Get instant access to this case solution for only $19

Depreciation at Delta Air Lines The Fresh Start Case Solution

Delta airline has changes their depreciation policy a number of times over the past two decades. Although there are a number of factors in the airline industry that could require a change in the estimated useful life of the equipment, the frequency observed in delta’s policy changes indicate that the company might be doing so to boost its earnings. The fact that the company recently filed for bankruptcy indicate that the company must have been facing lower earnings and had a motive to enhance earnings. The calculations indicate that the company was able to lower its earnings significantly by lower its annual depreciation rate. It is recommended that the regulatory bodies should not normally allow companies to adopt a ‘fresh start’ because it might allow the companies to manipulate their financial statements.

Following questions are answered in this case study solution:

-

What are some of the possible reasons why Delta may have extended the lives of flight equipment and changed residual values four times since 1986?

-

Assume Delta purchased the following six aircrafts:

|

Year |

Aircraft |

Price ($ millions) |

Aircraft number |

|

1985 |

MD88 |

$33 |

D2851 |

|

1988 |

MD88 |

$39 |

D2882 |

|

1992 |

B-757-200 |

$66 |

D3921 |

|

1993 |

B-757-200 |

$68 |

D3932 |

|

2006 |

B-777-200ER |

$210 |

D4061 |

|

2007 |

B-777-200ER |

$220 |

D4972 |

|

|

|

|

|

What would have been the assumed residual value of each aircraft and the first-year depreciation for each aircraft? (Use 25 and 30 years for estimated lives after 1998 and residual values of 5% for 1993 through 2006 and 10% of cost for 2007)

-

Assume each aircraft in question 2 is still in Delta’s fleet in 2007. How would you estimate the net book value of aircraft before application of “fresh start” accounting in 2007? How would this compare to the “fresh start” value that Delta estimated in 2007 as described in the notes from consolidated financial statements included in the Form 10-K and the case?

-

Should the adopting of “fresh start” accounting be open to any corporation where management feels traditional historical cost-based accounting no longer allows them to present a fair picture?

Depreciation at Delta Air Lines The Fresh Start Case Analysis

1. What are some of the possible reasons why Delta may have extended the lives of flight equipment and changed residual values four times since 1986?

It is understood that the there are a multitude of factors that affect the useful life of flight equipment. These factors include unexpected dynamics such as technological improvements. Therefore, it might be reasonable to suppose that the estimates of the useful might change with changes in these factors. For instance, ten year was the standard useful life of the airplane in the starting years of commercial operations. However, with the advent of more sophisticated technology, the useful life for airplanes started to increase. Thus, it is not surprising that delta used a useful life of ten years prior to mid 1980s, but increased the useful life thereafter. Similarly, it is normal for Delta to reassess its assets after the reorganization in 2007. As part of the revaluations, it makes sense that the company also adjusts the useful life and salvage value of the equipment. However, these were not the only occasions on which the company changed its depreciation policy. In fact, there were two other occasions, between 1985 and 2007, when the company extended the lives of its equipment.

It is hard to believe that the revisions in useful life were due to a factor such as technological improvements. Technology might improve the useful life of new equipments, but the existing (old) airplanes should not yield a longer useful life. It is a common practice for companies to manipulate their earnings by changing their accounting policies without substantial economic reason behind the change. A longer useful life results in lower depreciation expense for each year. A lower expense results in higher earnings. Moreover, the practice might not even result in additional taxation on higher earnings because the calculation of depreciation for tax purposes is different from the calculation of accounting depreciation. Such earnings manipulation can be expected in the airlines industry where tough competitive environment in recent years has lead to lower earnings for established airlines. Therefore, there is sufficient rationale to believe that Delta might have extended the life of flight equipment to boost its earnings. However, such practices reduce the quality of earnings because the increase in earnings is not backed by the core operations of the airlines and is not sustainable.

2. Assume Delta purchased the following six aircrafts:

|

Year |

Aircraft |

Price ($ millions) |

Aircraft number |

|

1985 |

MD88 |

$33 |

D2851 |

|

1988 |

MD88 |

$39 |

D2882 |

|

1992 |

B-757-200 |

$66 |

D3921 |

|

1993 |

B-757-200 |

$68 |

D3932 |

|

2006 |

B-777-200ER |

$210 |

D4061 |

|

2007 |

B-777-200ER |

$220 |

D4972 |

What would have been the assumed residual value of each aircraft and the first-year depreciation for each aircraft? (Use 25 and 30 years for estimated lives after 1998 and residual values of 5% for 1993 through 2006 and 10% of cost for 2007)

