Get instant access to this case solution for only $19

Diageo Plc Case Solution

Diageo has pursued aggressive financing policies by restricting debt. According to the data provided in the model and information from the case, Diageo is underleveraged and should take on more debt to finance its expansion through acquisitions and internal growth. Moreover, divesture of Burger King and Pillsbury are shrewd steps that should benefit Diageo in terms of increased synergies and reduced conglomerate discount.

Lastly, the Monte Carlo simulation provides a good analysis in terms of tradeoff between tax shields and costs of financial distress. However, it ignores the possible operational and business risks and also fails to take into account the potential increase in sales that could be achieved by financing growth by debt.

Following questions are answered in this case study solution

-

What do you think about the capital structure policies Diageo has pursued in the past? Do they make sense? How does it compare to Diageo’s competitors’ policies? Which competitors would make for the best comparison?

-

Why is Diageo selling Pillsbury and spinning off Burger King? How might value be created through these transactions?

-

Based on the result of the simulation model, what recommendation would you make for Diageo’s capital structure? Does the model capture all of the important risk factors faced by Diageo? Would you want to adjust the model in any way? Note: I do not expect you to do your own Monte Carlo Simulations. The emphasis should be on understanding conceptually how the model helps evaluating Diageo’s capital structure, and what the possible shortcomings of this approach could be?

Case Analysis for Diageo Plc

1. What do you think about the capital structure policies Diageo has pursued in the past? Do they make sense? How does it compare to Diageo’s competitors’ policies? Which competitors would make for the best comparison?

