Get instant access to this case solution for only $19

Daniel Dobbins Distillery, Inc Case Solution

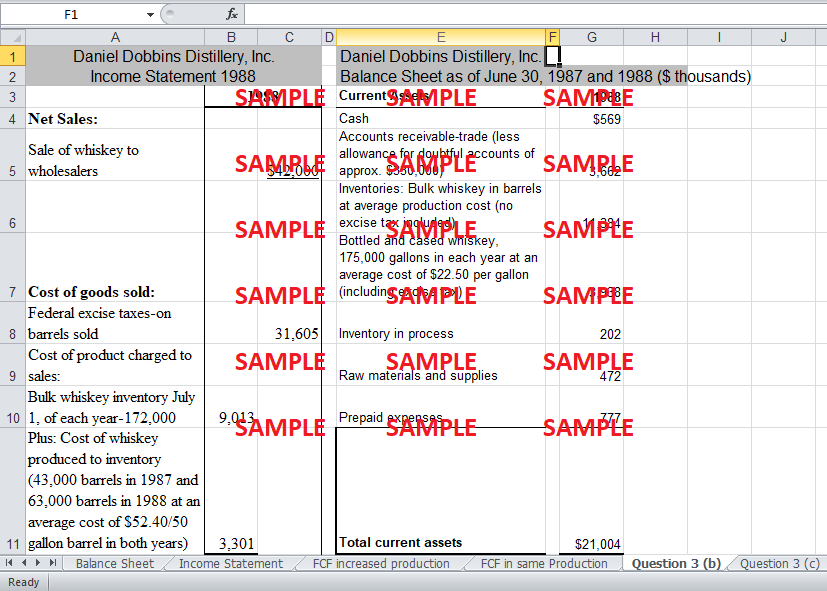

Daniel Dobbins carried on his family tradition of beverage manufacture and started distilling whiskey in 1880. Lately, in 1973 David Dobbins took over as COO of the company and nearly doubles sales revenue during next 10 years. Recently, in order to capture a larger market share of whiskey consumption, a decision was made to expand production to try at a board meeting in December 1987. Hence, the board had decided to increase the production of bourbon in 1988 by 50% in order to meet the demand for straight bourbon whiskey. Consequently, Daniel Dobbins Distillery reported a loss of $814,000. David Dobbins along with managers are pondering whether they should submit the 1988 financial statements to the Ridgeview National Bank of Nashville, Tennessee in support of a recent loan request for $3 million. The discussion among the managers revolved principally around the method of accounting should be used to for the treatment of various expenses reported in “other costs” section of the operating income statement. In order to remain solvent, the company needed an additional working capital immediately. Hence, a decision had to be reached on these matters quickly.

Following questions are answered in this case study solution:

-

Is Dobbins using LIFO or FIFO? Which should it use?

-

Please provide a FCFF and Intrinsic Firm Value for Dobbins

A. as if it had not increased production;

B. Given its increases in production.

-

In your opinion, what costs should be included in Dobbins's inventory?

-

Assuming Dobbins decided to charge barrel costs (but not other warehousing and aging costs) to inventory, what 1988 income statement and balance sheet items would change, and what would the new amounts be?(Assume no change to in-process inventory)

-

If Dobbins's suggestion of including all warehousing and aging costs in inventory were accepted, how would the 1988 financial statements is affected? (Same assumption as for Question 2)

-

What method of accounting would you recommend that Dobbins use in preparing the annual financial statements to be submitted to Ridgeview National Bank?

