Get instant access to this case solution for only $19

Dividend Policy at Linear Technology Case Solution

This case presents a decision analysis by Linear Technology regarding its dividend policy. The company first started giving out dividends in year 1992 and since then, it has successfully maintained this policy by gradually increasing the payout. In order to ensure the stability of dividend payments, the company set the initial dividend at a very modest level, despite large cash on its disposal. Despite being in the technology industry, Linear’s does not have many suitable growth opportunities available. Hence, a huge sum of $1.5 billion of cash is available, and the company is considering to increase dividend so that shareholders share the benefits of healthy cash flow of the company. Another option for Linear Technology is to use this excess cash to repurchase stocks and hence prevent double taxation of income by shareholders. An analysis of financial statement data in the case will show which option is in the best interest of shareholders.

Following questions are answered in this case study solution:

-

What is Linear’s current payout policy?

-

What are Linear’s financing needs? What should Paul Coghlan recommend to the board? Why?

-

What are the advantages and disadvantages for the firm’s shareholders if:

a. The firm increases dividends.

b. The firm maintains the same amount of dividends.

c. The firm cuts dividends.

-

What will be the market reaction to each of the three actions described in the previous question? Why

-

If you were the manager acting in the interest of the current shareholders, what would you do?

-

Would your answer to the previous question change if managers act in their own interest?

Dividend Policy at Linear Technology Case Analysis

1. What is Linear’s current payout policy?

In October 1999, Linear Technology announced its first dividend. Since then, the company has regularly paid dividends with a slow and steady increase in payout rate. This pattern of dividends was maintained regardless if the financial performance of the company in a particular year. Dividends were not reduced during periods of modest or even poor earnings. On the other hand, dividend was not increased exceptionally during years of excellent financial performance. So, the idea was to keep the dividend payout steady to demonstrate to shareholders the financial strength and stability of the company. Reduction in payout ratio sends a very negative message in the market. That’s why, in spite of being a very cash rich business, Linear Technology started dividend payments, in 1992, at a very modest payout ratio. This policy helped the company to ensure dividend payments even in years of poor financial performances. By maintaining a steady series of dividend payments, Linear Technology had a reputation of being a firm that, unlike other technology firms, can maintain a steady income level. This strategy attracted investments form a large group of investors who looked for safe investments in equity with high liquidity.

2. What are Linear’s financing needs? What should Paul Coghlan recommend to the board? Why?

Apart from working capital and other requirements, Linear Technology needed $200 million to build new analog facility. Paul should use pro-forma statements, value of cash holding and dividend payout ratio to determine how much the value of company increases due to increase in dividends. Data for dividend payments for previous years can be used by the company to calculate the clientele effect information for investors. The dividend decisions of the company should be compared to other technology players in the industry.

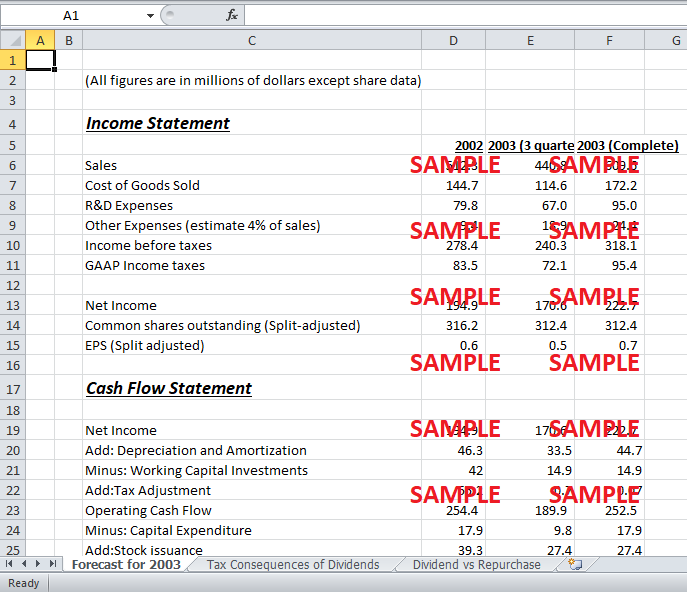

In order to understand the financial implications of an increase in dividends, pro-forma financial statement data for the fourth quarter of year 2003 should be prepared. Sales for the first half of year 2003 have increased by 19% as compared to the first half of year 2002. Therefore, assuming 19% increase in sales, income statement and cash flow statement for year 2003 can be prepared. This analysis will help the company to estimate dividend payments and their effects on value of the company.

