Get instant access to this case solution for only $19

Harmonic Hearing Co. Case Solution

Harmonic Hearing Co. is a small competitor in a hearing aid producing Industry. Wren founded this company in 1974 and approached Burns about purchasing the company for 14 times Year 2010 net income. Burns and her partner accepted to purchase this company. They have two major options of financing the required amount to purchase the company which are all debt and all equity financing. In all debt financing, borrowing money is backed by the appraised value of land and building, accounts receivables, inventory and equipment. The total money financed is around 25 million in debt financing. In other alternative, Equity financing, the comet capital is agreed to finance 30 million with 0.25 million financed by Irvine and Burns. The calculations and the write up will lead to the decision that which alternative is better.

Following questions are answered in this case study solution:

-

For both financing alternatives, how large are the forecasted revenues, expenses, profits, and free cash flows generated by Harmonic in years one through seven? What is the terminal value of the company under each scenario? What cash payments will be made by the company at the end of year seven, and how large are these payments?

-

At what price must Harmonic repurchase the building and land from Frank Thomas to produce his required 15% after-tax return?

-

What proportion of the terminal value must be distributed to Comet Capital to produce its required 27% before-tax rate of return?

-

What are the forecasted cash flows, rates of return on investment, and value created for Burns and Irvine under the debt and equity financing alternatives?

-

What are the positives and negatives of each proposal? Which financing alternative would you recommend, and why?

Harmonic Hearing Co Case Analysis

1. For both financing alternatives, how large are the forecasted revenues, expenses, profits, and free cash flows generated by Harmonic in years one through seven? What is the terminal value of the company under each scenario? What cash payments will be made by the company at the end of year seven, and how large are these payments?

Following are the two financing alternatives:

