Get instant access to this case solution for only $19

Flash Memory Inc Case Solution

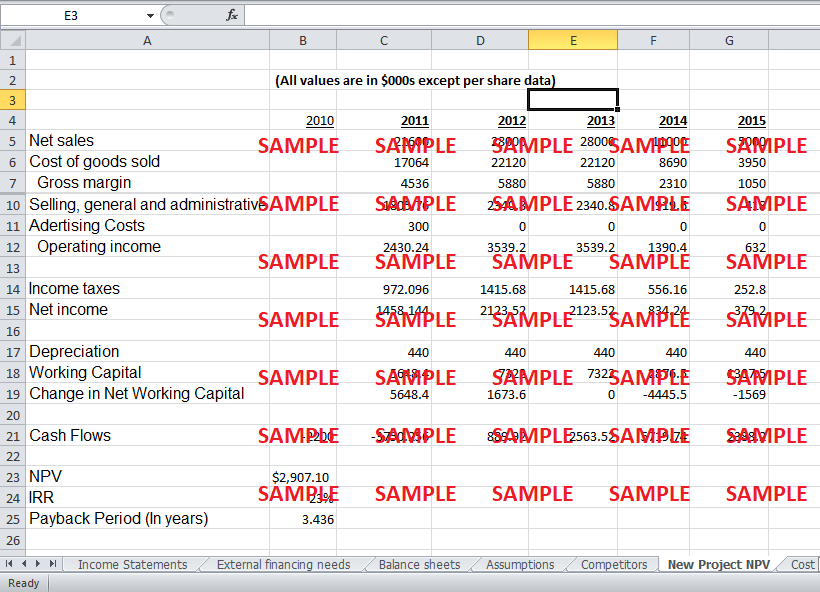

Using the assumptions given in the case, all elements of income statement and balance sheet can be projected for next three years 2010, 2011 and 2012. Sales cycle of the products of the company is such that sales of a particular product increases initially for few years and then starts to decline as the new technology introduced by the competitors renders that particular product obsolete. The current product mix of the company is in such a stage currently that it has been estimated that sales of the company will increase significantly for the next two years and then stay the same for the third year. Net Sales for next three years have been estimated as $120 million, $144 million and $144 million. Cost of goods sold has been estimated to be 81.10% of sales for next three years. Thus, COGS values for years 2010, 2011 and 2012 come out to be $97.32 million, $116.784 million and $116.784 million. Another way to calculate the gross margin for next three years is just to take 19.9% of sales for all the three years. Research and development costs are expected to remain almost the same for next few years to come. Thus, it is safe to assume that R&D costs will be 5% of the net sales of the company. These values for next three years come out to be $6 million, $7.2 million and $7.2 million respectively. Selling general and administrative expenses are highly correlated to sales of the company and therefore, it is safe to assume that these expenses are a certain percentage of sales figures for next three years. It has been estimated that SG&A expenses will remain at 8.36% of the net sales for next three years. Thus, these expenses come out to be $10.032 million, $12.038 million and $12.038 million for years 2010, 2011 and 2012 respectively. Expense values are same for last two years because sales values will remain the same for these particular years.

Following questions are answered in this case study solution:

-

Assuming the company does not invest in the new product line, prepare forecasted income statements and balance sheets at year-end 2010, 2011, and 2012. Based on these forecasts, estimate Flash's required external financing: in this case all required external financing takes the form of additional notes payable from its commercial bank, for the same period.

-

Assume that firm will issue equity if it decides to go ahead with the new project:

a. Construct a table showing all the project cash flows from initial outlay to termination.

b. Calculate the NPV, IRR and Payback period for the project.

c. Should the company accept or reject this investment opportunity?

-

How would this decision change if the executive team decided to finance the project with bank loans?

Flash Memory Inc Case Analysis

Interest expense for a particular year can be given by multiplying the cost of debt by the amount of notes payable outstanding at the beginning of that particular year. Although this will not be actual interest expense, but looking at the financial statements in the past, it can be safely assumed that such an estimate is very close to the actual values. Other expenses for next three years have been estimated to be $50,000 for next three years. Effective income tax for the company for next three years has been estimated to be 40%. Using all these values, Net income after taxes comes out to be $3,192 million, $3,837 million and $3,837 million for years 2010, 2011 and 2012 respectively.

