Get instant access to this case solution for only $19

Food Ingredient Industries Inc Case Solution

The total capital structure of any company is only divided between debt and equity and their sum must equal to 100% or 1. If the debt part of the capital structure is 60% and the percentage of capital structure would be equal to (100-60) 40 percent of the total capital structure. Furthermore, the benefit of financing the acquisition through equity would concentrate the number of shares within a limited number of shareholders. This would make the takeover, or acquisition, difficult by any other firm in the future time period.

Following questions are answered in this case study solution

-

Given the risk profile, what ROE objectives would you require?

-

What would be the Total Enterprise Value be?

-

How would you capitalize the acquisition?

-

Predict the Outcome?

Case Analysis for Food Ingredient Industries Inc

1. Given the risk profile, what ROE objectives would you require?

The business profile contains two immensely significant risk factors. First risk factor has been intrigued by the high margins in the industry. High margins have attracted vast number of competitors in the industry as the barriers of entry are very low. Second risk factor is associated with the level of customer concentration. For every different customer segment, a new product line is required. Failure of any product line will subsequently lead to a high number of losses, which pose a huge risk itself.

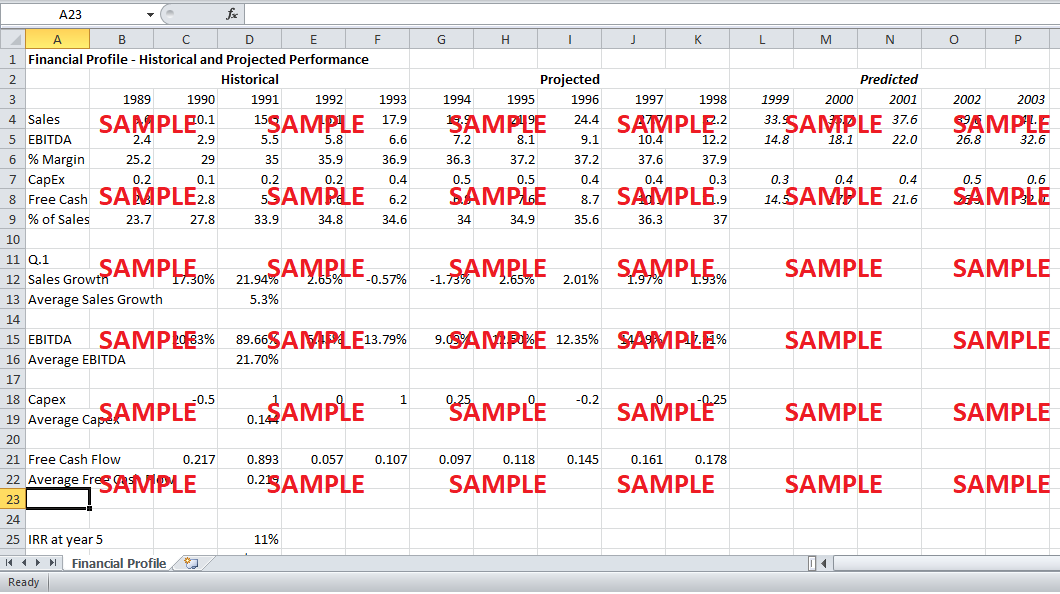

ROE objectives are set on the basis of expected growth and profitability of the company. From the company financials given, it can be observed that sales have grown almost every year, and the overall profitability has increased tremendously. On average, sales have grown by 5.3 percent per annum. In addition to that, it is expected that the company will generate 16 percent increase in sales over the next five years after the acquisition has taken place. Similarly, on average the profits have increased by 21.70 percent every year. Therefore, as private equity based investor; the maximum expected ROE to acquire the company would be 21.70 percent per annum.

2. What would be the Total Enterprise Value be?

Enterprise value reflects the total economic value of a firm. In other words, it indicates to depict the hypothetical takeover price that any investor would be willing to pay to purchase the company.

Total Enterprise Value can be calculated by the following formula:

Market Capitalization – Cash + Total Debt

It is also presumed that the company will take long term debt to incur improvements in the long run. Therefore, Capital Expenditure reflects the total debt of the company

Assuming the investor is willing to take over the company in the year 1998. At the time of acquisition, cash in hand is equivalent to 11.9 and the total debt stands at 0.3. Furthermore, it is also assumed that the company is not publicly traded and possesses a market capitalization of (11.9-0.3) 11.6.

Similarly, if the investor is looking to buy the company today, i.e. in the year 1993, then the total enterprise value of the firm is around (6.2-0.4) 5.8.

3. How would you capitalize the acquisition?

• Percentage of capital structure as debt

Based on the enterprise value, huge amount of money is required to take over the firm. Since, the firm’s enterprise is on an increase as the sales are growing and, overall profitability is on a hike. Approximately, 60 percent of capital would be required through debt to acquire the firm. Acquiring the firm through debt would benefit the investor acquiring the company in a way that as it provides tax shield. Other benefits provided by the debt financing include the reduction of ownership by a third party. The owner does not lose upon its voting rights.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.