Get instant access to this case solution for only $19

Dow's Bid for Rohm and Haas Case Solution

This case discusses an acquisition option before Dow Chemical Company. The option of $18.8 billion acquisition offers a chance to expand the horizons of the company internationally and position itself as a major player in the chemical industry. However, the unexpected wave of gigantic economic meltdown that started in the end of 2008 made it very difficult for the company to close the transaction deal. The sales of the company declined quickly and to make matters worse, PIC refused to close the proposed joint venture with the Dow Company. Dow company was expecting to finance the acquisition of “Rohm and Haas” through the cash generated by joint venture with PIC. Resultantly, Dow refused to close the acquisition deal due to which it got sued by Rohm and Haas Company.

Following questions are answered in this case study solution:

-

Why does Dow want to buy Rohm? Was the $78 per share bid reasonable?

-

What are major risks inherent in the merger transaction? How and to whom does the merger agreement allocate these key risks?

-

As of early February 2009, what should Andrew Liveris do and what should Raj Gupta do?

-

If you were the judge in the Delaware Court of Chan-cery, how would you resolve this legal dispute?

Dow s Bid for Rohm and Haas Case Analysis

1. Why does Dow want to buy Rohm? Was the $78 per share bid reasonable?

The newly elected chief executive of the Dow Company had adopted a long term strategy to accelerate and stabilize the financial growth of the company. The idea was to make Dow a manufacturer of high quality, non-cyclic and high value commodity chemicals instead of being a traditional manufacturer of low quality and highly cyclic products. Being a market leader, Dow had earned the reputation of being innovative and successful in introducing new chemical products to cater to the ever changing needs of costumers. Dow had earned this reputation through a successful series of acquisitions and mergers in the recent history. Some businesses were even sold out to achieve the objective of carrying low assets and earning greater return by increasing the value addition in the value chain.

The acquisition of Rohm and Haas was an ideal opportunity for the company because, considering the market conditions at that time; it was difficult to find such a complete package for acquisition. The financial performance of the company was good, and it was expanding globally by expanding into India, China and Middle East. The Dow Company had always wanted to become a producer of specialty chemical products like polymer business. Rohm and Haas had outclassed Dow in the Polymer business. By acquiring the former company, Dow can not only eliminate its fiercest competitor, but also become a top supplier of specialty chemicals. Successful acquisition of agriculture business of “Rohm and Haas” and various long term projects with the same company in the past made it clear that integration of the company with Dow will not be very difficult.

By acquiring Rohm and Haas, Dow will not only become the biggest supplier of acrylic polymers to the coatings industry but also emerge as a great global player of chemical industry. The influence of the company in China and India will increase enormously. Furthermore, the technical expertise and brand name of Rohm and Haas will serve to enhance the manufacturing capacity of electronic chemicals, ion exchange and plastics. The market share of the company will increase tremendously, and this approach of growth is exactly in line with the strategy of the new CEO of Dow Chemicals.