Using data from financial statements and current money markets, valuation of cash holdings can be done. This valuation of cash holdings shows that Linear’s technology is earning a return of only 3.1% ($0.11 for $3.56). Another way of doing this analysis is using the dividend payment chart to estimate the after tax percentage return to the shareholders of the company for different scenarios.

This analysis shows that an increase in dividend amount of $0.01 will position Linear Technology as highest dividend paying company with an all time high payout ratio of 29.64%. Even after paying this level of dividends, company will still be using just 26.13% of its operating cash flow increased from 24.43% for the previous year. But, the liquidity position of the company is so great that even after paying $66 million and other liabilities out of $1.5 billion, the company will be left with $48 million. Setting a very high payout ratio as compared to competitors will force the company to decrease payout ratio in the future which will cause clientele effect because investors will start to doubt the financial growth of the company at the previous rate.

Finally, a comparison of expected rate of return with required rate of return for Linear Technology shows that an increase in dividend payout will make expected rate of return 24.21%, much higher than 0.45% required rate of return that is based on its correlation since the establishment of SOX. Maintaining same payout rate will leave investors with an expected rate of return of 18.29%. On the other hand, if the dividend is decreased, expected rate of return by investors will fall to 12.38%. This means that the company will be valued more highly by investors if the dividend is increased. However, CFO of linear also needs to analyze the increase in value of the company if it chooses to repurchase stocks.

