Get instant access to this case solution for only $19

Cost of Capital at Ameritrade Case Solution

Ameritrade is a discount brokerage company that is looking to implement a new advertising program and introduce technological upgrades. The company needs to decide if the project will generate sufficient return to cover the cost of capital. For this purpose, they need to calculate the appropriate cost of capital for the project. The executives realize that the CAPM is an appropriate approach to derive the cost of capital, but they are unsure about the inputs required by the model: riskfree rate, market risk premium and asset beta. This essay highlights the relevant considerations in choosing these inputs, and calculates the cost of capital relevant to the project. In particular, there is considerable uncertainty surrounding the appropriate asset beta because the company was not publicly traded until recently. We use the data about the appropriate comparable companies to estimate the asset beta for Ameritrade.

Following questions are answered in this case study solution:

-

What factors should Ameritrade management consider when evaluating the proposed advertising program and technology upgrades?

-

How can the Capital Asset Pricing Model be used to estimate the cost of capital for a real (not financial) investment decision?

-

What is the estimate of the risk-free rate that should be employed in calculating the cost of capital for Ameritrade?

-

What is the estimate of the market risk premium that should be employed in calculating the cost of capital at Ameritrade?

-

In principle, what are the steps for computing the asset beta in the CAPM for the purposes of calculating the cost of capital for a project?

-

Ameritrade does not have a beta estimate because the firm has been publicly traded for only a short time period. Exhibit 4 provides various choices of comparable firms. What comparable firms do you recommend as the appropriate benchmarks for evaluating the risk of Ameritrade’s planned advertising and technology investments?

-

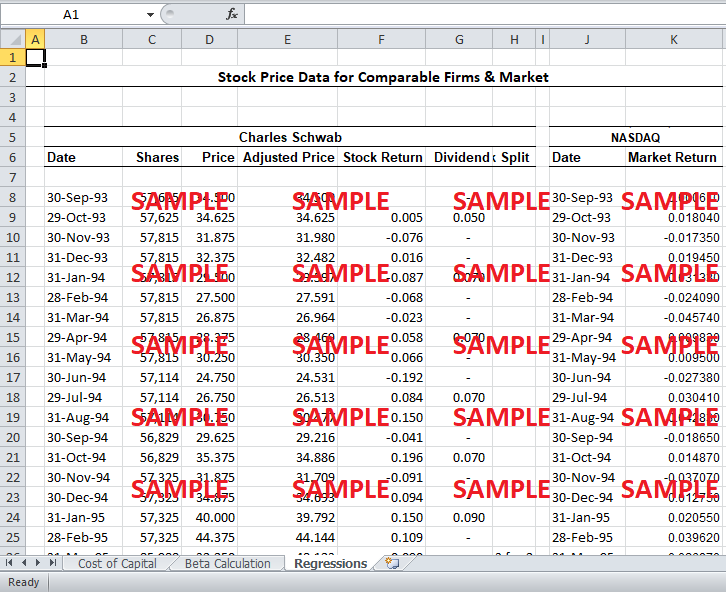

Using the stock price and returns data in Exhibits 4 and 5, and the capital structure information in Exhibit 3, calculate the asset betas for the comparable firms.

-

How should Joe Ricketts, the CEO of Ameritrade, view the cost of capital you have calculated?

Cost of Capital at Ameritrade Case Analysis

1. What factors should Ameritrade management consider when evaluating the proposed advertising program and technology upgrades?

The cost of capital is perhaps the most pertinent factor to consider when deciding on the new technology upgrades and the advertising program. It is vital that the company discounts the projected cash flows at the appropriate discount rate – a rate that accurately reflects the risk reflected in the project. The discount rate is required to derive the net present value of the cash flows, which include the initial cash outlays, cash from operating activities, salvage values and net working capital. Therefore, the relevant cash flows constitute another important consideration in addition to the discount rate. It is imperative that the company accurately forecasts the projected cash flows without any prejudice. The company should also consider any additional benefits or costs that might result from the new project. For instance, the new technology might improve the quality of the service provided by the company, allowing it to attract more customers or charge higher price. Similarly, the improvements might allow the company to eliminate some manual activities and save expense related to workforce. Any incremental effects such as these should be taken into consideration when evaluating the proposed scheme.

2. How can the Capital Asset Pricing Model be used to estimate the cost of capital for a real (not financial) investment decision?

