Get instant access to this case solution for only $19

Hightrek Inc Case Solution

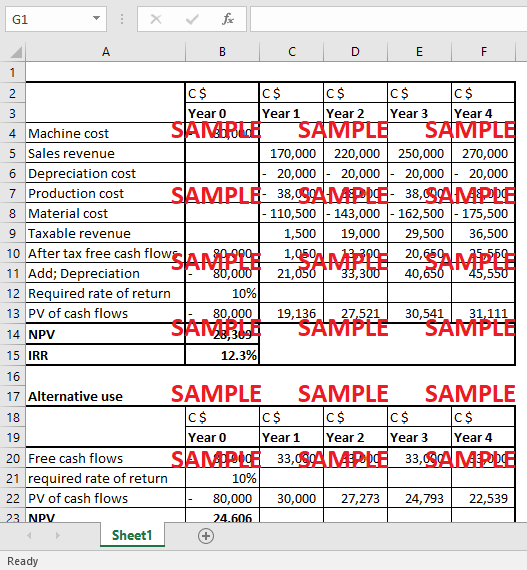

In order to find the NPV & IRR, free cash flows generated from the machine are required. Machine cost of 80,000 would result in an immediate cash outflow. The sales revenue in all four years would account for the only cash inflow from the machine production since there is no salvage value of the machine and at the end of the useful life of 4 years, the machine would not have any resale value. Since, the useful life is four years hence annual depreciation charge of 20,000 would be deducted from the sales revenue.

Following questions are answered in this case study solution

-

Calculate the NPV and IRR for the hoophouse investment.

-

How you would address the ideas raised by Manning and Knight?

-

If the plant manager proposed an alternative use of the C80,000 that would generate net after-tax cash flows of C33,000 each year for the subsequent four years. How does this alternative compare to the hoophouse project based on NPV and IRR metrics?

Case Analysis for Hightrek Inc

The production cost and material cost are also cash outflows of the company which would further reduce the cash inflows. The taxable income is computed after deducting depreciation cost, production cost, and material cost. The tax rate is 30% and after-tax cash flows are deducted. Since depreciation is a non-cash expense, thereby adding it to the after-tax cash flows to determine the total free cash flows of the machine. The present value was calculated at 10% return and NPV came out to be 28,309 and IRR is 12.3%. Since NPV is positive and IRR is greater than required return of 10%, both indicators suggest that it is financially viable.

|

C $ |

C $ |

C $ |

C $ |

C $ |

|

|

Year 0 |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

|

|

Machine cost |

- 80,000 |

|

|

|

|

|

Sales revenue |

|

170,000 |

220,000 |

250,000 |

270,000 |

|

Depreciation cost |

|

- 20,000 |

- 20,000 |

- 20,000 |

- 20,000 |

|

Production cost |

|

- 38,000 |

- 38,000 |

- 38,000 |

- 38,000 |

|

Material cost |

|

- 110,500 |

- 143,000 |

- 162,500 |

- 175,500 |

|

Taxable revenue |

|

1,500 |

19,000 |

29,500 |

36,500 |

|

After tax free cash flows |

- 80,000 |

1,050 |

13,300 |

20,650 |

25,550 |

|

Add; Depreciation |

- 80,000 |

21,050 |

33,300 |

40,650 |

45,550 |

|

Required rate of return |

10% |

|

|

|

|

|

PV of cash flows |

- 80,000 |

19,136 |

27,521 |

30,541 |

31,111 |

|

NPV |

28,309 |

|

|

|

|

|

IRR |

12.3% |

|

|

|

|

2. How you would address the ideas raised by Manning and Knight?

Dake Manning is of the view to update the existing manufacturing facilities and intends to redirect the investment to existing products. He is reluctant to replace the old machine since the cost of the new machinery would come from his budget. The idea raised by Manning does not seem to be in line with the existing business environment in which the company is operating in. Since, HighTrek is involved in the manufacturing of low-cost tents which would be sold through retailers to casual customers who are highly price sensitive. The growth prospects in the existing business segments of the company were low on account of steady sales volume. It is also pertinent to mention that the margins were also squeezing in the tent business. There is sufficient evidence to suggest that the existing product portfolio of the company is going through a maturity stage and the company needs to take some aggressive measures to restore profitability and business growth.

Chritine Knight supports the idea of expansion in related product lines. Being a marketing executive, she can sense the decreasing business volumes of the company and proposing to grow the company through the introduction of new products. For this purpose, the company is considering producing lightweight hoop houses for gardening.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.