-

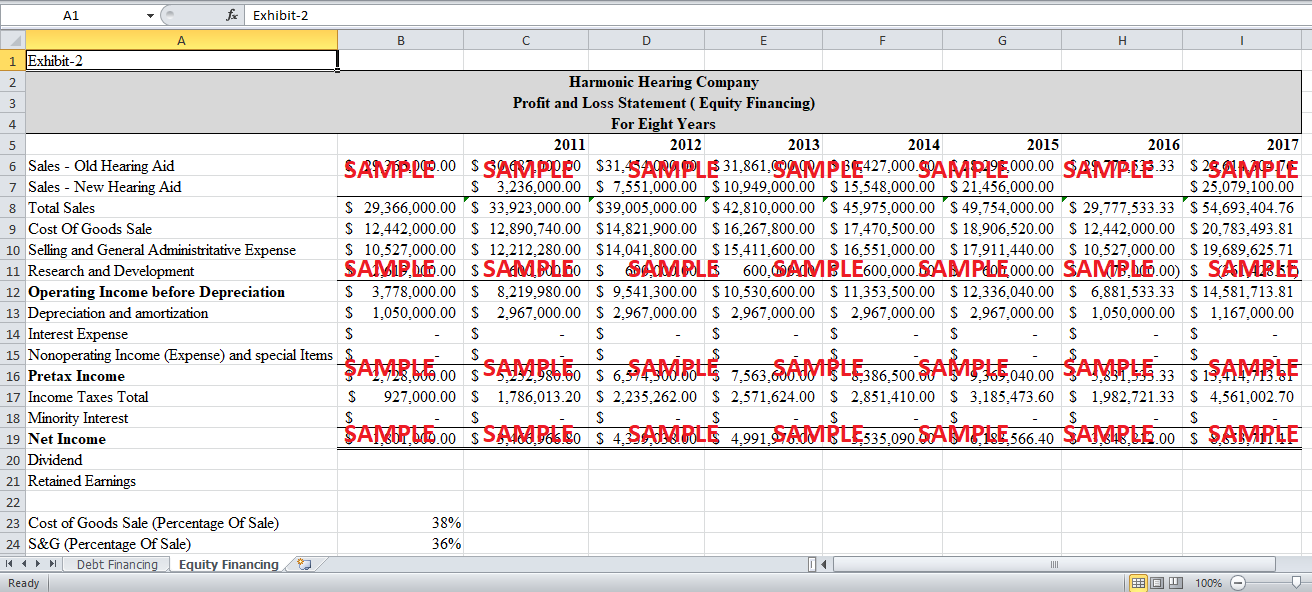

Harrison Price’s Proposal – All Debt Financing

-

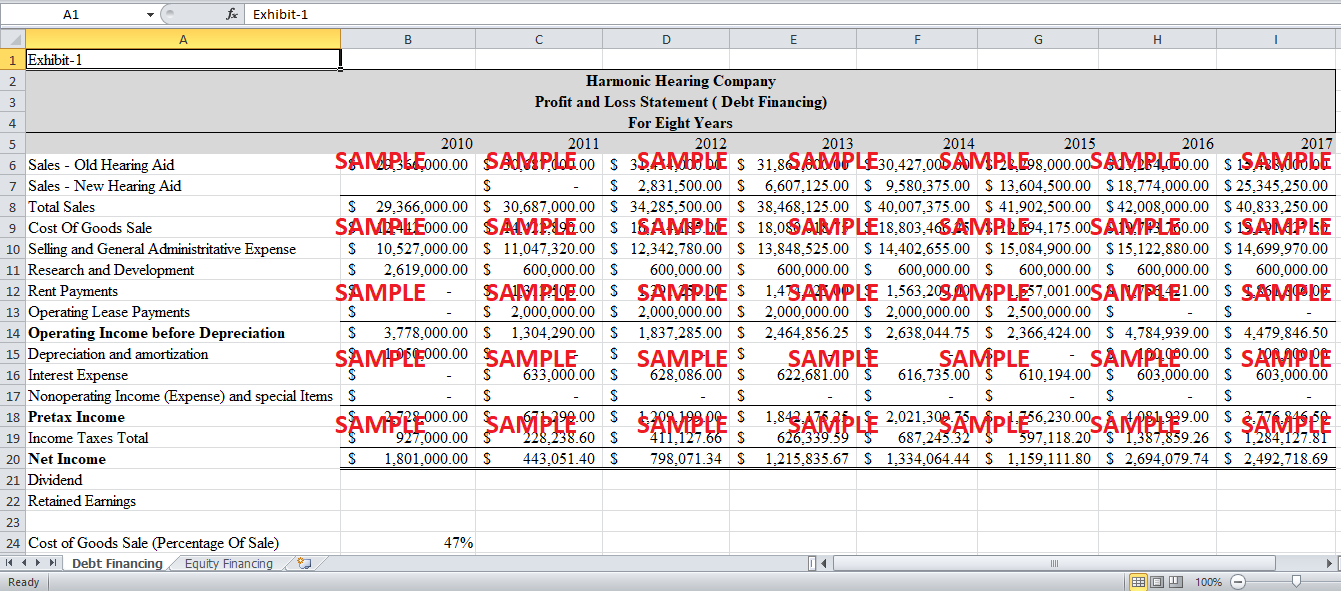

Joe Fowler’s Proposal – All Equity Financing

i. Forecasted Revenues

The forecasted revenues in debt financing in the first year i.e. 2011 do not increase too much from the previous year; as, the company will not be able to produce and sale new hearing aid for one year due to fixed interest payments. This one year gap will result in reduced market share of hearing aid in coming years. Still, there is a sharp increase in revenues in the next year. The revenues in next four years increase with a decreasing rate and in the last year sales decreases due to a sharp decline in the sales of old hearing aid.

