Get instant access to this case solution for only $19

Creative Chips (Abridged) Case Solution

The CC Company has ordered the raw material on 20th December 2003, which means they have incurred the purchases but haven’t yet paid for it. Thus account payable was credited for the purchase order of raw materials.

Following questions are answered in this case study solution:

-

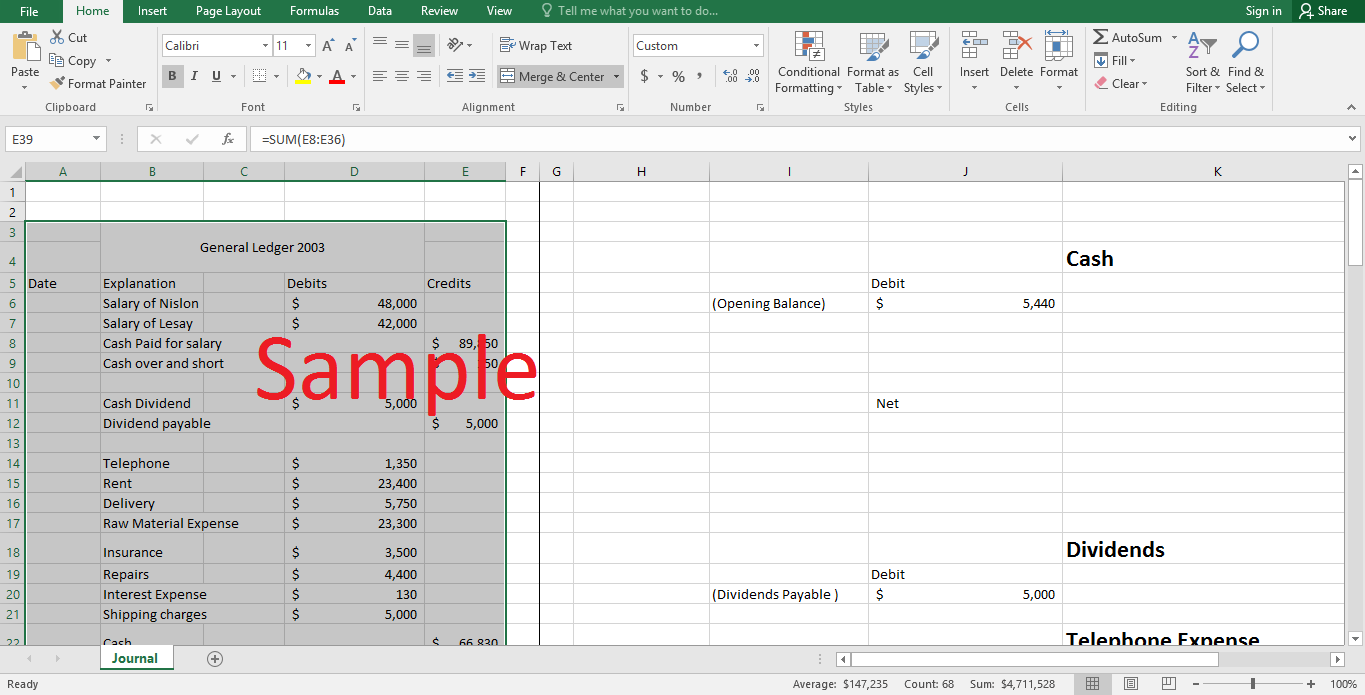

T Accounts for all the transactions of the Fiscal Year 2003

Creative Chips Abridged Case Analysis

1. T Accounts for all the transactions of the Fiscal Year 2003

|

|

|

Cash |

|

|

|

|

Debit |

|

Credit |

|

|

(Opening Balance) |

$ 5,440 |

|

$ 89,850 |

(Salary Expense) |

|

|

|

|

$ 66,830 |

(Operational Expenses) |

|

|

|

|

$ 100,000 |

Insurance |

|

|

Net |

|

$ 251,240 |

|

Explanation

The closing Balance of the year 2002 was the opening balance of the year 2003, which was $5440. Whereas During the 2003 the CC company paid the salary expenses, Operational Expenses and the Insurance Expenses. As these expenses were paid in cash, the overall cash asset of the CC Company reduced. The company has also shipped 5000 units during the year, thus the revenue from the sales would result in either the increase in cash or the accounts receivable. But Lesay do not want Graham to organize the record of the sales.

