Get instant access to this case solution for only $19

Dow Chemicals Bid For The Privatization Of PBB In Argentina Case Solution

The case is about Dow Chemicals’ bid for the privatization of Petroquimica Bahia Blanca (PBB). PBB, a producer of both Ethylene and Polyethylene in Argentina, is being privatized by the local government. Dow holds a leading market position in Ethylene and Polyethylene, and wants to utilize this opportunity to expand into Argentina. Dow has developed a three-stage operational strategy for expansion of its polyethylene operations in Argentina. The acquisition of PBB represents the first stage of the strategy and provides a gateway to the second and third stage. The cash flows from each stage of the project have been valued using the discounted cash flow (DCF) approach. The discount rate for the valuation has been adjusted for the country risk premium, and a modified version of CAPM has been used to calculate a best case and a worst case estimate of the discount rate. This gives us a range of possible acquisition values for PBB. Given that the acquisition also enables Dow to benefit from the from the high cash flows of the second and third stage of the project and that other parties are also interested in the acquisition, it is recommended that Dow bids a relatively high price of $280 million for PBB.

Following questions are answered in this case study solution:

-

Executive Summary

-

Introduction

-

Analysis

-

Additional Risk in Argentina

-

The CAPM Approach

-

Country Risk Premium

-

The Adjusted Discount Rate

-

Other Relevant Factors

-

Conclusion

Dow Chemicals Bid for PBB Case Analysis

2. Introduction

Dow had been interested in the Argentina market since the 50’s when it asked the Argentine government to develop a petrochemical complex. The government developed the complex in the late 70s and this led to the creation of PBB. In a bid to become more open and attract foreign direct investment, the government decided to privatize PBB in 1995. The expected growth of Argentina and the high forecasted demand for Polyethylene made PBB an attractive acquisition. Dow was a multinational company with 94 plants across 30 countries. Dow had a presence in several countries of Latin America, including Argentina. Polyethylene represented about 15% of Dow’s total revenue and roughly 35% of its profits. It saw the PBB acquisition as once in a lifetime opportunity to establish a stronghold in the Argentinean market. Dow faced some competition in its bid for PBB. Copesul, a Brazilian company and Perez Company, a local Argentinean firm, had teamed up to bid against Dow.

