Get instant access to this case solution for only $19

Lab International Inc Case Solution

The challenges faced by the company in an attempt to raise funds are of various natures. The two divisions of the company are in desperate need of external funding and if not provided on a timely basis, the company's ability to create value will be effected. The Lab Research needs $8.5 Million for renovations and $25.5 Million for expansion which was to be carried out in next 3 years.

Following questions are answered in this case study solution

-

How does each of the two divisions create value for shareholders?

-

What is the nature of the financing challenge facing LAB international?

Case Analysis for Lab International Inc

1. How does each of the two divisions create value for shareholders?

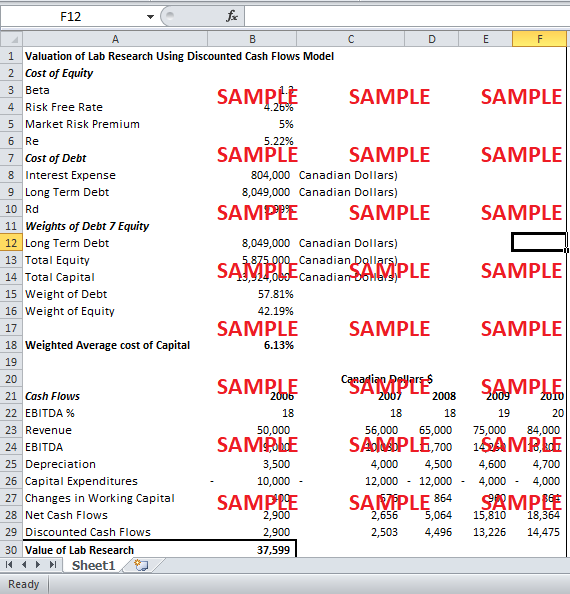

The shareholders’ value is increased if the company’s decision taken regarding the current financing problem is in the best interest of the company. The best interest of the shareholders is the maximum present value of the future cash flows. If the value is substantially high then the decision must be taken in order to provide shareholders maximum benefit. The two divisions must be valued at the market level so that the worth to shareholders can be determined. Exhibit 1 shows the valuation of the Lab research which is one of the divisions of the company. The valuation is done using the discounted cash flows method.

Cost of equity and cost of debt are the major determinant of the valuation of the company which ultimately contributes to the shareholder's value. The cost of equity is estimated by utilizing the capital asset pricing model which comes out to be 5.22%. The cost of debt is around 10% for the Lab Research Division. The weights of equity and debt are determined by using the book value of the debt and equity. The weighted average cost of capital is calculated to be 6.13%. This rate is used to discount the projected cash flows of the company. All the cash inflows and outflows associated with the division are stated in Exhibit 1 for the coming years. The net cash flows are discounted using the subject discount rate. The value comes out to be 37,599 Canadian Dollars which is the value of this division to shareholders.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Solomon Business School Implementing The New Strategy Case Solution

- State Street Bank And Trust Co New Product Development Case Solution

- Googles Project Oxygen Do Managers Matter Case Solution

- Centuria Health System Case Solution

- Cultural Transformation At Microsoft IT India Too Fast Or Just Right Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.