Get instant access to this case solution for only $19

Laurentian Bakeries Case Solution

Laurentian Bakery operates in the frozen pizza segment in the Canada Market. They have come across an opportunity to expand their operations to the USA by securing a contract with an American retail store. The company will need to expand its existing facilities in order to cater to this additional demand. The company has holistic criteria for evaluating capital expenditures. The company meets most of the non-financial criteria. However, it is not clear if the company will be able to meet the hurdle rate of 18% required on expansion projects. A detailed analysis of the cash flows associated with the project has been constructed. It is believed that the company will not be able to meet the hurdle rate. However, the WACC of the company is estimated to be much lower than the hurdle rate. It is believed that the project exhibits the average riskiness of the company, and it should be discounted at the WACC. If the project is discounted at the WACC, it produces a positive net present value. The project represents a significant opportunity to expand into the larger American market. Moreover, the existing plant has reached its full capacity, and it requires an expansion to meet future increases in demand. Therefore, it is recommended that the company undertakes the expansion project, as it provides a significant opportunity and is likely to add value to the company.

Following questions are answered in this case study solution

-

Executive Summary

-

Introduction

-

Non-financial Considerations

-

Relevant Cash Flow Considerations

-

Cash Flows from the Project

-

Relevant Discount Rate

-

Net Present Value of the Project

-

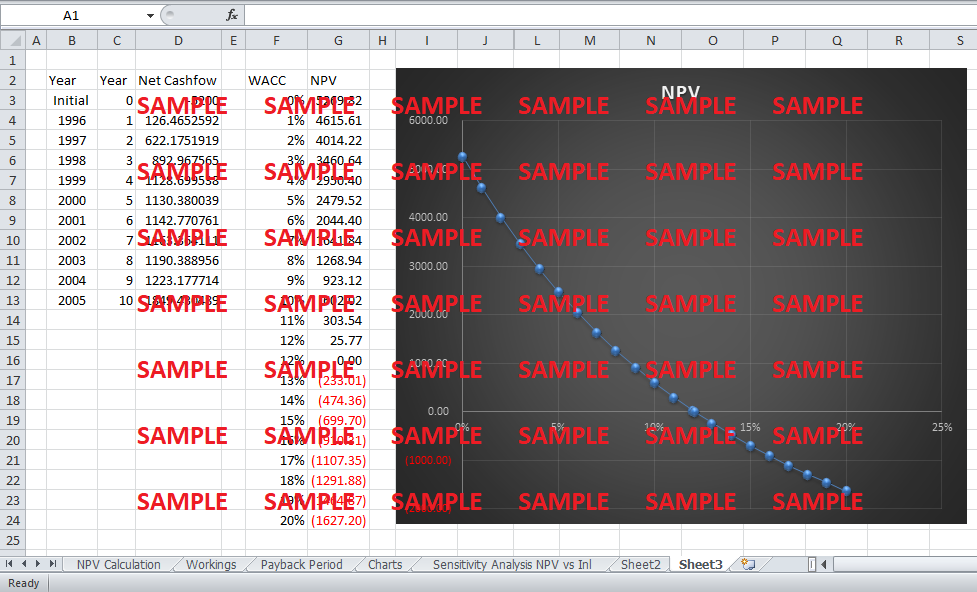

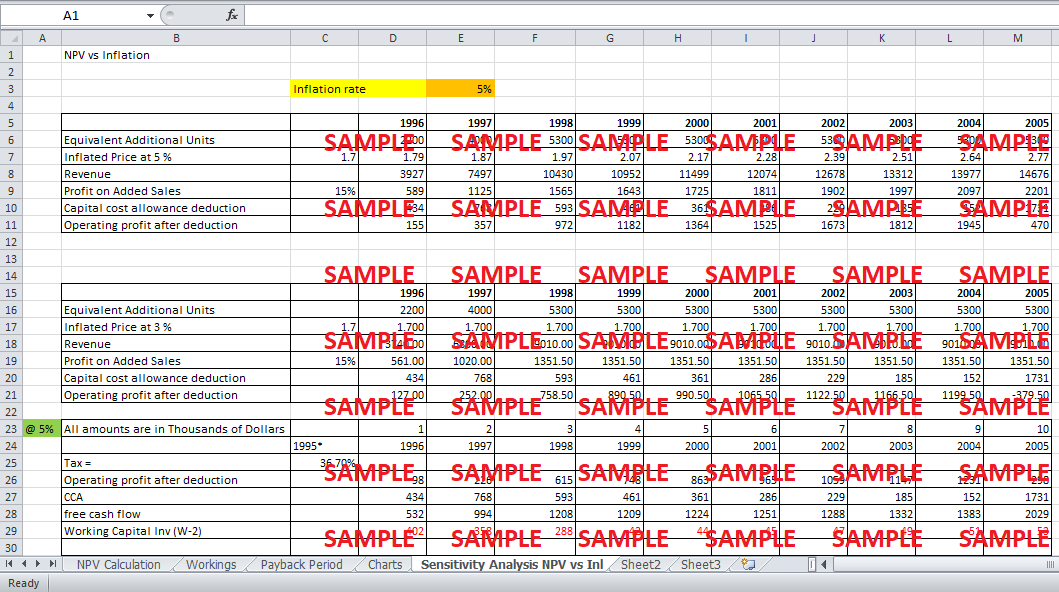

Sensitivity Analysis of Net present Value

-

Recommendation

Case Analysis for Laurentian Bakeries

2. Introduction

Laurentian is a Canada-based company that operates in the frozen pizza market. The company is the second-largest company in the frozen pizza market with a market share of over 20%. It focuses on producing low-cost and high-quality pizza and selling it through the retail channel. The company has focused on the concept of continuous improvement, and it strives to expand its business operations while maintaining efficiencies. It also considers the interests of all stakeholders and considers employee well-being and environmental impacts when making strategic decisions. The company has a comprehensive methodology in place that focuses on improved performance in the direction of the company’s long-term strategic objectives. The company is currently considering an expansion project for its existing facilities. The company has entered into a contract with an American retail chain where it should be able to supply the frozen pizzas across the border. The company would need to undertake an expansion of its existing facilities to facilitate the additional demand. The expansion provides a great opportunity as Laurentian will gain an entry into the US frozen pizza market, which is considerably bigger than the Canadian market. However, the expansion project needs to satisfy the capital budgeting criteria established by the company. The aim of this paper is to analyze the financial aspects of the expansion project and provide a recommendation.

