Get instant access to this case solution for only $19

Dakota Office Products Case Solution

Dakota Office Products (DOP) Company was a distributor of office supplies to different businesses. It had a comprehensive product line. Its products ranged from simple writing material to high speed copier. It had gained a good reputation in the market due to its customer service and responsiveness. In 2000, it realized that, despite the increase in orders, it is incurring a loss. The pricing policy at the time was to charge 15% markup over the purchased product cost. The following analysis shows that the costing and pricing system is incorrect. Activity based costing should be used for better analysis and pricing decision. Six activities have been identified with relevant cost drivers. This costing method facilitates in comparing customers. Furthermore, recommendations are made to discontinue desktop deliveries and manual ordering. Furthermore, it should encourage customers to order in bulk so as to reduce the cost of ordering.

Following questions are answered in this case study solution

-

Why was Dakota’s existing pricing system inadequate for its current operating environment?

-

Develop an activity-based cost system for Dakota Office Products (DOP) based on Year 2000 data. Calculate the activity cost-driver for each DOP activity in 2000.

-

Using your answer to Question 2, calculate the profitability of Customer A and Customer B.

-

What explains any difference in profitability between the two customers?

-

What are the limitations, if any, to the estimates of the profitability of the two customers?

-

Is there any additional information you would like to have to explain the relative profitability of the two customers?

-

Assume that DOP applies the analysis done in Question 3 to its entire customer base. How could such information help the DOP managers increase company profits?

-

Suppose that a major customer switched from placing all its orders manually to placing all its orders over the internet site. How should this affect the activity cost driver rates calculated in Question 2? How would the switch affect DOP’s profitability?

Case Analysis for Dakota Office Products

1. Why was Dakota’s existing pricing system inadequate for its current operating environment?

Dakota Office Products (DOP) earned its revenue by charging its customer a markup of 15% over the product cost. This 15% mark-up was expected to earn profits after covering the storage, distribution and other general and selling expenses. The current pricing system was inadequate because DOP only earned profit when the clients placed large orders. Similarly, they faced a drop in profit when many customers made small orders. In the current operating environment, each customer ordered different products with different distribution procedure. Hence the mark up pricing system is inadequate. Furthermore, the costs used to determine the product cost in the pricing strategy need to be reallocated as they are not assigned accurately. Therefore, DOP needs to change the costing method before an alternative pricing strategy is considered. Activity based costing (ABC) method should be analyzed to determine the feasibility of this method for DOP. ABC method can be used to determine costs for individual customers and then charging them accordingly. However, DOP must also figure out its other operational issues which reduce the profitability of the business.

2. Develop an activity-based cost system for Dakota Office Products (DOP) based on Year 2000 data. Calculate the activity cost-driver for each DOP activity in 2000.

