determined by changes in the historical values of the fixed assets in the balance sheet. Exhibit 1 shows that two major cash outflows by the purchase of $250,000 worth of land and $907,500 worth of property plant and equipment. The cash outflow from investing activities is $1,157,500.

For the cash flow from financing activity, there are five main activities; the increase in the short term and long term loans, the increase in notes payable, the decrease in treasury stock and dividend payments. Hence, the cash inflow from financing activities was $1,107,000.

The overall change in cash in 1992 is the outflow of $103,510.

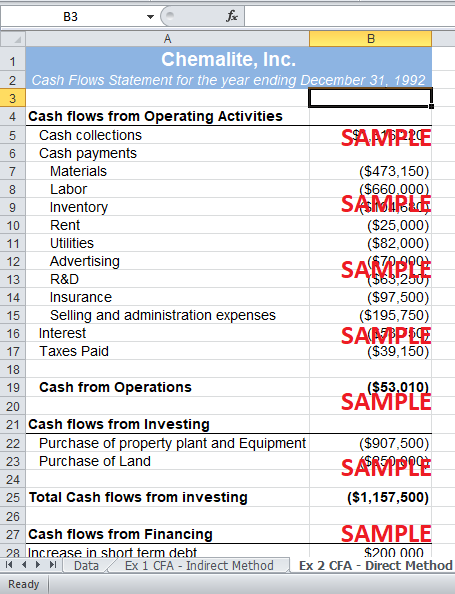

2. Prepare a proforma statement of cash flows for 1992 using the direct method.

Exhibit 2 shows that the cash flow statement where direct method is used. In the direct method, the cash collections are calculated using the accounts receivables and sales. The payments for material, labor, Inventory, rent, utilities, advertising, research and development, insurance, selling and administrative expenses are also calculated using the income statement and balance sheet. The cash outflow from operations turns out to be $53,010. The cash flow from investing and financing activities is the same as in indirect method.

3. What are the main sources and uses of cash revealed by your analysis?

The main source of cash for Chemalite Inc. was the short term and long term loans totaling up to $710,000. Furthermore, the notes payable also increased by $425,000. Hence, the firm is highly leveraged. Similarly, the main uses of cash are the investment in land and property, plant and equipment from $1,157,500.

It is important to note that the proforma income statement of 1992 shows a high income, but the cash flow statement depicts low cash in hand. This can lead to drastic problems for the firm in the future. Furthermore, it is obvious from the cash flow statement that the firm is using its short term loans to buy long term assets. The short term debt of $200,000 was used to buy Land. Another debt in the form of Notes payable of $425,000 at 10% interest was acquired to buy the production facility. These debts might lead to liquidity problems for the firm. The firm has a high cash outflow from operations, but it has decided to pay dividends of $12000 for 1992. Hence, the firm might not have enough cash to pay this dividend or meet the other day to day expenses.

There are several reasons for the low cash at hand. One reason is that as the inventory is so high a lot of cash is tied up in it. Another reason is that Chemalite Inc does not buy the material on credit. This can be assumed from the absence of accounts payable from the balance sheet. Similarly, all the other expenses are also on cash.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.