3. Non-financial Considerations

The company had established multi-faceted criteria to evaluate capital budgeting projects. Apart from the financial cash flows related to the project, the expansion project also had to meet some other non-financial factors. The plant, proposing the project, had to show a commitment to the concept of continuous improvement adopted by the company. To show such a commitment, the plant had to meet its profit objectives. The project also had to be included in the long-term strategic plan. The plant met both these criteria as it had achieved its profit objectives and had included the proposed expansion of the plant after the company reached its operating capacity. The operating capacity had been recently reached. A proposed project also had to consider its environmental impacts and take measures to reduce any detrimental impact. It was believed that the expansion project also met this criterion as the project included the installation of an improved drainage system, better water management, and improved refrigeration coolant.

4. Relevant Cash Flow Considerations

i. Assess the capital allocation policy at Laurentian Bakeries.

With regard to the financial considerations, it is important to include only the relevant cash flows associated with the project. The relevant cash flows are usually defined as the incremental cash flows that are dependant on the decision to undertake the project. If certain cash flow is not affected by the existence of the project, it should not be included in the calculation of the project. A particularly important consideration here is the sunk costs. Sunk costs are the costs that have already been incurred and cannot be reversed. Such costs are not dependant on whether the project is undertaken or not. Therefore, these costs are not incremental costs and should not be considered in the calculation of the project. For an instant, the $40,000 spent on securing the US contract is sucking costs. This amount is not recoverable even if the company decides against the project. Therefore, the cost is not dependant on the decision to undertake the project, and it should be ignored. The decision gets a bit more complex when analyzing the $223,000 in fixed salaries of the administrative costs. An argument could be made that a portion of the administrative staff would be working on the new facility and that cost should be appropriated to the project. However, salaries do not change if the project is undertaken. In fact, the decision to undertake the project has no effect on these salaries. Therefore, it could be argued that the salaries are not incremental costs associated with the project, and they can be ignored.