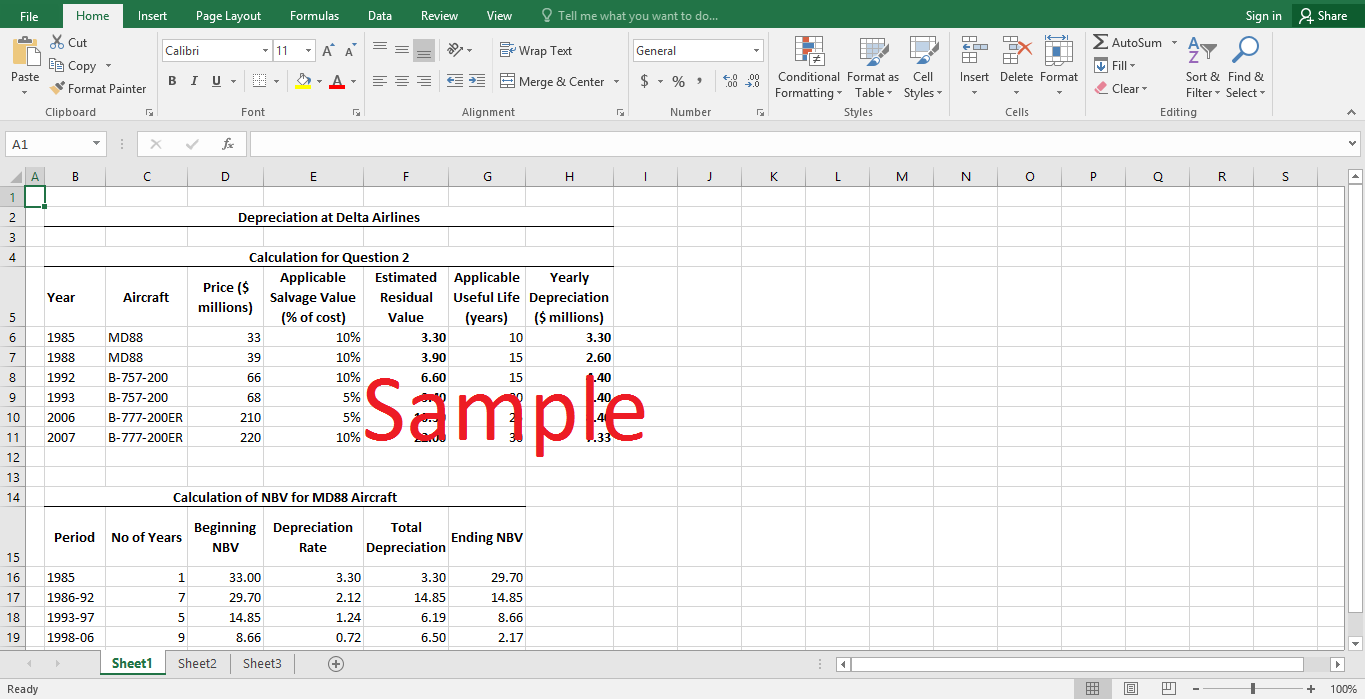

The aircrafts were purchased at various points in time where the company had different depreciation policy. It is important to note that the company has revalued all of its equipment following the recent reorganization and all the current equipment is subject to a similar depreciation policy. However, the depreciation policy at the time of the purchase of many of the afore-mentioned aircrafts was inconsistent. Therefore, the company’s estimate of salvage value and useful life at the time of the purchase of the aircrafts may differ. The following table states the applicable depreciation policy (salvage value and useful life) at the time of the purchase of each aircraft, and then calculates the estimated residual value and initial depreciation after the purchase:

|

Year |

Aircraft |

Price |

Applicable Salvage Value (% of cost) |

Estimated Residual Value ($ millions) |

Applicable Useful Life (years) |

Initial Depreciation |

|

1985 |

MD88 |

33 |

10% |

3.30 |

10 |

3.30 |

|

1988 |

MD88 |

39 |

10% |

3.90 |

15 |

2.60 |

|

1992 |

B-757-200 |

66 |

10% |

6.60 |

15 |

4.40 |

|

1993 |

B-757-200 |

68 |

5% |

3.40 |

20 |

3.40 |

|

2006 |

B-777-200ER |

210 |

5% |

10.50 |

25 |

8.40 |

|

2007 |

B-777-200ER |

220 |

10% |

22.00 |

30 |

7.33 |

The results highlight that, with the passage of time, the initial depreciation following the purchase of aircraft has decreased in proportion to cost of the equipment. This observation can be clearly authenticated by looking at the initial depreciation and price (cost) of the last two aircrafts. Although the aircraft purchased in 2007 costs more the aircraft purchased in 2006, the initial depreciation on the newer aircraft is lower because of the changes in depreciation policy.

3. Assume each aircraft in question 2 is still in Delta’s fleet in 2007. How would you estimate the net book value of aircraft before application of “fresh start” accounting in 2007? How would this compare to the “fresh start” value that Delta estimated in 2007 as described in the notes from consolidated financial statements included in the Form 10-K and the case?

The net book value of each aircraft can be calculated by subtracting the accumulated depreciation for the aircraft at the end of 2007 from its initial cost. The accumulated depreciation is a little tricky to calculate because the yearly depreciation amount changes with a change in the depreciation policy. Between 1985 and 2006, the depreciation policy has changed four times. Therefore, different depreciation rates were applicable in five different periods. Therefore, an aircraft can be subject to a maximum of five different depreciation rates. In fact, only one aircraft, MD88 purchased in 1985, is subject to five different depreciation rates. The aircrafts that were purchased later are subject to lesser variation in depreciation rates. For instance, the net book value of the aircraft that was purchased in 2007 is simply its cost ($220 million) minus the depreciation for 2007 ($7.33 million). Since, the calculation of net book value for MD88 aircraft purchased in 1985 is the most complex; we have illustrated the calculation in the following table in order to clarify the process:

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.