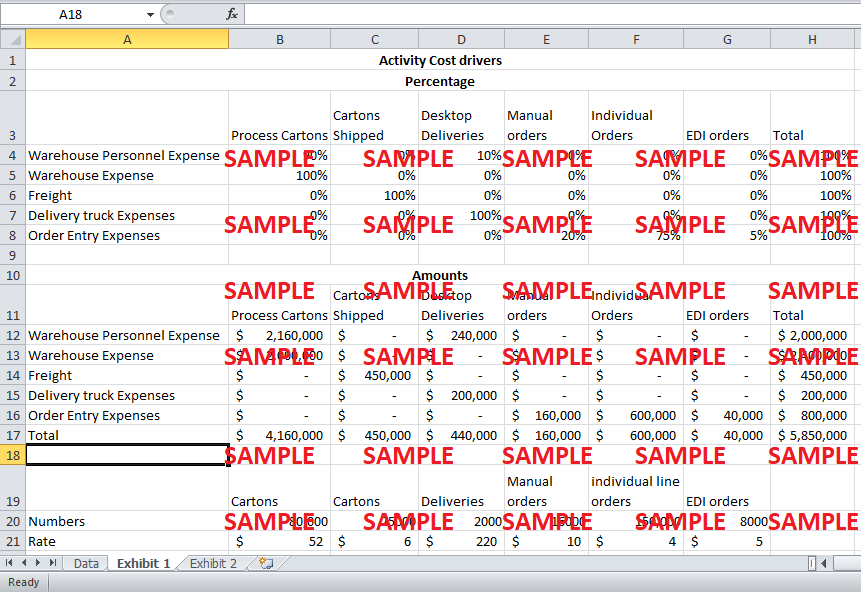

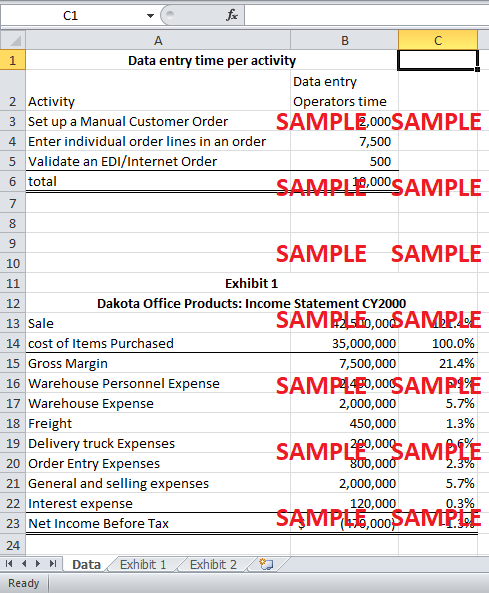

Exhibit 1 shows an activity based cost system for DOP for the warehouse, distribution and data entry expenses for different customers of DOP. In total, there were 6 activities performed at DOP which are carton processing, carton shipment, desktop deliveries, manual orders, individual orders and EDI orders. For the calculations, we used the following information available.

-

All the warehouse expenses are allocated to processing the cartons in and out of the warehouse as these expenses related to the receipt, storage and handling of the cartons.

-

90% of the warehouse workers processed cartons while the remaining 10% worked on the desktop delivery service. Hence, the warehouse personnel cost is divided accordingly

-

The delivery trucks were only used for the desktop deliveries. Hence, the entire delivery truck expense is allocated to desktop deliveries.

-

Similarly, as freight is only used for the cartons shipped, the entire freight cost is allocated to ship cartons.

-

The order entry expenses were divided amongst manual orders; individual orders and EDI/Internet orders based on the data entry time for worked for these three kinds of orders.

Based on this information the costs are divided among the activities and the rates are calculated. The Exhibit results show that carton processing cost should be charged at $52 per carton. The freight should be charged at $6 per carton. A desktop delivery charge is $220 per delivery, and individual line order charge is $4 per order. The manual order cost $10 per order while the Internet order cost $5.

3. Using your answer to Question 2, calculate the profitability of Customer A and Customer B.

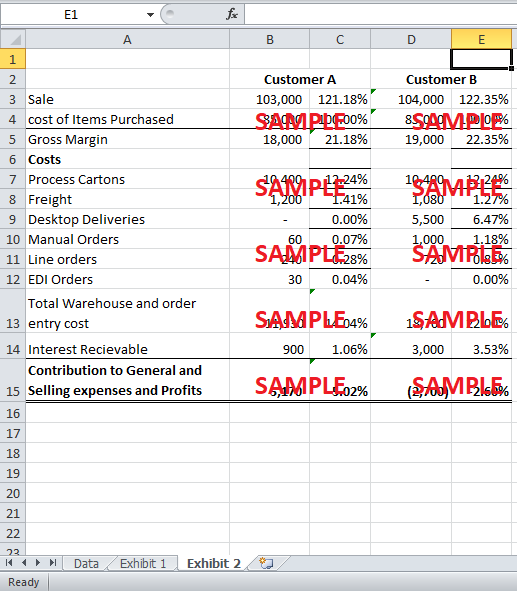

Exhibit 2 shows the calculation for the profitability of Customer A and Customer B. the rates calculated in Question 2 and the available information regarding the cost drivers of warehousing, distribution and ordering expenses are used to determine the contribution to general and administration expenses and profits. The 10% interest on Accounts receivable is also accounted for in the calculations. Customer A has a contribution of $5,070 while Customer B shows a loss of $2,700. This shows a contribution margin of 5.02% for the Customer A, and -2.60% for Customer B.