The situation gets different when deciding about the land that will be used to build a new facility. The land could be used for alternative purposes. In other words, there is an opportunity cost associated with the land. For instance, if the company chooses to decide against the project, it can choose to sell the additional land for $250,000. In other words, the company will be forgoing the $250,000 – from a potential sale of the land – by choosing to build the plant. Therefore, the $250,000 is sale proceeds is a lost opportunity that should be reflected in the cost associated with the project. Based on this reasoning, the opportunity cost of the land is added to the initial investment required for the project. Other components of the initial investment include $1.3 million spent on building expansion, $1.6 million spent on the spiral freezer, $1.3 million spent on the processing line, $600,000 spent on the construction of a warehouse, and an additional $400,000 for contingency needs.

5. Cash Flows from the Project

i. project’s cost of capital. State and explain the assumptions used

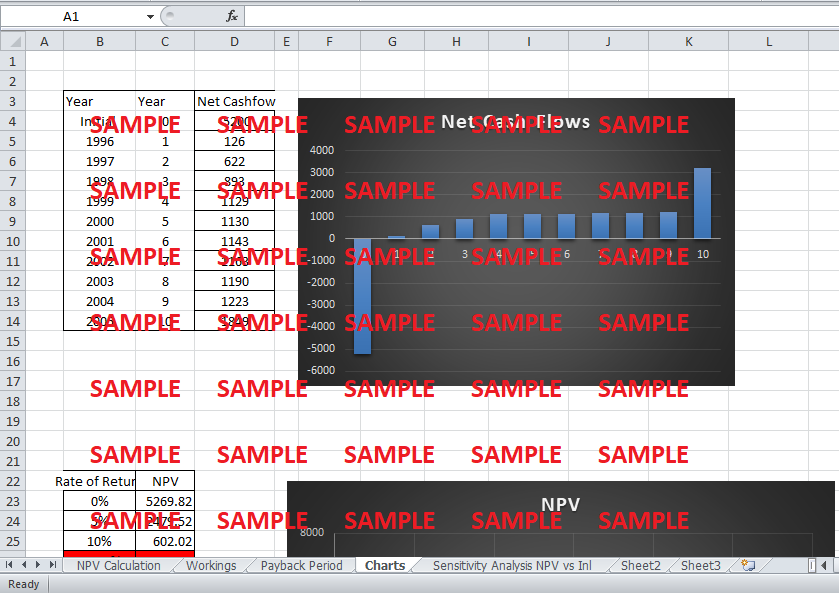

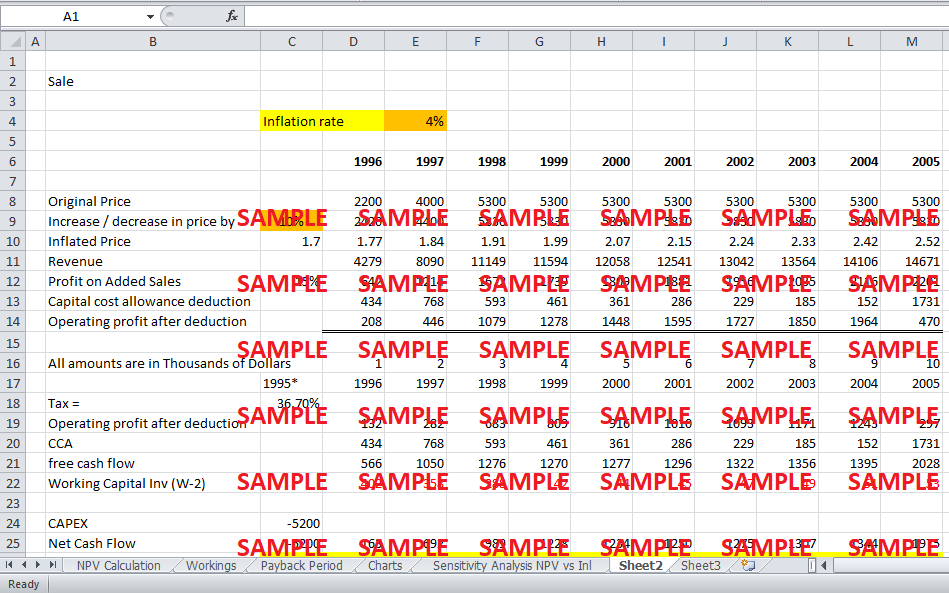

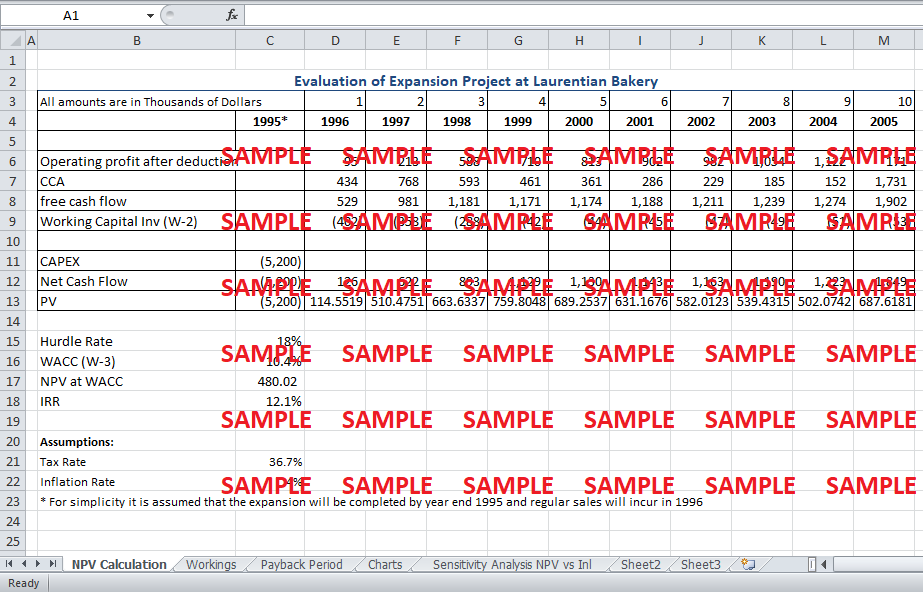

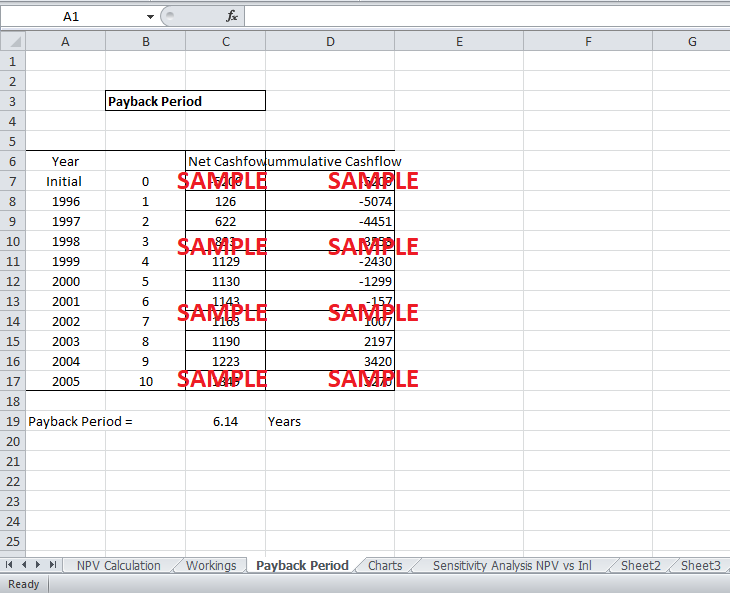

The attached spreadsheet shows the calculation of the net cash flow related to the project. The expansion project is expected to influence the cash flows of the company through a number of ways. The cash flows can be divided into four broad categories: the cash inflows from additional sales, the cash outflow for additional working capital requirement, capital expenditure & tax allowances, and cost savings. The calculations of each of these categories of cash flows will be discussed in detail.