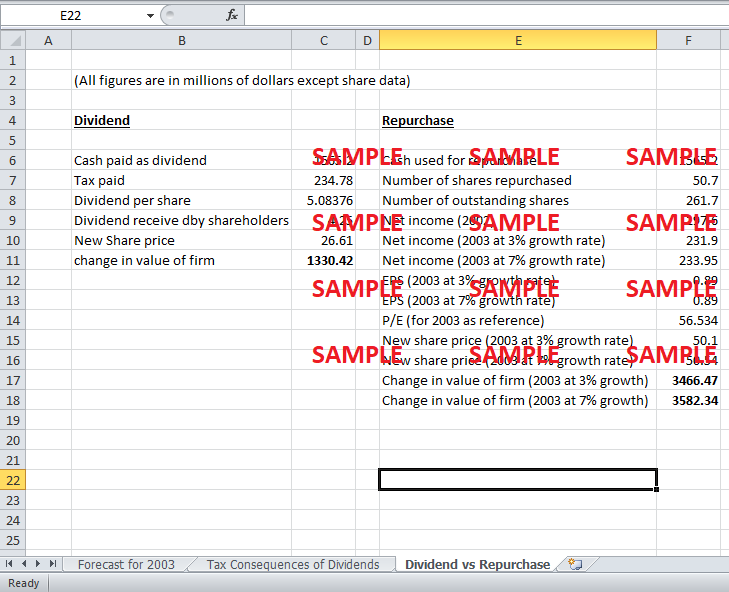

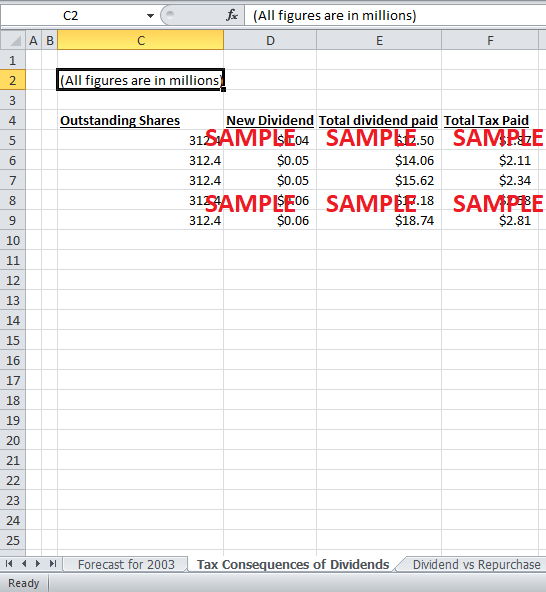

The choice between dividend increase and stock repurchase can be analyzed by considering the tax implications of two options. Dividends are taxed as ordinary income while capital gains on sale of shares are also subject to tax. Repurchase of shares is a better option from shareholders perspective if the capital gain tax is lower than the taxes on incomes of investors based on their income tax brackets. Also, taxes on dividends have to be paid immediately after realizing dividend income while tax on capital gain has to be paid when share are sold. Due to the time value of money, same amount taxes on capital gains have a lesser present value as compared to same taxes levied on dividends. The choice between stock repurchase and dividend increase varies among different kinds of investors. Financial institutions like pension funds do not need to distinguish between repurchases and dividends because they operate free of taxes. For corporations, an increase in dividend is a better option because they have to pay tax on only 30% of dividend while full tax has to be paid for capital gains realized. If, the company chooses to repurchase stock instead of increasing dividends, it will save the double taxation of income of shareholders. The tax savings, from shareholders perspective, have been calculated in “tax consequences of dividends” tab of excel sheet. Depending on the level of dividend, company will save taxes ranging from $1.87 to $2.8 million if it chooses to repurchase stocks instead of increasing dividends. Thus, as far as tax implications are concerned, repurchase of stock is a better option from shareholders perspective.

A comparison of repurchase and dividend increase option shows that the value of the company increases more, if it chooses to repurchase the stocks of the company. If, company uses $1,565.2 million to issue dividends after tax dividend received by shareholders is $4.25 per share. New share price will be $26.61 and value of the company will increase by $1330.42 million. On the other hand, if company uses $1,565.2 million to repurchase 50.7 million shares of the company, then new share price will be $50.1 (for 3% growth assumption) and $50.54 (for 7% growth assumption). The overall increase in value of the company, for both growth assumptions, is $3,466 million and $3,582 million respectively. Therefore, value addition of stock repurchase option is much more than dividend increment option.

3. What are the advantages and disadvantages for the firm’s shareholders if:

a. The firm increases dividends.

Since, the company had a history of maintaining steady dividend payments; an Increase in dividends will definitely have very positive effect on the reputation of the company. Risk adverse investors looking for liquidity and safety of their investments will welcome this decision. Many institutional investors and mutual funds have a policy of buying shares of only those companies that can give steady dividends without any interruption. Pension funds need constant dividends, even if their liquidity preference costs them in terms of lower rates of returns.

Technology firms are normally viewed as being very risky due to their volatile pattern of earnings. So, a large segment of shareholders normally invests in technology companies for a very short term period. An increase in dividend will attract a large pool of such investors who look for short term high returns. So, a majority of shareholders will welcome the increase in dividend and construe this policy as an indicator of excellent financial health of the company.

But, the advantages of increasing payout ratio are very temporary and short lived. Policy of increasing payout ratio puts the company in very difficult position because it psychologically binds the company to maintain that high payout ratio. By setting a high payout ratio, the company will essentially increase the level of minimum performance indicators and hence, the risks of not meeting the expectations of shareholders will increase steadily. Technology companies are immensely affected by even slightest of macroeconomic changes. In a time of high financial instability, it is unwise to expect to earn a steady level of income by Linear Technology. Therefore, the company should really think through this decision and analyze whether it can maintain such a high payout ratio or not.

b. The firm maintains the same amount of dividends.

If the firm chooses to maintain dividends, then this decision will have no significant effect on stock price of the company. An advantage will be that greater cash availability for investment in positive NPV projects. However, by maintaining the dividends, the firm will not be able to demonstrate its extremely good liquidity position.

c. The firm cuts dividends.

The possibility of a dividend cut by the management of Linear Technology cut is very low. Although, if the company chooses to cut the dividends of the company, its share price will be negatively affected. Since, the company had a long history of paying dividends, cutting dividends conveys the message that cash flow of the company is not good. The firm cannot justify dividend cut by demonstrating new investing opportunities because there is a plenty of cash left with the firm even after dividend payment and there are no suitable investment alternatives.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Dogfight over Europe: Ryanair (A) Case Solution

- Dove: Evolution of a Brand Case Solution

- Dow Chemicals Bid For The Privatization Of PBB In Argentina Case Solution

- Dow's Bid for Rohm and Haas Case Solution

- Dr. Tim's Premium All Natural Pet Food: Growth Options and Web Analytics Insights Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.