4. What explains any difference in profitability between the two customers?

The first significant difference apparent in Exhibit 2 is the cost of desktop delivery. Customer A has no cost of desktop delivery but Customer B has a desktop delivery cost of $5,500 which is 6.67% of the product cost. This delivery resulted in an increased mark-up of 2%, but this increase is not sufficient to cover the 6.67% of the increase in cost. Desktop deliveries are 37 times more expensive than shipments. Hence, as this delivery channel is so expensive it should be abandoned and only shipping channel should be used.

The second major distinction is in the cost of Manual order. For the Customer A, cost is just $60 which is 0.07% of the product cost. However, Customer B has a cost of $1000 which is 1.18% of the product cost. The cost of individual line orders is also different for both customers. While customer A incurs a cost of $240, customer B incurs a cost of $720. DOP will need to take some action regarding Customer B. It could increase the pricing markup to cater for the increased expense. It could also encourage this customer to use Internet orders by giving incentives. Also, in order to save time, incentives should also be given for bulk orders.

Finally, the accounts receivable for both customers are vastly different. Customer A has accounts receivable of $9000 which results in an interest of $900. However, Customer B has accounts receivable of $30,000 and so the interest is $3,000. Therefore, in order to encourage Customer B to do timely payments, price discounts could be offered.

5. What are the limitations, if any, to the estimates of the profitability of the two customers?

One limitation to estimate the profitability of the two customers is the limited information available. There is no information regarding the distance of desktop deliveries and total hour spend delivering. This will help commute the accurate cost per labor hour. These distances for customer B will help determine the relevant desktop delivery cost for this customer.

6. Is there any additional information you would like to have to explain the relative profitability of the two customers?

The following additional information would help give a more clear understanding of the relative profitability.

-

The total numbers of hours spend in desktop delivery is important information needed to calculate the cost per labor hour. Similarly, the estimated number of hours to be spent on desktop deliveries is also needed to estimate the desktop delivery cost.

-

The total number of personnel working in different activity centers. This will facilitate in the analysis and could be considered a cost driver.

7. Assume that DOP applies the analysis done in Question 3 to its entire customer base. How could such information help the DOP managers increase company profits?

The analysis applied in question 3 can be applied to the entire customer base to improve managers understanding of the costs. Firstly, the manager will discover that the pricing system is inadequate as it does not take account of the delivery cost. Furthermore, the delivery costs should be based on the distance where the order is placed because this determines the hours spend in delivery. Therefore, for customers at a distance for desktop deliveries a higher premium needs to be charged. Secondly, the manager would realize the usefulness of ABC costing to analyze and compare customer as well as making pricing decisions. Similarly, the manager will realize that as the number of orders is a cost driver it should offer discount on big orders to eliminate the possibility of a large number of customers placing small orders. Finally, the manager will correct the cost by determining the direct labor hours.

8. Suppose that a major customer switched from placing all its orders manually to placing all its orders over the internet site. How should this affect the activity cost driver rates calculated in Question 2? How would the switch affect DOP’s profitability?

If the major customer switches from placing order manually to placing an order on the internet site the rate of process cartons and data entry will change. In 2000, an EDI order required 500 hours of data entry operator time. This mean, considering total 8000 orders in 2000, 16 orders are completed in per hour. Hence if all orders are done on the internet and all 24000 orders are taken on the internet, the work hours will reduce from 10,000 hours to 1500 hours. This means an 85% wage cost reduction. Similarly, data entry costs will also fall as EDI order rate is lower than manual order. This fall in costs will result into higher profitability. Hence each customer, even those placing small orders, will increase the profits. This effect clearly shows that DOP should encourage EDI/internet orders and try and close manual orders.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.