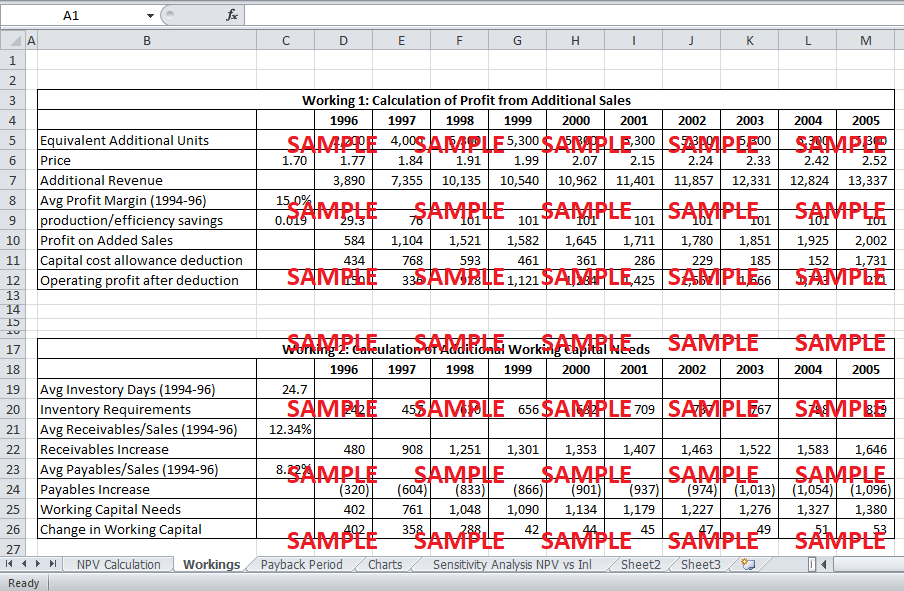

The sales are expected to increase gradually over a period of three years. 2.2 million additional units are expected to be sold in 1997, followed by an additional 1.8 million in 1997, and 1.3 million in 1998. Therefore, the total additional sales per year from 1998 onwards are expected to be 5.3 million. However, there is an equal chance that only half the specified amount of additional sales will be realized each year. Therefore, the sales are expected to 75% of the additional sales when the relevant probabilities are considered. The equivalent sales for each year are calculated and shown in ‘Workings 1’ of the attached spreadsheet. The sales are multiplied by the price per unit, which is expected to grow at the rate of inflation. The inflation rate is expected to be 3%, which is synonymous with a developed country like Canada. The revenue for each year is multiplied by the average profit margin for the past three years to get the operating profit on additional sales. The after-tax profit is assumed to be equal to the cash inflows from the additional sales.

The additional sales are also expected to result in additional working capital requirements. These requirements are calculated under ‘Working 2’ in the attached spreadsheet. The working capital is mainly comprised of inventory, receivables, and payables. The calculation of receivables and payables is fairly straight forward, as they are assumed to be a function of revenue. The receivables and payables are divided by sales for the past three years, and their average is calculated. The calculated average is then multiplied by the projected revenue for each year to calculate the future receivables and payables requirements. The inventory requirements are calculated through the average inventory days. The average inventory days are calculated for the past three years. It is mentioned that the new facility will lower the inventory days by two days. Thereby, the inventory requirements are calculated after adjusting the average inventory days for this added efficiency. The working capital requirements are calculating by subtracting the receivables requirements from the receivables and inventory requirements. The projected investment in working capital is equal to the net change in working capital for each year.

The capital expenditures are mentioned to be equal to the depreciation charge on the equipment. It is assumed that the capital expenditures are only expected to be incurred on the equipment (spiral freezer and processing line) as it is unusual to incur additional expenditure on land and buildings. The capital cost allowance is expected to produce a tax shield as well. The taxes are assumed to be equal to 35%. The depreciation tax shield is also calculated assuming a straight-line depreciation on the equipment. The land and buildings are not depreciated.

The savings from the use of new equipment is expected to be $0.019 per unit. It is equally likely that only half the amount of savings will be actually realized. Therefore, a probabilistic estimate demands that the savings amount is multiplied by a factor of 0.75 to calculate the expected savings. The expected savings per unit are then multiplied by the total unit produced by the plant to calculate the total savings. The implication is that the savings are also expected to apply to the existing output of the plant. Moreover, the savings in the first year are expected to be 70% of the total potential savings. These savings are calculated on an after-tax basis. There are some additional savings in the form of other savings. These savings are also adjusted for taxes. It is mentioned that the other savings are expected to increase at the inflation rate.

The equipment is expected to be depreciated to zero in ten years' time. However, it is expected that the land, building, and warehouse would continue to be operational after ten years' time. The disposal value for these assets needs to be estimated in order to account for all of the relevant cash flows. Although the company is not expected to dispose of the assets at the end of ten years, the disposal of assets is assumed to assign a value to these assets for the purpose of the investment’s appraisal. The land and buildings are not depreciated and they are known to maintain their value over the years. Therefore, it may be reasonable to assume that the assets can be disposed of at their cost at the end of the project. The investment in working capital is also expected to reverse at the end of the tenth year, and it is added back to the cash flows. Using these cash flows, the net cash flows are calculated for each of the ten years.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.