Get instant access to this case solution for only $19

Groupe Ariel S A Parity Conditions And Cross Border Valuation Case Solution

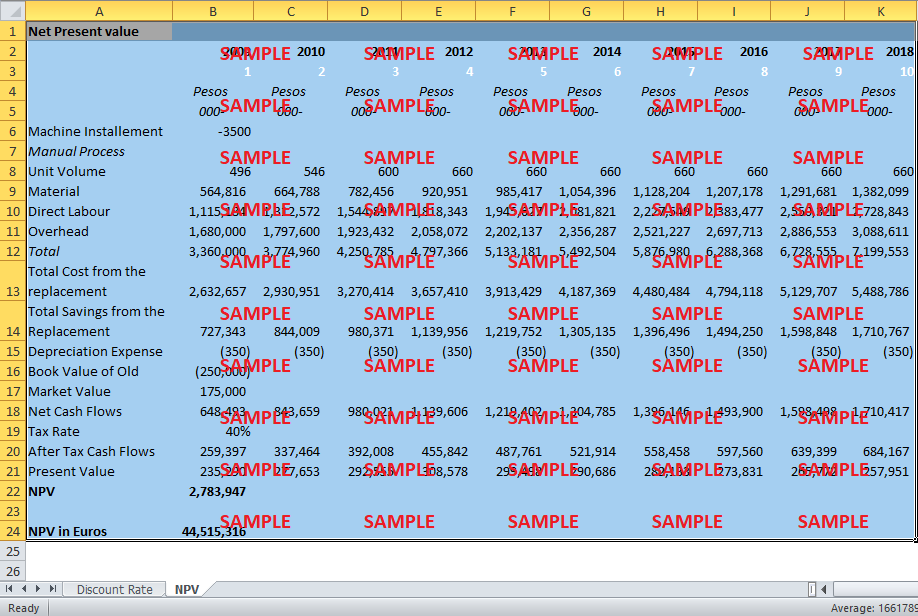

The net present value is calculated by doing the incremental analysis. The incremental analysis involves estimating the cost that would not be incurred by replacing the machine. First of all, as it was mentioned in the case that the total volume would be same irrespective of the fact that the machine is being replaced. There would be significant cost reduction if the company decides to go for replacing the machine. This reduction in cost would come from the fact that the lower labor would be used in the automated process.

Following questions are answered in this case study solution

-

Assume 3% inflation going forward in France. Based on this assumption and the information contained in the case, what hurdle (discount or cost of capital) rate, in pesos, would you use to discount the cash flows from the project? Show your calculations and assumptions.

-

Compute the project cash flows in pesos for years 0 through 10 and calculate the NPV in pesos. Calculate the IRR of the project. Show your calculations and assumptions in detail. Should the project be accepted or rejected?

-

Convert the Peso NPV to Euros at the June 23, 2008 spot exchange rate. Show your calculations.

Case Analysis for Groupe Ariel S A Parity Conditions And Cross Border Valuation

1. Assume 3% inflation going forward in France. Based on this assumption and the information contained in the case, what hurdle (discount or cost of capital) rate, in pesos, would you use to discount the cash flows from the project? Show your calculations and assumptions.

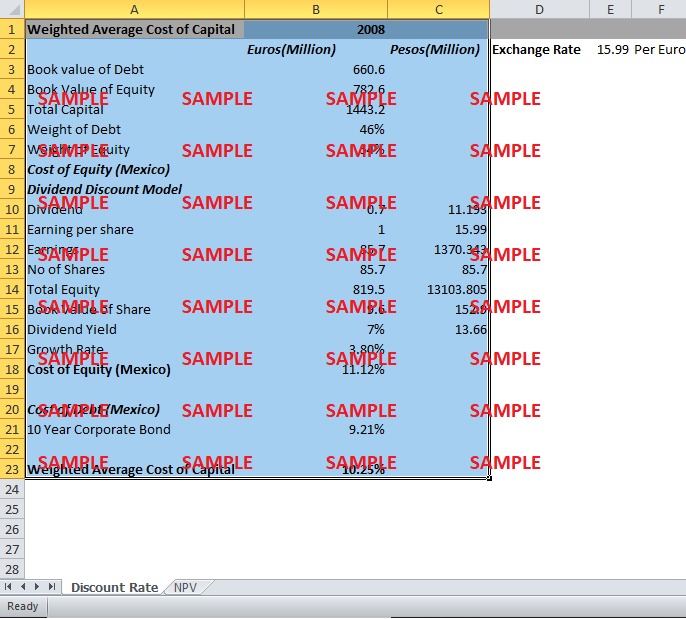

The discount rate is the weighted average cost of capital is used which essentially based on the cost of equity and the cost of debt. First of all, the weight of debt and equity is calculated using the book value of debt and equity. The weight of the debt as shown in Exhibit 1 comes out to be 46%, and the weight of the equity comes out to be 54%. After that, the cost of equity is required which is calculated using the dividend discount model. This model states that the cost of equity is the sum the dividend-yield and the growth rate. The dividend yield is essentially the ratio of current dividends to the current price of the stock.

To calculate the dividend yield, the dividend 0 Euros is used. The current price of the stock is derived using the earning per share ratio and the book value of equity. The current price of the share comes out to be 9.6 in Euros and 152 in Pesos. The dividend of 0.7 is divided by the book value of share which gives the dividend yield of 7%. The GDP growth rate of 3.8% was assumed as a reasonable growth rate. Therefore, adding these would result in a cost of equity of 11.12%. The cost of debt is fairly simple. It is benchmarked against the 10 year corporate bonds issued in Mexico as the objective is to calculate the NPV in Pesos. The cost of debt is 9.21%. Using the WAAC formula, the discount rate comes out to be 10.25%.

Exhibit 1

|

Weighted Average Cost of Capital |

2008 |

|

|

|

Euros(Million) |

Pesos(Million) |

|

Book value of Debt |

660.6 |

|

|

Book Value of Equity |

782.6 |

|

|

Total Capital |

1443.2 |

|

|

Weight of Debt |

46% |

|

|

Weight of Equity |

54% |

|

|

Cost of Equity (Mexico) |

|

|

|

Dividend Discount Model |

|

|

|

Dividend |

0.7 |

11.193 |

|

Earnings per share |

1 |

15.99 |

|

Earnings |

85.7 |

1370.343 |

|

No of Shares |

85.7 |

85.7 |

|

Total Equity |

819.5 |

13103.805 |

|

Book Value of Share |

9.6 |

152.9 |

|

Dividend Yield |

7% |

13.66 |

|

Growth Rate |

3.80% |

|

|

Cost of Equity (Mexico) |

11.12% |

|

|

Cost of Debt (Mexico) |

|

|

|

10 Year Corporate Bond |

9.21% |

|

|

Weighted Average Cost of Capital |

10.25% |

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.