Get instant access to this case solution for only $19

Diageo Plc Case Solution

Diageo was conglomerate involved in food and beverage industry in 1997. Initially founded by a merger between Grand Metropolitan and Guinness, the company went to become a significant player in the industry. For a number of reasons (low borrowing cost, investor confidence), Diageo opted to keep a conservative capital structure with low levels of debt. Three primary factors governed the capital structure policies of Diageo. They included Interest coverage ratios, EBIT to debt ratio and a target rating of A+. The simulation model constructed by the treasury group of Diageo clearly reflected that the company was underleveraged and could increase its market value by taking on more debt and using it to finance internal growth and acquisitions. Although, the simulation provided an in depth analysis for decision making; it lacked analysis on the operational factors affecting the capital structure policies. Moreover, it also ignored the benefits of a higher EBIT resulting from expansion through debt.

Following questions are answered in this case study solution:

-

Describe briefly Diageo’s business, putting particular emphasis on the potential sources of risk, and your evaluation thereof. Identify major sources of risk for equity holders and for debtholders.

-

Describe Diageo's current approach to managing its capital structure. What are the key variables that guide its capital structure policy?

-

What factors should Diageo consider in determining its capital structure? What information would you collect and what analyses would you conduct in order to determine the appropriate level of gearing?

-

How does the Treasury Group's simulation work? What aspects of Diageo's business does it capture? What does it ignore? What key assumptions does it make? How could you improve the model to adjust any missing factors?

-

What are the managerial implications of the summary results shown in Figure 2 of the case? As Ian Cray, what questions would you ask the Treasury team in reviewing their work? What should Cray recommend for Diageo's gearing when it becomes a pure beverage alcohol business? Frame your recommendation in terms of a target level of interest coverage or a target bond rating.

Diageo Plc Case Analysis

1. Describe briefly Diageo’s business, putting particular emphasis on the potential sources of risk, and your evaluation thereof. Identify major sources of risk for equity holders and for debt holders.

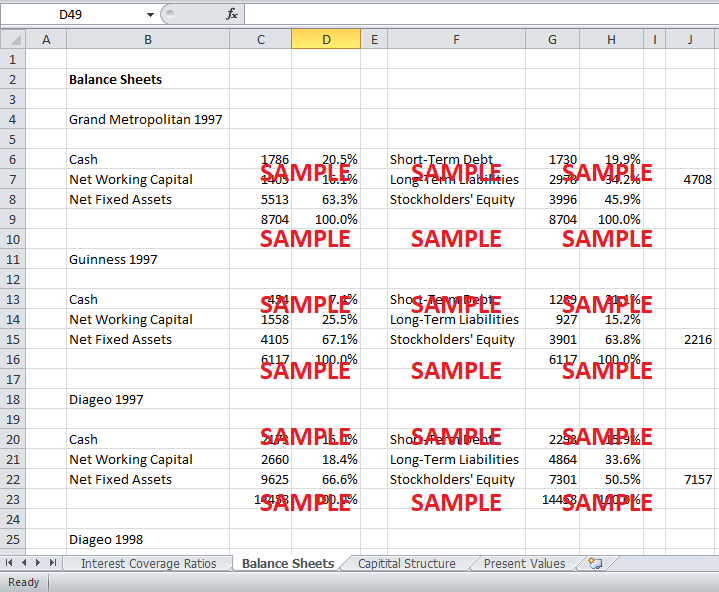

Diageo was formed as a result of a merger between Grand Metropolitan and Guinness and resultantly became the world’s seventh largest food and beverage company. Diageo has four main business divisions namely Spirits and wine, Guinness Brewing, Packaged food and Restaurants. Prior to divesting its packaged food subsidiary, Pillsbury, and restaurant, Burger king, Diageo was a conglomerate with diversified business interest. Diageo’s presence in dissimilar food and beverage industries reduced its business risk through diversification.

