Get instant access to this case solution for only $19

Diamond Chemicals PLC (A): The Merseyside Project Case Solution

Diamond Chemicals PLC is a major competitor in the chemical industry and one of the leading producers of polypropylene. Lucy Morris who is the plant manager of the Merseyside plant is recommending a £9 million project to renovate and modernize the plant. The initial analysis done by the plant controller Greystock had raised several objections that needed to be addressed. Revised cash flow analysis suggests that the company should go for the project as it met all the performance hurdles. The timing of the project is also perfect considering that the economy is in a downturn. Strategically, this project is essential for the company in order to preserve their lower cost advantage.

Following questions are answered in this case study solution:

-

What changes, if any, should Lucy Morris ask Frank Greystock to make in his discounted-cash-flow analysis? Why? What should Morris be prepared to say to the Transport Division, the Director of Sales, her assistant plant manager, and the analyst from the Treasury staff?

-

How attractive is the Merseyside project? By what criteria?

-

Should Morris continue to promote the project for funding?

Diamond Chemicals PLC A The Merseyside Project Case Analysis

1. What changes, if any, should Lucy Morris ask Frank Greystock to make in his discounted-cash-flow analysis? Why? What should Morris be prepared to say to the Transport Division, the Director of Sales, her assistant plant manager, and the analyst from the Treasury Staff?

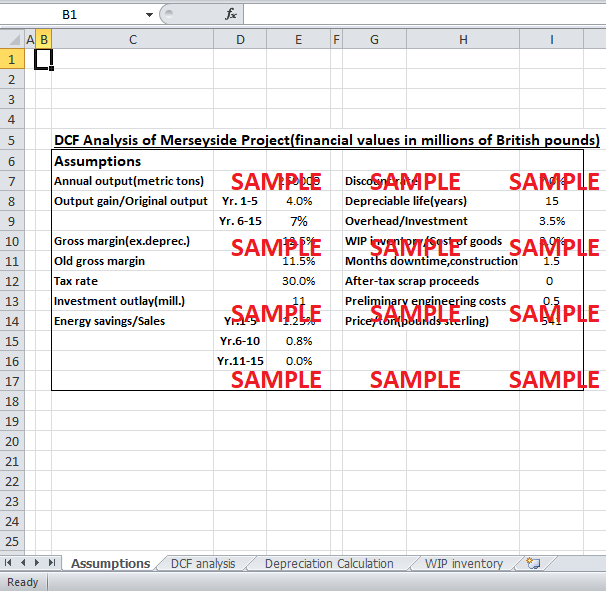

The initial discounted cash flow analysis done by Greystock contains several errors that need to be corrected. Greystock has included 0.5 million ‘preliminary engineering costs’ as an expense in the first year of his forecast. These are sunk costs that have already been incurred and cannot be recovered. In DCF analysis, only future costs are relevant; hence, 0.5 million should be removed from the year 1 forecast. The 2 million costs to purchase rolling stock to support the anticipated growth have also not been included in the DCF analysis. This 2 million transportation investment and the related 10 years depreciation should be considered when analyzing the project because the tanker cars are necessary to support the increased throughput, an outcome of this project. The point raised by Andrew Gowan from the treasury staff is a valuable one and should be taken into account. A basic rule of DCF analysis is that real cash flows should be discounted using a real discount rate and vice versa. Hence, nominal discount rate (10%) used in Greystock’s analysis should be adjusted for inflation (3%), and a real rate of 7% should be used to discount the incremental cash flows of the project. Greystock’s DCF analysis also concludes that all lost customers will return within one year, which is a very aggressive assumption. A more conservative approach would be to assume that not all customers would return so rapidly. A ramp up period should be accounted for before it is possible to reach the 7% additional revenue of the project. As a result of this approach, both NPV and IRR would be reduced accordingly. The concern put forth by the director of sales should be considered as well in the DCF analysis because a more efficient Merseyside plant is likely to cannibalize sales from Rotterdam plant.