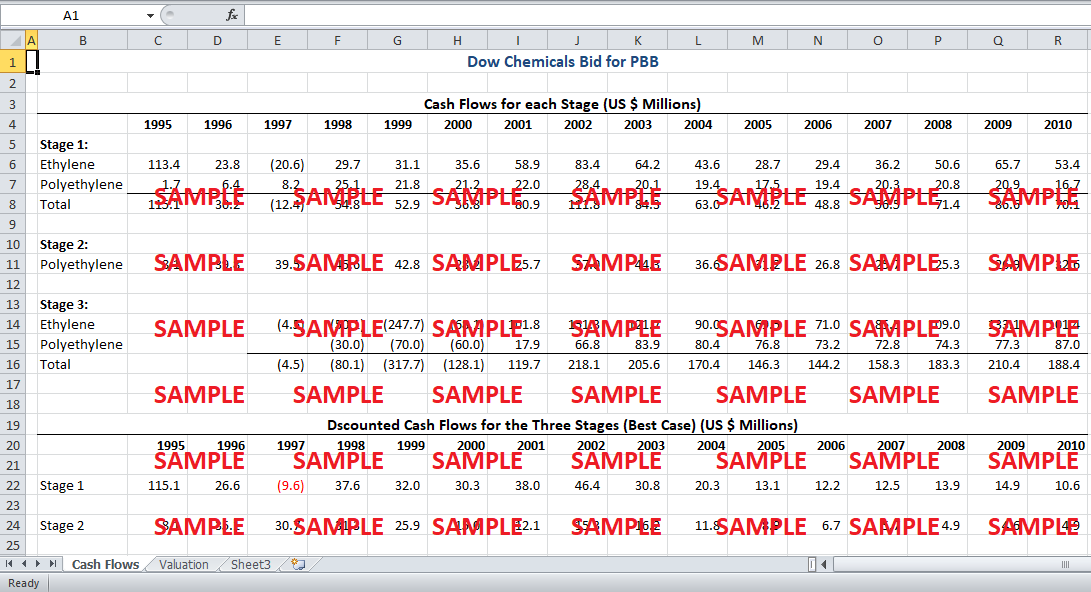

There were significant complications with respect to the benefits from a potential acquisition of PBB by Dow Chemicals. Dow expected the cash flows to be generated in three separate stages. The first stage involved an upgrade of the PBB facilities to make them internationally competitive. The second stage comprised of an acquisition of two polyethylene plants. The company would have to negotiate with a private company Ipako that was owned by a local businessman. The stage comprised of building new plants to expand capacity. Dow was looking for a partnership with YPF for the supply of ethane for the upgraded facilities. This deal was crucial to the success of the third stage. The Argentinean market was volatile and the country’s currency had experienced many currency devaluations in the past. Before making a bid, Dow has to decide on country risk premium and exchange rate risk before deciding on an appropriate discount rate for the cash flows.

3. Analysis

As far as polyethylene market is concerned, Dow Chemical lacks a strong footing in Argentina. If Dow Chemical decides against operating in a strong growth region like Argentina, it might be risking its leading position in polyethylene. On the other hand, Dow has sufficient operating experience in Argentina through Dow Quimica. The PBB project fits Dow Chemical’s strategy to be a cost leader through horizontal/vertical integration, technological leadership, and global presence. PBB is large Argentinean Company which represents 25% of the total Mercosur production. Due to its economies of scale, its local competitors in Argentina will have a cost disadvantage. If will be difficult for Dow to impose its dominance in the Argentinean market if another company acquires PBB. The three project stages represent a unique opportunity to rapidly build a large scale operation. Nevertheless, there are certain uncertainties involved with the second and third stages. More importantly, the later stages cannot be undertaken independently; they depend on stage one - the acquisition of PBB. Therefore, the acquisition of PBB represents a vital step Dow’s plan to expand into Argentina.

4. Additional Risk in Argentina

Due to the interests of other competitors and the advantages offered by this unique opportunity, Dow Chemicals has to make a serious bid offer for PBB. The cash flows from each stage of the project have already been estimated. The discounted cash flow (DCF) approach can be employed to discount the cash flows and obtain the intrinsic (present) value of PBB. However, investing in the Argentinean market pose certain risks that need to be taken into account before the DCF approach can be employed. Two of the major risks are the country risk and exchange rate risk. It is believed that the exchange rate risk has substantially subsided because of the recent measures taken by the Argentinean government to stabilize its currency. Moreover, if the company feels that the exchange rate risk is significant at any time in the future, it can hedge this risk by entering into currency futures contracts. Similarly, other hedging techniques can also be employed to minimize the exchange rate risk. Therefore, such a risk does not need consideration when determining the worth of PBB.

5. The CAPM Approach

On the other hand, Exhibit 12 clearly indicates the presence of a significant country risk. We will adjust the discount rate to reflect the additional country risk of operating in Argentina. One possible approach is to adjust the CAPM equation for the country risk premium. In the equation, the country risk premium is added to the market risk premium before multiplying it by the company’s beta. Therefore, the CAPM equation becomes:

Rs = Rf + β * (MRP + CRP)

We do know that required return without the country risk premium is between 8% and 10%. If we can estimate the risk-free rate and the market risk premium, we can use that information to get a range of possible betas for the company. Exhibit 12 gives us information about the riskfree rate in the US. It remains at 5% for a long period of time; then it slightly in mid-1993; it shaping to get back at the 5% level towards the end of 1995. Based on the evidence from exhibit 12, it is assumed that the riskfree rate is 5%. Based on the results of surveys and historical information, the market risk premium can be reliably assumed at around 5% (Fernandez and Baonza, 2010). Using this information, the beta can be calculated to range from 0.6 (when US discount rate is taken to be 8%) to 1 (when US discount rate is taken to be 10%). The calculation is shown in the attached spreadsheet. Once the information about the riskfree rate (Rf), the market risk premium (MRP) and the beta is available, we only need to calculate the market risk premium to arrive at the appropriate discount rate for Argentinean market.