In case of all equity financing, the forecasted revenues sharply increase during next two years as the company starts supplying new hearing aid in and gets big market share. Then revenues in this case keep rising but at a decreasing rate till seventh year.

ii. Expenses

The Selling and General Expenses for all equity are greater than the other alternative. As these expenses are the fixed percent of sales and sales in all equity, is greater than the sales in all debt financing. The R&D expense is same in both of the alternative. However the fixed rent and lease payments in case of all debt financing increases the expenses while there are no such expenses in other alternative.

iii. Profits

The fixed rent and lease payments have caused a huge difference in the net income of both alternatives. The net income sharply decreases in the first year in debt financing and then it increases till fifth year but still remain lower than net income in year 2010. During the next year, the net income increases sharply due to termination of 2 million fixed equipment lease payments. Moreover, the net income in the seventh year is lower than the previous one due to a sharp decline in the sales of old hearing aid.

Net Income increases in equity financing. It rises sharply in the next year and then keeps on rising till seventh year. High new hearing aid sales compensated the loss in sales of old hearing aid.

iv. Free Cash Flow

In debt financing, the free cash flow is negative in the first year and then it increases sharply during the second year. After then it keeps on decreasing till last year to 2.137 million.

In equity financing, due to high net income and depreciation, the free cash flows are way higher than in debt. It starts from 19 million and keep on decreasing to 9.8 million in the seventh year.

v. Terminal Value

As mentioned in the case study the terminal value is 14 times the net income. We are calculating the terminal value in the seventh year. The net income under debt financing is 2.492 million and so the terminal value using this alternative is around 34.898 million. As the net income under equity financing is higher than debt, so is the terminal value; because, terminal value of a company is solely dependent upon net income. In equity financing, the terminal value of the firm is 114.824 million which is 14 times of the seventh year net income i.e. 8.201 million.

vi. Cash Payments

In debt financing, following will be the payments made by the company at the end of the seventh year.

-

11.21 million Cash Payment to Thomas for financing 10.5 million.

-

5.42 million Cash Payment for the loan backed by A/R

-

1.277 million Cash Payment for the loan backed by Inventory

-

Rest 16.97 million of terminal value will be given to Burns and Irvine.

-

Following will be the payments made by the company in Equity Financing.

Payments from annual Cash Flow

-

6.58 million Cash payment to Comet Capital

-

3.29 million Cash payment to Burns and Irvine

Payments from Terminal Value

-

38.1 million To Comet Capital

-

85.85 million To Burns and Irvine

2. At what price must Harmonic repurchase the building and land from Frank Thomas to produce his required 15% after-tax return?

Thomas financed worth of 10.5 million dollars to the Harmonic Hearing Company. The total operating income from this financing for Thomas is 5.16 million dollars. After tax operating income at 40 percent tax is 3.1 Million. To produce Thomas’ 15% after tax return, 12.075 million is the whole after tax amount that must be received by Thomas. Also, 3.1 million dollars have been paid in shape of rent i.e. after tax operating income. 8.97 million dollar is the remaining amount required by Thomas as a capital gain. Harmonic hearing must pay 11.218 million to Frank Thomas so that he will be able to get required 15% after tax return.

3. What proportion of the terminal value must be distributed to Comet Capital to produce its required 27% before-tax rate of return?

Comet Capital financed 30 million for Harmonic Hearing Company to carry out its operations. In order to calculate the proportion of terminal value to be distributed to the Comet Capital, 27% of the Comet Capital financing i.e. 30 million is determined which turned out to be 38.1 million dollars. Moreover, it is calculated that 38.1 million is 33% of the terminal value which is to be distributed to the Comet Capital.

4. What are the forecasted cash flows, rates of return on investment, and value created for Burns and Irvine under the debt and equity financing alternatives?

i. Debt Financing

The forecasted cash flows for Burns and Irvine is same as the forecasted free cash flow of the company. The value created for Burns and Irvine after necessary cash payments is 16.979 million dollars.

ii. Equity Financing

The forecasted free cash flow for Burns and Irvine in equity financing is one third of the free cash flows of the company and rest two third is for comet capital. The terminal value created for Burn and Irvine after paying share to comet capital is 85.851 million.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.