Diageo’s equity holders are vulnerable to fierce competition from other players in the industry since it competes in an industry where several large players fight for a share in the food and beverage market. Both the debt and equity holders are also exposed to interest rate risk, which exists because of fluctuations in the market interest rates. More significantly, Diageo is exposed to exchange rate risk as mentioned in the case. The company has significant multinational operations, and the dealings in various currencies expose it exchange rate risk.

On the other hand, debt holders in Diageo are less vulnerable to default risk since the company has a high interest coverage ratio and is rated investment grate by rating agencies. The investors are also fairly secured against liquidity risk since the company had about 22% of its assets in cash in 1998. Other sources of risks for debt and equity holders include political risk and credit risk.

2. Describe Diageo's current approach to managing its capital structure. What are the key variables that guide its capital structure policy?

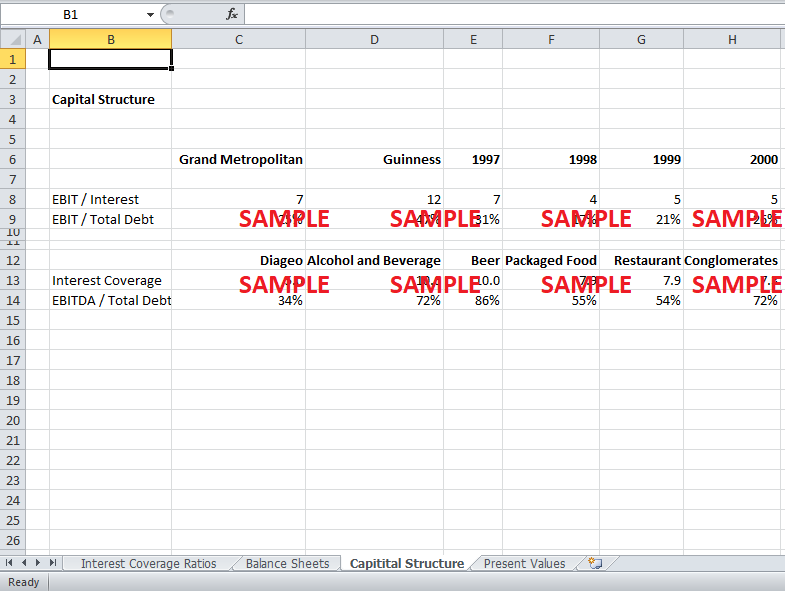

Diageo’s current approach to managing its capital structure is conservative and aggressive. The company aims to keep the level of gearing low in order to ensure investor confidence. Three primary variables guide Diageo’s capital structure policy:

-

Rating of A+ or Above: Ever since its formation by the merger of Grand metropolitan and Guinness, Diageo has strived to maintain an investment rating of A+. The investment grade rating enables the company to borrow at low costs i.e. the firm is able to issue bonds with a much lower yield and make low interest payments due to its rating. Moreover, the rating has facilitated Diageo’s access to the commercial paper market providing it with a source of cheap, unsecured and short term debt. Lastly, as mentioned before, a higher rating ensures public confidence and maintains investment in the company.

-

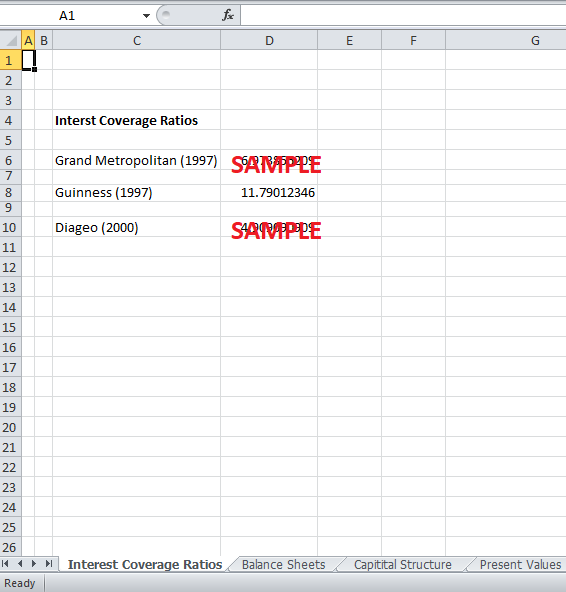

Interest Coverage Ratio Between 5 and 8: Diageo has correctly adopted interest coverage ratio as a benchmark for its debt level. Under the policy adopted by Diageo, the interest coverage ratio needs to be kept within the range of 5 to 8 times. Diageo engaged in debt issuance and share repurchases in order stay within this band.