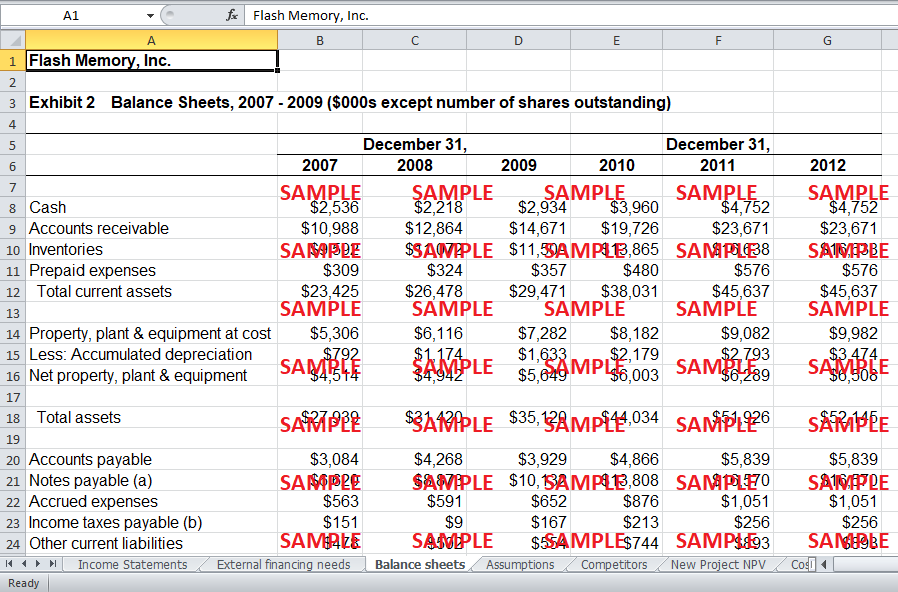

Calculations for balance sheet items depend a lot on the estimates based upon which income statement has been calculated. The first item of the balance sheet, cash, has been estimated to be 3.3% of the net sales for all the three years. Accounts receivable had been estimated to be 60 days of sales outstanding. Using the formula for day’s sales outstanding, the accounts receivable of the company for three years can be calculated easily by multiplying 60/365 with sales. One very important assumption in these calculations is that all sales of the company will be credit sales for all the three years. Similarly, inventory will remain at 52 days of cost of goods sold while accounts payable will be 30 days of purchases for next three years. As far as calculations for notes payable are concerned, it has been estimated that the company will borrow funds from a commercial bank in a way that ending value of notes payable will be 70% of the accounts receivable for that year. Accrued expenses will remain 0.735 of the net sales for next three years. Income taxes will be paid in such a way that 10% of the income tax for that particular year will remain payable at the end of the year. The number of shares outstanding will remain the same and thus, the only change in the equity side of the balance sheets for the next three years will be the change in the amount of retained earnings. This change will be equal to the net income of the company for last year because the company will not pay a dividend.

