Get instant access to this case solution for only $19

Darden Capital Management The Monticello Fund Case Solution

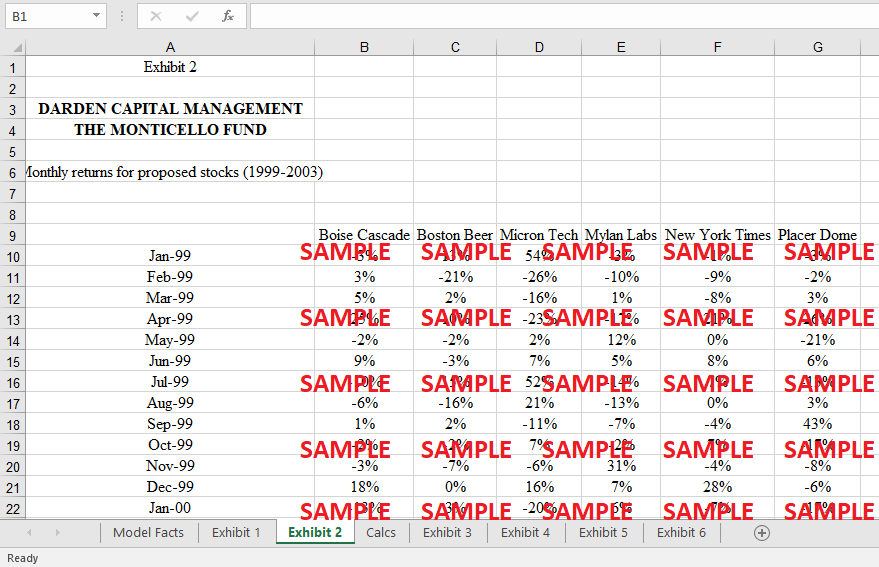

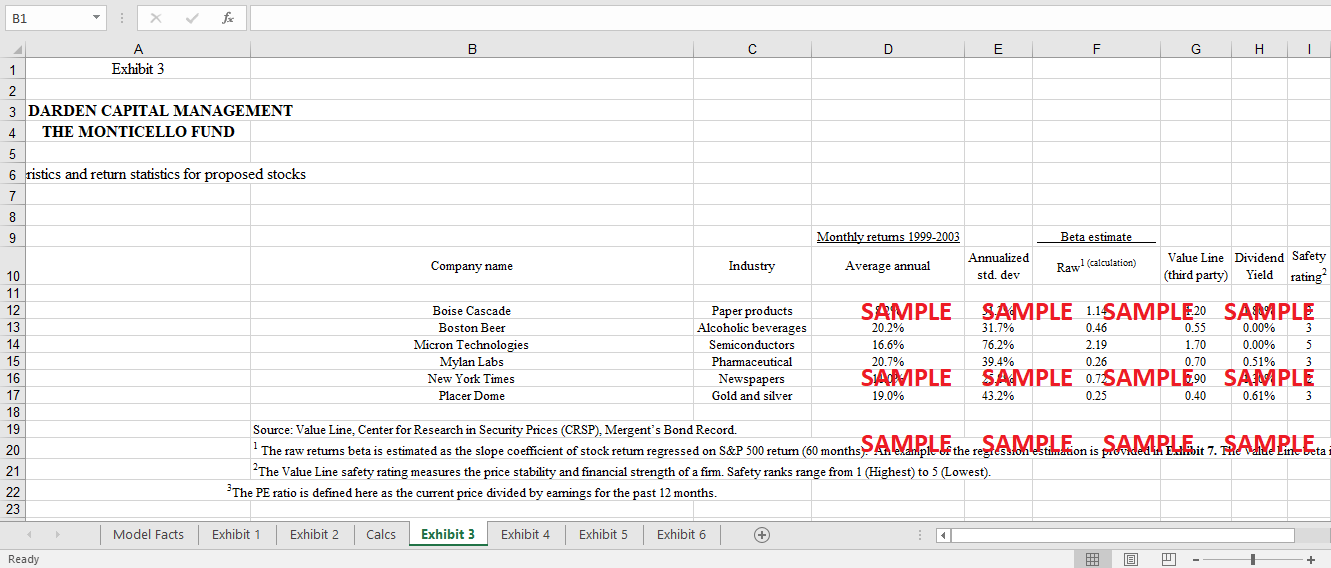

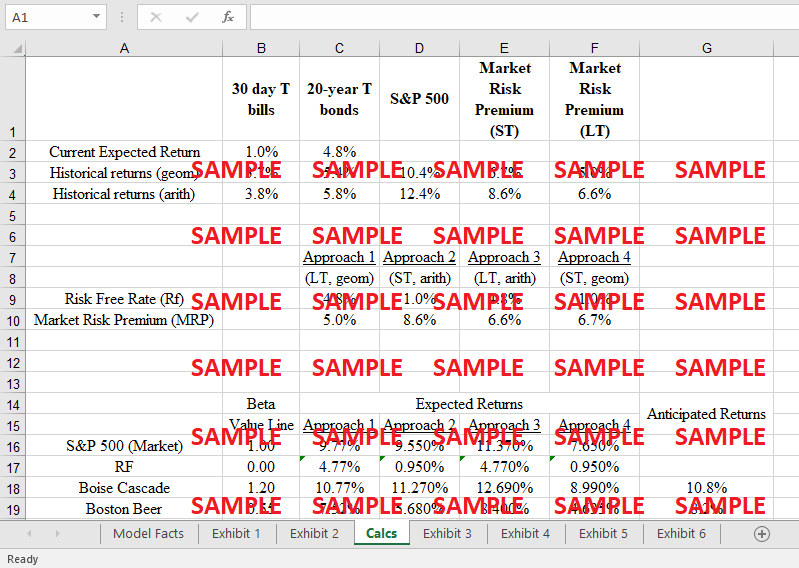

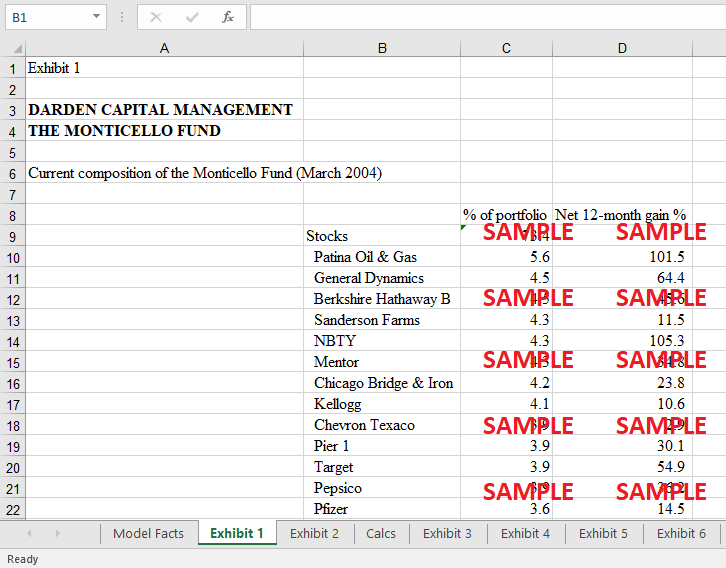

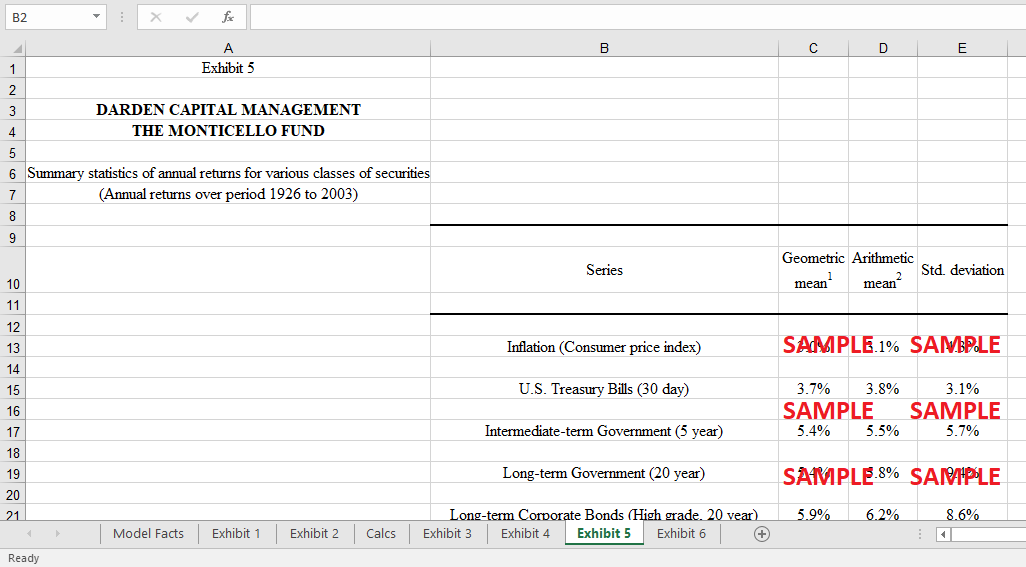

Amounting to more than $3 million, Darden Capital Management manages the Darden Fund, Monticello Fund, and Jefferson Fund. Of the three, only Monticello Fund relied on fundamental research to zero in on firms that were both poised for growth and reasonably priced. Over a one- to four-year time horizon, the fund's staff set out to find equities with above-average returns. Case study developed at Darden University. We