Get instant access to this case solution for only $19

Kingsley Management Case Solution

The approach of using two LLC’s rather than one was very unique and non-traditional. Therefore, Kingsley Management was prepared to give proper explanations to investors for using this method. The ides of organizing the business as a C Corporation, using internally generated cash flows and then going public is not practical. The firm needs a lot of funds that cannot be obtained through internal operations in the required time. The plan to structure the venture as two LLC’s makes sense because Lieb and his partners wanted to use a small amount of funding initially to prove the credibility of their business plan. By using $1.5 million generated through Fund 1, they could build start the business at small scale and practically demonstrate the profit and growth potential of the business. The Car wash setups established initially by funds generated through will start generating cash in a few months and hence, it will become much easier for the firm to raise funds in round two.

Following questions are answered in this case study solution

-

Given the current business plan, would you recommend that Kingsley Management be structured as a C Corporation or as an LLC? What are the advantages and disadvantages of each form for Kingsley Management? You should be prepared to defend your recommendation quantitatively.

-

What percentage of the first investment fund, Kingsley Development Fund I, LLC, should be retained by Kingsley Management?

-

Evaluate the plan to structure the venture as an equity development fund that owns the company’s assets and a separate management company. Would you recommend that they are structured as a fund and a management company?

Case Analysis for Kingsley Management

1. Given the current business plan, would you recommend that Kingsley Management be structured as a C Corporation or as an LLC? What are the advantages and disadvantages of each form for Kingsley Management? You should be prepared to defend your recommendation quantitatively.

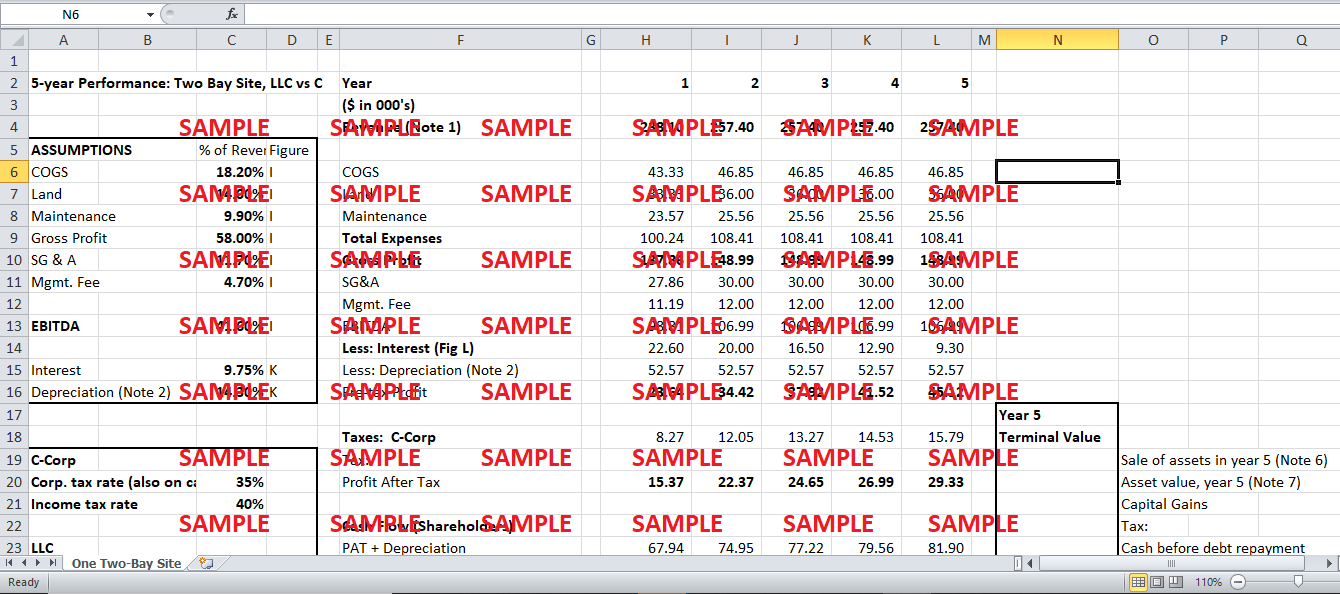

The choice of LLC or C Corporation is very critical at this stage of business for Kingsley Management because this decision will determine their ability and mode of raising funds. LLC practically combines limited liability feature of a corporation, operational and tax benefits of a partnership. In case of LLC, Kingsley Management would be protected from unlimited personal liability. Another very important aspect that Kingsley Management has to consider is that corporations have a set pattern and standard procedures for management purposes. On the other hand, LLC’s will give a lot of flexibility to Kingsley regarding management and lay out the infrastructure according to their plan. There are no requirements for annual general meetings and being answerable to the board of directors. Record keeping and hectic administrative work associated with a LLC is far less than a corporation. Therefore, from Kingsley management’s perspective, LLC is a much better choice as compared to C Corporation as far as management is concerned. However, C Corporation is better than LLC as far as the ability to raise funds is concerned. In case of Corporation, there is no limit to the number of shares that the management chooses to issue. The company can issue shares of its own choice whenever required. Corporation given an option of giving stock options to the management and employees so that there is no conflict of interest and management takes decisions that are in the best interests of organization and shareholders. However, Kingsley Management is very confident about the funds; they can choose to ignore this useful aspect of C Corporation.

The biggest concern for investors regarding the choice of LLC or C Corporation is the different tax treatment of the two modes of businesses. Corporate tax rate for C Corporation is 40% whereas tax rate for capital gains on LLC was 20%. In case of Corporation, cash flow to investor can be calculated by adding the profit after tax at the rate of 35% to depreciation. Debt payment should be then subtracted from that sum to come up with cash distribution to shareholders. Personal tax at the rate of 40% should be subtracted from that amount to come up with net cash payment to shareholders. In case of LLC, pre-tax profit should be used because unlike corporation, profit for LLC is taxed just once at the individual tax rate for capital gains i.e.20%. Pretax profit should be added to depreciation while debt payments should be subtracted. After deduction of tax at 20%, net cash for investors is obtained.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.