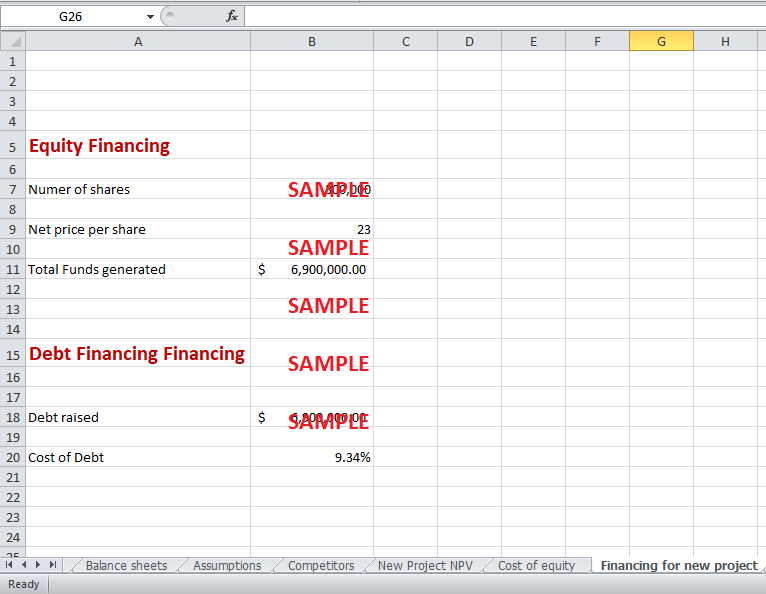

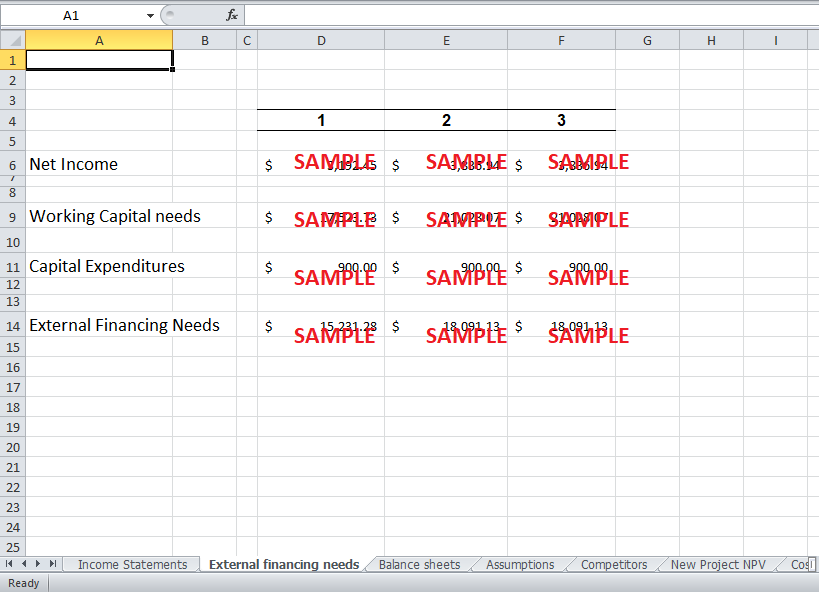

Financing requirements of the company can be determined by calculating the cash requirements of the company by adding the working capital needs and capital expenditure needs of the company. Working capital needs can be calculated by subtracting current liabilities from current assets of the company. Current assets of the company will remain significantly lower than current liabilities for next three years. Working capital needs of the company come out to be $17.523 million, $21,028 million and $21,028 million for years 2010, 2011 and 2012. Capital expenditures of the company will remain at $0.9 million for all three years. Adding the values of working capital needs and capital expenditure needs for all years and by subtracting these values from net income, we can calculate the external financing required by the company to meet the cash needs for next three years. As shown in calculations in excel sheet, external financing requirements for the company come out to be $15.231 million for 2010 and $18.091 million for 2011 and 2012 respectively.

2. Assume that the firm will issue equity if it decides to go ahead with the new project

a. Construct a table showing all the project cash flows from initial outlay to termination.

Sales from the project have been estimated to be $21.6 million, $2.8 million, $2.8 million, $1.1 million and $0.5 million for years 2011, 2012, 2013, 2014 and 2015 respectively. Cost of goods sold has been estimated to be 21% of revenue for all the five years. This is significantly lower than the cost of goods sold as % of sale for the existing business of the company i.e. 81.1%. However selling, general and administrative expenses will remain at the same level i.e. 8.36% of sales. Furthermore, there will one time advertising cost of $300,000 for year 2011. Operating income values for the next five years come out to be $2.43 million, $3.539 million, $3.539 million, $1.39 million and $0.632 million respectively. Using these values and applying the tax rate of 40%, net income values for next five years come out to be $1.458 million, $2,123 million, $2,123 million, $0.834 million and $0.379 million respectively for years 2011, 2012, 2013, 2014 and 2015 respectively. The equipment purchased for $2.2 million in 2010 will be depreciated on a straight line basis for five years. Therefore, annual depreciation comes out to be $440,000 for the next five years. Working capital will remain at 26.15% of sales for the project in next five years. So, as sales value changes, so does the working capital requirements. Changes in net working capital can be calculated by subtracting working capital for the previous year from working capital for the current year. Finally, free cash flows can be calculated by subtracting changes in working capital from the net income while adding depreciation expense at the same time. Thus, final free cash flows for the project come out to be $-3.750 million, $0.889 million, $2,563 million, $5,719 million and $2,388 million for years 2011, 2012, 2013, 2014 and 2015 years respectively.

b. Calculate the NPV, IRR and Payback period for the project.