6. Country Risk Premium

One of the methods of calculating the country risk premium is to calculate the bond yield spread between the Argentinean and the US market and then adjust it for the relative equity market volatility for Argentina. The bond yield spread is meant to account for the difference in risk free returns between the US and the Argentina market. The higher riskfree yield is Argentina is intended to compensate for the higher default risk of operating in Argentinean market. It also compensates for the difference geopolitical and environmental factors. The bond yield spread can be estimated from exhibit 12. The dotted line in exhibit 12 is the estimate of the bond yield spread over the stated period. The spread becomes insanely high during periods of crisis, but for the majority of the period between 1991 and 1994, the spread remains between 5% and 7%. The spread can be seen to be returning to this level at the end of 1995, after the stabilizing measures taken by the government. It is believed that a bond yield spread of 6% will be an appropriate measure to use on a long-term basis. The recent country ratings for Argentina by Moody’s rating agency confirm this assumption. The bond yield spread of 6% needs to be adjusted for the equity market volatility factor. The equity markets are more volatile than the bond market and the volatility factor, therefore, accounts for the added risk. The volatility factor can be calculated by dividing the standard deviation in equity market by the standard deviation in bond market. The equity market volatility factor has been found to be averaging around 1.5 times in the developing markets (Damodaran, 2012). It is assumed that Argentinean market has the same volatility. Using the bond yield spread and the equity market volatility, a country risk premium of 9% has been calculated for Argentina (calculations shown in attached spreadsheet).

7. The Adjusted Discount Rate

This estimated of country risk premium can be utilized in the CAPM equation above to calculate the discount rate for Argentina. Our estimates of beta vary from 0.6 to 1 because of the range of US discount rates used. Therefore, the Argentinean discount rate also varies depending on the US discount rate used. For a US discount rate of 8%, the beta comes out to be 0.6 and the Argentinean discount rate is calculated to be 13.4%. For a US discount rate of 10%, the implied beta is 1, and the Argentinean discount rate is calculated to be 19%. Therefore, the appropriate discount rate for PBB is between 13.4% and 19%. We can use both these estimates to calculate the discounted cash flows for the three stages of Dow’s planned acquisition. The cash flows with 13.4% discount rate are termed the ‘best case’ cash flows, while the cash flows with 19% discount rate are termed the ‘worst case’ cash flows. They will give us a range of possible acquisition values for PBB.

8. Other Relevant Factors

Besides the explicit cash flows, there are other factors that might influence the decision of Dow Chemicals regarding acquisition of PBB. PBB has very good competitive attributes: proximity to two of the largest gas basins in Argentina, easy access, proximity to Buenos Aires – the largest market, and good infrastructure and human resources. All these factors will enable Dow to manufacture high quality, cost effective product. The probability of risk from foreign exchange fluctuations is limited and can be hedged. The freight charges and duties are also limited because majority of the product will be sold locally within Argentina. The regulations regarding capital repatriation have been improved and are not expected to change in the future. All of these factors make PBB an attractive acquisition for Dow Chemicals.

9. Conclusion

The minimum bid, as required by the privatization rules, is $150 million. The intrinsic value of PBB, as calculated by DCF approach is between $384 million and $545 million. However, only 51% of the total value of PBB is being sold, while the remaining 49% will be retained by the government. For a 51% stake, the range of intrinsic values is between around $200 million and $280 million. However, this is only the intrinsic value for the stage 1 of the project alone, Besides giving a 51% claim on the stage 1 cash flows, the acquisition of PBB will also provide Dow with an option to proceed with stage 2 and stage 3 of the project. The value of such an option should also be taken into consideration when deciding on a bid price for PBB.

Although there are significant uncertainties attached with the second and third stage, their cash values translate into significant value for Dow. The cash flows from stage 2 are valued between $200 million and $280 million, but Dow will also need to acquire Ipako to realize them. Similarly, the cash flows from are valued between $130 million and $430 million, but Dow will have to reach a deal with YPF.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Dow's Bid for Rohm and Haas Case Solution

- Dr. Tim's Premium All Natural Pet Food: Growth Options and Web Analytics Insights Case Solution

- Ducati and Investindustrial: Racing out the pits and over the finish line Case Solution

- Dynashears Inc Case Solution

- Eagle Industries Office Supplies Sourcing Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.