|

|

|

Dividends |

|

|

|

Debit |

|

Credit |

|

(Dividends Payable) |

$ 5,000 |

|

Explanation

As lesay is the only stock holder of CC Company so she declared the cash dividend for herself. This declaration of cash dividends was resulted in Dividends Payable. As after the declaration of the dividends the company is bound to pay the dividends, but before it is not.

|

|

|

Telephone Expense |

|

|

|

Debit |

|

Credit |

|

(Cash) |

$ 1,350 |

|

|

|

|

|

Rent Expense |

|

|

|

Debit |

|

Credit |

|

(Cash) |

$ 23,400 |

|

|

|

|

|

Delivery Expense |

|

|

|

Debit |

|

Credit |

|

(Cash) |

$ 5,750 |

|

|

|

|

|

Raw Material Expense |

|

|

|

Debit |

|

Credit |

|

(Cash) |

$ 23,300 |

|

|

|

|

|

Insurance Expense |

|

|

|

Debit |

|

Credit |

|

(Cash) |

$ 3,500 |

|

|

|

|

|

Interest Expense |

|

|

|

Debit |

|

Credit |

|

(Cash) |

$ 130 |

|

|

|

|

Shipping Expense |

|

|

|

Debit |

|

Credit |

|

(Cash) |

$5,000 |

|

Explanation

The operational Expenses for the CC Company include Telephone, Rent, Delivery, Raw material, Insurance, Repair, Interest and the shipping Expense. There Expenses are incurred in order to make the sales and these expenses were paid in fiscal year 2003 in cash.

|

|

|

Insurance |

|

|

|

Debit |

|

Credit |

|

(Cash) |

$ 1,000,000 |

|

Explanation

The CC Company Purchase the insurance for the customers in case of having any damage to the shipped items (Chips). This purchase of the insurance was on cash, thus it reduced the overall cash asset of CC Company.

|

|

|

Raw Material |

|

|

|

|

Debit |

|

Credit |

|

|

(Accounts Payable) |

$ 1,250 |

|

$525 |

(Finished Goods) |

|

|

|

|

$ 50 |

(Partial Completed Goods) |

|

Net |

$ 675 |

|

|

|

Explanation

As CC Company has the work of making the chips so the inventory it has comprises of three types of the goods, the raw material, work in progress and the finished goods. The company made the purchases of the raw material during the fiscal year of 2003 and also uses some of the raw material to produce the final goods.

|

|

|

Office Photocopy |

|

|

|

||

|

|

Debit |

|

Credit |

|

|

|

|

|

(Opening) |

$ 1,700 |

|

$ 300 |

Amortization Expense Photocopy |

|||

|

|

|

|

|

|

|

|

|

|

Net |

$ 1,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization Expense Photocopy |

|||||||||||

| Debit | Credit | |||||||||||

| (Photocopy) | $ 300 | |||||||||||

|

|

Production Machine |

||||||||

|

|

Debit |

|

Credit |

|

|

|

|||

|

(Opening) |

$ 6,000 |

|

$ 300 |

Amortization Expense Production machine |

|||||

|

|

|

|

|

|

|

|

|||

|

Net |

$ 5,700 |

|

|

|

|

|

|||

|

|

|

Amortization Expense Production machine |

|||||||

|

|

Debit |

|

Credit |

|

|

||||

|

(Production Machine) |

$4,000 |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patent |

|

|

|

|

|

Debit |

|

Credit |

|

|

|

(Opening) |

$ 1,600 |

|

$ 200 |

(Amortization Expense) |

|

|

|

|

|

|

|

|

|

Net |

$ 1,400 |

|

|

|

|

|

|

|

Amortization Expense Patent |

|||

|

|

Debit |

|

Credit |

|

|

|

(Patents) |

$ 200 |

|

|||

Explanation

The Company has the assets in the form of Cash, Patents, Photocopy machine and the production machine. These assets depreciate over the period of time expect the cash. As the company management has chosen the straight line method for the depreciation so the same amount of the assets is depreciated every year.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.