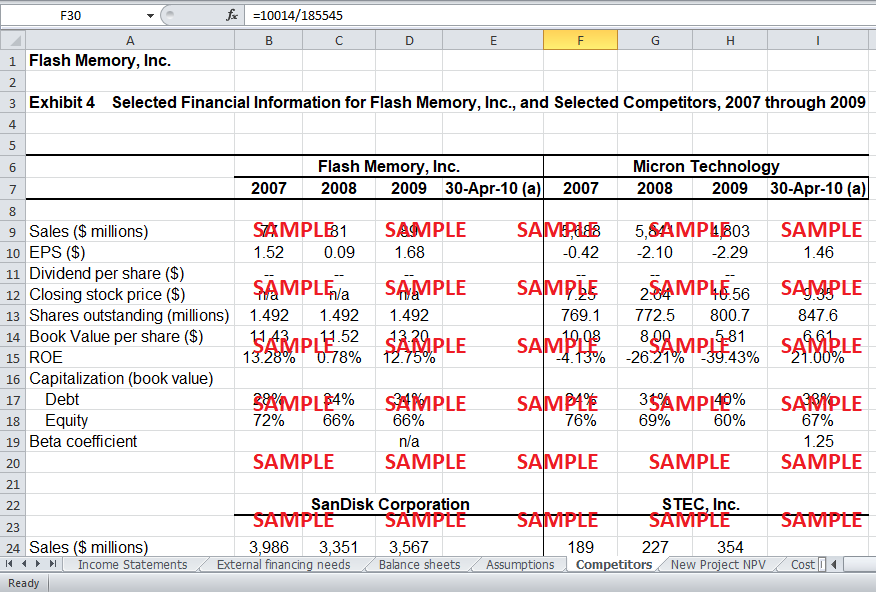

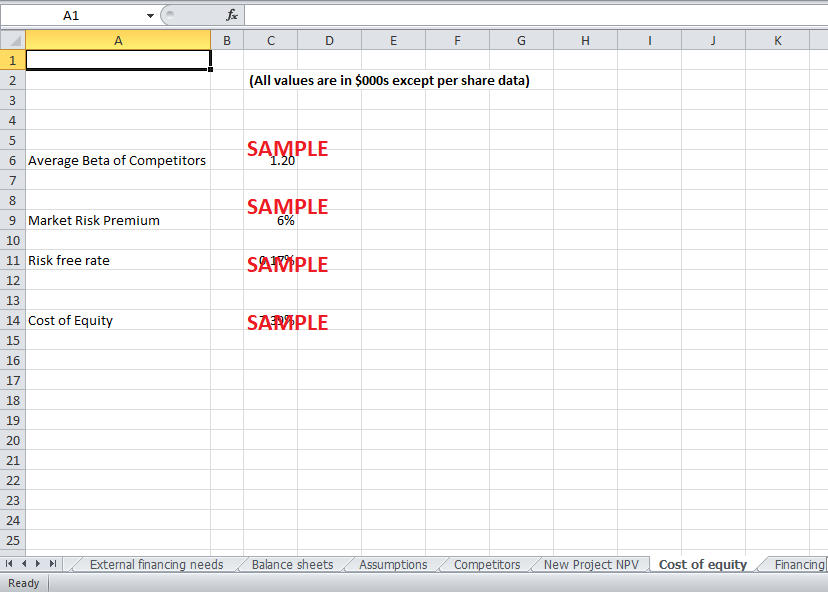

For the purpose of calculating the net present value of the project, an appropriate cost of capital has to be calculated at which free cash flows of the project should be discounted. Since the project will be solely financed by selling new shares, cost of equity will be used as the discount rate. Beta for the company can be assumed to be equal to average of the betas of the competitors of the company. This average beta value comes out to be 1.2. Risk free rate is 0.17% while risk premium has been estimated to be 6%. Thus by putting these values in CAPM formula, we can find the cost of equity for the company which is 7.39%.

Free cash flows of the project for next five years can be calculated by adding depreciation values and subtracting changes in working capital from net income. In 2010, there will be a cash outflow of $2.2 million as capital expenditure. In 2011, there will be an additional one time cash outflow of $300,000 as an advertising expense. Using net free cash flow values for next five years and discount rate for discounting, NPV for the project comes out to be $2907, 100. The rate of return at which net present value becomes zero i.e. IRR comes out to be 23%. This is a very high value even though cash flows of the project beyond 2015 have been ignored. This IRR value is much higher than the return on assets of the company and hence, inclusion of this project will increase the ROA of the company as a whole. In addition to the initial outflow of $2.2 million in 2010, the projects cash flow for year 2011 is also negative because of the extremely high change in working capital and one time advertising cost of $300,000. Therefore, these outflows of cash in first two years will be recovered by the cash inflows in next three years. Precisely, the payback period of the investment, as shown in excel sheet, comes out to be 3.436 years.

c. Should the company accept or reject this investment opportunity?

The company should accept the project because NPV of the project has a significant positive value, even though cash flows for just five years have been considered for this analysis. Therefore, inclusion of this project in the existing business will increase the overall value of the company. The IRR of the company is 16%, which is significantly greater than the cost of equity or cost debt available for the company. The market share of the company relative to its competitors is significantly lower. Therefore, it should strive to expand and increase its product mix. Due to continuous improvements in technology, sales of the company fluctuate significantly because certain products become obsolete after a few years of their introduction. Therefore, by increasing the product mix, the company can maintain sales in a better way because with the greater number of products in its portfolio, it will have greater flexibility.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- FleetBoston Financial Online Banking Case Solution

- FoldRite Furniture Company Planning to Meet a Surge in Demand Case Solution

- Ford Motor Company: Supply Chain Strategy Case Solution

- Ford Motor Company's Value Enhancement Plan (A) Case Solution

- Foreign Exchange Hedging Strategies at General Motors: Competitive Exposures Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.