Daniel Dobbins Distillery Inc Case Analysis

1. Is Dobbins using LIFO or FIFO? Which should it use?

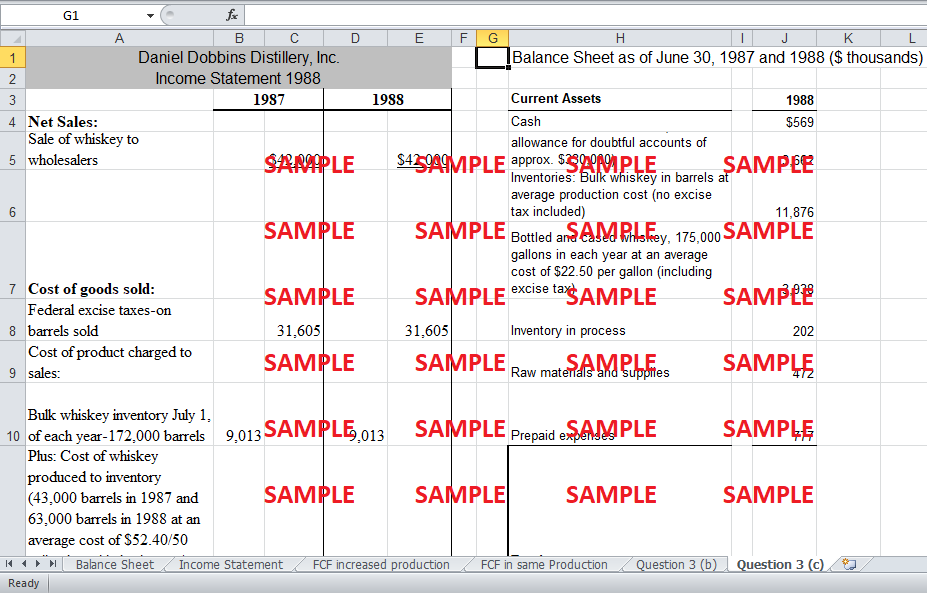

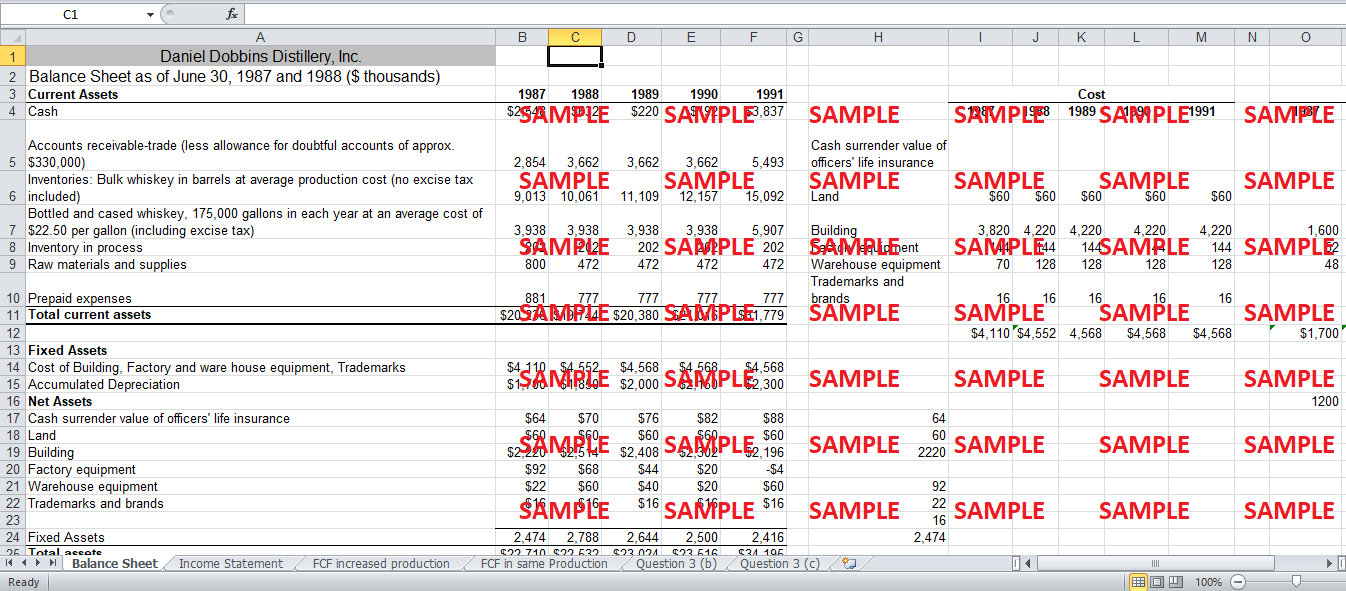

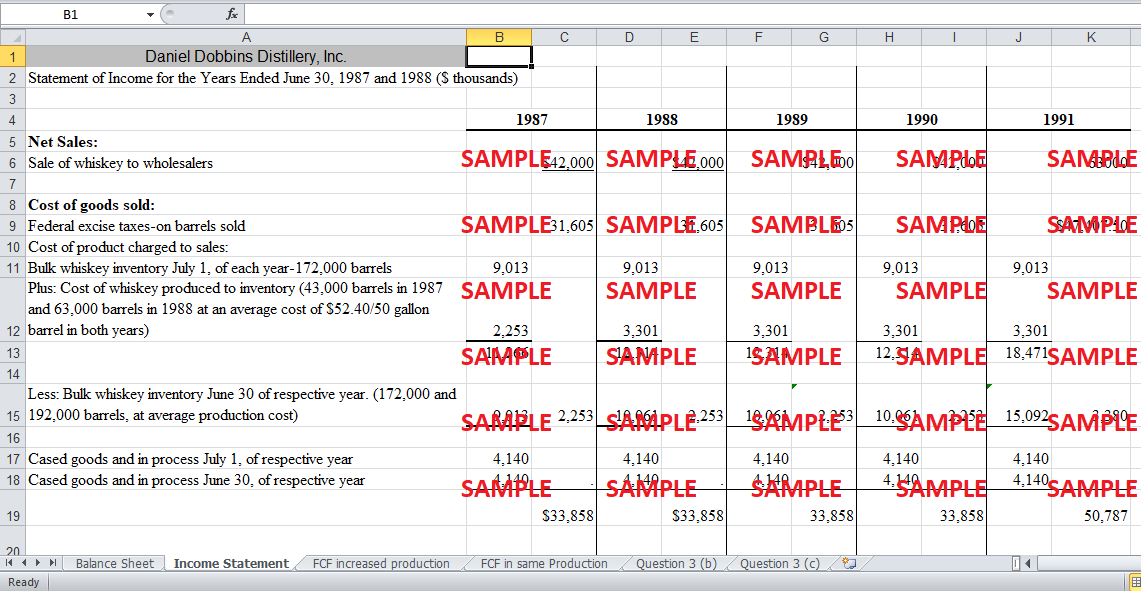

Evaluation of Dobbins financial statement shows that Dobbins is currently using LIFO, Last In First Out method. As production manager of Dobbins, James Doud mentioned that due to increase in production by 50% this year, the costs are bound to increase. It means that the costs, which are directly and indirectly attributable to new whiskey, are included in the income statement as a part of other costs. The direct costs of new bourbon are inventoriable costs, which must be capitalized. However, these costs are added in the income statement as a part of cost of goods sold. This clearly shows that method of accounting used by the Dobbins is LIFO.

The income statement, which resulted under LIFO method, shows negative net income, consequently, leaving little chance for the company to borrow $3 million from Ridgeview National Bank of Nashville, Tennessee.

On the basis of the production procedure along with aging, it is suggested that Daniel Dobbins Distillery should use FIFO method. The net income would be highly under-valued under the LIFO accounting method. In FIFO method of accounting, all the costs, which are traceable to new whiskey, are included in inventory. FIFO method would result in high net income and high level of operating assets for Dobbins.