-

EBITDA/Total Debt Between 30 to 35 %: Another significant guiding measure for the company was the ratio of EBITDA and total debt. Simply put, Diageo strived to keep its earnings to a certain proportion of total debt so that the company did not run into the risk of defaulting from its obligations.

3. What factors should Diageo consider in determining its capital structure? What information would you collect and what analyses would you conduct in order to determine the appropriate level of gearing?

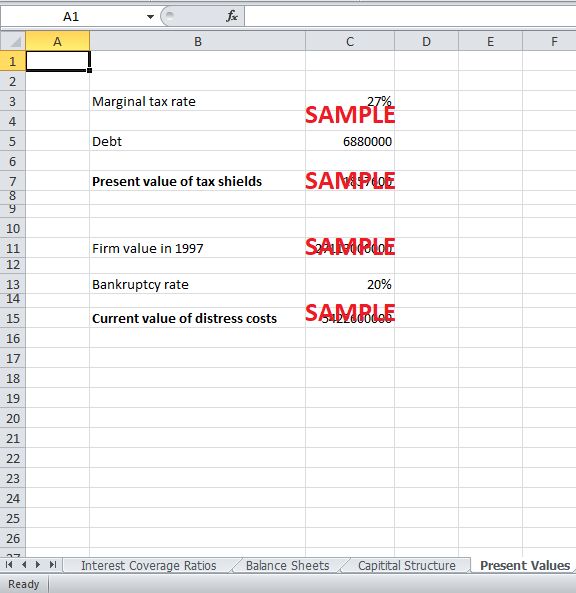

The primary factor that dictates the capital structure of Diageo and indeed any other firm is the balance between increased tax shield benefits and the cost of financial distress. The two factors oppose each other because as Diageo increases its debt level, it gets the advantage of higher tax shield benefits but at the same time incurs high financial distress costs (costs of legal proceedings, bankruptcy, lower rating etc.). Typically, firms try to balance financial distress against tax shield benefits of when making capital structure decisions. For Diageo the tax shield benefits are clear (Diageo has a marginal tax rate of 27%); however, the costs of financial distress are difficult to predict or measure. But since the firms who experience financial distresses usually have high levels of gearing, Diageo is considered to be relatively safe from potential bankruptcy and legal costs.

In order to balance the tax advantages of gearing with costs of financial distress, their values need to be calculated. Based on the information given in the case and in exhibit 1, the Present value of tax shields comes out to be 1858 million dollars. The financial distress costs are more difficult to estimate. However, given the information in the case they can be estimated to be around 20% of firm value (which comes out to be 5423 million dollars). More conclusive guidance for Diageo’s capital structure comes from figure 2, which shows that the sum of financial distress costs and taxes paid is minimized at an interest coverage ratio of 4.2. Since Diageo’s current ratio is around 5, the company can be more aggressive in its approach towards taking debt.

4. How does the Treasury Group's simulation work? What aspects of Diageo's business does it capture? What does it ignore? What key assumptions does it make? How could you improve the model to adjust any missing factors?

The Monte Carlo simulation demonstrates that the probability of financial distress is more with a higher level of debt but also corresponds with higher tax shield benefits. The model predicts Earnings before Interest and Taxes (EBIT), as a component of three variables, namely return on assets (linked with operating cash flow), exchange rate, and interest rates. The Monte Carlo model also considers many other risks through financial distress factors e.g. demand risk (consumers may not buy Diageo’s products) and competitive risk.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.