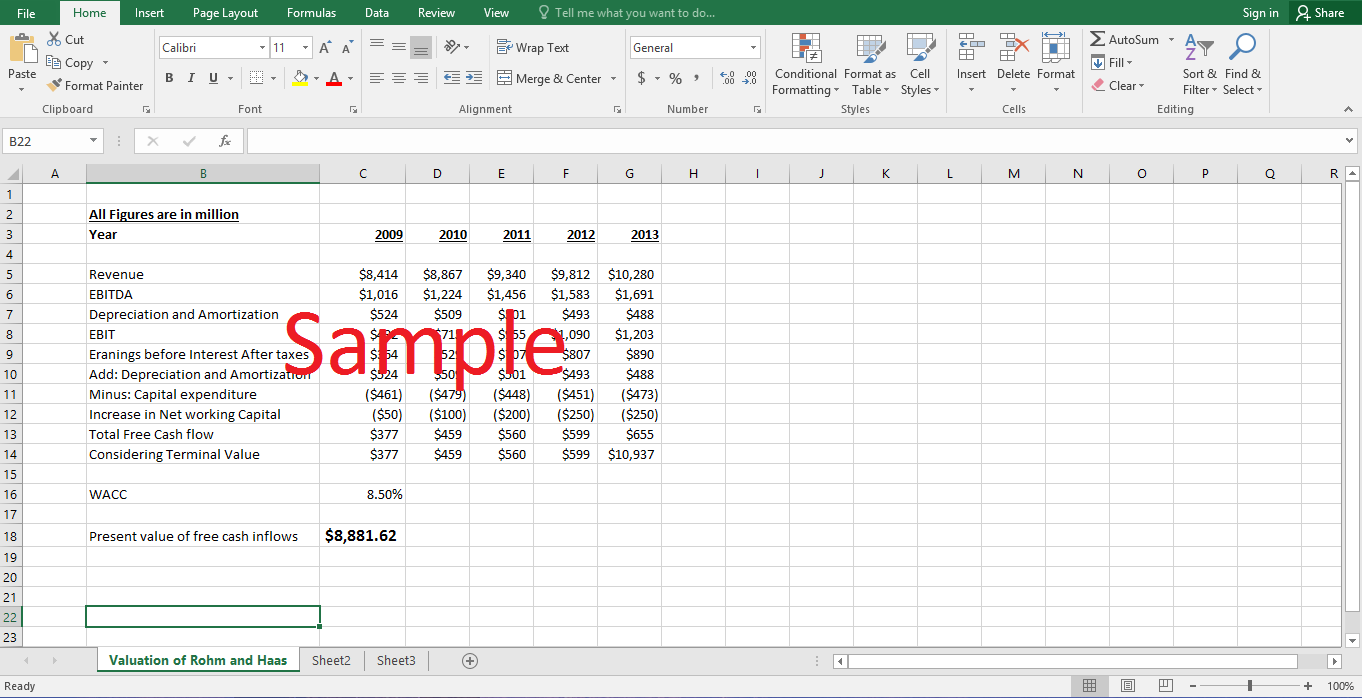

Although, huge premium associated with the share price of $78 per share looks very formidable, but if the market and financial position of the company after the acquisition is considered, the premium associated with the share can be justified. The present value of cash inflows comes out to be $8,881 million. This value is far less than the price agreed by Dow Company ($15.3 billion). The immense premium associated with this transaction is in essence the price of goodwill and all the creativity and market savvy earned through great effort by Rohm and Haas Company. In addition to the technical expertise and advanced manufacturing facilities, Dow Company will also acquire famous brand names like Rhoplex, Primal, Acrysol and Rhopaque in the coatings industry. So, the financial projections and the NPV calculated on the basis of these projections underestimate the true values of goodwill and brand names of the product lines of the company.

“Rohm and Haas” has already built successfully the infrastructure, brand name and costumer loyalty required for global expansion. So, Dow Company will have little work to do to materialize its dream of becoming a global player of specialty products. In addition to sophisticated manufacturing facilities, Dow will also acquire the experience, resources and time invested in R&D facilities for innovation and product development. So, ignoring the financial distress that occurred lately, it can be concluded that the premium embedded in the share price of $78 per share is justifiable and reasonable.

2. What are major risks inherent in the merger transaction? How and to whom does the merger agreement allocate these key risks?

The provision related to financing in the merger transaction posed some very serious risks for Dow Company. The Company was expecting to fund the acquisition through cash provided by bridge loan of the consortium and the joint venture of Kuwait Company. The parent company bore the default risk associated with these commitments. There was also a risk that the company could not satisfy the demands of consortium to ensure a healthy cash flow in the company. If the company fails to honor the merger transaction, it is liable to pay a fine of $3 million for each subsequent day.

The provision related to the closing date of the merger transaction also posed a risk for the parent company to honor the deal within the limited time frame. Similarly, the provisions related to Ticking fee and merger consideration also bind Dow Company to pay the price of acquisition on day date otherwise the consideration per share will increase by 8% per annum. The provision related to material adverse effect poses a risk to “Rohm and Haas” company because in case of a widespread financial distress, Dow will not be bound to acquire the company. It is a risk for the company because all the stakeholders like shareholders, management and employees will make their decisions based on the assumption that the company will be acquired at their desired price on a specific date. The “No Solicitation” provision binds Rohm and Haas Company to look for alternatives and the company cannot terminate the agreement just because another company has offered a better price.

The “Hell or High Water” provision binds Dow to deal with all the legal and regulatory disputes with the government to make sure that the merger does occur on due time. This provision poses a risk to Dow Company of extra ordinary fees or charges associated with litigation or lobbying. The “closing conditions” provision essentially poses a threat to Rohm and Haas because this provision gives some relaxation to Dow regarding merger transaction in case of extra ordinary events.

3. As of early February 2009, what should Andrew Liveris do and what should Raj Gupta do?

Both the CEO’s should strive for the best interest of their shareholders. Andrew Liveris should try to buy time through litigation and try to substantiate the “Material Adverse Effect” provision of the agreement. Although high risks of financial loss are associated with all the options available to Andrew, fighting to substantiate MAE in the court seems to be the best available option for him. However, if the court rejects the MAE provision, then Andrew should raise the funds required for acquisition by issuing perpetual proffered equity. This financing option will minimize the negative effects on the credit rating of the company. Since perpetual equity is counted towards capitalization ratio, the company can satisfy the bridge loan covenant that requires the maintenance of the ratio at 65%.

Andrew should put some of the financial burden on major shareholders of Rohm and Haas Company rather compromising on the dividend policy of the company that affects shareholders across the board. The company should reduce dividends for some time, but it should never cut the dividends completely. In order to make up for PIC mishap, the company should look to sell some other business to the Kuwaiti companies to raise a part of cash required for acquisition.

Gupta, on the hand, should try his best to avoid the “re-negotiation” option because he has the fiduciary duty to shareholders to stick to $78 per share price. It is in the best interest of Rohm and Haas that Dow does acquire the company because all the stake holders have made their investment decisions based on the assumption that the acquisition will take place.

4. If you were the judge in the Delaware Court of Chan-cery, how would you resolve this legal dispute?

The judge should look at the impact of recent macroeconomic events on the ability of Dow to honour the merger deal. He should assess whether Dow made reasonable efforts to complete the acquisition or not. A complete analysis based on these assertions shows that although Dow has been hit badly by recession, the company still has the ability to raise the requisite amount of funds to buy Rohm and Haas. Although these financing options put Dow Company in a very difficult position, it is the best decision in the present circumstances. So, the Judge should ask the Dow Company to close the deal.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Dr. Tim's Premium All Natural Pet Food: Growth Options and Web Analytics Insights Case Solution

- Ducati and Investindustrial: Racing out the pits and over the finish line Case Solution

- Dynashears Inc Case Solution

- Eagle Industries Office Supplies Sourcing Case Solution

- Eastern Waves, Inc. Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.