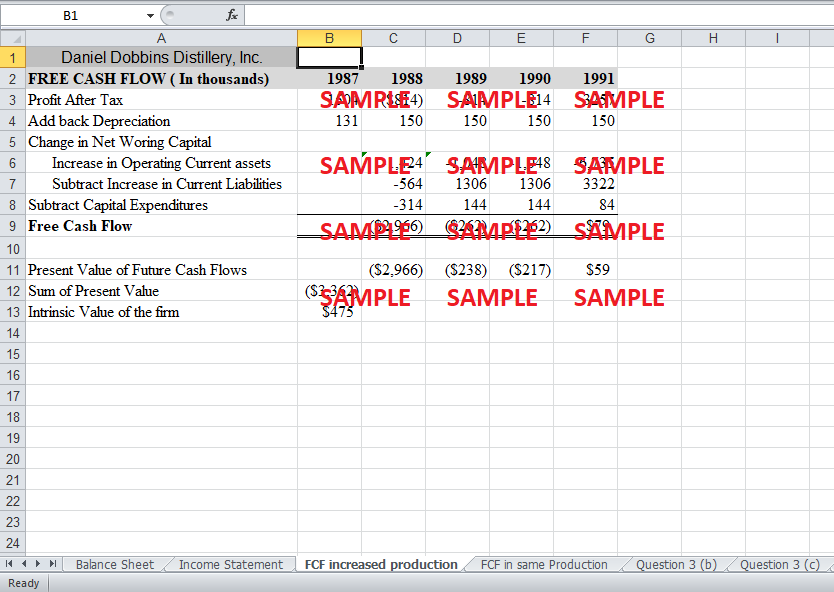

2. Please provide a FCFF and Intrinsic Firm Value for Dobbins:

A. as if it had not increased production;

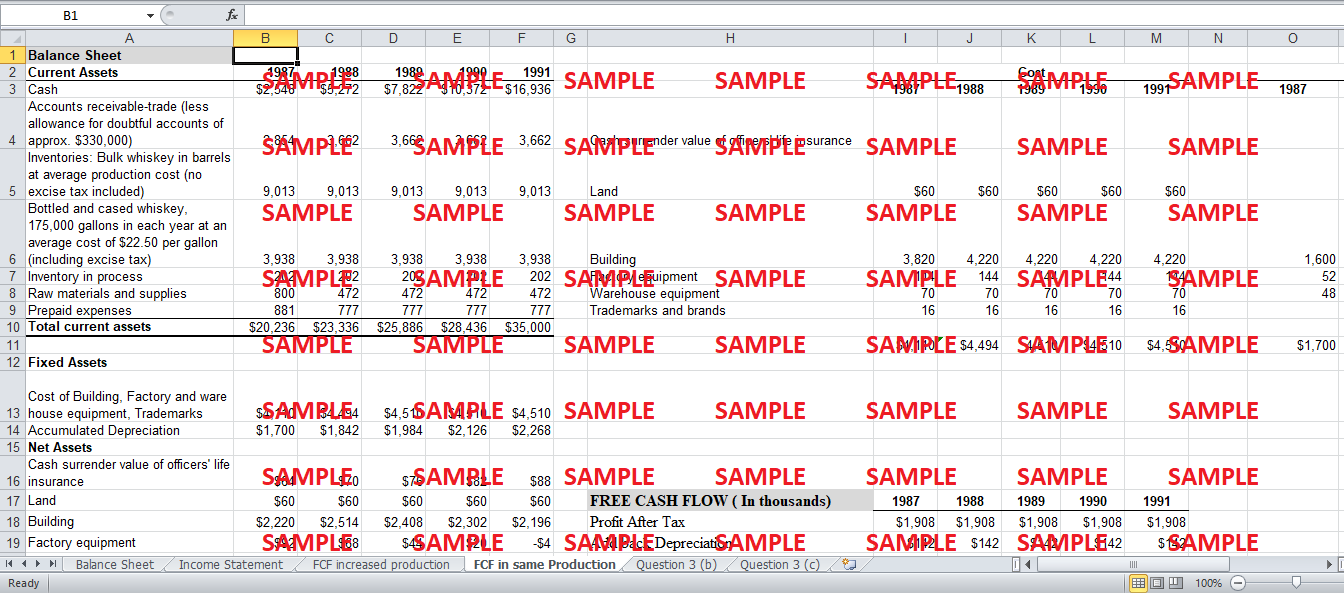

Free Cash Flow to the Firm is calculated under two different scenarios. In the first scenario, it is assumed that production had not increased. Hence the cost of barrel, $63 per barrel, would not change in coming years from 1988 to 1991. Similarly, all costs under the section of “other cost” would not change, such as, occupancy cost, warehouse labor cost and depreciation of warehouse equipment and etc. As a result of similar cost of goods sold; the projected net income would remain similar for next four years. The effect on the balance sheet in case of the same production would be positive, under current accounting method being used. Project amount of cash would keep rising. Operating current assets remains same due to same projected revenues in coming years. There is same increase in current liabilities during next years. The projected free cash flow rises from $1,606,000 to $2,606,000 till the last year. Firm value for Dobbins is calculated by adding present values of all free cash flows to the excess cash. The interest rate is assumed to be 10 percent while finding out the present values. The firm value in case of similar production comes out to be $25,232,000.

B. Given its increases in production.

Second scenario, in which firm increases its production, shows less projected income and lower projected cash for the future. The reason behind negative projected income is a large increase in “other costs”. In the ‘other cost’ section, there is an increase in cost of barrel, occupancy cost, and cost of warehouse labor and depreciation of warehouse equipment. This negative net income causes negative projected free cash flows of the firm; as a result, firm value of Dobbins lowers down. Intrinsic value of the firm, calculated as above mentioned procedure, comes out to be $475,000. The reason of unusually low free cash flows and value in the second scenarios are that the increased costs, which can be directly traced into increased production, are added in current years. However, the firm would obtain high revenues for four years after production has increased.

3. In your opinion, what costs should be included in Dobbins's inventory?

The income statement of Daniel Dobbins Distillery, Inc is showing a negative net income of $814,000. This low net income could be a hurdle for the company of in obtaining $3 million loan from the bank for additional capital. The increased production in 1988 has caused unusually low level of net income, and the revenue directly related to this increased production would benefit the firm after four years. Whether the costs related to increased production should be added in this period in the income statement or the period in which revenues are earned, is the question. Under the current accounting method, all the costs are added into current income statement under the section of other cost. This large increase in cost without revenues being increased caused a massive blow to company’s income statement. To overcome this condition caused by inappropriate method of accounting, it is suggested that all the costs that are direct costs for increased production and can be directly traced to the 50% increase in production should be included in Dobbin’s inventory.

Barrel costs i.e. more than 60 per barrel is the direct cost that can easily be traced into the increased production cost should be included in inventory. High net income and high inventory would be the result of this aging cost in inventory.

Aging is a highly necessary phenomenon in making a final product. Hence its cost cannot be considered as an indirect cost. In order to facilitate aging for increased production; Dobbins rented an aging warehouse at an annual rental cost of $200,000. Moreover, to control the temperature and humidity of the warehouse space, Dobbins incurs the cost for the warehouse labor and supervisor.

All these costs, including barrel cost, warehouse rental cost and warehouse labor costs are directly attributable to the increased production. Hence these costs must be included in inventory in year 1988.

Also, there is an increase in selling, advertising, administration and general expenses due to higher production in year 1988. However, these costs are indirect and cannot be traced directly into new bourbon. The Darlene argument of capitalizing everything, the salaries expenses and advertisement expenses, is flawed. As these costs are not considered to be the direct cost, so they cannot be capitalized.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.