The intuition behind CAPM is that the return on a stock is determined by systematic (or market) risk – composed of the risk free rate plus an additional market risk premium. The risk-free rate is the return that investor can obtain without taking any risk. The idea behind the additional market risk premium is to compensate investor for the additional risk that is inherent in the overall market – market risk. The market is composed of all types of assets including equities, bonds, commodities, and currencies. Therefore, the CAPM can be used to estimate not only the return demanded on a financial asset (such as a particular stock), but also the return demanded on any asset that is part of the market. The providers of capital for a real investment decision are usually stockholders and creditors in the company. Therefore, the return derived from the investment must satisfy the return demanded by these providers of capital. The CAPM is a popular and potent model to estimate the returns demanded by the providers of capital. The weighted average of these returns is the minimum return that a real investment of the company should generate and hence the cost of capital for the investment.

3. What is the estimate of the risk-free rate that should be employed in calculating the cost of capital for Ameritrade?

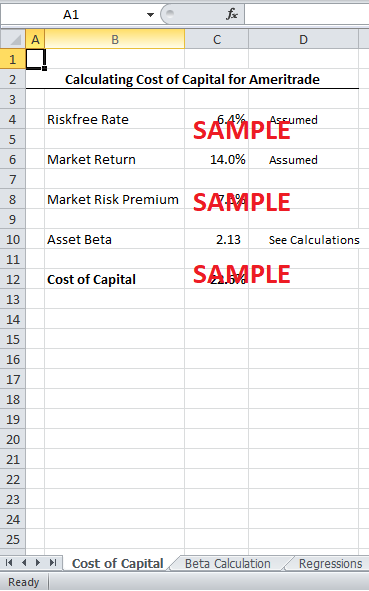

There is no agreed-upon measure of riskfree rate that investors could use. In fact, the available riskfree interest rate could be argued to change with changes in business cycles and economic policies. In the US, the rate offered by US Treasury securities is often deemed to be riskfree because of the negligible default risk. However, there is a great deal of disagreement regarding the maturity of the treasury security that should be used as a proxy for riskfree rate. For instance, the short T-bill offers a yield of 5.2%, while the long-term treasury bonds offer a yield of 6%. There is no full consensus of which proxy for riskfree rate should be used. Nevertheless, it is generally believed that the maturity of the riskfree rate proxy should match the purpose for which the rate is utilized. In our case, the riskfree rate is needed to evaluate an investment in new technology. In general, technologies tend to become outdated rather quickly. Therefore, it might be reasonable to assume that five years will be an appropriate time horizon for the project. Therefore, the yield of 6.4% on the intermediate term bonds (five-year maturity) should serve as an appropriate substitute for the riskfree rate.

4. What is the estimate of the market risk premium that should be employed in calculating the cost of capital at Ameritrade?

Technically, market constitutes all types of assets that are in existence include equity, bonds, commodities, and physical assets. However, it is a herculean task to measure the return on all types of assets. Therefore, the return on equities is usually taken as proxy for the return on market. Yet, it is hard to measure the return on all stocks that exist. Thereby, the return on a large stock index serves as an appropriate substitute. The proxy is usually a national stock index such as the S&P500 for US companies. A global stock index is not used because it is believed that the global stock markets are not very well integrated and their returns are not consistent with each other. The market risk premium only estimates the premium for the excess risk taken by market participants. Investors can earn a certain degree of return – the riskfree rate – without taking any risk. Therefore, the riskfree rate should be subtracted from the market return to calculate the market risk premium – the extra return that investors earn by taking risk. We already have an estimate of the riskfree rate that can be used for Ameritrade. Therefore, the market risk premium can be estimated by estimating the appropriate market return. In contrast to the Treasury bond market, where the yields provide an estimate of the future returns on the security, there is no consensus estimate on the future expected return on the stock market. Therefore, historical averages of stock returns are typically used to estimate the future expected return on the market.

