Get instant access to this case solution for only $19

Fortune Minerals The NICO Project Case Solution

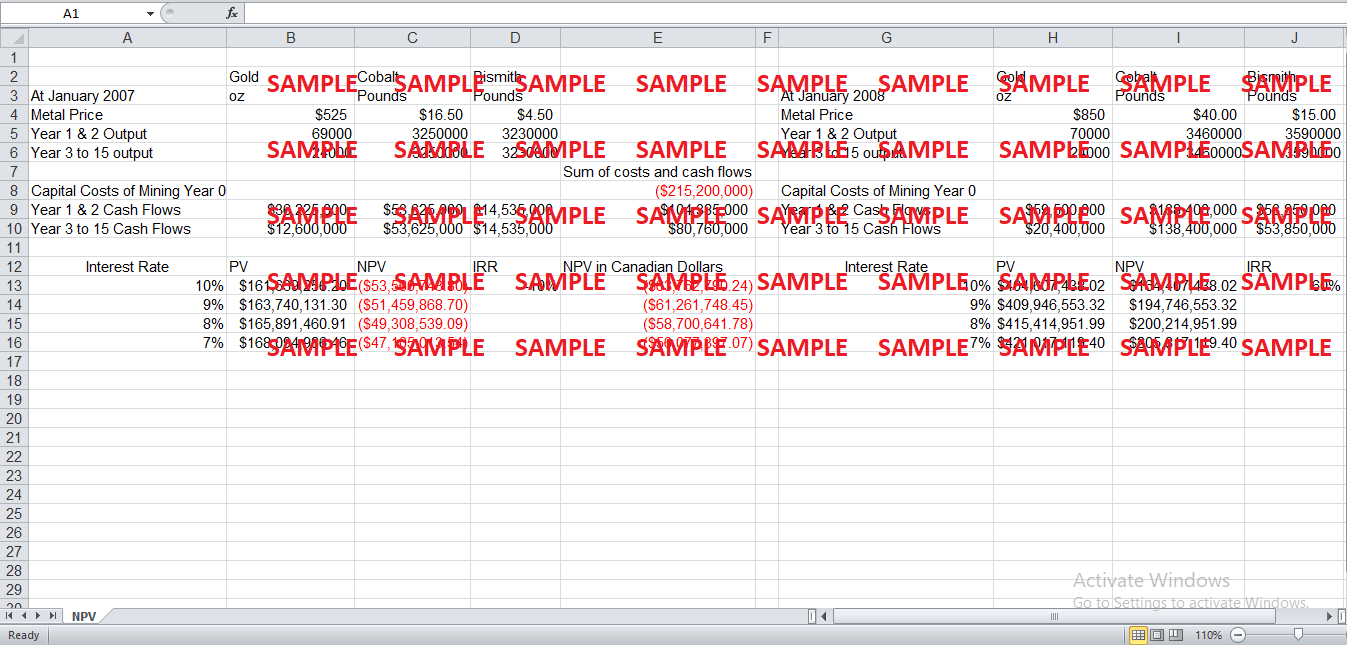

In the year 2007, the NICO project has shown negative NPV values for all scenarios of the interest rates. In the year 2007 the expected metal prices and quantity of output are low as compared to the year zero investment required for the project as given in the case study. This indicates that for the year 2007 Fortune Minerals will incur a loss if they decide to go ahead with the project, this is because of negative Net Present Values.

Following questions are answered in this case study solution

-

Answer 1 & 2: Net Present Value (NPV) and Sensitivity Analysis

-

What is your recommendation for the Project and why?

Case Analysis for Fortune Minerals The NICO Project

1. Answer 1 & 2: Net Present Value (NPV) and Sensitivity Analysis

The following calculations assume that Year 1& 2 Cash Flows and Year 3 to 15 have been discounted to Year 1 and Year 2 respectively.

|

|

Gold |

Cobalt |

Bismith |

|

|

At January 2007 |

oz |

Pounds |

Pounds |

|

|

Metal Price |

$525 |

$16.50 |

$4.50 |

|

|

Year 1 & 2 Output |

69000 |

3250000 |

3230000 |

|

|

Year 3 to 15 output |

24000 |

3250000 |

3230000 |

|

|

|

|

|

|

Sum of costs and cash flows |

|

Capital Costs of Mining Year 0 |

|

|

|

($215,200,000) |

|

Year 1 & 2 Cash Flows |

$36,225,000 |

$53,625,000 |

$14,535,000 |

$104,385,000 |

|

Year 3 to 15 Cash Flows |

$12,600,000 |

$53,625,000 |

$14,535,000 |

$80,760,000 |

|

|

|

|

|

|

|

Interest Rate |

PV |

NPV |

IRR |

NPV in Canadian Dollars |

|

10% |

$161,639,256.20 |

($53,560,743.80) |

-10% |

($63,762,790.24) |

|

9% |

$163,740,131.30 |

($51,459,868.70) |

|

($61,261,748.45) |

|

8% |

$165,891,460.91 |

($49,308,539.09) |

|

($58,700,641.78) |

|

7% |

$168,094,986.46 |

($47,105,013.54) |

|

($56,077,397.07) |

|

|

Gold |

Cobalt |

Bismith |

|

|

At January 2008 |

oz |

Pounds |

Pounds |

|

|

Metal Price |

$850 |

$40.00 |

$15.00 |

|

|

Year 1 & 2 Output |

70000 |

3460000 |

3590000 |

|

|

Year 3 to 15 output |

24000 |

3460000 |

3590000 |

|

|

|

|

|

|

Sum of costs and cash flows |

|

Capital Costs of Mining Year 0 |

|

|

|

($240,200,000) |

|

Year 1 & 2 Cash Flows |

$59,500,000 |

$138,400,000 |

$53,850,000 |

$251,750,000 |

|

Year 3 to 15 Cash Flows |

$20,400,000 |

$138,400,000 |

$53,850,000 |

$212,650,000 |

|

|

|

|

|

|

|

Interest Rate |

PV |

NPV |

IRR |

NPV in Canadian Dollars |

|

10% |

$404,607,438.02 |

$164,407,438.02 |

60% |

$160,868,334.65 |

|

9% |

$409,946,553.32 |

$194,746,553.32 |

|

$190,554,357.46 |

|

8% |

$415,414,951.99 |

$200,214,951.99 |

|

$195,905,041.09 |

|

7% |

$421,017,119.40 |

$205,817,119.40 |

|

$201,386,613.89 |

2. What is your recommendation for the Project and why?

To choose which of the projects the Fortune Minerals should choose, NPV rule applies as stated below:

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.