look at the 2004 investment choices made by a student portfolio management team from Darden School of Business's Graduate Program in Investment Management. Using the offered case materials, students may make educated projections of future returns by analyzing historical market data and using the Capital Asset Pricing Model (CAPM). The case is laid out in such a way that it will introduce the portfolio-allocation decision, delve into the significance of various measures of investment risk, cultivate an intuitive understanding of diversification, market risk, and the capital-asset-pricing model, and instruct the reader on how to estimate the CAPM parameters using real-world market data correctly.

Following questions are answered in this case study solution:

-

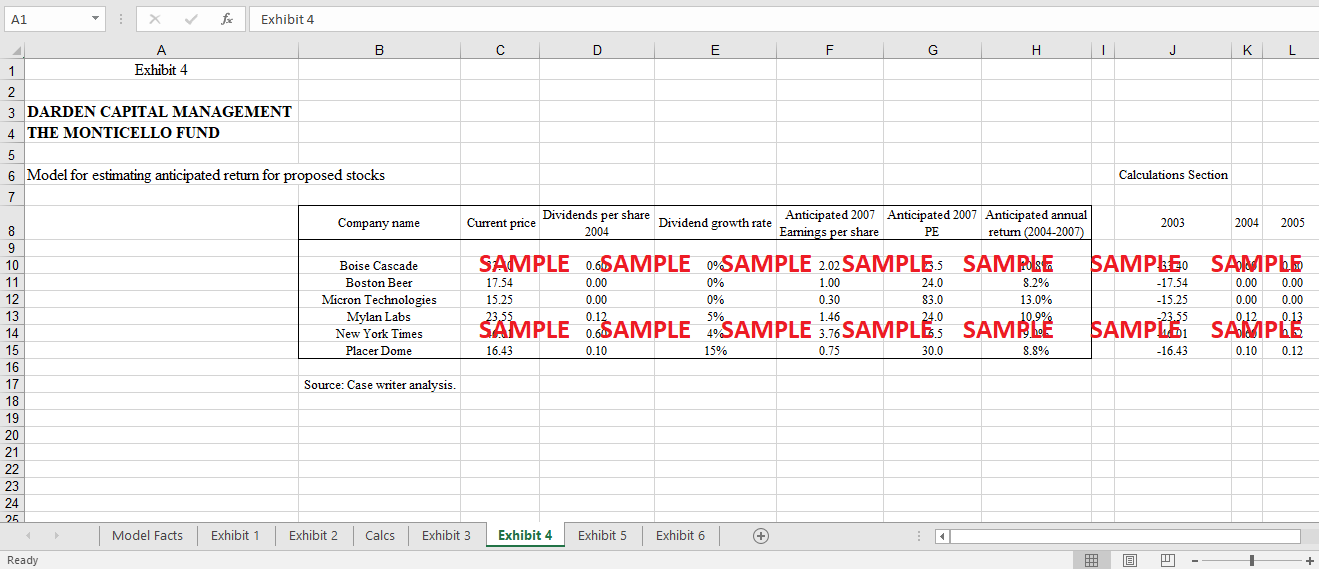

Should the team adjust for risk in evaluating the attractiveness of the proposed stocks? If so, how? (Compare the greatest expected return potential (Bose and Maguire), the standard deviation and anticipated return to the standard deviation of returns (Khtikian), and beta (Hill) arguments in terms of risk measurement appropriate from the standpoint of the Monticello Fund).

-

Is Hill correct about the attractiveness of a 50-50 weighted portfolio of Mylan Labs and Placer Dome? Compare the mean monthly return and standard deviation of Mylan Labs and Dome with a 50-50 portfolio using a 1999-2003time horizon). Also calculate the correlation coefficient between the two stocks.