Apart from the assistant plant manager, Lucy Morris should convey to everyone else that their respective concerns and recommendations will be included in the revised DCF analysis. As far as Tewitt’s proposal related to EPC is concerned, it represents an ethical issue. Developing EPC may seem a good idea considering the company’s competitive strength but the description from the assistant manager clearly shows that he is putting personal benefits above other stakeholder’s benefits. Hence, Morris should reject the EPC proposal.

2. How attractive is the Merseyside project? By what criteria?

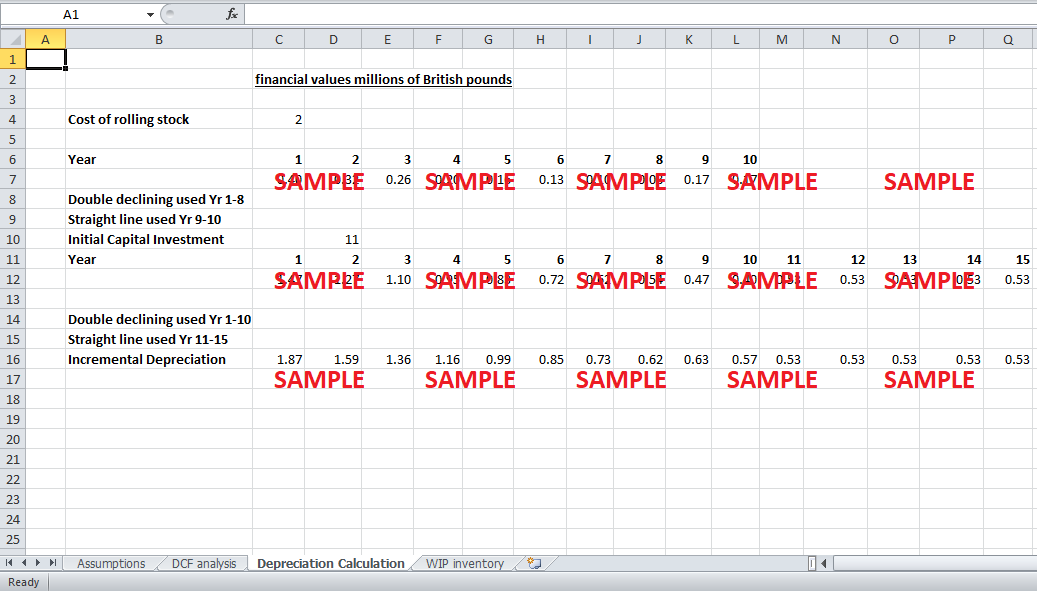

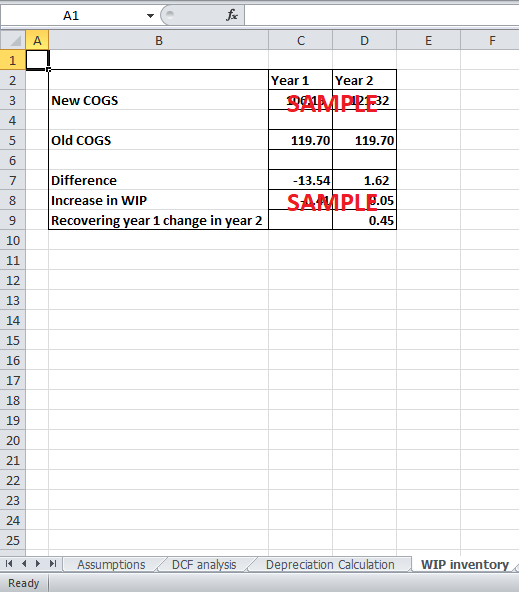

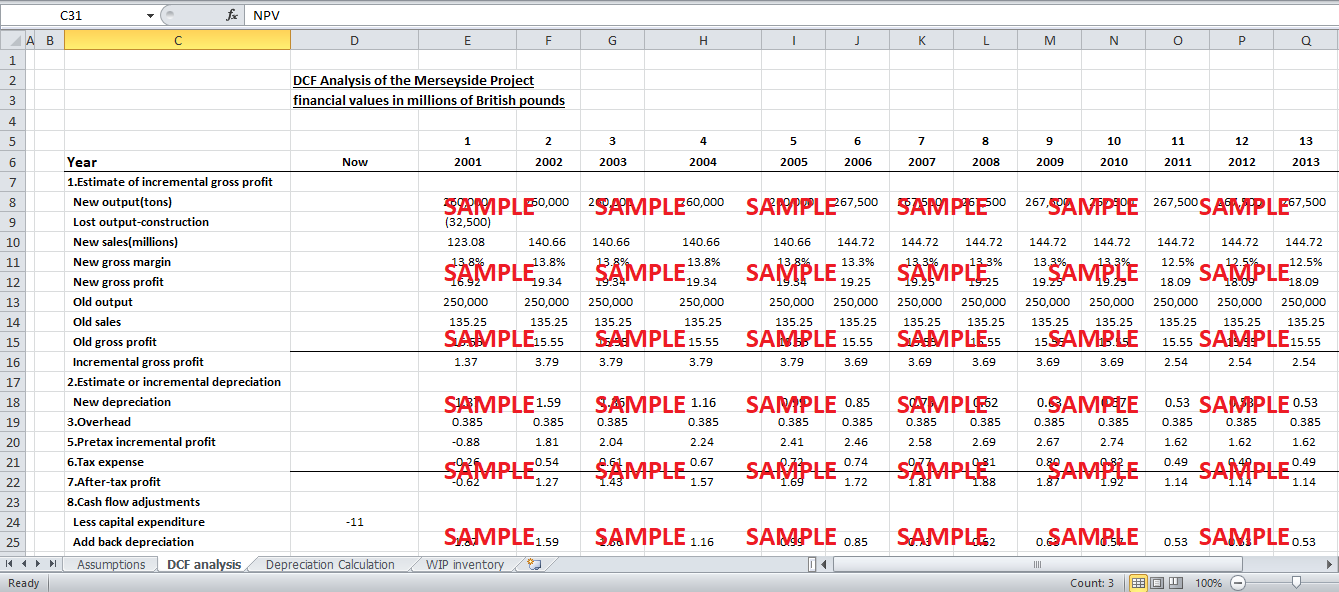

In order to gauge the attractiveness of the Merseyside project we have recalculated the discounted cash flows. In the revised DCF analysis, there have been addressed all the above mentioned issues. Due to lack of information related to cannibalization effect and ramp up period there have been assumed that the increase in manufacturing throughput will be 4% for the first 5 years in order to take into account the time required to win back lost customers, cannibalization effect and time taken by the economy to get out of the recession. In the remaining years, the increase in throughput rate would equal 7% as mentioned in the case. Depreciation expense has also been recalculated to include the depreciation of rolling stock. The 2 million transportation investment is assumed to be incurred at the start of the project and is included in the initial outflow. The increase in net working capital during the first year caused by an increase in work in process inventory is assumed to be recovered during the second year. Sunk costs have been removed, and inflation adjusted discount rate of 7% has been used for discounting.

Results of the revised DCF analysis clearly indicate that the Merseyside project should be accepted as it fulfills the criterion set by the management. Payback period of the project is expected to be 4.5 years, which is less than the 6 years limit. IRR is calculated at 20%, which is less than the hurdle rate of 10%. Above all, the NPV which is the best measure to determine the financial feasibility of a project is also positive (£9.12 million) and hence if accepted, the project is expected to increase the shareholders wealth. A close look at the free cash flows of the project shows us that apart from the initial investment all other cash flows are positive, which is a big plus for the company. The contribution to net income is also positive from the contemplated project which would positively impact the average annual earnings per share. Thus, the project passes all the four performance hurdles of the company.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.