Get instant access to this case solution for only $19

Crystal Meadows of Tahoe Case Solution

Crystal Meadows of Tahoe (CMOT) is looking to make significant investments in the upcoming year, and wants to finance a majority of the funding from cash generated by operating activities. The cash flow statement from 1991 has been constructed using direct and indirect methods. While the indirect methods provides a reconciliation between accounting income and actual cash from operating activities, the direct method provides additional information about the major sources and uses of operating cash flow. The cash flow statement reveals that the company generated significant cash flow from operating activities, but used a majority of the cash on investing activities (capital expenditures). However, if the company can maintain its operating performance during 1992, it may have enough cash towards the end of the fiscal year to finance a considerable portion of its proposed investments from internal sources.

Following questions are answered in this case study solution

-

Prepare a statement of cash flows for CMOT for fiscal year 1991 using the indirect method. Organize the cash flows into cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Does your statement explain the change in cash and cash equivalents between the beginning and end of 1991?

-

Prepare a schedule of cash flows from operations using the direct method. Is this schedule more or less informative about the company's operations than the one prepared by the indirect method in Question 1?

-

What does the analysis of cash flows reveal about CMOT that was not evident from analysis of the income statements and balance sheets?

-

Will Crystal Meadows of Tahoe be able to finance its planned 1992 capital investment program with cash provided by operations during that year?

Case Analysis for Crystal Meadows of Tahoe

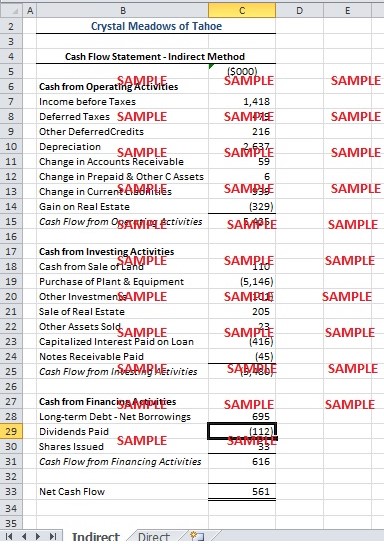

1. Prepare a statement of cash flows for CMOT for fiscal year 1991 using the indirect method. Organize the cash flows into cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Does your statement explain the change in cash and cash equivalents between the beginning and end of 1991?

Crystal Meadows of Tahoe (CMOT) is a holding company for two independent ski resorts. The majority of revenues are generated from the sale of lift tickets, skiing lessons, ski rentals, and sale of food and beverages. Winter months are the primary source of revenues, making the business highly seasonal. Accurate cash flow forecasting is necessary for a seasonal business because the cash position can vary from time to time. The indirect method of constructing cash flow statement divides the cash flows into separate categories. One way of categorizing the cash flow is by dividing it into three areas: cash from operating activities, cash from investing activities, and cash from financing activities. The attached spreadsheet calculated the cash flow using this indirect method. The sum of the three sources of cash flow gives us the net change in cash flow. The net cash flow, as calculated in the spreadsheet, is equal to the change in balance sheet cash flow from 1990 to 1991, adjusted for notes receivables.

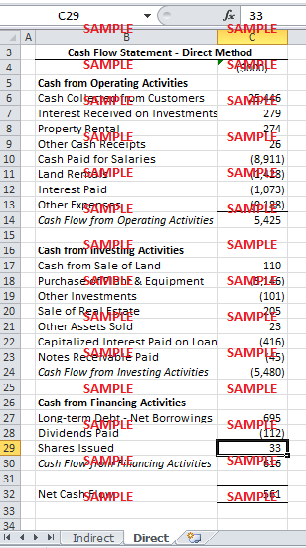

2. Prepare a schedule of cash flows from operations using the direct method. Is this schedule more or less informative about the company's operations than the one prepared by the indirect method in Question 1?

The attached spreadsheet also details the cash flow statement calculated using the direct method. It should be noted that the operating cash flow calculations under the direct method is different from the calculations under indirect method. However, the calculations for investing and financing cash flows remain the same under both methods. While the methods used to calculate operating cash flows are different, both direct and indirect methods result in the same dollar amount of cash flow. Nevertheless, the direct method of cash flow can give us more detailed information about a company’s operating activities. The indirect method uses the information that is already contained in the income statement and balance sheet. Indirect method starts from reported income and works backwards by making adjustments to that reporting income. While it provides a reconciliation between net income and operating cash flow, it does not reveal any new information that could not be obtained from the balance sheet or income statement itself. On the other hand, the direct method reveals more information about the particular uses and sources of operating cash flow. It gives us information about the major areas that generate cash and the main operating activities that use the cash. Such information is not available from other sources such as income statement and balance sheet, and can be used to improve cash management.

3. What does the analysis of cash flows reveal about CMOT that was not evident from analysis of the income statements and balance sheets?

The 1991 income statement for CMOT reveals a net income of $1,418,000. This income is $747,000 higher than the previous year, and more than doubles CMOT’s profitability in a span of one year. Similarly, the growth in revenues from 1990 to 1991 is also significant. Therefore, it is evident that the company is experiencing growth and may be ready for the desired capital investments. However, it is not clear if the company will have enough cash to support such investments. The cash flows statement can help determine if the company has significant cash outflows for the required capital investments – namely the purchase of new snow making equipment and other improvements. In 1991, CMOT had $5.425 million in net cash provided by operating activities. However, the cash outflow resulting from investing activities is also over $5 million. Therefore, the company is not able to conserve much cash from the current operating year. While it was clear that from the income statement that company earned significant profits, the cash flow generated was not evident. Moreover, the amount of cash flow spent on capital expenditures was also not clear. Furthermore, the cash flows statement also reveals that the company generated some additional cash flow through financing activities.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.