-

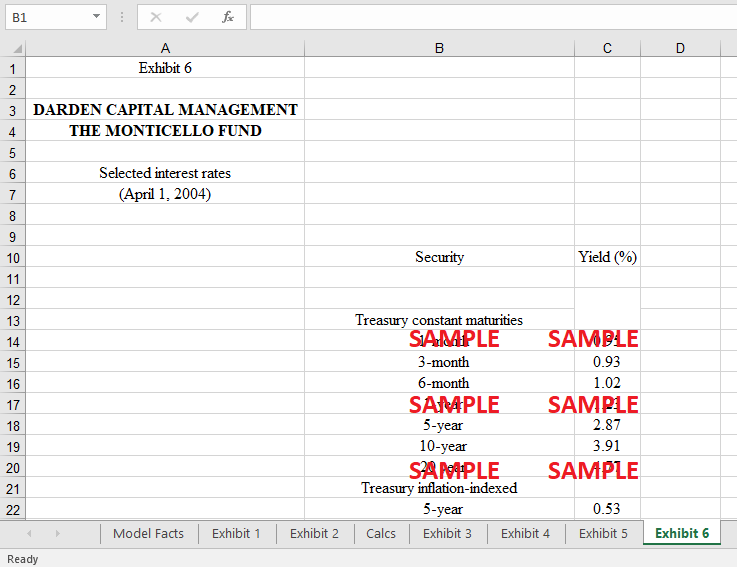

What is the expected return of the S&P portfolio and on the proposed stocks? (Be sure to explain the reasons for the inputs to your model?

-

Which two to three stocks appear to provide the most attractive opportunity for the Monticello Fund? (Hint: You may want to use estimates from #3 and do a comparison similar to Figure 7-3 in the textbook).

Case Study Questions Answers

1. Should the Team adjust for risk in evaluating the attractiveness of the proposed stocks? If so, how? (Compare the greatest expected return potential (Bose and Maguire), the standard deviation and anticipated return to the standard deviation of returns (Khtikian), and beta (Hill) arguments in terms of risk measurement appropriate from the standpoint of the Monticello Fund).

If the Team evaluates the stocks' attractiveness, it should consider risk. The first step you should do when planning your portfolio is to calculate the risk and adjust depending on the predicted risk. Diversifying your holdings when you invest at home is vital, but it's crucial when you start looking abroad. Micron Technologies stock, which is notoriously volatile, was highlighted; it reached an all-time high in 2000. A stock's past performance is of little use in predicting its future performance. Calculate and forecast the stock with accuracy using data that isn't limited to the stock's past performance. The Team's upper management has asked that they restrict their options to just two or three businesses. The Team does this by looking back at the last five years of predicted returns and evaluating various risk factors. You may find the suggestions below.

-

What is the highest possible rate of return I can get from investing in Micron Technologies?

-

The Team shouldn't put money into Micron because of its large standard deviation. The greatest returns are seen in the Boise Cascade and the New York Times because of their minimal risk (anticipated return to standard deviation is low for both).

-

The level of risk you're willing to take with your investment should be compared to your expected return. The firm's stock returns in connection with the returns of a diverse portfolio should be employed in the analysis of the stocks. Known as Beta, it is the linear relationship's slope. Mylan Labs and Placer Dome had the greatest adjusted returns.

The last suggestion seems to make the most sense to me. Beta evaluates stock volatility in the market so that the Team can choose the least risky stock with the highest predicted return.

2. Is Hill correct about the attractiveness of a 50-50 weighted portfolio of Mylan Labs and Placer Dome? Compare Mylan Labs and Dome's mean monthly return and standard deviation with a 50-50 portfolio using a 1999-2003time horizon). Also, calculate the correlation coefficient between the two stocks.

The "standard deviation" is the measuring approach that forms the vast majority of the time while carrying out an analysis of risk, and the term "standard deviation" is where the term "standard deviation" originates from. The actual measurement method is also known as the "standard deviation," which is why the two phrases are sometimes used interchangeably. When discussing diversification, it is of the utmost importance to consider not just the capital asset pricing model (CAPM), but also any and all other index models pertinent to the matter at hand. This is because the CAPM is only one of many different index models that may be used. After that point, for the first time, investors would have the opportunity to design an investment portfolio that is as free of risk as it is practically possible. This would be a significant step forward regarding the level of risk diversification currently available to investors.

The information on the Beta and Alpha can be acquired from such models, both of which are further risk indicators, and anticipating can be a direct result of such models. In addition, anticipate collecting this information is most useful. Looking forward to learning more about this as it becomes available. In addition, as a direct result of the use of such models, anticipate obtaining information on the Beta and the Alpha. In addition, these models will shed light on the Beta and the Alpha. To be more explicit, expecting to carry out this activity because anticipate gathering such information.

αp = rp – [rf + βp(rM – rf)]

βp=∑ k (wk)(βk)

Correlation Coefficient Calculation:

|

Parameter |

Value |

|

Pearson correlation coefficient (r) |

-0.1814 |

|

P-value |

0.1654 |

|

Covariance |

-0.002574 |

|

Sample size (n) |

60 |

|

Statistic |

-1.4047 |

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.