Get instant access to this case solution for only $19

Hony CIFA And Zoomlion Creating Value And Strategic Choices In A Dynamic Market Case Solution

Since there is a substantial cultural and geographic distance between CIFA and Zoomlion which may pose challenges to the firm in integration after the acquisition. The integration may not result in the desired business outcome on account of cultural differences which may result in employees’ restraints. Moreover, the acquisition may distract the management of Zoomlion to explore opportunities in the domestic market and miss out on the growth opportunities in China. Moreover, the global volatile economic situation also creates an uncertain business outlook for the acquisition. On the other hand, the acquisition of CIFA would allow Zoomlion to become a truly global leader in the heavy machinery equipment industry. Lastly, the acquisition would eliminate the threat from Sany Heavy Industry of acquisition of CIFA and gaining market share.

Following questions are answered in this case study solution:

-

What are the risks of pursuing the CIFA acquisition? What are the potential benefits?

-

How is investing in Zoomlion’s acquisition of CIFA different from investing in Zoomlion itself? Does this pose fewer or more risks for Hony?

-

A payment package needs to be designed for PE to exit the JV after the deal. The design needs to consider not only the synergy of the deal on the Zoomlion side but also the synergy on the CIFA side. Zoomlion designed a put-call feature for the payment. Do you think it is a good design? Why do think Zoomlion designed in such a way?

-

Among Zoomlion, Hoye, Goldman, and Mandarin, who benefited the most from the put-call feature? Who suffered?

-

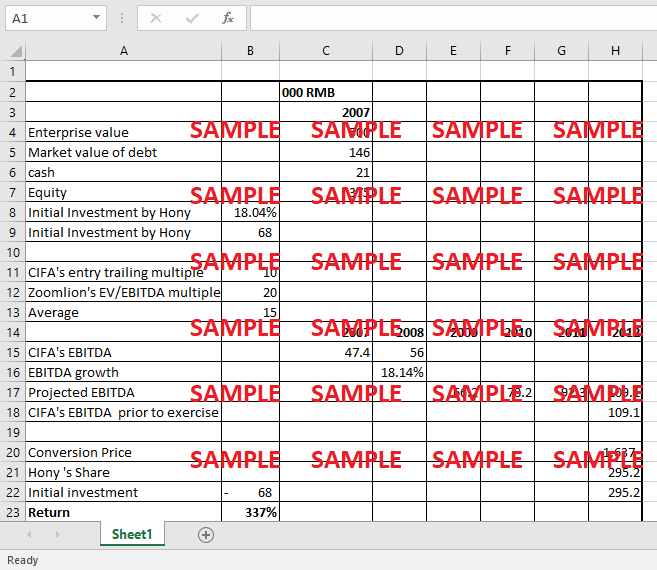

What is the estimated return of CIFA deal for Hony? Assume that a) Hony will exit in 5 years; b) Hony will exercise the option at the time; c) CIFA’s entry trailing EV/EBITDA multiple was 10, and Zoomlion would be trading at an average EV/EBITDA multiple of 20 at the time of exit.

Case Study Questions Answers

2. How is investing in Zoomlion’s acquisition of CIFA different from investing in Zoomlion itself? Does this pose fewer or more risks for Hony?

The investment in Zoomlion ‘s acquisition of CIFA is different from the investment in Zoomlion itself by the Hony Capital since investment in Zoomlion’s acquisition of CIFA poses more challenges. The investment in acquisition now accounts for 2 companies whereby previously only one company affect the return on investment by Hony Capital. The cash flows of both companies must be monitored by the analyst at Hony Capital now since the stake is now in both companies. Although, the industry-specific risk in both companies is the same since both operate in the same sector however the investment becomes riskier on account of company-specific risk which may arise from but not limited to customer concentration and supplier’s risk.

3. A payment package needs to be designed for PE to exit the JV after the deal. The design needs to consider not only the synergy of the deal on the Zoomlion side but also the synergy on the CIFA side. Zoomlion designed a put-call feature for the payment. Do you think it is a good design? Why do think Zoomlion designed in such a way?

Zoomlion designed a put-call option for the payment which allowed it to covert the CIFA shares into either the Zoomlion shares or in cash. This put-call feature allows Zoomlion a cushion in case the integration of Zoomlion and CIFA would not go as planned and the market value of CIFA would decrease substantially on account of the integration. As a result of a potential decline in the market value of the company, the investor could exercise their put-call feature to convert in Zoomlion’s share or cash before the possible decline in Zoomlion’s value as well. Given the uncertain economic environment, this payment design seems to be reasonable.

4. Among Zoomlion, Hoye, Goldman, and Mandarin, who benefited the most from the put-call feature? Who suffered?

Among the capital provider in the proposed transaction of the acquisition of CIFA, Zoomlion may be able to get the most benefit out of the put-call feature since it is the largest equity holder in the acquired company (70%).

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.