The case provides different categories of expected returns on the market. The stock returns are divided into return on small and large stocks. Moreover, the historical average span over two different time-periods: 1950-1996 and 1929-1996. It can be argued that large companies’ stocks provide a better estimate of the market return than small companies’ stocks. This argument is supported by the fact that S&P500, which is often used as a proxy for market return, is comprised of the 500 largest companies in the United States. Therefore, we use the average return on large stocks as a proxy for market return. Concerning the appropriate time-horizon, the period from 1950-1996 is considered more appropriate because it signifies more recent performance of the stock market. Moreover, the average stock market return from 1929-1996 is negatively influenced by unstable returns during the volatile periods of the Great Depression and World War 2, which might not be likely to recur in the near future.

In summary, the average return on large companies’ stock during the period from 1950 to 1996 is considered an appropriate proxy for market return. The return is commensurate to 14.0%. The previously calculated riskfree rate of 6.4% is deducted from this market return to obtain a market risk premium of 7.6%.

5. In principle, what are the steps for computing the asset beta in the CAPM for the purposes of calculating the cost of capital for a project?

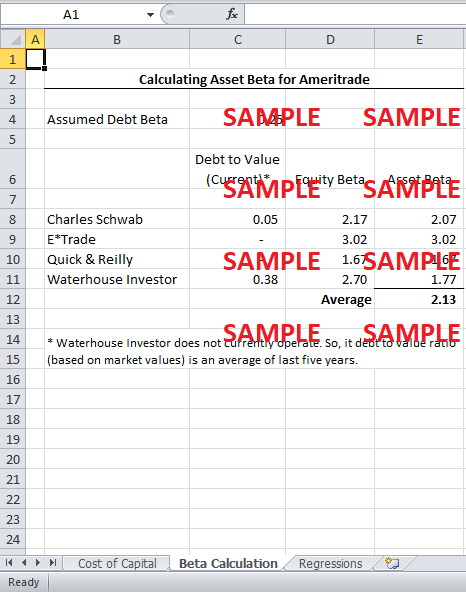

The cost of capital for the company can be visualized as the weighted average of the cost of debt and equity – commonly known as WACC. The weights for calculating this average are calculated using the most recent market values of debt and equity. The calculation of WACC makes intuitive sense if we realize that the asset beta of a company is the weighted average of the individual betas of debt and equity. Besides the riskfree rate and the market risk premium, the beta – sensitivity of factor return to market return – is an integral component of CAPM. It is a common practice to assume that debt has no relationship to market risk – that is the beta of debt is zero. However, this practice is equivalent to the supposition that the cost of debt is equal to the riskfree rate. We know from practice that the cost of debt (interest rate) for a corporation is likely to be higher than the riskfree rate. The implication is that debt taken by a corporation has some inherent risk. Therefore, it might not be prudent to assume a zero beta for debt. Some empirical studies of corporate debt returns suggest it would be better to assign a positive beta to debt. The estimates for this beta range from 0.20 to 0.30. Therefore, we have assumed a debt beta of 0.25 for Ameritrade.

The equity beta is usually obtained by running a time-series regression of a company’s equity returns with the returns on stock market. The company’s equity beta is the slope coefficient on the resulting regression line. However, the stock of Ameritrade was not publicly traded until their recent IPO. Therefore, there is not enough data available to run its regression with the stock market. Instead, we can obtain its beta by observing comparable firms’ betas, and then estimate the equity beta for Ameritrade using the pure play approach. The comparable firms are selected on the basis of their operational similarity with Ameritrade. The equity betas for these firms are unlevered using their respective leverage ratios. The average of their unlevered betas is then relevered using Ameritrade leverage ratios. The resulting beta is as estimate of the equity beta for Ameritrade. This technique will be employed in the next section.

6. Ameritrade does not have a beta estimate because the firm has been publicly traded for only a short time period. Exhibit 4 provides various choices of comparable firms. What comparable firms do you recommend as the appropriate benchmarks for evaluating the risk of Ameritrade’s planned advertising and technology investments?

The project is investing in implementing new technology that will enable it to carry trades over the internet. This had some analysts to compare to other internet companies. However, this investment in technology is intended to bolster the company’s position in the deep-discount brokerage market. The company is still expected to generate its revenue from the brokerage market. Ameritrade derives approximately 90% of its revenues from brokerage business.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Country Risk Analysis and Managing Crises Tower Associates Case Solution

- Country Risk Analysis and Managing Crises Tower Associates Case Solution

- Creating a Process-oriented enterprise at Pinnacle West Case Solution

- Creating a Process-oriented enterprise at Pinnacle West Case Solution

- Creative Chips (Abridged) Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.