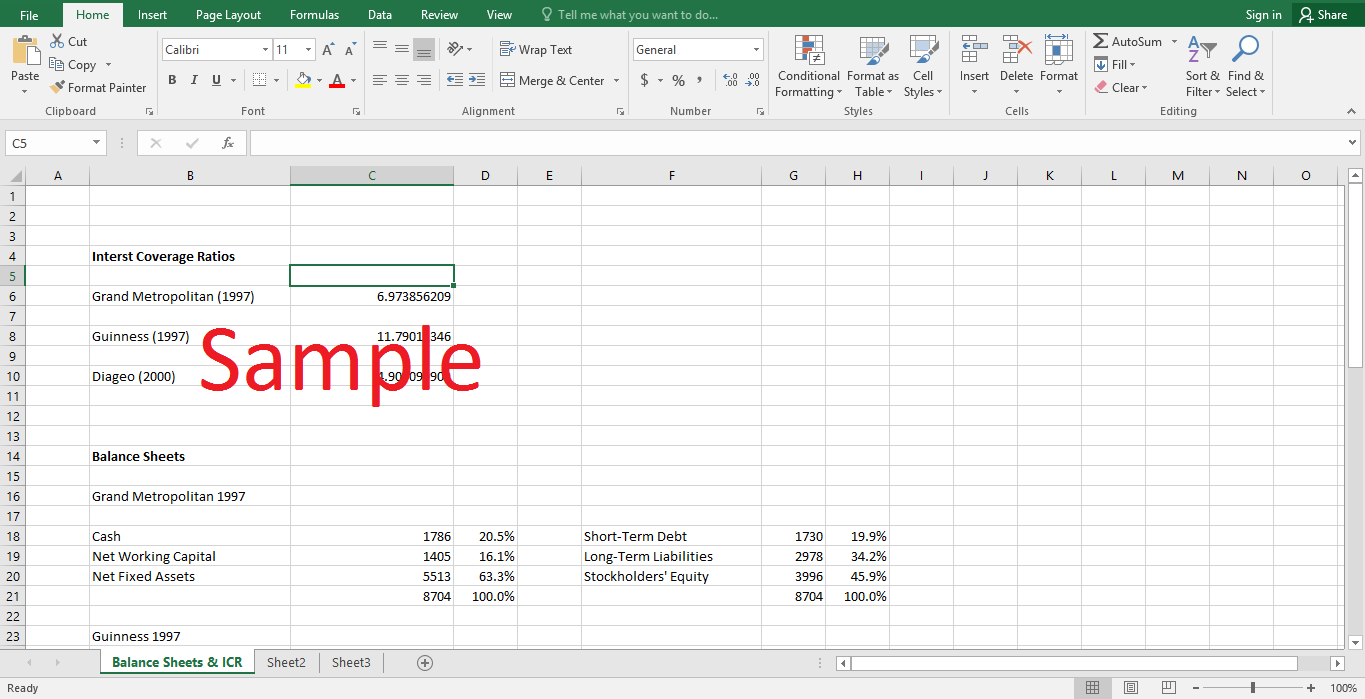

Diageo was founded as a result of a merger between Grand metropolitan and Guinness. Prior to the merger, both these companies followed an aggressive capital structure policy with high interest coverage ratios and low gearing ratios. Grand metropolitan and Guinness had an interest coverage ratio of 7 and 12 respectively. In order to maintain its credit ratings post-merger to A+ or above and ensure public confidence Diageo has continued the stringent capital structure policy. The company in year 2000 was able to maintain its interest coverage ratio to 5 and EBITDA to 34%. Both these financial ratios were consistent with a credit rating of A+.

The maintenance of an A+ rating is significant for Diageo as it enables the firm to keep the cost of debt low. The company is able to issue bonds with a much lower yield and hence make low interest payments due to its investment grade rating. Furthermore, the rating has helped Diageo access the commercial paper market which is a source for cheaper, unsecured, short term debt.

A segment level (beverage, packaged food etc.) analysis shows that Diageo is more aggressive than its competitors. For most of the segments, the interest coverage ratio of Diageo is lower than its competitors. The 5x ratio of interest coverage is lower than the average of 10x for beer segment and 7.88x average for the packaged food and restaurant segment. Comparison to the conglomerates shows that Diageo is more aggressive than Unilever but still has the same rating possibly due to a less stable business in comparison to Unilever. In contrast, Diageo’s policies are less aggressive than Seagram, but Diageo still enjoys a higher credit rating.

A careful analysis of Diageo’s financials in comparison to its competitors reveals that Diageo has a low probability of financial distress. The company’s debt’s payback period (Debt/EBITDA) reflects its capacity to pay off its debt in a comparatively brief period of time. Together with the high ratio of cash available for interest payments (EBITDA/Interest expense), this provides evidence for low financial distress.

2. Why is Diageo selling Pillsbury and spinning off Burger King? How might value be created through these transactions?

Diageo agreed to sell off its packaged food subsidiary, Pillsbury to General Mills and displayed interest to spin off Burger King first through an initial public offering and then following it up by equity carve out. Selling of these subsidiaries allowed Diageo to focus exclusively on its core business of beverage/alcohol industry. Both Pillsbury and Burger King did not fit in with the primary divisions of beverage and brewing. Selling these divisions off allowed Diageo to get rid of the incompatibilities of shared production, marketing and distribution. Further it enabled Diageo to generate cost savings despite the fact that both Pillsbury and Burger King had comparatively steady cash flows.

Furthermore, Divesture of these business divisions enabled Diageo to generate financing for further expansion and growth. Diageo, as a result of these divestures raised funds for both internal investments and future mergers and acquisitions that were more compatible with its primary business, allowing the company to enjoy synergies and operational and financial efficiencies.

Another potential benefit besides getting rid of incompatibilities, cost savings and generating revenue is the avoidance of conglomerate discount. Conglomerate discount is referred to the tendency of the stock market to undervalue or ‘discount’ the stock of conglomerates. Under this theory, the sum of value of individual divisions or subsidiaries is more than the value of the conglomerate. Exhibit 3 is a reflection of this phenomenon as it clearly shows that Diageo’s share price has continuously lagged the broad market index (FTSE) due to the tendency to discount.

3. Based on the result of the simulation model, what recommendation would you make for Diageo’s capital structure? Does the model capture all of the important risk factors faced by Diageo? Would you want to adjust the model in any way? Note: I do not expect you to do your own Monte Carlo Simulations. The emphasis should be on understanding conceptually how the model helps evaluating Diageo’s capital structure, and what the possible shortcomings of this approach could be?

Diageo is in a position to take on more debt. Based on information provided in exhibit 4 the debt level of the company can be estimated to be around 6.7 billion dollars. In order to take the advantages of a higher credit rating, Diageo should take on more debt to finance its growth by acquisitions and expansion.

The Monte Carlo model shows that the probability of financial distress was high with a higher level of debt, but it did correspond with higher tax shield benefits. The model prediction EBIT as a component of return on assets (linked to operating cash flow), exchange rate, and interest rates. Based on the recommendations of the model and graph provided in exhibit 8, Diageo’s ideal interest coverage ratio should be between 5 and 8 in order to make the likelihood of financial distress low. Within this range, Diageo is also able to realize substantial tax shield advantages.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.